Table of Contents

Market Overview

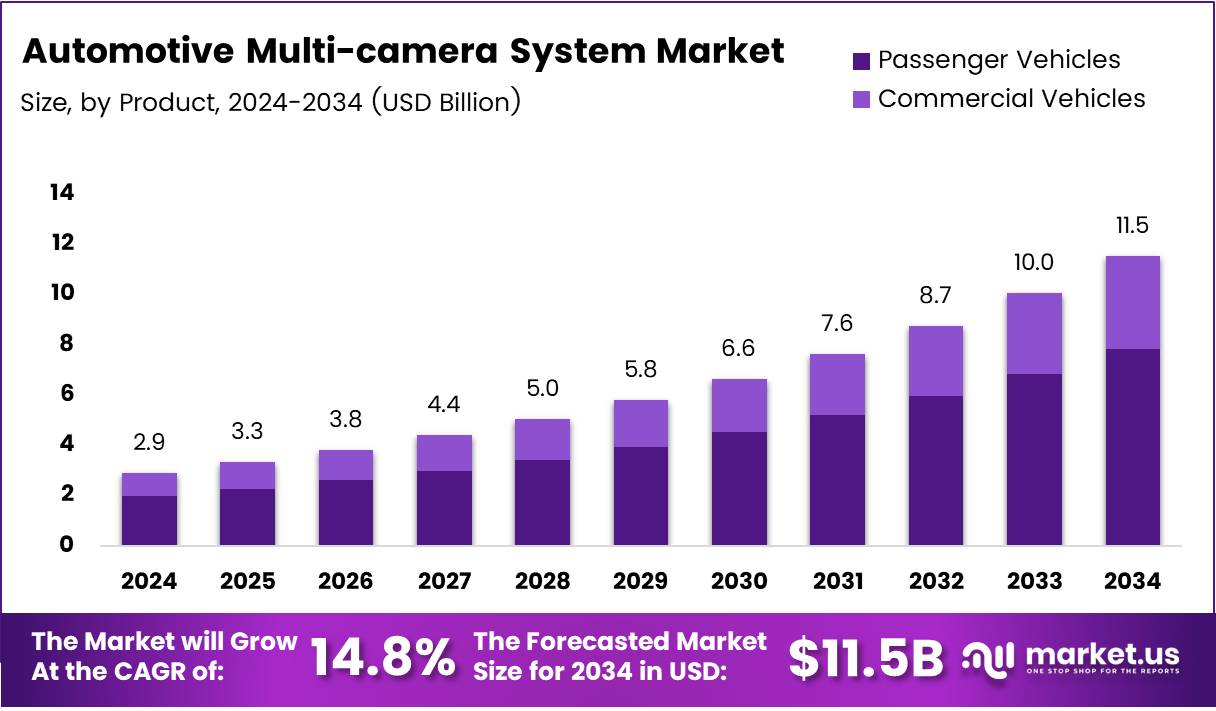

The Global Automotive Multi-camera System Market size is expected to be worth around USD 11.5 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 14.8% during the forecast period.

The automotive multi-camera system market is growing fast. Demand rises due to road safety and smart driving tech. Over 800,000 accidents happen yearly from blind spot lane-change errors. Multi-camera systems reduce such risks with a 360-degree view. More automakers now add these systems in new vehicles. Buyers prefer cars with safety features. This trend boosts OEM adoption worldwide.

Currently, only 25% of vehicles have lane departure warnings. Just 9% include lane assistance tech. This creates a big market gap. Retrofit and aftermarket sales are set to grow. Safety upgrades are in high demand. Fleet operators are also investing in these systems. Governments push for safer vehicles. New rules support ADAS adoption globally.

Investments in autonomous and smart mobility add momentum. These systems improve driver awareness and reduce crashes. Real data proves impact. Nissan Rogue with ProPILOT Assist cut lane departure crashes by 25%. That’s compared to models with LDP alone. The market sees strong returns on safety tech. With rising regulation and buyer demand, growth continues.

Key Takeaways

- Global Automotive Multi-camera System Market projected to reach USD 11.5 Billion by 2034, up from USD 2.9 Billion in 2024, growing at a CAGR of 14.8%.

- Passenger Vehicles dominated with a 73.9% market share in 2024, fueled by growing use of ADAS technologies.

- 2D View Type led the view segment with a 61.5% share in 2024, due to its clarity and reliability.

- Parking Assist System held the top spot in application with 30.1% share in 2024, reflecting rising demand for safety features.

- Asia Pacific led regionally with 36.6% market share and USD 1.1 Billion in revenue in 2024, driven by strong automotive sectors in China, Japan, and South Korea.

Market Drivers

- Rising ADAS Demand: Multi-camera systems are key to features like auto parking, lane assist, and object detection.

- Enhanced Driving Experience: Real-time visual data improves safety, comfort, and driving accuracy.

- Safety Regulations: Governments push mandatory safety tech, boosting camera system adoption.

- Consumer Awareness: Buyers value features like 360° view and collision alerts for accident prevention.

- Autonomous Vehicle Growth: Self-driving cars need cameras for mapping, tracking, and obstacle detection.

Challenges

High Integration Cost: Multi-camera systems are expensive due to hardware, processors, and calibration needs, making them less feasible for budget vehicles.

Complex Calibration & Data Processing: Achieving accurate 360° views requires precise calibration and high computing power, posing technical hurdles for real-time performance.

Segmentation Insights

Vehicle Analysis:

Passenger vehicles led the market in 2024 with 73.9% share, driven by rising ADAS adoption for safety and comfort. Features like lane assist and parking support are boosting demand. Commercial vehicles are growing too, but high retrofitting costs keep their share lower.

View Analysis:

2D view systems held 61.5% share in 2024 due to low cost and ease of use. They’re widely used for parking and rear-view support. 3D systems are gaining in premium cars, but high prices limit mass adoption for now.

Application Analysis:

Parking Assist Systems led with 30.1% share in 2024, thanks to rising demand for safer and easier parking in cities. Multi-camera setups offer 360° views, reducing accidents. Other ADAS features are growing, but parking assist remains most popular.

Regional Insights

Asia Pacific: Leads the market with 36.6% share and USD 1.1B revenue, driven by China, Japan, and South Korea’s strong auto production and ADAS demand.

North America: Strong growth due to advanced auto tech, safety regulations, and high ADAS adoption in the U.S. and Canada.

Europe: High demand from Germany, UK, and France, driven by strict safety and emission laws.

Middle East & Africa: Small but growing market, with rising safety focus in UAE and South Africa.

Latin America: Emerging market; Brazil and Mexico adopting ADAS slowly as tech becomes affordable.Recent Developments

Recent Developments

- In May 2025, Quantum Systems secured €160 million in funding to accelerate its expansion and innovation in aerial intelligence technologies. This investment aims to position the company as a global leader in autonomous drone and surveillance solutions.

- In March 2024, Renesas made a strategic acquisition of Altium Limited for $5.9 billion. This move strengthens Renesas’ capabilities in electronics design automation (EDA) and embedded solutions for next-generation devices.

Conclusion

The global automotive multi-camera system market is on a rapid growth path, projected to reach USD 11.5 Billion by 2034, up from USD 2.9 Billion in 2024, at a CAGR of 14.8%. This surge is driven by rising ADAS adoption, safety regulations, and increasing consumer demand for 360° vision and parking assist features. Although high costs and technical challenges persist, growing investments in autonomous mobility, strong OEM demand, and supportive government policies are set to sustain market momentum over the next decade.