Table of Contents

Report Overview

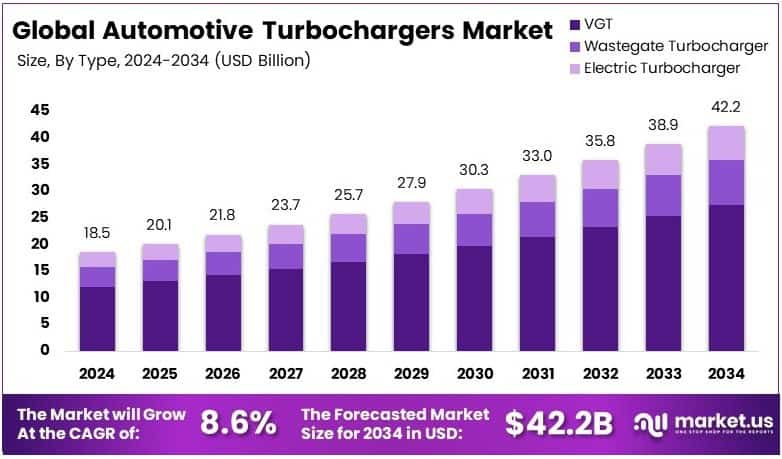

The Global Automotive Turbochargers Market size is expected to be worth around USD 18.5 Billion by 2034, from USD 42.2 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034.

The automotive turbochargers market is witnessing robust growth driven by increasing demand for fuel-efficient and high-performance engines. According to Capital One, 37% of engines in U.S. passenger vehicles for the 2023 model year were turbocharged, reflecting a significant shift toward adopting turbocharging technology for improved efficiency and power output.

Moreover, the market offers substantial opportunities due to the rising preference for downsized engines that maintain performance standards. Accelleron reports that although turbochargers represent roughly 10% of the overall cost of two-stroke engines, they can deliver up to 75% of the engine’s power, highlighting their critical role in enhancing engine performance while controlling emissions.

Government investments and stringent regulations are further propelling market expansion. Increasingly strict emission standards worldwide are encouraging automakers to integrate turbochargers, which help reduce fuel consumption and lower greenhouse gas emissions. Additionally, several countries are offering incentives to support the development of cleaner automotive technologies, accelerating turbocharger adoption.

Key Takeaways

- 37% of engines in U.S. passenger vehicles for the 2023 model year were turbocharged, indicating growing adoption.

- Variable Geometry Turbochargers (VGT) hold a dominant 65.3% market share in 2024.

- Gasoline-powered turbochargers lead with a 52.7% market share due to widespread use in passenger cars.

- Passenger cars account for 64.4% of turbocharger use globally.

- Asia Pacific commands a 44.2% share of the automotive turbochargers market, valued at US$8.18 billion.

- Turbochargers can deliver up to 75% of a two-stroke engine’s power while only constituting 10% of its cost.

- Cast iron is the leading material, representing 58.8% of turbocharger components for durability and heat resistance.

Market Segmentation

In 2024, Variable Geometry Turbochargers (VGT) dominate the automotive turbocharger market with a 65.3% share, thanks to their dynamic intake flow adjustment that boosts engine efficiency and reduces lag. Wastegate Turbochargers remain popular for their cost-effectiveness and reliability in standard applications. Meanwhile, Electric Turbochargers are emerging rapidly, especially in hybrid and electric vehicles, due to their immediate boost capabilities.

Gasoline-powered turbochargers lead with 52.7% market share, driven by widespread use in passenger cars and compliance with emission norms. Diesel turbochargers are crucial for heavy-duty vehicles requiring high torque, while natural gas turbochargers gain traction as a cleaner energy alternative.

Passenger cars account for 64.4% of turbocharger use, reflecting high personal vehicle demand. Light and heavy commercial vehicles utilize turbochargers to improve power and fuel efficiency under varying operational needs. Cast iron is the dominant material at 58.8%, valued for durability and heat resistance, while aluminum is preferred for lightweight, high-performance applications.

