Table of Contents

Market Overview

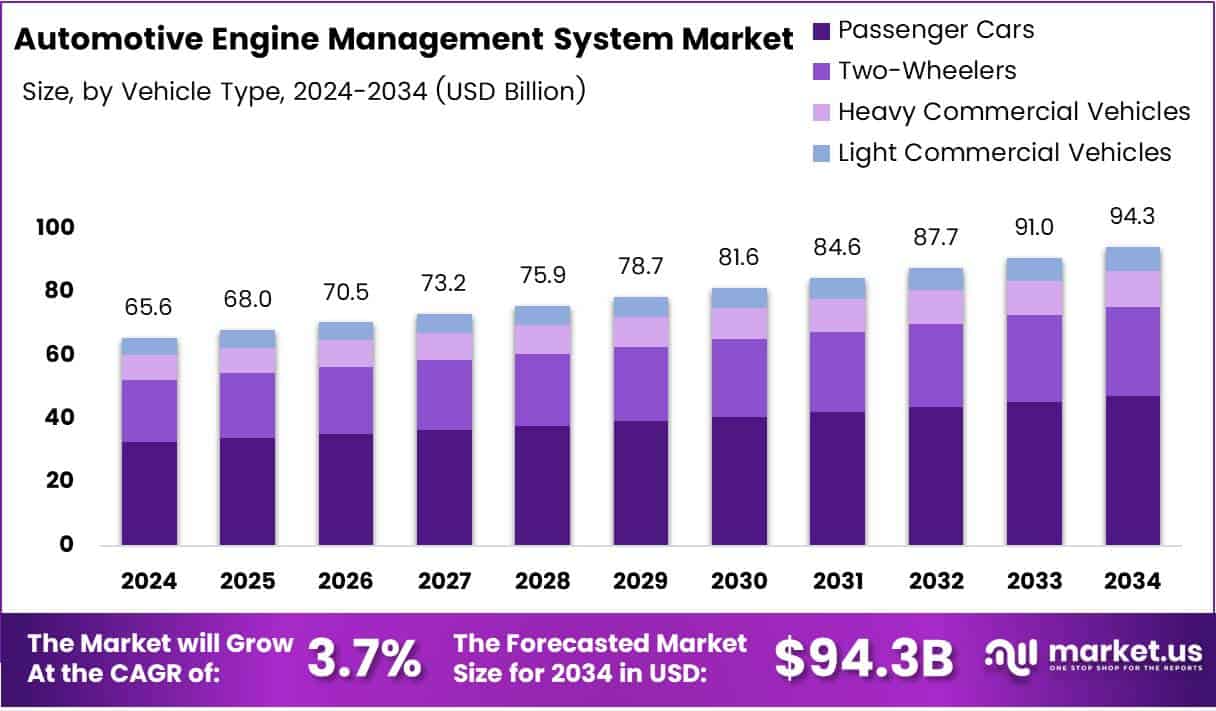

The Global Automotive Engine Management System Market size is expected to be worth around USD 94.3 Billion by 2034, from USD 65.6 Billion in 2024, growing at a CAGR of 3.7% during the forecast period.

The Automotive Engine Management System (EMS) Market is witnessing substantial growth due to the rising demand for fuel-efficient and low-emission vehicles globally. With advancements in powertrain technologies and stringent emission norms, manufacturers are rapidly adopting engine management systems to optimize engine performance. Diesel engines, for instance, offer 30-35% better fuel economy compared to traditional gasoline engines. This superior efficiency is a key factor propelling EMS integration, especially in commercial vehicles and long-haul transport applications.

The market presents robust opportunities in hybrid and gasoline direct injection (GDI) systems. Hybrid vehicles, with 20-35% better fuel efficiency, are gaining traction as governments push for greener mobility. Additionally, gasoline engines equipped with advanced EMS technologies can deliver up to 10% better fuel economy, making them a preferred choice for urban consumers seeking affordability without compromising on performance.

Government investments and policy frameworks are further fueling this momentum. Several countries are offering incentives for hybrid and electric vehicles, enforcing strict CO₂ regulations, and funding R&D in clean mobility. These measures are compelling OEMs to adopt advanced EMS solutions to remain compliant and competitive. As a result, the EMS market is set to expand steadily, driven by innovation, regulatory compliance, and growing consumer awareness around fuel economy.

Key Takeaways

- Global Automotive Engine Management System Market is expected to reach USD 94.3 Billion by 2034, growing at a CAGR of 3.7% from 2025 to 2034.

- Passenger Cars led the By Vehicle Type segment in 2024 due to rising personal mobility and tech innovation.

- Gasoline Engines dominated the By Engine Type segment in 2024, driven by lower cost and mature infrastructure.

- Electronic Control Unit (ECU) accounted for a 39.3% market share in the By Component segment in 2024, owing to its core role in engine performance.

