Table of Contents

Market Overview

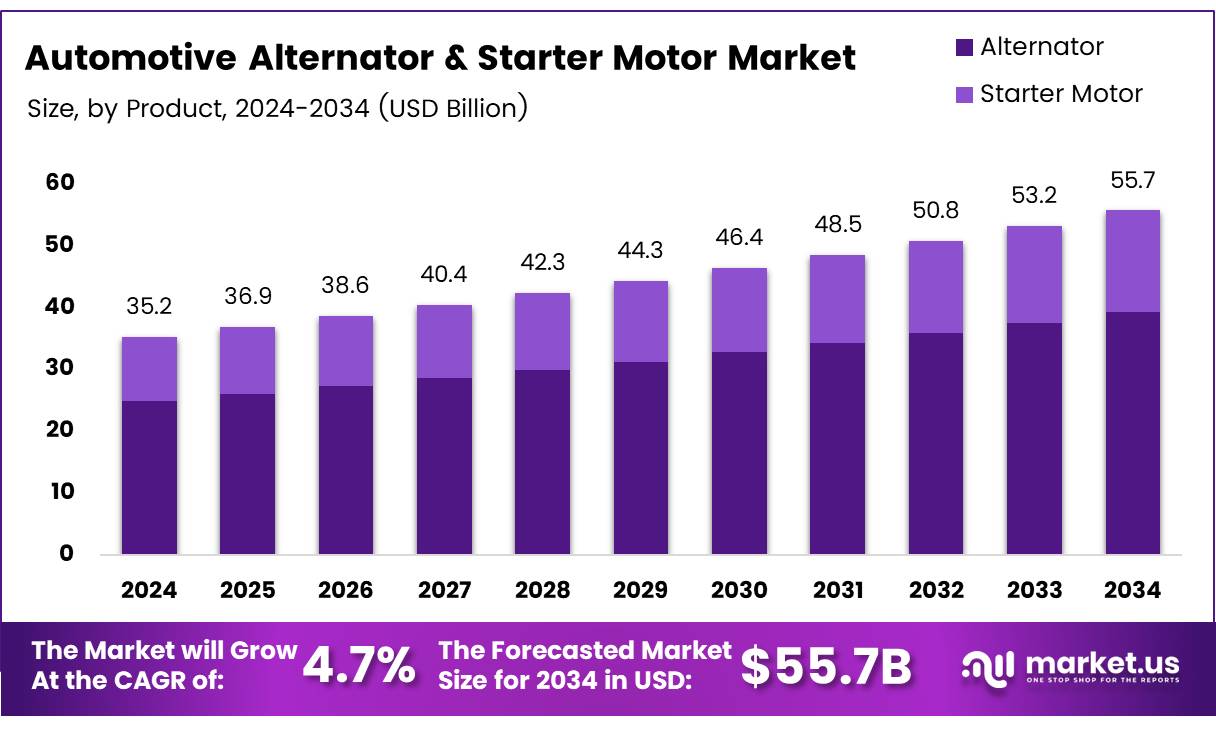

The Global Automotive Alternator & Starter Motor Market size is expected to be worth around USD 55.7 Billion by 2034, from USD 35.2 Billion in 2024, growing at a CAGR of 4.7% during the forecast period.

The Automotive Alternator & Starter Motor Market is evolving rapidly. Both components last between 100,000 to 150,000 kilometers. The aftermarket is growing due to timely replacements. Light commercial vehicle registrations dropped -10.2%. In the UK, LCV demand fell -14.9% in April. Registrations of vehicles over 3.5 tonnes fell 6.3% in 2024. These declines impact market growth in the short term.

Government investments in green mobility are driving innovation. Stricter emission rules boost demand for efficient systems. Automakers now prefer lightweight and high-performance units. The shift to electric and hybrid models fuels new opportunities. Asia-Pacific markets show high growth potential. Emerging economies drive vehicle production and fleet upgrades. Manufacturers invest in R&D to stay competitive. The aftermarket remains a strong revenue channel. Efficiency, durability, and compliance are key growth drivers.

