Table of Contents

Market Overview

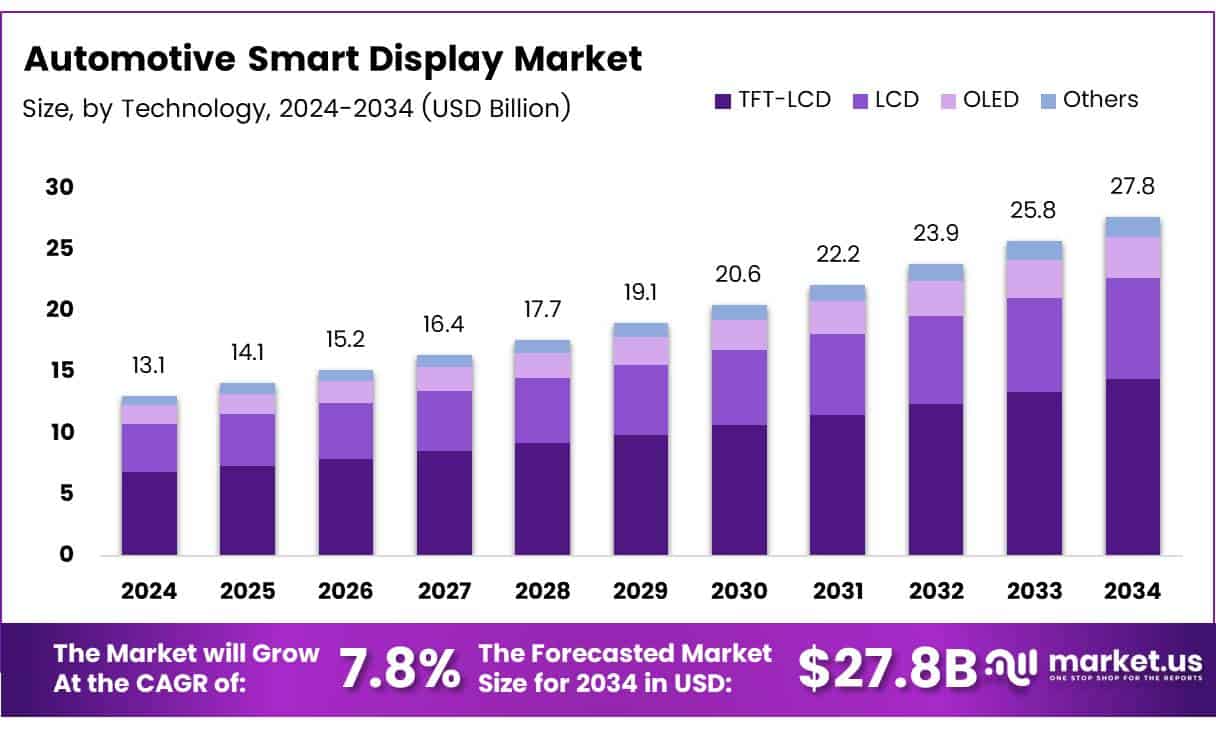

The Global Automotive Smart Display Market size is expected to be worth around USD 13.1 Billion by 2034, from USD 27.8 Billion in 2024, growing at a CAGR of 7.8% during the forecast period.

The Automotive Smart Display Market is growing fast. It was valued at USD 8.2 billion in 2023. It is expected to reach USD 18.5 billion by 2032. The market will grow at a CAGR of 9.5%. Rising demand for smart and connected vehicles drives this growth. Automakers are adding more digital displays in cars. Consumers want better infotainment and navigation.

Smart displays are used in center stacks, dashboards, and rear-view monitors. Electric vehicles (EVs) boost this trend. EVs often feature advanced cockpit systems. Automakers invest in AI-based infotainment and digital user interfaces. This creates new market opportunities.

Governments are also supporting this shift. Policies favor electric and autonomous vehicles. Investment in smart mobility is rising. Asia-Pacific and Europe lead in such initiatives. This helps the smart display market grow. Regulations are changing in favor of safety. Features like ADAS, digital dashboards, and rear cameras are being mandated. These rules push adoption of smart displays. They also improve driver safety and awareness.

