Table of Contents

Market Overview

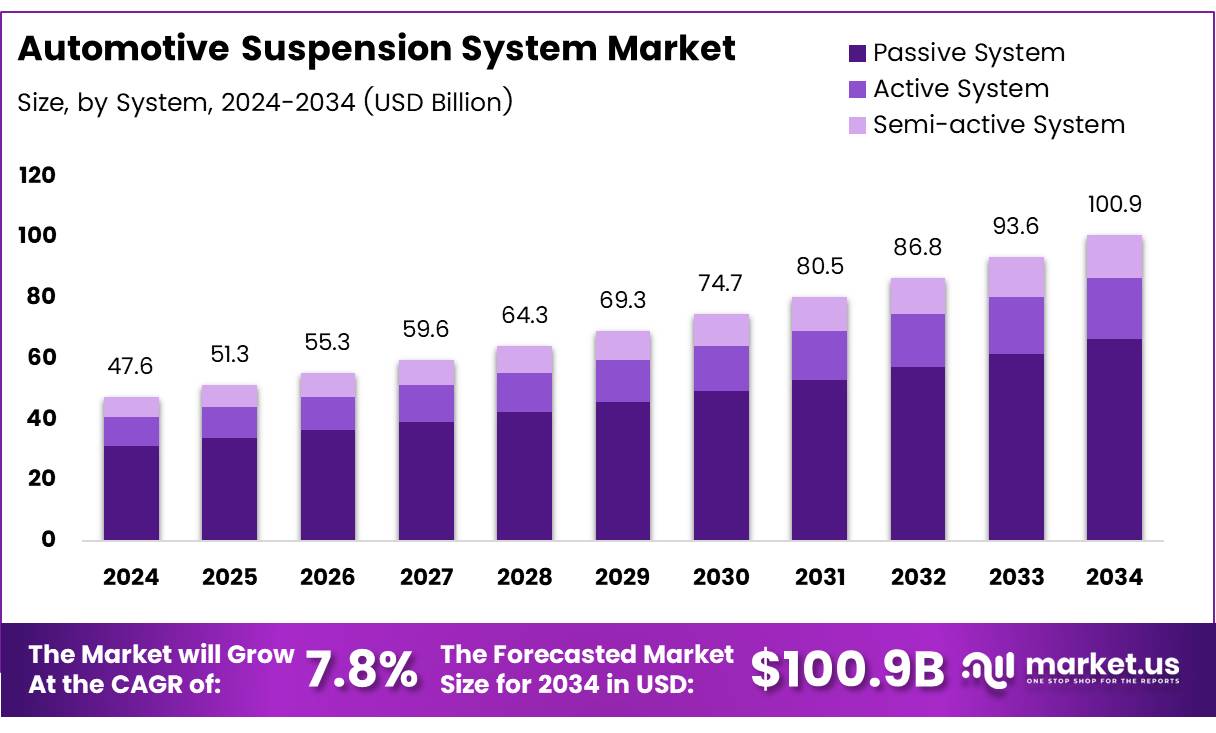

The Global Automotive Suspension System Market size is expected to be worth around USD 100.9 Billion by 2034, from USD 47.6 Billion in 2024, growing at a CAGR of 7.8% during the forecast period.

The automotive suspension system market is growing steadily. Demand rises for better ride comfort and safety. Automakers are adding advanced suspension systems. These include active and semi-active solutions. Suspension issues cause 13% of car mechanical failures. This increases demand for reliable systems. Vehicle owners prefer low-maintenance and long-lasting parts.

Emerging markets boost market growth. Countries like China and India lead in car sales. This pushes OEMs to adopt new suspension tech. Electric vehicles also need strong, light suspension systems. Battery weight creates extra pressure on the setup. This opens doors for custom solutions.

Governments invest in road safety and vehicle standards. New rules push for better suspension systems. Focus is on emission cuts and fuel savings. This leads to demand for lightweight materials. Companies that offer such innovations gain market share. Asia-Pacific remains the top market due to production and demand. Rising disposable income drives premium vehicle sales. More vehicles on road mean more suspension replacements.

