Table of Contents

Introduction

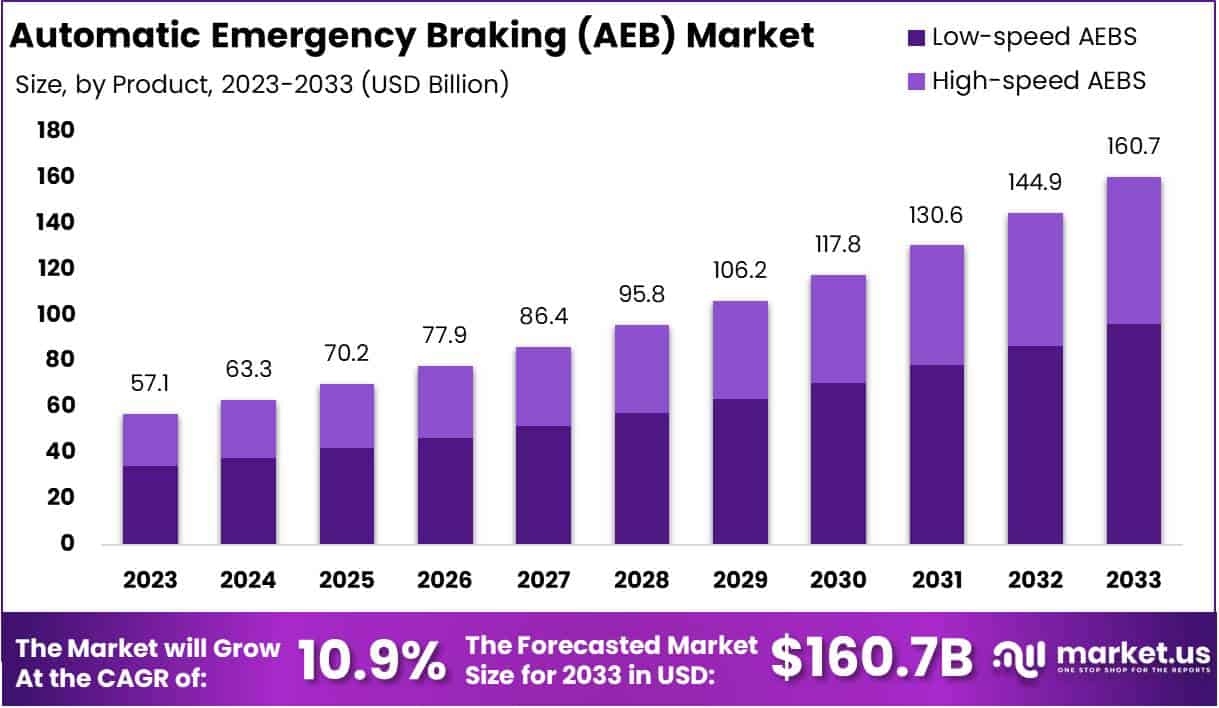

The Global Automatic Emergency Braking (AEB) Market is anticipated to expand from USD 57.1 billion in 2023 to an estimated USD 160.7 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 10.9% over the forecast period from 2023 to 2033.

The Automatic Emergency Braking (AEB) Market refers to a segment of the automotive industry focused on technologies designed to increase vehicle safety by automatically applying the brakes when a potential collision is detected. AEB systems are integral to the broader push towards autonomous and semi-autonomous vehicles, aiming to reduce human error and enhance road safety.

Growth factors for the AEB market include increasing regulatory mandates worldwide that require the integration of advanced safety technologies in new vehicles, heightened consumer awareness about vehicle safety features, and advancements in sensor and camera technologies which improve the efficiency and reliability of AEB systems.

Additionally, the integration of AEB systems in a wide range of vehicles, from economy to luxury models, underlines its growing necessity and popularity in the automotive sector.

The demand for AEB systems is spurred by the rising number of road traffic accidents and the substantial economic burden they represent, driving consumers and governments to invest in safer automotive technologies. Opportunities in the AEB market are vast, especially as these systems become standard features in new vehicles across developed and emerging markets.

Furthermore, ongoing innovations, such as the incorporation of artificial intelligence to predict and prevent collisions more effectively, are likely to propel market expansion, making AEB a standard cornerstone in the future of automotive safety technologies.

Key Takeaways

- The Global Automatic Emergency Braking (AEB) Market is expected to grow from USD 57.1 billion in 2023 to USD 160.7 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 10.9%.

