Table of Contents

Introduction

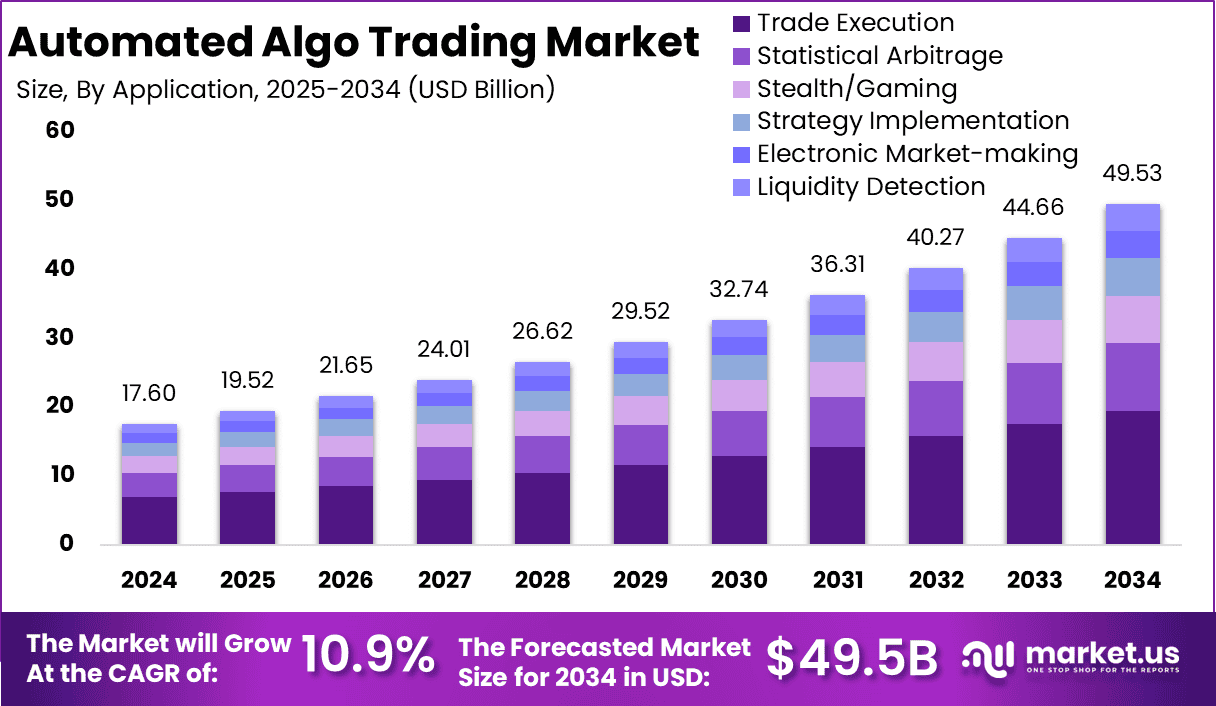

In 2024, the global automated algo trading market was valued at US$17.6 billion and is projected to reach approximately US$49.53 billion by 2034, expanding at a CAGR of 10.9% during the forecast period. North America led the market with a 33.6% share, contributing US$5.9 billion in revenue.

The market is thriving due to the increased adoption of AI, machine learning, and high-frequency trading strategies by financial institutions. As stock exchanges become increasingly digitized, algorithmic trading systems are transforming trade execution efficiency, minimizing human error, and optimizing returns, reshaping the global trading landscape.

How Growth is Impacting the Economy

The rapid expansion of the automated algo trading market is influencing economic dynamics by enhancing capital market efficiency and liquidity. Algorithmic systems can execute trades within milliseconds, reducing transaction costs and slippage. This fosters higher market participation from institutional and retail investors alike.

Additionally, increased algo trading adoption fuels demand for data centers, low-latency infrastructure, and fintech jobs, which contributes to GDP growth in developed and emerging economies. These systems also aid in managing volatility by executing pre-defined strategies during unpredictable market conditions. Moreover, as governments and regulatory bodies adjust to the tech-driven financial sector, new regulatory frameworks are emerging, promoting transparency while maintaining economic stability.

➤ Unlock growth! Get your sample now! @ https://market.us/report/automated-algo-trading-market/free-sample/

Impact on Global Businesses

Businesses worldwide are experiencing both benefits and challenges from the algo trading boom. The shift to automated trading has increased the need for high-performance computing, driving up IT infrastructure costs. Financial institutions must continually invest in algorithm upgrades, data analytics, and cybersecurity.

Supply chains now prioritize data feeds, network speed, and AI integration, disrupting traditional software vendor relationships. Sector-specific impacts vary: hedge funds and investment firms are leveraging algorithms for predictive modeling, while banks deploy them for arbitrage and market making. However, market saturation, operational risks, and compliance burdens require careful strategy and risk mitigation planning.