Key Takeaways

- Global automotive alternator & starter motor market to reach USD 55.7 billion by 2034 at 4.7% CAGR.

- In 2024, commercial vehicles held 80.2% market share.

- OEM segment led in 2024 with 84.3% market share.

- Asia Pacific leads due to industrial growth and vehicle production.

- High output from China, India, and Japan boosts regional share.

Market Drivers

- Global Automotive Production Growth: Rising vehicle production in emerging markets fuels steady demand for alternators and starter motors.

- Technological Advancements: Compact, efficient designs and ISG technology boost fuel efficiency and appeal to regulators.

- Stringent Emission Regulations: Tighter norms drive adoption of fuel-efficient alternator and starter motor systems.

- Rise of Hybrid and Mild Hybrid Vehicles: Hybrid growth increases demand for advanced starter motors and regenerative alternators.

Challenges

- Shift Towards EVs:Fully electric vehicles reduce long-term demand for traditional alternators and starter motors.

- High Competition: Numerous suppliers create pricing pressure and squeeze profit margins.

- Durability Issues: Extreme conditions cause wear and failures, impacting brand reputation.

- Integration Complexity: Advanced systems require complex integration with vehicle powertrains.

Segmentation Insights

Vehicle Type Analysis

In 2024, commercial vehicles dominated the market with 80.2% share, driven by high demand for LCVs and HCVs in logistics and transport. Off-road vehicles like tractors and construction equipment also contributed, especially in developing regions. Passenger vehicles grew slower due to rising electric and hybrid adoption reducing reliance on traditional alternators and starter motors.

Sales Channel Analysis

OEMs led with 84.3% share in 2024, supplying high-quality components for new vehicles. The aftermarket, though smaller, is growing steadily from replacement demand, longer vehicle lifespans, and independent repair shops, while OEMs remain dominant.

Regional Insights

In 2024, Asia Pacific led the automotive alternator and starter motor market, driven by rapid industrialization, high vehicle production in China, India, and Japan, and strong EV adoption supported by infrastructure investments.

North America holds a solid share with strong manufacturing in the U.S. and Canada, boosted by electric and hybrid vehicle growth.

Take advantage of our unbeatable offer - buy now!

Europe benefits from its advanced automotive industry, strict environmental rules, and focus on premium, tech-driven vehicles.

The Middle East & Africa shows slower growth but is seeing opportunities from rising output in South Africa and the UAE. Latin America grows steadily, led by Brazil and Mexico, though economic challenges limit faster expansion.

Emerging Trends

- Start-Stop Technology: Cuts fuel use and emissions in passenger and commercial vehicles.

- Integrated Starter-Generator (ISG) Systems: Combines alternator and starter for efficiency, weight reduction, and mild hybrid support.

- Lightweight Materials: Advanced materials reduce weight and boost vehicle efficiency.

- Smart Alternators: Adjust output to real-time demand, improving fuel economy.

- Aftermarket Digitization: E-commerce growth simplifies replacement part purchases.

Regional Analysis

- In March 2025, Lucas TVS announced the expansion of its EV battery production capacity, aiming to strengthen its position in the growing electric mobility sector. The company also revealed plans to enter the energy storage market, targeting opportunities in renewable integration and grid support solutions.

- In January 2025, Euler Motors secured $20 million in debt funding to accelerate its expansion plans. The funds will be utilized to scale up production, enhance distribution networks, and expand its electric commercial vehicle portfolio.

Conclusion

The automotive alternator and starter motor market remains a vital part of the automotive supply chain, supported by steady vehicle production and technological innovation. While the rise of electric vehicles poses a long-term challenge, ongoing demand for ICE and hybrid vehicles will sustain the market for the foreseeable future. Advances in start-stop systems, ISG technology, and smart charging solutions position the industry for continued evolution. Suppliers that focus on innovation, cost efficiency, and regional expansion will be best positioned to thrive in this dynamic landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)