- Low-speed Automatic Emergency Braking Systems (AEBS) capture the largest market share at 53.1%, favored for their effectiveness in dense urban settings and their widespread adoption by automobile manufacturers.

- Dominating the technology segment, Dynamic Brake Support holds a 49% share, valued for its ability to augment braking force during critical situations.

- In terms of vehicle type, Passenger Vehicles lead with a 71.1% market share, underpinned by robust demand for advanced safety features in new automobiles.

- Disc brakes are the preferred choice in the brake type category, accounting for 79.3% of the market, due to their superior performance in stopping power and heat management.

- The Asia-Pacific region is at the forefront of the AEB market, holding a 42.27% share. This leadership is driven by rapid adoption of Advanced Driver Assistance Systems (ADAS), high vehicle production rates, and strong regulatory support in key countries like China, Japan, and South Korea.

Automatic Emergency Braking Statistics

- 43% reduction in rear-end collisions with AEB technology.

- 27% reduction in front impact crash rates due to AEB.

- AEB reduces pedestrian fatalities by 27% and injuries by 33%.

- Studies show a reduction in rear-end collisions between 25% and 50% with AEB.

- Vehicles with AEB experience a 38% reduction in rear-end crashes.

- NHTSA projects that AEB could prevent 24,000 injuries and save 360 lives annually in the U.S.

- Over 70,000 U.S. pedestrian accidents annually highlight the need for broader AEB integration.

- 83% of consumers favor blind spot warnings; over 80% appreciate forward collision warnings and rear-view cameras.

- 61% of consumers show interest in autonomous driving.

- By 2023, around 92% of new passenger vehicles in the US included AEB as standard.

- Trucks with AEB have 41% fewer rear-end collisions.

- AEB can reduce the impact speed of unavoidable collisions by up to 15 mph (24 km/h).

- AEB could save up to 1,000 lives annually in Europe.

- In 2023, 89% of new cars in Australia had AEB; New Zealand saw a 56% reduction in injury crash rates.

- As of March 2023, 84.6% of new passenger cars in Japan had AEB.

- 78% of new passenger vehicles in China featured AEB in 2023.

- In 2023, 92% of new passenger vehicles in South Korea had AEB.

- Germany reached 95% AEB integration in new cars by 2023.

- 86% of new vehicles in Canada had AEB in 2023.

- Commercial AEB use in the EU could prevent 5,000 crashes annually.

- AEB systems lower bodily injury insurance claims by 30%.

- Vehicles with AEB show a 35% drop in pedestrian-related insurance claims at speeds below 50 km/h.

- AEB reduces rear-end crashes by 44% in heavy trucks and 43% in light trucks and vans.

- AEB can reduce cyclist-related crashes by up to 38% in urban areas.

- AEB decreases the risk of rear-end collisions on wet roads by up to 54%.

- AEB reduces injury severity in unavoidable crashes by up to 40%.

- The average cost of AEB installation is $300-$500 per vehicle.

- By 2025, 99% of new vehicles sold in the US will likely have AEB as standard.

- Over 80% of consumers are aware of AEB’s benefits as a safety feature.

Emerging Trends

- Regulatory Push for Standardization: Governments worldwide are increasingly making AEB systems mandatory in new vehicles. In the U.S., for example, the National Highway Traffic Safety Administration (NHTSA) has set a requirement that all passenger cars and light trucks include AEB by 2029. This regulatory push aims to reduce crash-related fatalities and injuries, encouraging higher adoption rates across vehicle categories.

- Integration with Advanced Driver Assistance Systems (ADAS): AEB is being increasingly integrated with other ADAS technologies such as adaptive cruise control, lane departure warning, and pedestrian detection systems. This integration enhances overall vehicle safety, offering a more comprehensive collision avoidance package. Such bundled solutions make vehicles more appealing to safety-conscious consumers and help automakers meet evolving safety standards.

- Focus on Vulnerable Road Users: Recent advancements in AEB technology include improvements aimed at detecting and protecting pedestrians and cyclists. These systems are now designed to detect pedestrians in various conditions, including low-light scenarios, which is crucial for urban environments. This trend is driven by the need to enhance safety for all road users, not just vehicle occupants.

- Adoption in Commercial Vehicles: There is a growing demand for AEB systems in commercial vehicles, particularly from fleet operators. By integrating AEB, businesses aim to reduce accident rates, lower insurance costs, and ensure the safety of their drivers. This segment presents significant growth opportunities as businesses look for technologies that can offer a return on investment through safer fleet management.

