Table of Contents

- Introduction

- Editor’s Choice

- Automotive Cyber Security Market Statistics

- Location of Automotive Cyber Security Attacks

- Top Cyber Security Attacks in the Automotive Statistics

- Statistics of Cyber Security Attacks in the Automotive Sector

- Number of Common Vulnerabilities and Exposures (CVEs) in Automotive Companies

- Impact of Cybercrime on Automotive Companies

- Cyber Incident Impact Distribution of Automotive Supply Chain Parties

- Recent Developments

- Conclusion

- FAQs

Introduction

Automotive Cyber Security Statistics: The automotive industry’s digital transformation has increased vehicle connectivity and brought cybersecurity challenges.

Automotive cybersecurity protects vehicles and passengers from cyber threats, including hacking, malware, and data breaches.

Moreover, governments and industry organizations have introduced regulations to ensure cybersecurity measures are in place.

Challenges include complex vehicle systems and the need for real-time monitoring, requiring collaboration and information sharing.

Additionally, emerging technologies like AI play a crucial role in threat detection. Further, as vehicles become more connected and autonomous, automotive cybersecurity remains critical for maintaining trust and security in the industry.

Editor’s Choice

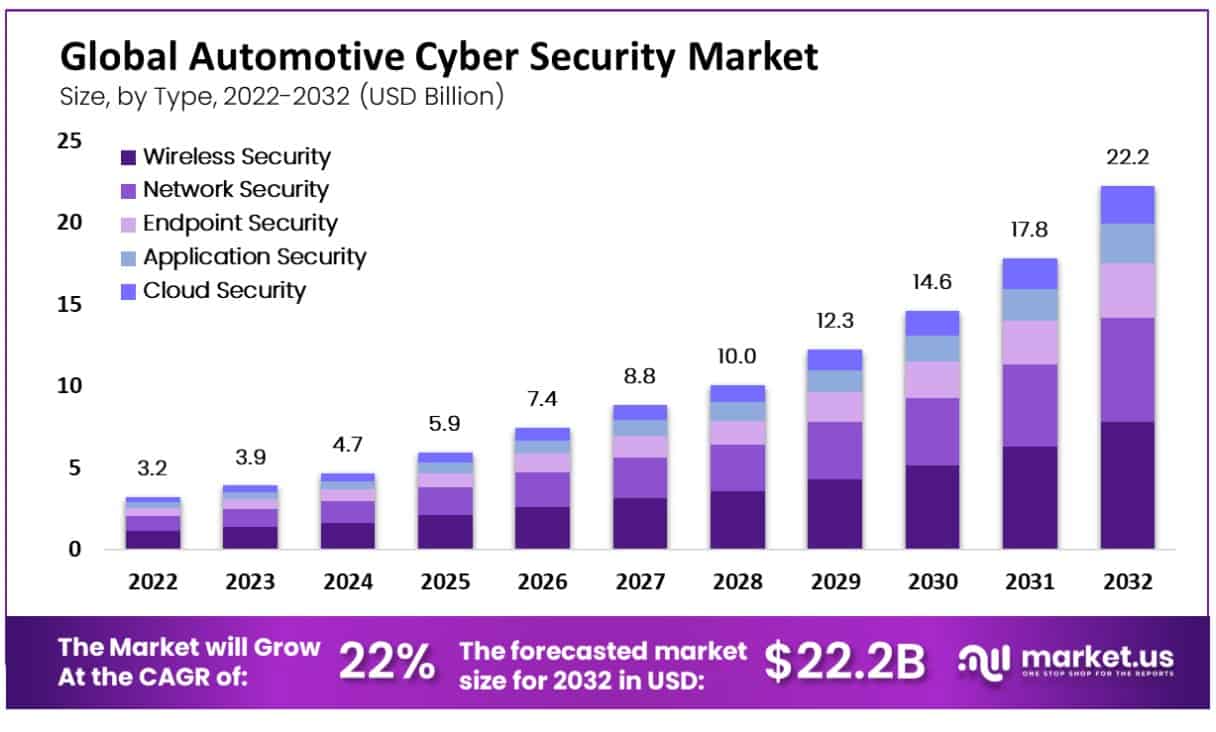

- The automotive cybersecurity market is set for substantial growth over the next decade at a CAGR of 22%. Reflecting the increasing importance of cybersecurity in the automotive industry.

