Table of Contents

Introduction

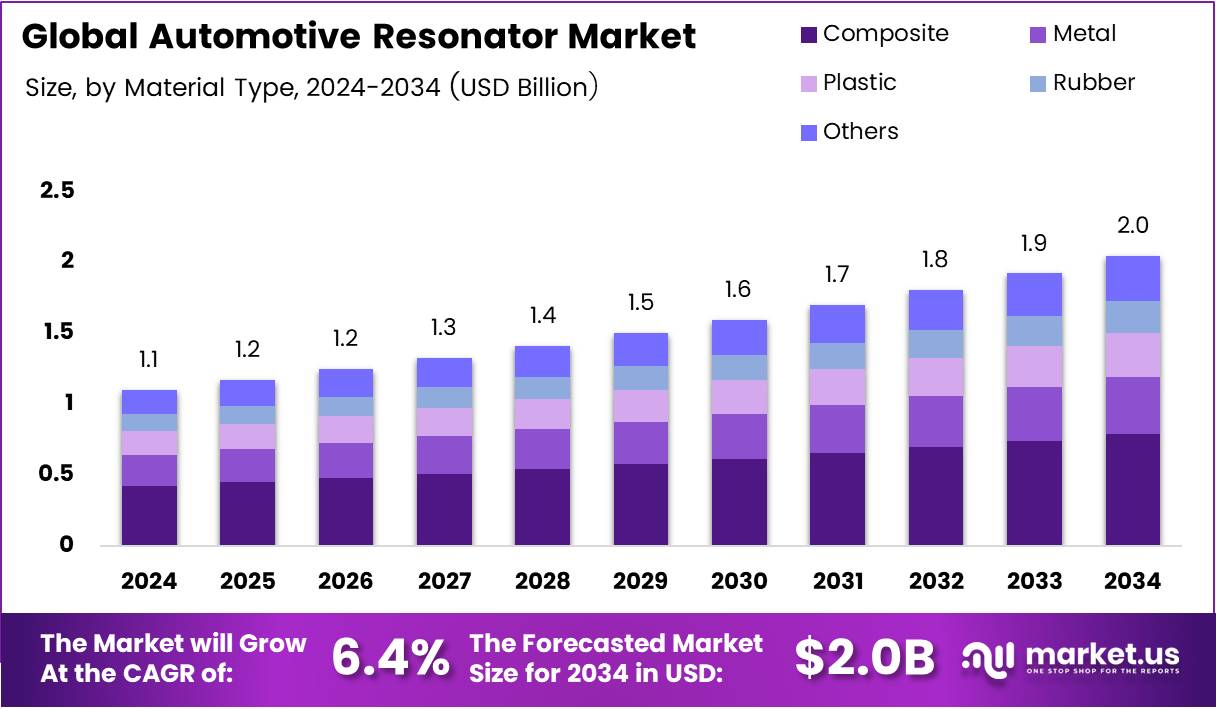

The Global Automotive Resonator Market is experiencing significant growth as automakers focus on reducing engine noise, improving fuel efficiency, and enhancing driver comfort. Valued at USD 1.1 Billion in 2024, the market is projected to reach USD 2.0 Billion by 2034, expanding at a CAGR of 6.4% from 2025 to 2034.

Driven by technological advancements in noise, vibration, and harshness (NVH) control, automotive resonators have become essential for meeting global emission norms and acoustic comfort standards. Manufacturers are adopting lightweight composite materials to balance performance, durability, and environmental sustainability.

Moreover, increasing consumer preference for quieter and efficient vehicles is pushing OEMs to integrate advanced exhaust and intake resonators. As governments tighten noise and emission regulations, the market continues to expand, offering new opportunities for innovation and global collaboration across automakers and suppliers.

Key Takeaways

- The Global Automotive Resonator Market is projected to reach USD 2.0 Billion by 2034, growing from USD 1.1 Billion in 2024 at a CAGR of 6.4% (2025–2034).

- Composite materials led the By Material Type segment in 2024 with a 38.4% share, driven by lightweight and noise-reducing properties.

- Passenger Cars dominated the By Vehicle Type segment in 2024 with a 67.3% market share, supported by rising sales and focus on comfort.

- OEMs held an 82.7% share in the By Sales Channel segment in 2024, integrating resonators directly into vehicle designs.