- Advancements in Sensor Fusion and AI: Sensor fusion technology, which combines data from radar, cameras, and lidar, is becoming more prevalent in AEB systems. Paired with machine learning algorithms, these technologies enhance detection accuracy and response times, enabling vehicles to better analyze potential collision scenarios and act accordingly. This continuous innovation in AI and sensor technologies is vital for improving the reliability and effectiveness of AEB system

Top Use Cases

- Collision Avoidance with Vehicles: AEB systems detect potential collisions with other vehicles and automatically apply the brakes to avoid or reduce the impact. Studies indicate that AEB can reduce rear-end collisions by up to 50%, making it a crucial feature in reducing accidents.

- Pedestrian Detection and Protection: AEB systems are increasingly equipped with pedestrian detection capabilities. The technology can recognize pedestrians and apply emergency braking at speeds of up to 37 mph. This is expected to reduce pedestrian-related collisions by around 30%.

- Highway Safety Enhancements: AEB systems are effective at higher speeds, providing safety on highways by preventing collisions with sudden stops or slow-moving vehicles. As of 2024, new regulations mandate AEB functionality up to 90 mph for all new passenger vehicles in the U.S..

- Urban Traffic Management: In dense urban environments, AEB helps manage the risk of sudden stops or unexpected vehicle movements, reducing minor accidents. This is particularly beneficial during low-speed urban driving, where rear-end collisions are common.

- Night-time Crash Reduction: Modern AEB systems include enhanced sensors that improve performance in low-light conditions. By detecting potential collisions in darkness, these systems help to prevent accidents that are 25% more likely to occur during nighttime driving

Major Challenges

- False Activations and Phantom Braking: A significant issue with AEB systems is false activations, where the system brakes unnecessarily, mistaking harmless objects like shadows or roadside signs for obstacles. These events can cause sudden stops, leading to potential rear-end collisions or driver dissatisfaction. Reports indicate that up to 10% of AEB activations may be false positives.

- High Implementation Costs: Integrating AEB technology, particularly with advanced features like pedestrian detection and low-light capabilities, can add up to $500 to $1,000 per vehicle. This increases the overall cost of new cars, presenting a challenge for automakers to keep prices competitive.

- Regulatory and Compliance Delays: Although AEB is mandated for all new vehicles in markets like the U.S. by 2029, automakers have raised concerns about the feasibility of meeting these deadlines. Some have petitioned for extended timelines due to challenges in aligning with regulatory requirements and ensuring system reliability.

- Limited Effectiveness at High Speeds: While AEB is highly effective in reducing collisions at low speeds, its performance diminishes at speeds above 60 mph. At higher speeds, the system may not react quickly enough to prevent collisions, which limits its usefulness on highways. This has been a focus of further research and development.

- Varying Performance Across Brands: AEB systems are not standardized across all manufacturers, leading to differences in effectiveness. Some models may perform better in detecting pedestrians or reacting in low-visibility conditions. This inconsistency can impact consumer trust and complicates regulatory oversight

Top Opportunities

- Growing Demand in Emerging Markets: Countries like India, China, and Brazil present significant opportunities for AEB market expansion. As these economies develop, vehicle safety standards are becoming more rigorous, and consumers are increasingly prioritizing safety features like AEB. This is expected to drive strong demand growth, with a projected rise in installations as vehicle production increases in these regions.

- Integration with Autonomous Driving Technologies: The AEB market is poised to benefit from advancements in autonomous driving. As the development of self-driving vehicles accelerates, AEB systems are being integrated with other advanced driver-assistance systems (ADAS). This trend is expected to enhance vehicle safety and attract consumer interest, potentially boosting AEB adoption rates..

- Aftermarket Opportunities: As awareness of AEB’s safety benefits increases, there is a growing trend of consumers retrofitting existing vehicles with AEB systems. This is particularly relevant for markets where older vehicles make up a large portion of the fleet. The aftermarket sector offers a lucrative opportunity for AEB providers, especially as consumers seek cost-effective ways to enhance the safety of their current vehicles.

- Advancements in Sensor Technology: The continuous improvement of radar, lidar, and camera-based sensor technologies presents a key growth driver. These innovations make AEB systems more accurate and reliable, thereby expanding their applicability across a broader range of vehicle types, including high-speed and low-speed systems. This is crucial for maintaining the system’s effectiveness in different driving conditions and is expected to encourage adoption across both passenger and commercial vehicles.