- In 2022, the automotive cybersecurity market generated revenue of USD 3.2 billion. Which is expected to rise to 22.2 billion by 2032.

- In 2022, the distribution of automotive cyber-attacks worldwide revealed a predominant trend towards remote attacks, accounting for a significant share of 97%.

- In contrast, physical attacks constituted a much smaller portion, comprising only 3% of the total.

- In 2022, the distribution of automotive cyber-attacks worldwide revealed a predominant trend towards remote attacks, accounting for a significant share of 97%.

- In contrast, physical attacks constituted a much smaller portion, comprising only 3% of the total.

- Suppliers bore the brunt of cyber incidents, accounting for the majority at 67.3%.

- Cybersecurity Statistics display that it has become an indispensable component of modern life.

Automotive Cyber Security Market Statistics

Automotive Cyber Security Market Size Statistics

- The automotive cybersecurity market is set for substantial growth over the next decade at a CAGR of 22%. Reflecting the increasing importance of cybersecurity in the automotive industry.

- In 2022, the market generated revenue of USD 3.2 billion, a number that is expected to rise steadily.

- By 2023, the revenue is projected to reach USD 3.9 billion, followed by USD 4.7 billion in 2024 and a notable increase to USD 5.9 billion in 2025.

- However, vehicles become more interconnected and reliant on digital technologies, and the need for robust cybersecurity solutions has become ever more critical.

- This trend is reflected in the market’s continued expansion. With revenue anticipated to reach USD 7.4 billion in 2026, USD 8.8 billion in 2027, and USD 10.0 billion in 2028.

- The growth continues with USD 12.3 billion in 2029, USD 14.6 billion in 2030, and USD 17.8 billion in 2031.

- By 2032, the automotive cybersecurity market is projected to reach a staggering USD 22.2 billion. Underscoring the industry’s commitment to safeguarding vehicles against emerging cyber threats and ensuring the safety and security of vehicles on the road.

(Source: Market.us)

Automotive Cyber Security Market Size – By Type Statistics

- The automotive cybersecurity market is poised for substantial growth in the coming years. The total revenue is expected to reach USD 3.2 billion in 2022 and steadily increase to USD 22.2 billion by 2032.

- The market is segmented into various types of cybersecurity solutions, including wireless security, network security, endpoint security, application security, and cloud security.

- In 2022, wireless and network security accounted for USD 1 billion in revenue, while the other segments had no revenue.

- However, as we move forward, we can anticipate significant developments in the cybersecurity landscape.

- By 2032, wireless security is projected to generate USD 8 billion, network security USD 6 billion, endpoint security USD 3 billion, application security USD 2 billion, and cloud security USD 2 billion in revenue.

- These numbers reflect the increasing importance of safeguarding automotive systems and data against cyber threats as vehicles become more connected and reliant on digital technology.

- With continuous advancements in the automotive industry, the demand for comprehensive cybersecurity solutions is expected to grow steadily, creating opportunities for businesses in this sector to thrive.

(Source: Market.us)

Location of Automotive Cyber Security Attacks

- In 2022, the distribution of automotive cyber-attacks worldwide revealed a predominant trend towards remote attacks, accounting for a significant share of 97%.

- These remote attacks typically involve cybercriminals gaining unauthorized access to vehicle systems and control through digital means. Such as hacking into onboard computer systems or exploiting vulnerabilities in software.

- In contrast, physical attacks constituted a much smaller portion, comprising only 3% of the total.

- Physical attacks involve direct actions on the vehicle, like tampering with its physical components or systems.

- The overwhelming dominance of remote attacks underscores the growing significance of digital security in the automotive industry as vehicles become increasingly connected and reliant on digital technologies, necessitating robust cybersecurity measures to protect against remote threats.