Key Market Segments

By Type

- VGT

- Wastegate Turbocharger

- Electric Turbocharger

By Fuel Type

- Gasoline

- Diesel

- Natural Gas

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

By Material

- Cast Iron

- Aluminum

Top Use Cases

- Passenger Vehicles: Turbochargers enhance fuel efficiency and power output in passenger cars, helping manufacturers meet stricter emission regulations while delivering better driving performance.

- Heavy-Duty Trucks: In heavy commercial vehicles, turbochargers provide increased torque and engine power, essential for hauling heavy loads over long distances with improved fuel economy.

- Hybrid and Electric Vehicles: Electric turbochargers support hybrid powertrains by providing instant boost without lag, improving acceleration and overall vehicle responsiveness.

- Motorsports and Racing: High-performance racing cars use lightweight aluminum turbochargers to reduce engine weight and maximize power output for competitive advantage on the track.

- Natural Gas Vehicles: Turbochargers in natural gas engines improve combustion efficiency, reducing emissions and promoting cleaner energy use in commercial and passenger applications.

Major Challenges

Despite growth, the turbocharger market faces challenges such as complex engine designs that increase assembly and maintenance difficulties. Turbocharged engines often cost more to repair due to their high-pressure operation, which may deter buyers in price-sensitive markets. Turbo lag, the delay in power boost, and stricter emission standards also create hurdles for manufacturers, adding to development costs.

Top Opportunities

New opportunities in the turbocharger market arise from electrification and material innovation. Hybrid vehicles benefit from turbocharging for improved fuel efficiency without sacrificing performance. Electrically assisted turbos reduce lag and improve acceleration, especially in luxury cars. The aftermarket segment is growing as owners upgrade engines, and lightweight materials like titanium are improving turbocharger efficiency and durability.

Emerging Trends

The market is seeing advances like twin-scroll and variable geometry turbochargers for better fuel economy and faster response in premium cars. Modular designs allow flexible use across different engine types, cutting costs and speeding development. Waste heat recovery systems are adding efficiency by converting engine heat into energy. Turbochargers are also being adapted for alternative fuels, supporting cleaner and low-emission vehicles.

Regional Analysis

Asia Pacific leads the automotive turbochargers market with a 44.2% share valued at US$8.18 billion, driven by strong automotive manufacturing in China, Japan, and India, rising demand for fuel-efficient vehicles, rapid industrial growth, and supportive government regulations promoting emissions reduction.

North America maintains a significant presence due to strict environmental policies and a focus on energy-efficient vehicles, while Europe contributes strongly through its leadership in turbocharger innovations aimed at reducing emissions and enhancing fuel economy.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 42.2 Billion |

| Forecast Revenue (2034) | USD 18.5 Billion |

| CAGR (2025-2034) | 8.6% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Segmentation | By Type (VGT, Wastegate Turbocharger, Electric Turbocharger), By Fuel Type (Gasoline, Diesel, Natural Gas), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)), By Material (Cast Iron, Aluminum) |

| Competitive Landscape | Garrett Motion, Continental GT, Aptiv PLC, Turbonetics, ABB, Cummins Inc., Ningbo Motor Industrial Co. Ltd., Precision Turbo and Engine Inc., Robert Bosch GmbH, Mahle, Rotomaster International, Mitsubishi Heavy Industries, Ltd. |

Conclusion

In conclusion, the global automotive turbochargers market is poised for robust growth driven by increasing demand for fuel-efficient and high-performance engines, supported by stringent emission regulations and government incentives. Key technologies like Variable Geometry Turbochargers and electric turbochargers are enhancing engine efficiency and responsiveness across passenger and commercial vehicles. The Asia Pacific region leads the market, fueled by strong automotive manufacturing and supportive policies, while advancements in materials and turbocharger designs continue to open new opportunities. As the industry embraces electrification and cleaner fuels, turbochargers will remain essential in balancing performance with sustainability, positioning the market for sustained expansion through 2034.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)