The automotive suspension system market has huge opportunity. Innovation, regulations, and EV growth drive it forward. Brands that offer durable, efficient, and smart suspension systems will win. This market promises long-term, stable returns for investors and OEMs.

Key Takeaways

- The global automotive suspension system market is projected to reach USD 100.9 billion by 2034, growing at a CAGR of 7.8% from 2025 to 2034.

- Passive systems dominate with 65.1% market share in 2024 due to their cost-efficiency and simple design.

- Shock absorbers lead the component segment with 35.3% share, enhancing ride comfort and stability.

- Passenger cars dominate by vehicle type, driven by increasing consumer demand.

- Asia-Pacific leads regionally with 27.2% market share, valued at USD 12.8 billion.

Market Drivers

- Ride Comfort & Handling: Growing need for smoother, safer rides boosts demand for advanced suspension systems.

- Vehicle Production: Rising global vehicle output increases demand for durable suspension components.

- Advanced Technologies: Automakers adopt smart suspension systems for better control and comfort.

Challenges

- High Costs: Advanced suspension systems are expensive to produce and integrate, limiting adoption in low-cost vehicles.

- Design & Maintenance Complexity: Complex designs and costly maintenance make advanced systems less appealing for budget-focused buyers.

Segmentation Insights

System Analysis

In 2024, Passive Systems led the market with 65.1% share due to their low cost, simple design, and wide use across vehicle types. Active and Semi-active Systems are growing but remain behind because of higher costs and complexity.

Component Analysis

Shock Absorbers held a 35.3% market share in 2024, thanks to their key role in ride comfort and stability. Struts, Control Arms, and Ball Joints also have strong demand, while Air Compressors are gaining use in advanced systems.

Suspension Type Analysis

Hydraulic Suspension led in 2024 for its smooth ride and reliability. It is preferred over Air Suspension for being more cost-effective. Leaf Springs are being phased out due to lower performance.

Vehicle Type Analysis

Passenger Cars dominated the market in 2024, driven by demand for comfort and safety. Other vehicle types contribute less, with passenger vehicles leading in tech adoption and sales.

Regional Insights

Asia-Pacific leads with 27.2% market share (USD 12.8 billion), driven by strong automotive manufacturing in China, India, and Japan, rising EV production, and demand for advanced suspension technologies.

North America holds a notable share due to innovations like air and adaptive suspensions. The U.S. is the key contributor, though growth is slower due to a mature market.

Europe benefits from strict safety and emission regulations, with countries like Germany and France pushing for fuel-efficient and lightweight suspension systems, especially in EVs.

Middle East & Africa sees moderate growth led by South Africa and UAE, but remains import-dependent with limited market size.

Latin America shows slow yet steady progress, mainly from Brazil and Mexico, due to rising vehicle manufacturing.

Recent Developments

- In March 2024, ZF Rane Automotive India acquired TRW Sun Steering Wheels, strengthening its position in the steering and suspension systems segment. This strategic move enhances ZF Rane’s capabilities in OEM supply and component integration.

- In November 2024, MidOcean Partners acquired Arnott Industries, a leading aftermarket suspension products platform. The acquisition supports MidOcean’s expansion in the premium auto parts aftermarket and performance enhancement segment.

- In January 2025, Gabriel India acquired the assets of Marelli Motherson Auto Suspension Parts for ₹60 crore. This acquisition boosts Gabriel India’s manufacturing capabilities and reinforces its OEM and aftermarket presence in India.

Conclusion

The global automotive suspension system market is poised for strong, long-term growth, projected to reach USD 100.9 billion by 2034 at a CAGR of 7.8%. Demand is fueled by rising vehicle production, growing EV adoption, and the need for comfort and safety. While passive systems dominate due to cost-efficiency, advanced technologies are steadily gaining ground. Asia-Pacific leads the market, with innovation and regulations driving global momentum. Companies offering durable, lightweight, and smart suspension solutions are well-positioned for sustained success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)