- The Asia-Pacific region led globally with a 43.8% share valued at USD 0.4 Billion, driven by robust automotive production in China, Japan, and South Korea.

Market Segmentation Overview

In 2024, the Composite segment dominated the By Material Type category with a 38.4% share, as automakers prioritized lightweight and durable materials for improved fuel efficiency and noise control. Metal resonators remained significant in heavy-duty applications, while plastic and rubber materials showed steady growth due to cost efficiency and flexibility.

By Vehicle Type, Passenger Cars led the market with a commanding 67.3% share. The increasing production of passenger vehicles and consumer demand for quieter cabins have driven this dominance. Meanwhile, Light and Heavy Commercial Vehicles are adopting resonators to meet stricter noise regulations and enhance operational comfort.

In the By Sales Channel analysis, OEMs accounted for an impressive 82.7% share, as most resonators are integrated directly during vehicle production. The Aftermarket segment, though smaller, is expanding as consumers seek customized solutions and replacement parts for performance enhancement and sound tuning.

Drivers

One of the primary drivers of the Automotive Resonator Market is the rising demand for reduced engine and road noise in passenger vehicles. As consumers expect smoother and quieter rides, automakers are investing in high-performance resonator systems to improve comfort and align with premium vehicle expectations.

Another major driver is the growing shift toward lightweight exhaust and intake systems. With strict emission targets and sustainability goals, manufacturers are increasingly utilizing composites and aluminum-based resonators to enhance fuel efficiency while maintaining superior acoustic control.

Use Cases

Automotive resonators play a crucial role in passenger cars, where they help reduce exhaust and intake noise for enhanced cabin comfort. These systems are vital for premium and electric vehicles that demand precise sound tuning and minimal vibration levels to meet consumer comfort expectations.

In commercial vehicles, resonators are employed to manage exhaust frequencies and minimize noise in logistics fleets. This application ensures compliance with noise regulations while improving driver experience, especially for long-haul and urban delivery vehicles.

Major Challenges

A major challenge in the automotive resonator market is the high cost of advanced materials and manufacturing processes. Composites and specialized alloys needed for acoustic and thermal efficiency significantly increase production costs, limiting adoption in budget vehicle categories.

Additionally, integrating resonators in electric and hybrid vehicles poses design complexities. Unlike internal combustion engines, EVs have distinct noise characteristics, requiring customized resonator systems, which prolong development cycles and raise engineering expenses.

Business Opportunities

The rise of electric and hybrid vehicles presents a new growth avenue for resonator manufacturers. Companies are designing compact and adaptive intake resonators for EVs to manage artificial sound profiles and cabin noise, creating opportunities in next-generation vehicle acoustics.

Furthermore, the adoption of 3D printing and additive manufacturing allows for rapid prototyping and lightweight resonator production. This innovation enables automakers to create custom designs efficiently while cutting material waste, boosting profitability and innovation speed.

Regional Analysis

Asia-Pacific dominates the automotive resonator market with a 43.8% share valued at USD 0.4 Billion. The region’s leadership stems from strong automotive manufacturing hubs in China, Japan, and South Korea. Rising investments in emission control systems and growing electric vehicle adoption continue to bolster demand for acoustic technologies.

North America holds a substantial market position supported by advanced automotive infrastructure and stringent noise regulations. Growing sales of electric and performance vehicles, along with OEM innovation, are accelerating product development and adoption across the U.S. and Canada.

Recent Developments

- In September 2025, AutoDukan secured USD 1 million in Pre-Series A funding to enhance India’s auto aftermarket through digital innovation and supply chain optimization.

- In May 2025, Autoneum acquired Chengdu FAW-Sihuan Automobile Interior Parts, expanding its acoustic and thermal management capabilities in Asia.

- In April 2024, Vehicle Accessories completed the acquisition of Maxton Group, strengthening its portfolio in car styling and performance parts.

Conclusion

The Global Automotive Resonator Market is evolving rapidly as the automotive industry embraces sustainability, electrification, and acoustic innovation. With a forecasted value of USD 2.0 Billion by 2034, the market offers immense potential for OEMs and suppliers focusing on lightweight, efficient, and compliant resonator technologies. Strategic collaborations, material innovation, and digital manufacturing will define the next decade of growth and competitive differentiation in the automotive acoustic systems landscape.