(Source: Statista)

Impact Range of Remote Cyber Attacks

- There was a notable distribution of impact ranges in the global landscape of remote cyber-attacks within the automotive industry in 2022.

- Most of these attacks fell into the category of long-range attacks, comprising a significant 70% share.

- These long-range cyber attacks typically involve threats from remote locations. Potentially spanning vast distances and targeting vehicles or their systems.

- Conversely, short-range attacks constituted a smaller yet noteworthy portion. Accounting for 30% of the total.

- Short-range attacks typically have a more localized impact, often from closer proximity to the target vehicles.

- This distribution highlights the prevalence of long-range cyber threats in the automotive sector. Underlining the need for robust cybersecurity measures to safeguard vehicles from remote attacks anywhere in the world.

(Source: Statista)

Top Cyber Security Attacks in the Automotive Statistics

- Cybercrime is growing in complexity and impact, with global damages estimated at USD 6 trillion in 2021.

- Projections indicate that by 2025, these losses could surge to USD 10.5 trillion annually, marking a 15% annual increase.

- Critical infrastructures at the Edge and IoT are attractive targets due to their vulnerabilities, significantly damaging businesses and consumers.

- The automotive industry has not been spared, experiencing a 225% increase in cyberattacks over the last three years.

- Remote cyberattacks are the primary method, accounting for 85%. With 40% targeting back-end servers.

- Common attack types include ransomware, data, and control system breaches.

- Overall, the automotive sector could face a staggering $505 billion loss by 2024 due to cyberattacks.

(Source: Edge Labs)

Ransomware & data breaches

- An Asian automotive manufacturer’s American branch faced a ransomware attack orchestrated by the DoppelPaymer gang. Who demanded a $20 million ransom to provide a decryption key and prevent the leaking of stolen data.

- Meanwhile, two major Israeli public transportation companies suffered a ransomware attack that led to data theft and brought down their websites.

- In April 2021, a North American electric vehicle maker fell victim to cybercriminals who used a drone equipped with a Wi-Fi dongle to hack into the vehicle doors.

- In late February 2022, Toyota had to halt production at several Japanese plants due to a severe cyberattack on one of its suppliers. Underscoring the automotive industry’s vulnerability to such incidents.

- The attack disrupted operations at 28 production lines across 14 plants, affecting the production of approximately 10,000 vehicles, equivalent to around 5% of the company’s monthly output in Japan.

- In January 2022, Emil Frey, Europe’s largest car dealer. Faced a ransomware attack that compromised their systems and backups, disrupting operations.

- However, the exact method by which the attackers accessed customer information remained undisclosed.

(Source: Edge Labs)

DDoS/Botnets/Hacking

- In September 2021, criminals employed sophisticated hacking equipment to steal 25 high-end European-manufactured cars in London.

- Meanwhile, in Oakville, Canada, a total of 124 car thefts were recorded in a city with a population of 211,000, with a significant 60% of these thefts being carried out using keyless entry technology.

- Denso, one of the world’s largest technology and component manufacturers, faced a cyberattack in March 2022 when hackers infiltrated the company’s network in Germany, prompting the network’s disconnection from compromised devices once the breach was detected.

- The alleged attackers claimed to have made off with 1.4 terabytes of data.

- In another incident, a hacker exploited a vulnerability in a prominent European Tier-1 infotainment system deployed in a vehicle from an Asian automotive manufacturer.

- This was accomplished by inserting a USB device and executing an exploit to gain root-shell access to the infotainment system.

- Finally, in June 2021, reports emerged of hackers leveraging a feature within modern vehicle Engine Control Units (ECUs) to target other ECUs for the first time remotely.

- These hackers successfully attacked and disabled multiple vehicles’ powertrain ECUs and power steering ECUs.

(Source: Edge Labs)

Statistics of Cyber Security Attacks in the Automotive Sector

- From January 2022 to March 2023, there has been a fluctuating trend in the monthly number of cyber-attacks on automotive production companies worldwide.

- In January 2022, there were 27 reported attacks, marking a relatively high point. However, this number decreased to 20 in March 2022.

