Table of Contents

Introduction

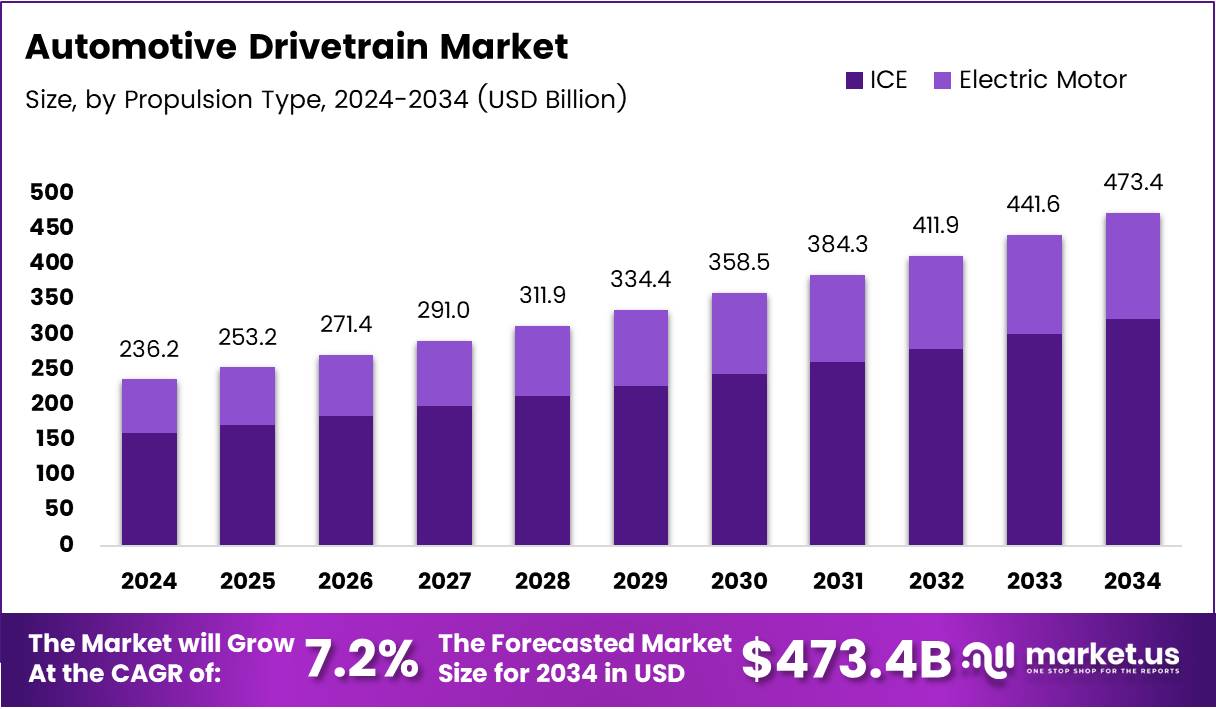

The Global Automotive Drivetrain Market is poised for remarkable expansion, projected to reach USD 473.4 Billion by 2034, from USD 236.2 Billion in 2024, registering a CAGR of 7.2% during 2025–2034. This growth reflects the industry’s transformation toward electric and hybrid vehicle technologies.

As vehicle electrification accelerates, traditional drivetrain systems are evolving into advanced, integrated electric drivetrains. Automakers are investing heavily in research and innovation to enhance energy efficiency and comply with stringent emission regulations, paving the way for sustainable and high-performance mobility solutions worldwide.

Furthermore, the rise in hybrid and electric vehicle adoption across global markets continues to fuel drivetrain advancements. Increasing demand for efficient propulsion, lightweight materials, and smart control systems highlights the drivetrain’s critical role in shaping the future of automotive engineering.

Key Takeaways

- The Global Automotive Drivetrain Market is projected to reach USD 473.4 Billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

- In 2024, ICE dominated the propulsion type segment due to its global reach, mature technology, and lower initial costs.

- In 2024, FWD led the drive type segment, driven by cost-effectiveness, lightweight design, and improved fuel efficiency.

- In 2024, Passenger Cars held the largest share in vehicle type, supported by strong consumer demand and urbanization trends.

- Asia Pacific led the regional market in 2024, capturing 43.5% share with a market value of USD 102.7 Billion, fueled by growing automotive production and supportive EV policies.

Market Segmentation Overview

By Propulsion Type, the Internal Combustion Engine (ICE) segment retained dominance in 2024 due to its mature technology and affordability. Emerging economies continue to favor ICE vehicles because of established infrastructure and lower fuel costs, although electric motors are gradually gaining ground with advancements in battery efficiency and incentives.

