Table of Contents

Market Overview

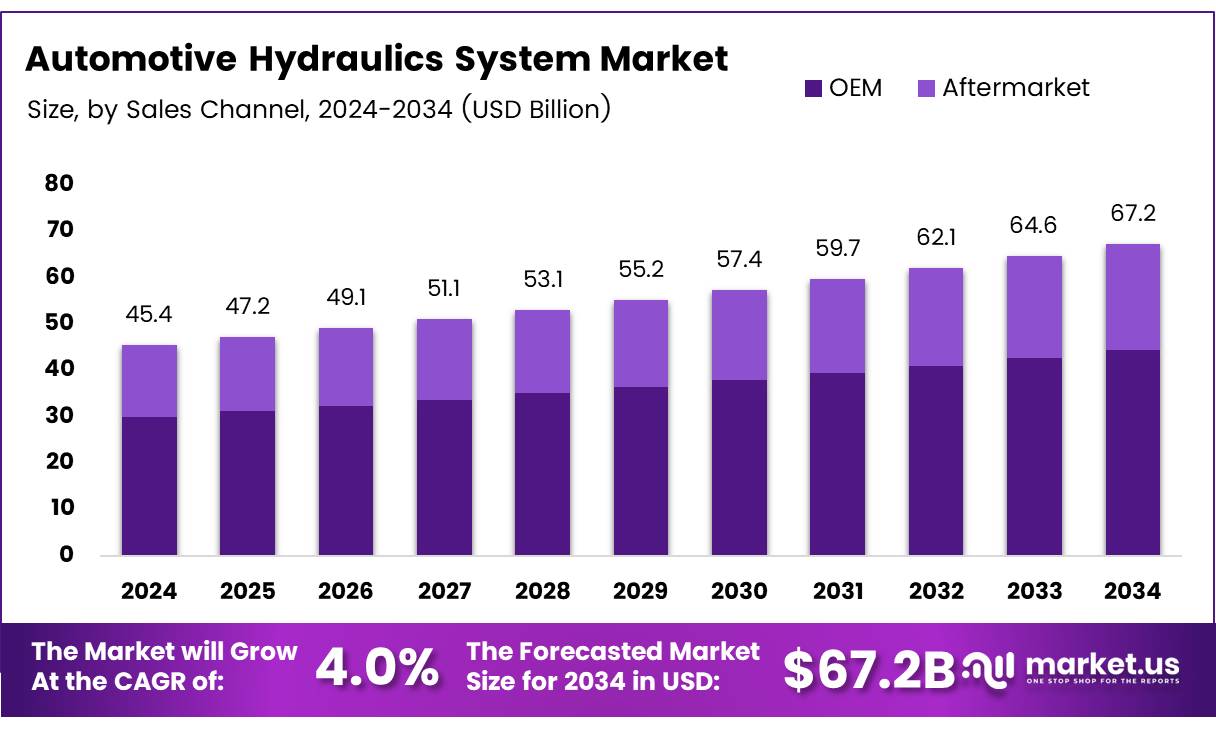

The Global Automotive Hydraulics System Market size is expected to be worth around USD 67.2 Billion by 2034, from USD 45.4 Billion in 2024, growing at a CAGR of 4.0% during the forecast period.

The Automotive Hydraulics System Market is undergoing a steady transformation driven by advancements in efficiency and vehicle performance. One of the major innovations is the shift from traditional hydraulic systems to servo-hydraulic technology, which helps reduce energy consumption by over 50% per cycle (kWh). This transition is not only improving fuel efficiency but also supporting sustainability goals across the automotive sector.

Growth in this market is supported by the rising number of passenger vehicles, particularly in developed regions. In the EU, for instance, the average stands at 0.56 passenger cars per inhabitant, indicating a mature yet stable demand base. This opens up consistent opportunities for hydraulic system upgrades and replacements in existing fleets.

Governments are playing a significant role by investing in advanced automotive technologies and enforcing safety and emission regulations. These regulations are encouraging manufacturers to adopt more efficient hydraulic solutions. At the same time, funding support for R&D into smarter, energy-saving hydraulic components is opening new opportunities for suppliers.