- The trend continued to show variations, with 32 attacks in May 2022 and a decrease to 15 in July 2022.

- As we moved into the latter part of 2022, the number of attacks remained relatively stable, with 16 attacks in September and November 2022.

- In January 2023, the number increased slightly to 20 but dropped to 15 in February 2023. Indicating some fluctuation.

- By March 2023, the number of attacks further decreased to 11. Suggesting a potential decline in cyber threats to automotive production companies during this period.

- These numbers underscore the importance of cybersecurity measures in the automotive industry as it faces a dynamic and evolving landscape of cyber risks.

(Source: Statista)

Number of Common Vulnerabilities and Exposures (CVEs) in Automotive Companies

- The annual count of Common Vulnerabilities and Exposures (CVEs) affecting automotive companies worldwide saw a noticeable upward trend from 2019 to 2022.

- In 2019, there were 24 recorded CVEs in the automotive sector.

- The following year, in 2020, this number increased to 33, indicating a growing vulnerability landscape.

- However, the most significant surge occurred in 2021, with a substantial jump to 139 CVEs. Signifying a marked escalation in cybersecurity concerns within the automotive industry.

- This trend continued into 2022, with the number of CVEs reaching 151, underscoring the increasing importance of cybersecurity measures in addressing vulnerabilities and threats in the automotive sector.

- The data highlights the need for proactive efforts to enhance security and resilience in the face of growing cyber risks.

(Source: Statista)

Impact of Cybercrime on Automotive Companies

- From 2010 to 2022, cybercrime has had a notable impact on automotive companies worldwide, with various types of attacks affecting the industry.

- Data and privacy breaches emerged as the most prevalent, accounting for 31% of reported cyber incidents.

- These breaches not only jeopardize sensitive information but also erode consumer trust. Service and business disruptions were a significant concern at 23%, disrupting operations and causing financial losses.

- Vehicle theft and break-ins, alongside control over vehicle systems, each accounted for 23% of attacks, highlighting the vulnerability of connected vehicles.

- Fraud, manipulation of car systems, location tracking, and policy violations collectively represented 10% of cybercrime impacts.

- The evolving threat landscape underscores the importance of robust cybersecurity measures to protect against diverse cyberattacks in the automotive sector.

(Source: Statista)

Cyber Incident Impact Distribution of Automotive Supply Chain Parties

- Moreover, In the first half of 2022, cyber incidents had a discernible impact on various automotive supply chain parties worldwide.

- Suppliers bore the brunt of these incidents, accounting for the majority at 67.3%.

- This underscores suppliers’ critical role in the automotive ecosystem and susceptibility to cyberattacks.

- Dealers, while less affected, still represented a significant share at 17.3%. Indicating vulnerabilities within the retail end of the supply chain.

- Third-party entities, including service providers and partners, comprised 9.6% of those impacted, emphasizing the interconnected nature of the automotive industry.

- Other parties, accounting for 5.8%, faced similar challenges, underscoring the importance of a coordinated and comprehensive approach to cybersecurity across the entire supply chain to mitigate risks and safeguard critical operations.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- Aptiv acquires Wind River: In early 2023, Aptiv, a global technology company, acquired Wind River, a leader in delivering software for intelligent systems, for $4.3 billion. This acquisition aims to enhance Aptiv’s capabilities in automotive cyber security by integrating Wind River’s advanced software solutions.

- Panasonic acquires Blue Planet: In mid-2023, Panasonic completed its acquisition of Blue Planet. A cybersecurity firm specializing in automotive solutions, for $150 million. This merger is expected to strengthen Panasonic’s cybersecurity offerings and provide robust protection for connected vehicles.

New Product Launches:

- Karamba Security’s XGuard: In early 2024, Karamba Security launched XGuard, a new automotive cybersecurity solution designed to protect vehicle control units from cyber attacks. XGuard offers real-time threat detection and prevention, ensuring vehicle safety and data integrity.

- Harman’s Shield: Harman introduced Shield, an advanced cybersecurity suite for automotive applications, in late 2023. This product includes intrusion detection and prevention systems, secure over-the-air updates, and comprehensive risk management tools.

