Table of Contents

Market Overview

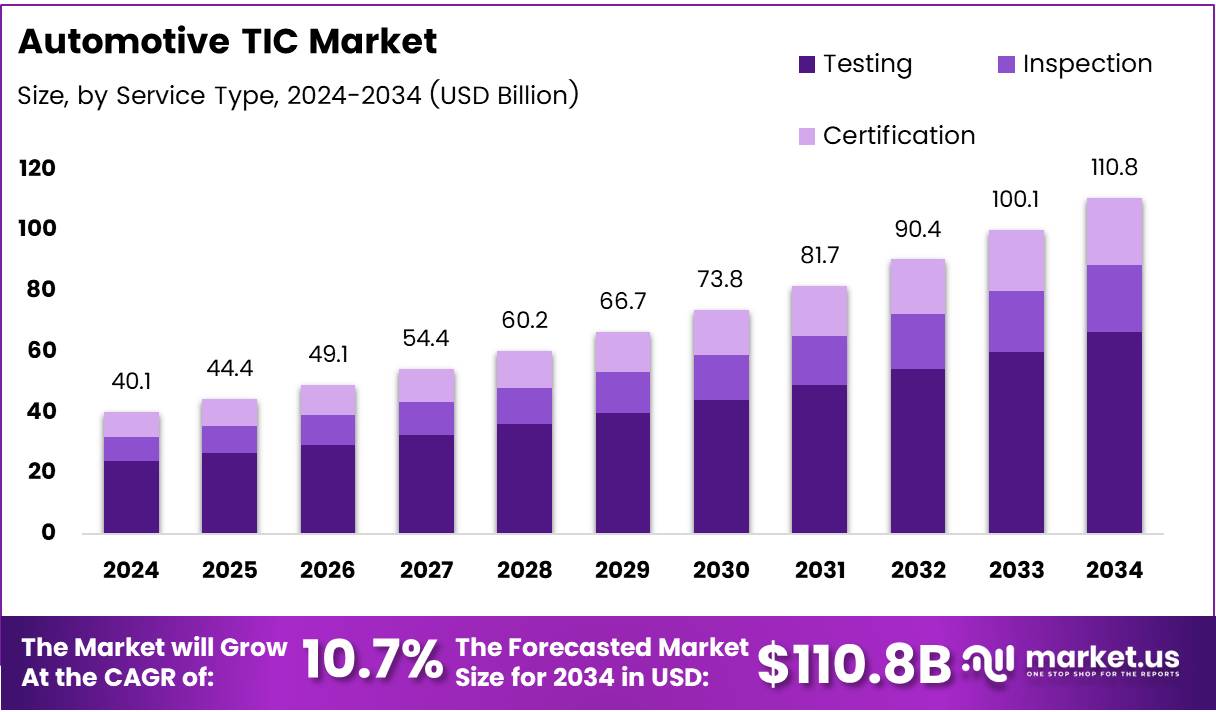

The Global Automotive TIC Market size is expected to be worth around USD 110.8 Billion by 2034, from USD 40.14 Billion in 2024, growing at a CAGR of 10.7% during the forecast period.

The Automotive TIC market is growing steadily due to rising vehicle complexity. Premium cars now use 100 million lines of code, increasing the need for strong testing and certification. Demand for automotive TIC services will grow as software systems expand. In the last 7 days, TIC prices dropped by -0.23%, but this has not affected long-term market potential.

Governments are investing in safety, emission checks, and auto compliance. These efforts drive demand for automotive inspection and certification. Strict global laws now require proper TIC certification before export. This trend is boosting the market globally.

There is high opportunity in the automotive TIC industry. By the end of 2024, 5.23 million passenger cars were registered, showing strong vehicle production. Yet only 62.4% of TIC providers see testing as their main task. This leaves room for new players to offer better, focused services.

As EVs and autonomous cars rise, TIC services must evolve. Companies that align with laws and tech trends will win. The automotive TIC market offers steady growth, strong government support, and untapped segments. Now is the time to invest, adapt, and lead in the fast-changing TIC space.

Key Takeaways

- The global Automotive TIC market is projected to reach USD 110.8 billion by 2034, growing at a CAGR of 10.7% from 2025 to 2034.

- Testing services led the market in 2024, accounting for a 74.2% share.

- In-house sourcing dominated the sourcing type segment in 2024 with a 56.4% market share.

- Vehicle Inspection was the top application in 2024, capturing 22.2% of the market.

- Asia Pacific was the largest regional market in 2024, holding 32.5% of the global market value.

Market Drivers

Strict Regulations

Tough safety and emission rules are pushing automakers to use more third-party TIC services to meet updated global standards. Regular testing is needed as rules keep changing.

More Cars & New Tech

With more cars being made especially in developing markets and new tech like ADAS and autonomous systems, there’s a bigger need for both mechanical and electronic testing.

EV & Hybrid Growth

The rise of electric and hybrid vehicles creates new testing needs for batteries, charging, and power systems. TIC companies are expanding their services to support this growing market.

Challenges

TIC providers face cost pressures due to automakers’ budget constraints and a fragmented regulatory landscape, which increases complexity and delays.

Additionally, emerging markets lack technical expertise and infrastructure, causing reliance on external services and certification delays.

Segmentation Insights

Service Type Analysis

In 2024, Testing led the Automotive TIC market with 74.2% share, driven by essential PLC, RTU, and HMI checks throughout vehicle design, production, and final verification.

Sourcing Type Analysis

In-house sourcing held 56.4% share as automakers prioritized direct control over quality and compliance, while outsourcing grew more slowly due to coordination and oversight challenges.

Application Analysis

Vehicle Inspection topped applications with 22.2% share, fueled by stricter safety and emissions rules, alongside rising demand for components, materials, ADAS, and durability testing.

Regional Insights

Asia Pacific led the Automotive TIC market in 2024 with a 32.5% share, valued at USD 12.8 billion, driven by strong automotive growth and strict safety regulations in China, India, and Japan.

North America holds a significant share, supported by a mature automotive sector, EV growth, and demand for advanced tech like autonomous vehicles.

Europe remains a key market due to strict safety and emission standards, strong manufacturing hubs, and heavy investment in EVs and R&D.

Middle East & Africa and Latin America are smaller but growing markets, driven by modernization efforts and rising adoption of global vehicle safety standards.

Recent Developments

- In April 2025, DEKRA invested $22.8 million to accelerate advancements in electric vehicles (EVs), cybersecurity, and automotive innovation. This strategic move aims to strengthen DEKRA’s global position in future mobility testing and certification services.

- In June 2024, Battery Smart raised $65 million in Series B funding to rapidly grow its EV battery swapping network across India. The capital will support infrastructure expansion and improve access to affordable EV energy solutions.

- In June 2024, Applus acquired an 80% stake in IDIADA, reinforcing its capabilities in automotive engineering, testing, and homologation. This acquisition enhances Applus’s presence in the global automotive TIC market.

Conclusion

The Automotive TIC market is set for strong growth, reaching USD 110.8 billion by 2034 at a 10.7% CAGR. Rising vehicle complexity, EV adoption, and stricter global regulations are driving demand for testing and certification services.

Testing dominated in 2024 with a 74.2% share, while Asia Pacific led regionally with 32.5% market share. Investments by key players like DEKRA and Applus show strong industry momentum.

With growing compliance needs and tech innovation, now is the right time to invest, innovate, and lead in the evolving TIC space.