Strategies for Businesses

To remain competitive, financial firms should integrate AI and machine learning into their trading systems for improved strategy execution. Investing in low-latency trading infrastructure, co-location services, and real-time data feeds enhances algorithm performance. Building proprietary models and back-testing frameworks can provide a competitive edge.

Partnering with fintech startups may accelerate innovation, while adopting regulatory compliance automation can help mitigate risks. Businesses should also upskill teams in quantitative analysis and AI ethics to support long-term sustainability. Emphasis on transparency, performance monitoring, and fraud detection is essential for retaining investor trust in an increasingly automated ecosystem.

Key Takeaways

- Market to grow to US$49.53 billion by 2034 at 10.9% CAGR

- North America holds a 33.6% share in 2024 with US$5.9 billion revenue

- AI and ML integration are accelerating the adoption of algorithmic trading

- Increased IT infrastructure and compliance costs are reshaping business models

- Hedge funds, banks, and retail investors are driving demand

➤ Stay ahead—secure your copy now @ https://market.us/purchase-report/?report_id=153563

Analyst Viewpoint

The present algorithmic trading landscape reflects growing demand for speed, accuracy, and data-driven decisions. Analysts view current adoption as a baseline for future innovation in AI-based predictive models, decentralized finance (DeFi) integration, and cross-asset trading automation.

As global financial markets become more interconnected, algo trading will play a pivotal role in maintaining liquidity, reducing systemic risks, and enhancing portfolio performance. In the coming years, democratization through API-based platforms and improved access for retail traders will further fuel market growth, supported by ongoing regulatory advancements and technological evolution.

Regional Analysis

North America dominates the automated algo trading market due to its advanced financial infrastructure, widespread adoption among institutional investors, and presence of major stock exchanges. Europe follows closely, supported by MiFID II regulations and a growing focus on transparency and best execution practices.

Asia Pacific is witnessing rapid growth, especially in Japan, China, and India, driven by fintech expansion and increasing retail investor participation. The Middle East and Latin America are also showing interest in adopting algorithmic trading systems, primarily among private equity firms and regional banks, fostering new investment and growth opportunities.

Business Opportunities

The global surge in algo trading presents vast opportunities across the technology and financial service sectors. Startups can offer innovative trading APIs, backtesting tools, and custom algorithms for niche markets. Cloud providers and data analytics firms can support the growing demand for real-time trade execution environments.

There’s also space for cybersecurity firms to address vulnerabilities unique to automated trading platforms. Retail trading platforms integrating user-friendly algorithm builders are tapping into the self-directed investor segment. Furthermore, demand for AI-powered risk management systems, latency reduction tools, and cross-border trading platforms offers significant potential for expansion.

➤ Don’t Stop Here—check our Library

- Blue Economy Market

- Life Insurance Policy Administration Systems Market

- AI Complaint Management Market

- Gamified Learning Market

Key Segmentation

The market is segmented by Component, Trading Type, Deployment Mode, and End-User.

- Component: Solutions and Services, with solutions leading due to algorithm integration needs.

- Trading Type: Equities, Forex, Commodities, and Cryptocurrencies—equities and forex dominate due to volume and volatility.

- Deployment Mode: Cloud-Based and On-Premise, with cloud gaining traction for flexibility.

- End-User: Banks, Hedge Funds, Institutional Investors, Retail Traders—Hedge funds and institutional investors lead usage.

These segments highlight the flexibility of algorithmic trading across financial products, trading styles, and user bases.

Key Player Analysis

Leading firms in the algo trading market are focused on enhancing the speed, accuracy, and adaptability of their platforms. They invest heavily in R&D to develop next-gen predictive algorithms and machine learning models. These companies offer integrated solutions with real-time data feeds, cloud scalability, and compliance monitoring.

Strategic partnerships with cloud providers, exchanges, and fintech firms enable faster innovation cycles. Some players are entering retail trading markets with customizable bots, while others serve institutional clients with advanced analytics and AI-based trading assistants. Ethical AI deployment and regulatory alignment remain central to long-term strategy.

- AlgoTerminal LLC

- Vela

- AlgoTrader GmbH

- Cloud9Trader

- Quantopian

- InfoReach, Inc.

- Trading Technologies International, Inc.

- QuantConnect

- Tethys Technology

- Citadel

Recent Developments

- Launch of AI-driven sentiment analysis tools integrated into trading platforms

- Expansion of low-latency data centers for faster execution in global markets

- Collaboration between cloud providers and trading platforms for edge computing

- Introduction of no-code algo builders targeting retail investors

- Regulatory sandbox trials to test algorithmic trading models under supervision

Conclusion

The automated algo trading market is accelerating with advanced AI, real-time execution, and growing investor interest. As businesses navigate rising infrastructure needs and regulatory challenges, strategic innovation will be key to thriving in this high-speed, data-driven financial ecosystem.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)