Table of Contents

Market Overview

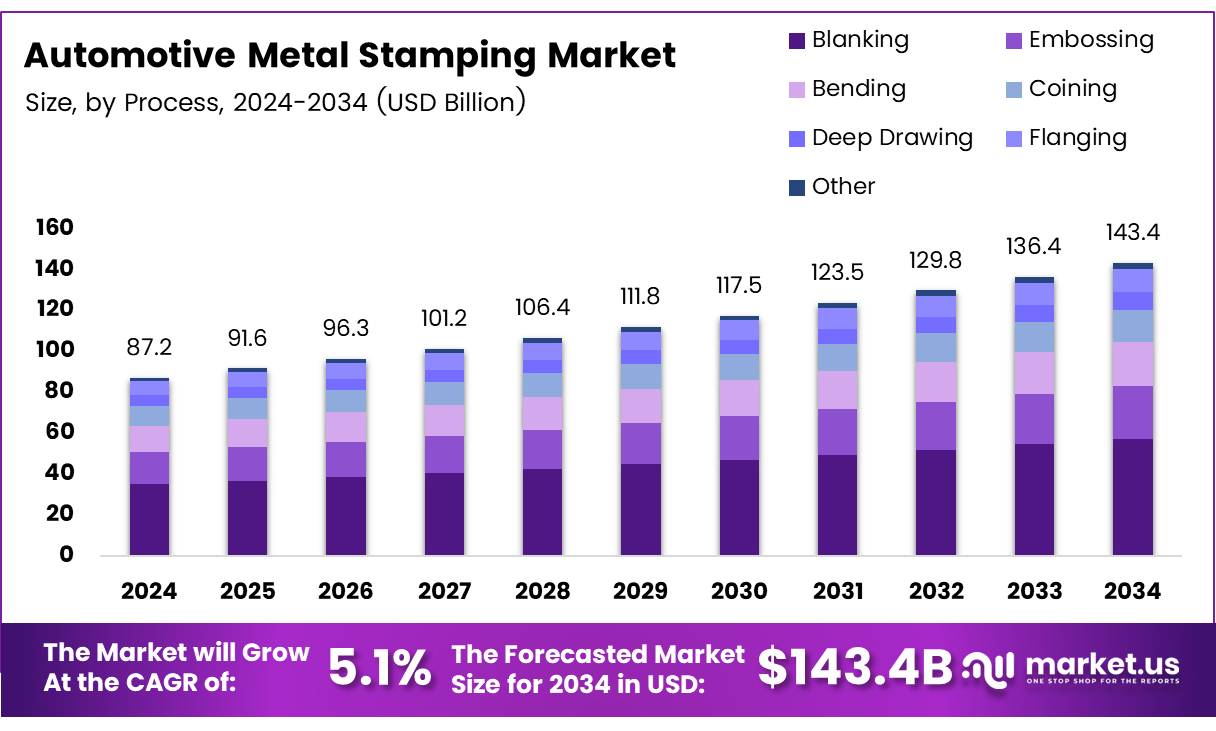

The Global Automotive Metal Stamping Market size is expected to be worth around USD 143.4 Billion by 2034, from USD 87.2 Billion in 2024, growing at a CAGR of 5.1% during the forecast period.

The Automotive Metal Stamping Market is growing steadily. Over 40% of more than 2,000 automotive parts are stamped sheet metal. This shows metal stamping is crucial in vehicle manufacturing. In the EU, there are 0.56 passenger cars per inhabitant on average. This high car density drives demand for metal stamping. According to Statistics Austria, 167,918 new passenger cars were registered from January to July 2025. This growth boosts the need for stamped metal parts.

The rise of electric vehicles (EVs) creates new market opportunities. EVs need special metal parts like battery enclosures. Advanced stamping technologies improve strength and reduce weight. These innovations increase metal stamping market potential.

Government investments support market growth. Strict regulations on fuel efficiency and emissions promote lightweight materials. Metal stamping helps manufacturers meet these rules. Companies using advanced stamping techniques gain a competitive edge. The global automotive market’s growth will keep boosting metal stamping demand.

Key Takeaways

- The global automotive metal stamping market is expected to reach USD 143.4 billion by 2034, growing at a CAGR of 5.1%.

- The blanking process dominated the market in 2024, capturing a 40.5% share.

- Passenger cars accounted for the largest vehicle type segment with a 62.3% market share in 2024.

- Asia Pacific leads the market with a 41.2% share, driven by key automotive players in China, Japan, South Korea, and India.

Market Drivers

- Global vehicle production is rising due to urbanization and higher disposable incomes, boosting demand for stamped metal parts.

- Lightweight metals like aluminum and AHSS are increasingly used to enhance fuel efficiency and lower emissions.

- Advanced stamping technologies and automation improve production speed, accuracy, and reduce waste.

- Growing electric vehicle adoption drives demand for specialized lightweight stamped metal components.

Challenges

- High capital costs for presses and tooling limit small manufacturers.

- Stamping advanced lightweight metals requires specialized, precise tooling.

- Supply chain issues and raw material price swings disrupt production.

- Environmental regulations raise compliance costs and operational expenses.

Segmentation Insights

Process Analysis

In 2024, blanking led automotive metal stamping with 40.5% market share. It precisely cuts metal sheets into shapes needed for car parts. Other key processes like embossing, bending, coining, deep drawing, and flanging help create strong, detailed, and complex components for vehicles.

Material Analysis

Steel dominated in 2024 due to its strength, reliability, and low cost. Aluminum is growing thanks to its light weight and corrosion resistance, especially for electric vehicles. Copper and other materials like magnesium and titanium serve special roles in electrical parts and high-performance applications.

Vehicle Type Analysis

Passenger cars held a major 62.3% share in 2024, driven by growing demand. Commercial vehicles support logistics and deliveries, while off-road vehicles serve farming and construction. Two-wheelers and other specialized vehicles add to the market diversity across regions and industries.

Regional Insights

In 2024, Asia Pacific led the automotive metal stamping market with a 41.2% share, worth USD 35.7 billion, driven by major car makers in China, Japan, South Korea, and India.

North America sees steady growth thanks to strong auto manufacturing and tech advances,

while Europe benefits from established car makers and a shift to electric vehicles.

The Middle East & Africa market is smaller but growing, supported by new manufacturing and infrastructure projects.

Latin America is expanding slower, with Brazil as the main contributor.

Emerging Trends

- Automation and Industry 4.0 boost precision, flexibility, and speed in metal stamping.

- Advanced High-Strength Steel (AHSS) enhances safety and reduces vehicle weight.

- Sustainability efforts focus on waste reduction, recycling, and energy efficiency.

- Customization and lightweight designs drive innovation in stamping materials and tech.

Recent Developments

- In August 2024, GIMSA will invest $40 million to establish a new metal stamping plant focused on the automotive sector. This facility will be located in Monclova, a key industrial city in the Mexican state of Coahuila.

- In June 2024, Martinrea announced an investment of nearly $35 million to expand its Ridgetown, Ontario facility. The expansion includes adding a 3000-ton stamping press to manufacture larger and more complex automotive parts.

Conclusion

In short, the global automotive metal stamping market is on a steady growth path, expected to reach USD 143.4 billion by 2034 with a CAGR of 5.1%. Driven by rising vehicle production, increasing electric vehicle adoption, and government regulations favoring lightweight materials, the market is embracing advanced stamping technologies and automation. Asia Pacific leads the market, supported by key automotive hubs. Despite challenges like high capital costs and supply chain issues, ongoing investments and innovations continue to propel the industry forward.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)