- Stricter Safety Regulations and Incentives: Governments around the world are introducing regulations that mandate AEB as a standard feature in new vehicles. In the U.S., all passenger cars are required to have AEB systems by 2029, creating a substantial market opportunity for manufacturers to meet these requirements. Additionally, insurance companies offering reduced premiums for vehicles equipped with AEB systems are creating incentives for consumers to opt for vehicles with this feature, further driving market growth

Key Player Analysis

- Robert Bosch GmbH: Bosch is a leading player in the AEB market, known for its comprehensive portfolio of advanced driver assistance systems (ADAS) including AEB technologies. In 2024, Bosch leveraged its expertise in radar and camera integration to enhance AEB systems, catering to both passenger and commercial vehicles. The company has a strong global presence and strategic partnerships in markets like Asia-Pacific and North America, contributing to the projected market growth of 14.8% CAGR in the AEB sector.

- Continental AG: Based in Germany, Continental AG is a key manufacturer of AEB systems, emphasizing safety solutions for both vehicles and road users. The company offers integrated AEB systems that use radar and camera technology to enhance detection capabilities. In 2023, Continental held a significant share of the AEB market, driven by its focus on enhancing sensor-based solutions and its strong presence in Europe and North America. The company is also focusing on expanding AEB applications in electric and autonomous vehicles.

- Delphi Automotive LLP (Aptiv): Delphi, now operating as Aptiv, is known for its innovative AEB solutions that integrate with other ADAS functionalities. With a strong focus on connected vehicle technology, Delphi’s AEB systems use advanced sensors to provide real-time data processing for crash avoidance. The company has made strategic moves to enhance its market position in North America and Europe, with a focus on scalable solutions for different vehicle models.

- ZF Friedrichshafen AG: ZF is a prominent supplier of AEB and other ADAS technologies, specializing in dynamic brake support (DBS) that enhances braking power during emergency situations. The company’s AEB solutions are well-integrated with its driveline and chassis technologies, making them suitable for both passenger and commercial vehicles. ZF’s strategic investments in expanding its product line have contributed to a robust CAGR of 7.8% in the DBS segment.

- Mobileye: An Intel subsidiary, Mobileye is a leader in vision-based AEB systems, using advanced AI algorithms and cameras to detect potential collisions. Mobileye’s technology is widely adopted in autonomous driving solutions, making it a crucial player as the automotive industry shifts towards higher levels of vehicle autonomy. The company’s market presence is bolstered by partnerships with major automakers, contributing to the anticipated $105.4 billion market size for AEB by 2030

Recent Developments

- In 2024, on April 29, the National Highway Traffic Safety Administration (NHTSA) announced that by September 2029, almost all new passenger cars and trucks sold in the U.S. must be equipped with automatic emergency braking (AEB) systems. The agency estimates that implementing this requirement will save at least 360 lives and prevent around 24,000 injuries each year by reducing accidents, particularly rear-end collisions.

- On May 9, 2024, NHTSA issued a final rule mandating automatic emergency braking systems in all U.S. light vehicles and trucks by September 2029. This rule falls under a new Federal Motor Vehicle Safety Standard (FMVSS), enacted as part of the 2021 Bipartisan Infrastructure Law (BIL). The law directs NHTSA to set safety standards for AEB and other Level 2 advanced driver assistance systems (ADAS), such as lane departure warnings, lane-keeping assist, and forward collision warnings.

- On June 24, 2024, a coalition of leading automakers, including General Motors, Toyota Motor, and Volkswagen, called on NHTSA to revisit the April rule mandating advanced AEB systems by 2029. The automakers claim that the technology required to enable vehicles to stop and avoid collisions at speeds up to 62 miles per hour is not yet feasible, highlighting the significant technological challenges involved in meeting this new safety standard.

Conclusion

Automatic Emergency Braking (AEB) Market is set for sustained growth, driven by increasing emphasis on vehicle safety, regulatory mandates, and advances in sensor technology. AEB systems are now seen as essential for both passenger and commercial vehicles, helping to reduce collision risks and improve overall road safety. As global regulations become more stringent, requiring AEB in new vehicles, manufacturers are integrating these systems more widely, meeting both consumer demand and compliance needs.

Technological advancements, including AI and machine learning, continue to enhance AEB’s capabilities, making the systems more responsive and effective in diverse driving conditions. Despite challenges such as high implementation costs, the growing consumer awareness and the rising focus on autonomous driving technologies position AEB as a critical component in the future of automotive safety. The market’s expansion into emerging regions further solidifies its potential, as vehicle production increases and safety becomes a priority in these markets

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)