Table of Contents

Introduction

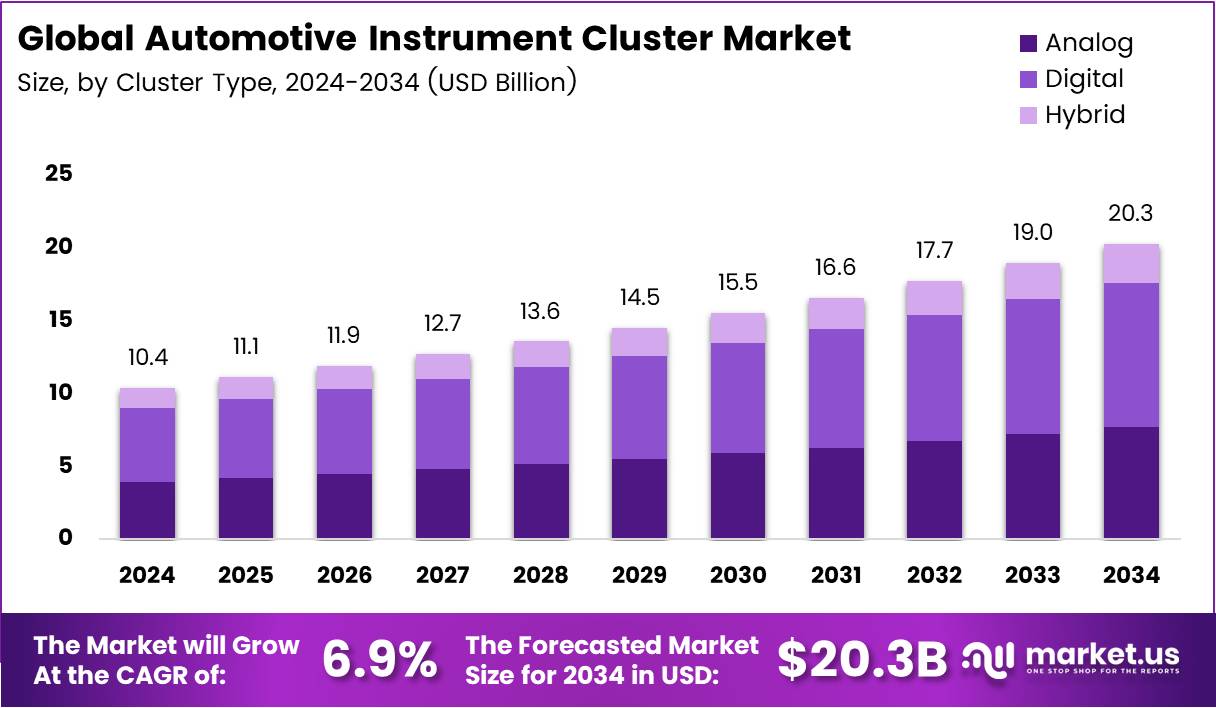

The Global Automotive Instrument Cluster Market is experiencing rapid transformation as the automotive industry embraces digitalization and connectivity. Valued at USD 10.4 Billion in 2024, the market is projected to reach around USD 20.3 Billion by 2034, growing at a robust CAGR of 6.9% from 2025 to 2034.

Modern vehicles are increasingly equipped with smart, multifunctional dashboards that combine real-time driving data, infotainment, and safety alerts. These clusters have evolved from simple analog meters to advanced digital and hybrid displays that enhance the driving experience while improving vehicle performance visibility.

Moreover, the market’s momentum is supported by the growing adoption of electric and autonomous vehicles, which require sophisticated data visualization systems. Continuous innovation, along with strong OEM–technology collaborations, positions the instrument cluster as a key enabler in the next generation of connected, intelligent vehicles.

Key Takeaways

- The Global Automotive Instrument Cluster Market was valued at USD 10.4 Billion in 2024 and is projected to reach USD 20.3 Billion by 2034 at a CAGR of 6.9%.

- Digital clusters dominated the market with a 48.9% share in 2024, driven by advanced display features and integration with smart cockpit systems.

- Passenger Cars held the leading share of 56.6% in 2024, supported by the growing adoption of digital dashboards and connected vehicle technologies.

- Asia Pacific dominated regionally with a 48.9% share, valued at approximately USD 5.0 Billion in 2024, due to strong automotive manufacturing in China, Japan, and South Korea.

Market Segmentation Overview

In the By Cluster Type segment, Digital clusters lead with a 48.9% share in 2024, offering superior display resolution, customization, and integration with infotainment systems. The shift toward fully digital dashboards is accelerating as automakers enhance user experience and safety through real-time data visualization.

Analog clusters maintain relevance in economy vehicles due to affordability and simplicity. They remain popular among cost-sensitive manufacturers seeking reliable and durable solutions for basic driver information systems, particularly in emerging markets where digital adoption is gradual.

