Table of Contents

Market Overview

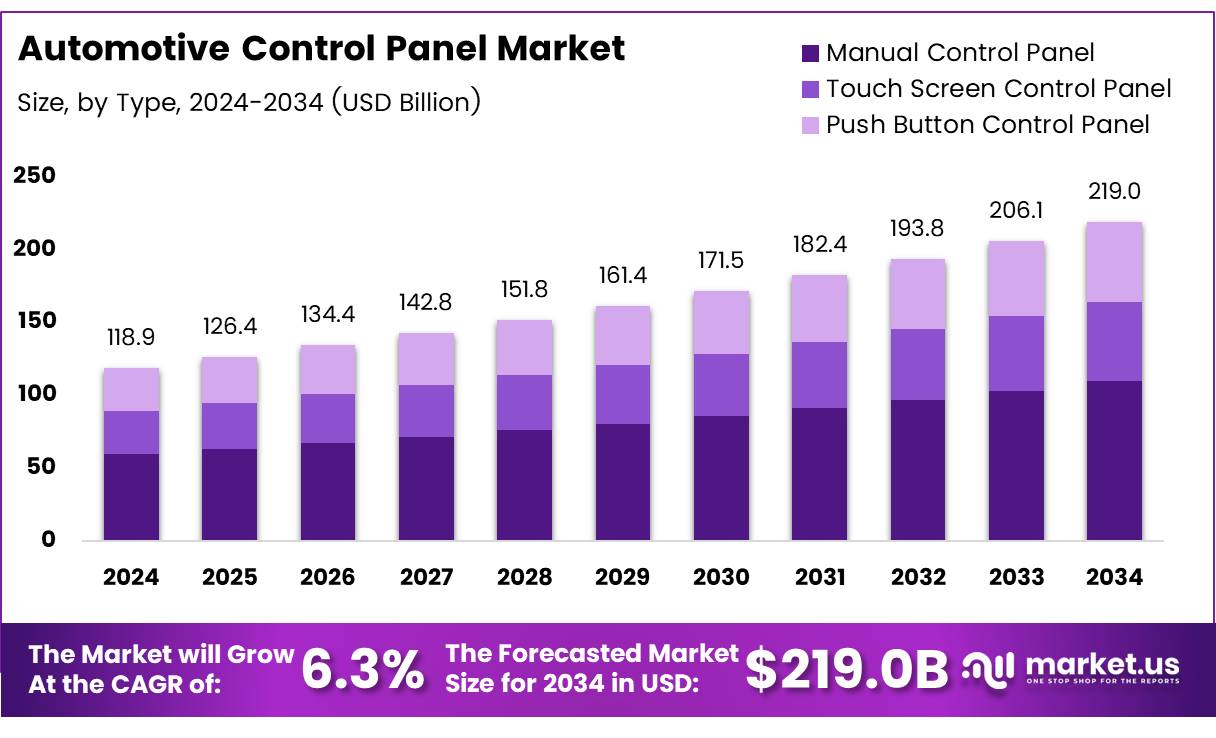

The Global Automotive Control Panel Market size is expected to be worth around USD 219.0 Billion by 2034, from USD 118.9 Billion in 2024, growing at a CAGR of 6.3% during the forecast period.

The automotive control panel market is growing steadily. Rising demand for smart vehicles drives this trend. In 2023, over 76.67 million passenger cars were sold. This boosts the need for advanced control panels. Automakers focus on comfort and safety features.

This creates demand for touch and digital control panels. Light Commercial Vehicles (LCVs) are key to market growth. LCVs weigh up to 3.5 t and suit city driving. They make up 80% of all commercial vehicle sales. High sales of LCVs increase demand for modern dashboards. Fleets need efficient and user-friendly control panels.

Governments support vehicle tech upgrades. They invest in EVs and smart mobility systems. New laws push automakers to improve vehicle safety and emissions. This encourages control panel innovation. Opportunities are rising in electric and hybrid vehicles. These need advanced user interfaces. Aftermarket upgrades also grow. Consumers prefer connected and interactive vehicle systems.

The market will see strong competition and tech upgrades. Players should focus on cost, design, and features. Investing in R&D and software integration is crucial. Long-term growth depends on meeting global standards.

Key Takeaways

- Global Automotive Control Panel Market will grow from USD 118.9 billion (2024) to USD 219.0 billion (2034) at a CAGR of 6.3%.

- Manual Control Panels dominate by type with a 39.1% market share in 2024.

- Passenger Cars lead application segment with a 54.2% share in 2024.

- Asia Pacific holds the largest regional share at 36.1% in 2024, led by China, Japan, and South Korea.

Market Drivers

- Rising demand for infotainment, climate control, and smart interfaces is boosting control panel complexity.

- Automakers are adding touch, voice, gesture, and haptic tech to enhance user experience and safety.

- EVs need specialized control features like battery status and regenerative braking access.

- Connected vehicles require centralized control for apps, cloud, OTA updates, and digital assistants.

- Control panels are now key to interior aesthetics with premium materials and minimalist design.

- Luxury and EV brands use control panels to reflect brand identity and elevate cabin appeal.

Segmentation Insights

Type Analysis

Manual Control Panels led the market in 2024 with 39.1% share, favored for their reliability and ease of use. Touch Screen Panels are growing due to their modern design, while Push Button Panels remain popular for quick, tactile control. The market balances traditional and advanced systems to suit varied user needs.

Application Analysis

Passenger Cars dominated with a 54.2% share in 2024, driven by demand for comfort and tech features. HCVs are using advanced panels for safety and efficiency, while LCVs focus on ergonomic, easy-to-use designs. Each segment shows rising adoption of smarter control systems.

Regional Insights

Asia Pacific leads the global automotive control panel market with a 36.1% share, valued at USD 42.8 billion, driven by strong automotive production in China, Japan, and South Korea, along with rising demand for tech-rich vehicles due to urbanization and higher incomes.

North America benefits from top automakers and tech firms pushing innovation in safety and connectivity, while strict regulations further boost adoption of advanced panels.

Europe sees high demand for luxury vehicles and eco-friendly technologies, supporting compact, efficient control panel designs.

Meanwhile, the MEA region grows steadily with rising auto sales in South Africa and the UAE.

Latin America shows potential through economic recovery and export-focused vehicle production in Brazil and Mexico.

Recent Developments

- In Jan 2025, an auto ancillary stock surged 5% after the company declared a ₹650 crore capacity expansion plan. The funds will enhance production efficiency and cater to rising OEM demand.

- In Mar 2025, Bajaj Auto’s board approved a strategic ₹1,364 crore investment in its Netherlands subsidiary. This investment aims to strengthen its presence in European electric mobility markets.

- In Nov 2024, TactoTek secured $60 million in funding led by Virala Group. This investment will accelerate its in-mold structural electronics (IMSE) production capabilities and global market expansion.

- In Aug 2024, Aptiv expanded its Chennai plant to develop fully integrated, software-defined cockpit solutions. This move supports the growing demand for intelligent vehicle architecture in India and Asia-Pacific.

- In March 2024, Stellantis announced a massive €5.6 billion investment in South America. It marks the largest-ever investment in the region’s automotive sector, aimed at boosting electrification and modernization.

Conclusion

The Global Automotive Control Panel Market is on a steady growth path, driven by rising demand for advanced in-vehicle features, EV adoption, and smart mobility initiatives. With a projected CAGR of 6.3%, the market will reach USD 219.0 billion by 2034. Asia Pacific leads in production and innovation, while strong aftermarket demand, tech integration, and regulatory push will further shape the competitive landscape.