OEMs and Tier 1 suppliers are adopting new display tech. Features like voice control and 3D navigation are becoming standard. This makes the Automotive Smart Display Market a key focus area for future mobility.

Key Takeaways

- The Automotive Smart Display Market is expected to decline from USD 27.8 billion in 2024 to USD 13.1 billion by 2034, at a CAGR of 7.8%.

- Displays smaller than 5 inches held the largest market share in 2024 at 45.1%, widely used in small and mid-sized cars.

- TFT-LCD technology dominated in 2024 with a 50.2% share, favored for its high reliability and display quality.

- The Center Stack application led the segment in 2024, contributing 40.2% of the market due to its multimedia and control functionalities.

- Asia Pacific was the top regional market in 2024, capturing 50.1% share and generating USD 6.55 billion in revenue.

Market Drivers

- Connected Vehicles Demand: Consumers want smartphone-like features in cars, making smart displays essential for connectivity and control.

- ADAS & Autonomous Integration: Smart displays deliver critical alerts and system updates in vehicles with advanced driver assistance or self-driving capabilities.

- Enhanced In-Car Experience: Drivers prefer immersive tech like smart navigation, multimedia access, and voice control via smart displays.

- EV Growth: Electric vehicles use smart displays to show battery, range, and performance data, enhancing the user interface.

Market Challenges

- High Cost: Advanced smart displays with OLED/AMOLED tech raise production costs, limiting use in lower-end vehicles.

- Integration Issues: Automakers struggle to integrate displays with various systems while maintaining cybersecurity and compatibility.

- Distraction Risk: Poorly designed interfaces can distract drivers, leading to safety concerns and stricter regulations.

Segmentation Insights

Size Analysis

In 2024, displays under 5 inches led the market with a 45.1% share due to their low cost, small size, and use in compact vehicles. Mid-sized (5–10 inch) displays followed, popular in premium cars for better features. Larger displays (10+ inches) are growing slowly, mainly in luxury cars, due to higher cost and complex installation.

Technology Analysis

TFT-LCD held a 50.2% market share in 2024, favored for its durability and visibility. LCDs remained strong in budget models, while OLED displays gained traction for their sharp visuals. Emerging tech like AMOLED and flexible screens are also drawing interest for future use.

Application Analysis

Center Stack displays led with a 40.2% share, as they centralize control for media and settings. Digital Instrument Clusters ranked next, offering key driving info. Head-Up Displays (HUDs) grew due to safety benefits by projecting data on the windshield. Rear Seat Entertainment stayed niche but valuable in luxury and family vehicles.

Regional Insights

In 2024, Asia Pacific led the global automotive smart display market with a 50.1% share, driven by strong auto production in China, Japan, and South Korea, along with rising demand for tech-enhanced, safer vehicles.

North America followed, led by the U.S., where IoT and AI adoption in vehicles is high and supported by partnerships between automakers and tech firms.

Europe remained strong due to strict safety rules and high integration of smart displays by luxury brands like BMW and Mercedes.

Meanwhile, Latin America and the Middle East & Africa are emerging markets, growing slowly but steadily due to increasing car sales, urbanization, and rising safety awareness.

Recent Developments

- In Jan 2025, VueReal secured access to USD $40.5 million in Series C funding to accelerate the commercialization of its microLED display technology. This funding will enhance production capacity and support partnerships across the automotive and consumer electronics sectors.

- In Jul 2025, CarUX announced the strategic acquisition of Pioneer Corporation to strengthen its global footprint in automotive display and infotainment solutions. The move is aimed at integrating Pioneer’s R&D capabilities to drive innovation in next-gen cockpit systems.

- In Apr 2024, Microchip completed the acquisition of VSI Co. Ltd., a leader in ADAS and digital cockpit connectivity. This acquisition enhances Microchip’s automotive networking portfolio and expands its leadership in vehicle communication technologies.

Conclusion

The global automotive smart display market is poised for continued expansion, driven by technological advancements, rising consumer expectations, and the evolution of connected and electric vehicles. While challenges around cost and integration persist, ongoing innovation and growing demand are likely to sustain strong growth across all vehicle categories and regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)