- The Asia Pacific region held a dominant 44.2% market share in 2024, valued at USD 28.8 Billion.

Market Drivers

- Stringent Emission Regulations: Regulatory bodies worldwide are enforcing stricter emission standards, prompting OEMs (original equipment manufacturers) to adopt advanced EMS technologies to ensure compliance.

- Fuel Efficiency Focus: Growing concerns about fossil fuel consumption and high fuel prices are pushing manufacturers to improve engine efficiency through better management systems.

- Technological Innovations: The proliferation of advanced sensors, IoT integration, and AI-driven analytics in EMS architecture is enhancing vehicle monitoring and automation.

- Rise in Electrification: The increasing shift toward hybrid and electric vehicles necessitates more sophisticated energy and engine control systems, expanding the EMS application scope.

Market Challenges

- High Development Costs: Designing and implementing advanced EMS solutions involve significant R&D investments, which can be a barrier for smaller manufacturers.

- Complex Integration: Integrating EMS into legacy systems or various vehicle platforms requires technical expertise and can be time-consuming.

- Cybersecurity Concerns: With greater digital connectivity, EMS systems are becoming vulnerable to cyber threats, requiring additional layers of data security.

Opportunities

- Aftermarket Growth: As vehicles age, the replacement and upgrade of EMS components in the aftermarket segment offer notable growth potential.

- Connected Vehicle Ecosystems: Increasing demand for connected and autonomous vehicles presents lucrative opportunities for EMS developers to create integrated solutions.

- Emerging Markets: Developing countries are witnessing a surge in automotive sales, creating new avenues for EMS adoption, especially as emission standards become more uniform globally.

Segmental Insights

Vehicle Type:

Passenger Cars led in 2024 due to high demand and tech upgrades. Two-Wheelers grew in emerging markets. HCVs rose with logistics needs. LCVs thrived from e-commerce growth.

Engine Type:

Gasoline Engines dominated for cost and ease. Hybrids grew with fuel savings. Electric engines gained traction. Diesels stayed strong in heavy-duty use.

Component:

ECU (39.3%) led as the engine’s brain. Fuel Pumps, Sensors, Actuators, and Others supported smooth, efficient engine performance.

Regional Trends

Asia Pacific:

Leads with 44.2% market share (USD 28.8B) due to strong auto production in China, Japan, and India. Growing use of advanced systems in traditional and electric vehicles boosts growth.

North America:

Strong demand for tech-driven vehicles and presence of major automakers drive growth. Investments in EVs and autonomous tech support the market.

Europe:

Strict emission rules and focus on fuel efficiency increase demand for advanced systems. EV adoption adds to the need for smart engine controls.

Middle East & Africa:

Growth driven by rising car sales, especially luxury models in UAE and Saudi Arabia. Interest in hybrids and EVs also supports market expansion.

Latin America:

Moderate growth as auto sector recovers. Rising vehicle production and EV adoption push demand for engine management systems.

Competitive Landscape

The EMS market is characterized by the presence of well-established automotive component suppliers and technology providers. These players are actively investing in R&D, strategic partnerships, and acquisitions to strengthen their product portfolios and global reach. Competitive strategies also focus on improving system reliability, expanding product lines, and offering modular, customizable solutions for diverse vehicle platforms.

Collaboration between automakers and EMS technology providers is intensifying, especially in the context of electric mobility and connected vehicle trends. This collaboration is fostering the development of unified control units capable of managing not just the engine, but entire powertrain systems.

Recent Developments

April 2025: Advancing domestic capabilities, a prototype diesel engine with over 50% indigenous content is set for development at a cost of Rs 270 crore. Notably, 70% of the funding comes from the Government of India, accelerating local innovation and strengthening the country’s automotive manufacturing ecosystem.

January 2024: Cummins propelled economic momentum by launching a $580 million expansion project at its Rocky Mount Engine Plant. This strategic move is designed to generate jobs and stimulate regional development, reinforcing the company’s long-term commitment to U.S.-based manufacturing and sustainability initiatives.

December 2024: Daimler Truck North America unveiled a $285 million investment at its Detroit Diesel Corporation subsidiary. The capital infusion aims to upgrade facilities and enhance production capacity, thereby reinforcing its leadership in the commercial diesel engine segment and aligning with future mobility goals.

May 2025: In a decisive move, Hero MotoCorp successfully acquired a 34.1% stake in Euler Motors, an electric vehicle startup. This acquisition strengthens Hero’s presence in the EV space, enabling synergy in innovation and expanding its footprint in India’s rapidly growing electric mobility sector.

Conclusion

The Automotive Engine Management System Market is at the crossroads of innovation and regulatory evolution. The transition to cleaner, smarter, and more efficient vehicles is making EMS a cornerstone of modern automotive engineering. As technology continues to evolve and global regulations tighten, the demand for intelligent, integrated, and high-performance EMS solutions will continue to surge, reshaping the automotive landscape in the process.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)