By Drive Type, Front-Wheel Drive (FWD) maintained leadership in 2024 owing to its cost efficiency, compact design, and superior fuel economy. Its suitability for compact and mid-sized vehicles supports its widespread adoption, while Rear-Wheel Drive (RWD) and All-Wheel Drive (AWD) continue to cater to performance and off-road segments.

By Vehicle Type, Passenger Cars captured the largest market share in 2024, driven by rising consumer demand and a wide array of model offerings. Urbanization and increasing disposable incomes are supporting this dominance, while Commercial Vehicles continue to contribute to the market through growth in logistics and fleet expansion.

Drivers

Surge in Hybrid Drivetrain Integration: The growing popularity of hybrid drivetrains across mid-range vehicles is driving market momentum. Automakers are launching affordable hybrid options that blend fuel efficiency with performance, appealing to eco-conscious consumers and meeting regulatory standards for emissions reduction.

Lightweight Materials and e-Axle Adoption: Increasing focus on fuel efficiency and emission control is pushing manufacturers to use lightweight materials such as aluminum alloys and composites. Simultaneously, the integration of e-axles—combining motors, transmissions, and power electronics—improves range and energy management in electric and hybrid vehicles.

Use Cases

Electric Vehicle Drivetrains: Electric drivetrains powered by high-efficiency motors exceeding 90% efficiency are revolutionizing performance standards. These systems optimize energy transfer, reduce mechanical losses, and deliver smooth, responsive driving experiences that align with environmental sustainability goals.

Hybrid Propulsion Systems: Hybrid drivetrains enable seamless switching between electric and combustion modes, offering enhanced mileage and lower emissions. Automakers are deploying such systems in mass-market vehicles, bridging the transition toward full electrification while maintaining cost competitiveness.

Major Challenges

High Development Costs: Developing advanced multi-speed transmission systems demands extensive R&D investment and precision manufacturing. These high costs can limit adoption among smaller automakers and delay commercialization, posing a significant barrier to widespread implementation of next-generation drivetrain technologies.

Integration with Autonomous Platforms: The synchronization of drivetrains with autonomous driving systems presents technical challenges. Seamless communication between sensors, control modules, and propulsion units requires advanced software integration, increasing complexity and overall development expenses.

Business Opportunities

Expansion of AWD Systems: Growing demand for all-wheel-drive configurations in off-road and luxury vehicles is creating lucrative opportunities. Consumers value AWD for its enhanced traction and safety, prompting automakers to innovate with electronically controlled and software-optimized AWD systems.

Growth of 48V Mild Hybrid Systems: Automakers are investing in 48V mild hybrid systems as a cost-effective alternative to full electrification. These systems improve fuel efficiency and reduce emissions, offering manufacturers a flexible solution to comply with global fuel economy standards.

Regional Analysis

Asia Pacific: The region dominated the market with a 43.5% share and a value of USD 102.7 Billion in 2024. Rapid industrialization, robust EV production, and government initiatives promoting clean mobility have positioned Asia Pacific as the leading hub for drivetrain manufacturing and innovation.

North America and Europe: In North America, growth is driven by increasing adoption of EVs and hybrids, supported by investments in advanced drivetrain R&D. Meanwhile, Europe’s stringent emission regulations and electrification goals encourage the development of next-generation propulsion systems and lightweight drivetrain architectures.

Recent Developments

- In April 2025, Volektra secured new capital to advance commercialization of its Virtual Magnet Motor technology, targeting automotive and industrial sectors.

- In April 2025, Conifer raised USD 20 million in seed funding to scale next-generation electric vehicle motor production.

- In September 2024, the White House announced a USD 1 billion EV supplier fund to strengthen domestic supply chains and manufacturing capabilities.

- In June 2025, Toyota revealed plans to invest USD 531 million in a new drivetrain parts facility in San Antonio, Texas, expanding its North American production capacity.

Conclusion

The Global Automotive Drivetrain Market stands at the forefront of the automotive revolution, driven by electrification, efficiency, and innovation. As automakers transition toward electric and hybrid systems, the integration of advanced drivetrains will define the next decade of mobility, offering sustainable, high-performance, and cost-efficient vehicle solutions.

With robust regional growth, expanding technological partnerships, and increasing consumer demand for greener vehicles, the market promises vast opportunities. Companies investing in electric powertrains, modular architectures, and intelligent drivetrain technologies are set to lead the global shift toward sustainable transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)