Hybrid clusters are gaining traction as they merge analog familiarity with digital innovation. Their balanced cost-performance ratio and user-friendly design appeal to mid-range vehicles, making them a growing segment as automakers cater to diverse consumer preferences.

By Vehicle Type, Passenger Cars dominate with a 56.6% share in 2024. The growing demand for connected, premium, and personalized driving experiences is pushing automakers to integrate digital and hybrid clusters across mainstream models.

Light Commercial Vehicles (LCVs) are adopting digital clusters to enhance fleet management, navigation, and driver monitoring. As e-commerce and last-mile logistics expand, cluster technology is being optimized for real-time data tracking and improved safety.

Heavy Commercial Vehicles (HCVs) are focusing on durable, diagnostic-enabled clusters that reduce downtime and maintenance costs. The use of advanced display systems enhances driver safety and fleet efficiency in long-haul applications.

Electric Vehicles (EVs) represent a rapidly growing subsegment. Their reliance on smart clusters to display range, energy usage, and charging status aligns with global electrification trends, accelerating adoption in both premium and mass-market EV models.

Drivers

The rising integration of digital and hybrid clusters in passenger vehicles is a key growth driver. Automakers are replacing analog dashboards with high-definition digital displays that provide real-time driving and safety information, ensuring improved ergonomics and user engagement.

Another major driver is the increasing demand for connected and smart vehicles. Modern clusters now integrate navigation, infotainment, and driver-assistance systems, enabling seamless connectivity and personalized interfaces that improve driving comfort and safety.

Use Cases

Automotive instrument clusters play a crucial role in driver assistance and safety. They provide instant visibility into vehicle diagnostics, fuel levels, navigation, and warnings, allowing drivers to make quick and informed decisions on the road.

In electric and autonomous vehicles, instrument clusters serve as the control center for energy monitoring, range optimization, and real-time communication. This integration supports efficient energy use while enhancing the overall intelligent driving ecosystem.

Major Challenges

One of the biggest challenges for this market is the increasing complexity of software and cybersecurity demands. As clusters connect to vehicle networks and cloud systems, ensuring secure data transmission and preventing hacking incidents has become a major technical hurdle.

Another challenge involves rapid technological obsolescence. Frequent advancements in display panels, processors, and connectivity standards compel automakers to continuously upgrade hardware, increasing costs and reducing profitability, especially for mid-tier manufacturers.

Business Opportunities

The development of AI-based and AR-enhanced instrument clusters offers significant growth potential. These technologies deliver real-time alerts, navigation cues, and safety visualizations, creating immersive and interactive cockpit experiences that enhance user safety and engagement.

Another opportunity lies in the expansion of mid-range digital clusters in affordable vehicles. As production costs decline, automakers can integrate advanced features in budget-friendly models, opening vast opportunities across emerging economies in Asia, Africa, and Latin America.

Regional Analysis

The Asia Pacific region dominates the global market with a 48.9% share, valued at USD 5.0 Billion in 2024. The region’s strong automotive manufacturing ecosystem in China, Japan, and South Korea drives large-scale production. Additionally, government incentives for EVs and technology localization continue to strengthen market expansion.

In North America, the market is growing steadily due to high consumer demand for advanced infotainment systems and smart cockpit integration. The surge in electric vehicle sales and premium SUVs is accelerating adoption of large, customizable digital displays.

Europe represents a mature market characterized by technological innovation and stringent regulations related to safety and driver assistance. The region’s emphasis on sustainable mobility and luxury vehicle production supports continuous investment in premium digital instrument clusters.

Recent Developments

- In January 2024, Continental AG introduced its “Face Authentication Display” technology integrated behind a driver-display console, enhancing vehicle security and personalization.

- In January 2024, Ford Motor Company’s Lincoln division launched the “Digital Experience” in the 2024 Nautilus featuring a massive 48″ panoramic display merging infotainment and cluster functions.

- In January 2024, Robert Bosch GmbH and Qualcomm showcased a joint Cockpit & ADAS Integration Platform at CES 2024, demonstrating next-generation computing and autonomous capabilities.

Conclusion

The Global Automotive Instrument Cluster Market stands at the forefront of the automotive digital transformation era. With advancements in display technology, artificial intelligence, and vehicle connectivity, clusters are evolving into intelligent, multifunctional systems that redefine the driving experience.

Driven by the growth of electric mobility, safety mandates, and user-centric innovation, the market is projected to achieve a valuation of USD 20.3 Billion by 2034. Strategic collaborations between automakers and tech providers, along with supportive government regulations, will ensure sustained expansion. As vehicles become more software-defined, the instrument cluster will remain central to the evolution of next-generation mobility ecosystems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)