Funding:

- Upstream Security raises $100 million: In 2023, Upstream Security, a leading provider of automotive cybersecurity solutions. Raised $100 million in a Series C funding round to expand its research and development efforts and enhance its cloud-based security platform.

- GuardKnox secures $75 million: GuardKnox, an automotive cybersecurity company, secured $75 million in early 2024 to accelerate the development of its secure vehicle architecture solutions and expand its global market reach.

Technological Advancements:

- AI and Machine Learning Integration: Advances in AI and machine learning are being integrated into automotive cybersecurity systems to improve threat detection, anomaly detection, and predictive analytics, enhancing the overall security of connected vehicles.

- Blockchain for Secure Transactions: The development of blockchain technology is being applied to secure vehicle-to-everything (V2X) communications. Ensuring secure data exchanges between vehicles, infrastructure, and other entities in the automotive ecosystem.

Market Dynamics:

- Growth in Automotive Cyber Security Market: The global automotive cybersecurity market is projected to grow at a CAGR of 21.4% from 2023 to 2028. Driven by the increasing connectivity of vehicles, rising cyber threats, and regulatory requirements for vehicle safety and security.

- Rising Demand for Connected Vehicles: The demand for connected vehicles with advanced infotainment and telematics systems is driving the need for robust cybersecurity solutions to protect against potential cyber threats and vulnerabilities.

Regulatory and Strategic Developments:

- UNECE WP.29 Regulations: The United Nations Economic Commission for Europe (UNECE) implemented the WP.29 regulations in early 2024. Mandating cybersecurity and software update requirements for new vehicles, aiming to enhance vehicle safety and cybersecurity standards globally.

- US National Highway Traffic Safety Administration (NHTSA) Guidelines: The NHTSA issued new cybersecurity guidelines in 2023. Focusing on improving the cybersecurity posture of automotive manufacturers and ensuring the protection of critical vehicle systems from cyber attacks.

Research and Development:

- Vehicle Intrusion Detection Systems (IDS): R&D efforts are focusing on developing advanced vehicle intrusion detection systems that provide real-time monitoring and detection of unauthorized access attempts, enhancing the security of vehicle networks.

- Secure Over-the-Air (OTA) Updates: Researchers are working on secure OTA update mechanisms to ensure that vehicle software can be updated securely and efficiently. Reducing the risk of cyber attacks during the update process.

Conclusion

Automotive Cyber Security Statistics – In conclusion, automotive cybersecurity is paramount as vehicles become more technologically advanced and connected.

The need for robust cybersecurity measures is evident with rising cyber threats targeting the automotive industry, including remote and physical attacks.

However, governments and industry regulators have responded with regulations, and the market for automotive cybersecurity is growing steadily.

Supply chain parties, suppliers, dealers, and third-party entities are vulnerable to cyber incidents. Collaboration and the adoption of emerging technologies are key to addressing these challenges.

Moreover, the automotive industry’s future success hinges on its ability to proactively address and mitigate cybersecurity risks to ensure vehicle and passenger safety.

FAQs

Automotive cybersecurity protects vehicles and their connected systems from cyber threats and attacks. It involves securing various components, including software, hardware, communication networks, and data, to ensure the safety and integrity of vehicles on the road.

Automotive cybersecurity is crucial because modern vehicles rely heavily on digital technologies and connectivity. Cybercriminals can exploit vulnerabilities in these systems to gain unauthorized access, steal data, disrupt vehicle functions, and even pose safety risks to drivers and passengers.

Common cyber threats in the automotive sector include hacking attempts, malware infections, ransomware attacks, data breaches, and unauthorized access to vehicle systems. These threats can target various components, from infotainment systems to critical control units.

Governments and industry organizations have introduced regulations and standards to ensure vehicle manufacturers implement robust cybersecurity measures. These regulations aim to protect consumers and maintain trust in the automotive industry.

Best practices for automotive cybersecurity include regular software updates, encryption of communication channels, access control mechanisms, intrusion detection systems, and employee training. Additionally, collaboration among stakeholders and information sharing can enhance security efforts.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)