In summary, the combination of energy-saving technologies, consistent vehicle demand, and supportive government policies positions the automotive hydraulics system market as a promising area for investment, innovation, and long-term growth.

Key Takeaways

- The global automotive hydraulics system market is projected to reach USD 67.2 billion by 2034, up from USD 45.4 billion in 2024, at a 4.0% CAGR.

- In 2024, the OEM segment dominates with a 65.5% market share.

- Passenger Cars hold the largest share in the By On-Highway Vehicles segment.

- The Brakes application segment leads the market, driven by vehicle safety and regulatory standards.

- Asia Pacific is the top regional market with a 33.4% share, valued at approximately USD 14.9 billion.

Market Drivers

- Rising demand for safer, high-performance vehicles is driving the adoption of advanced hydraulic systems.

- Expansion in commercial and heavy-duty vehicle sectors boosts the need for durable hydraulic solutions.

- Increasing preference for hydraulic suspension enhances ride quality and vehicle stability across segments.

Challenges

EV Shift: The rise of electric vehicles is reducing demand for traditional hydraulic systems, as EVs favor more efficient electronic alternatives like braking and steering systems.

High Maintenance Costs: Hydraulic systems are prone to leaks and require regular upkeep, leading to higher operational costs compared to low-maintenance electronic systems.

Segmentation Insights

Sales Channel Analysis

In 2024, OEMs led the market with 65.5% share due to rising vehicle production and strong ties with automakers. Their systems are reliable, high quality, and built into new vehicles. Aftermarket options are growing but face challenges with consistency and brand preference.

Component Analysis

The Master Cylinder was the top component in 2024 because it’s essential for braking and clutch systems. Other parts like the Reservoir, Slave Cylinder, and Hose are important too but have smaller market shares.

On-Highway Vehicles Analysis

Passenger cars dominated in 2024, driven by demand for safer, efficient vehicles using hydraulic systems. Heavy and light commercial vehicles also saw growth, but passenger cars remained ahead due to tech upgrades and EV trends.

Application Analysis

Brakes led all applications in 2024, thanks to their key role in safety and performance. Other uses like tappets, clutch, and suspension matter too, but braking systems hold the biggest share due to strict safety needs.

Regional Insights

Asia Pacific leads the market with a 33.4% share (USD 14.9 billion), driven by strong vehicle production in China, India, and Japan, along with rising demand for fuel-efficient vehicles.

North America follows, led by the U.S., where demand is boosted by commercial vehicle production, EV integration, and advanced automotive technologies.

Europe holds a notable share, supported by premium automakers and strict regulations promoting safety and efficiency.

Latin America sees growth mainly in Brazil and Mexico, though economic and political factors pose challenges.

Middle East & Africa shows gradual growth due to expanding manufacturing and rising income levels in countries like the UAE and Saudi Arabia.

Recent Developments

- In March 2025, Orsan Automotive Limited, a wholly owned subsidiary of Orsan Industries Incorporated (€120 million turnover), acquired Edbro Hydraulics Limited. This move is expected to enhance Orsan’s manufacturing capabilities and broaden its footprint in specialized hydraulic applications.

- In January 2025, TotalEnergies Lubrifiants acquired the fire-resistant hydraulic fluid product lines from German niche player Fluid Competence. This strategic acquisition strengthens TotalEnergies’ advanced lubricants portfolio in the high-performance hydraulic fluid segment.

- In November 2024, Fortress, a global leader in industrial technologies, acquired Texas Hydraulics, a prominent manufacturer of hydraulic cylinders and systems. The acquisition aims to expand Fortress’s product portfolio and bolster its presence in the growing hydraulic solutions market.

- In October 2024, Complete Hydraulics was acquired by DWI Power Systems, marking a significant consolidation in the hydraulic service and component market. The acquisition is expected to expand DWI’s service network and customer base across key regions.

Conclusion

The automotive hydraulics system market is poised for steady growth, reaching USD 67.2 billion by 2034 at a 4.0% CAGR, driven by rising demand for safer, high-performance vehicles and government-backed innovations. While the shift toward EVs and high maintenance costs pose challenges, the adoption of energy-efficient technologies like servo-hydraulics, strong OEM demand, and ongoing acquisitions highlight the market’s long-term potential for innovation, investment, and global expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)