Table of Contents

Report Overview

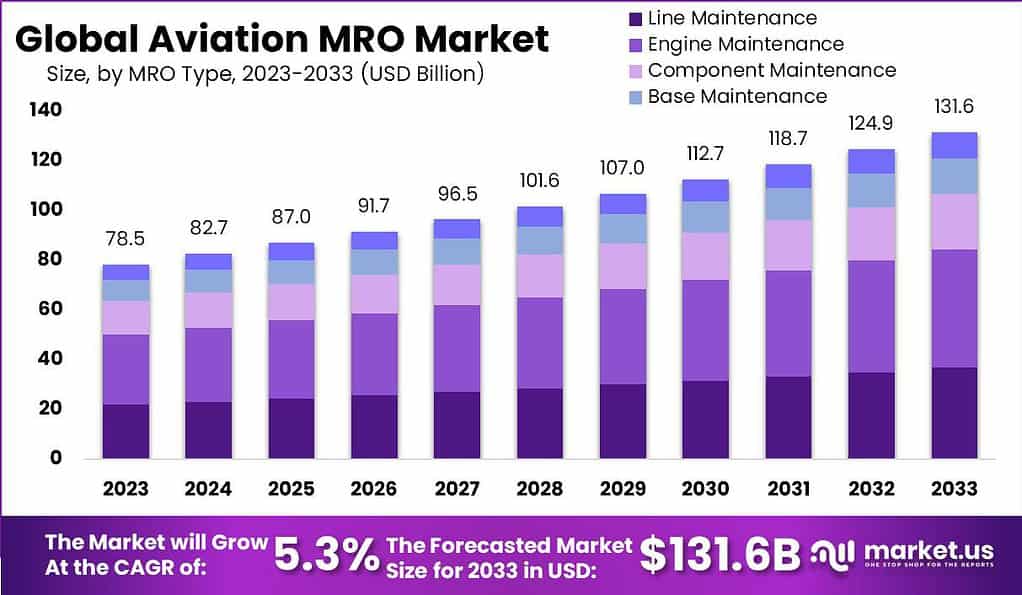

The global Aviation Maintenance, Repair, and Overhaul (MRO) market is projected to experience consistent growth, driven by the steady expansion of global air traffic, increasing fleet size, and the rising demand for aircraft reliability. In 2023, the market was valued at approximately USD 78.5 billion, and it is expected to reach a value of around USD 131.6 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.3% during the forecast period from 2023 to 2033.

This sustained growth can be attributed to the aging of commercial aircraft fleets, which necessitates more frequent maintenance cycles, particularly in developing markets where older aircraft are still widely in operation. Airlines are increasingly investing in MRO services to ensure operational safety, extend aircraft lifespan, and avoid unexpected downtime, especially as travel demand rebounds globally. Moreover, the shift toward more fuel-efficient aircraft has intensified the demand for component-level upgrades and advanced engine diagnostics, reinforcing the strategic role of MRO in long-term airline cost efficiency.

The growing presence of low-cost carriers and regional airlines in emerging economies is also driving the need for cost-effective and technologically advanced MRO services. In parallel, digital transformation within the aviation sector – through predictive maintenance technologies, AI-driven diagnostics, and real-time performance monitoring – is reshaping the MRO landscape, enabling providers to optimize operations and reduce turnaround time. These trends, combined with increased outsourcing of maintenance activities by airline operators, are expected to reinforce the market’s upward trajectory over the next decade.

Aviation MRO Statistics

- In 2023, Engine Maintenance was the top MRO type, capturing over 36.1% market share, owing to the high frequency and cost intensity of engine overhauls and inspections.

- Line Maintenance and Component Maintenance also contributed significantly, supporting continuous aircraft operation and ensuring flight safety across global fleets.

- By aircraft type, Commercial Aircraft held the dominant share of over 57.9%, fueled by rising global air traffic and the need for regular service cycles.

- Military Aircraft and General Aviation followed, supported by strategic defense contracts and expanding private aviation fleets, respectively.

- Independent MRO Providers led the service provider segment in 2023 with over 54.7% market share, driven by competitive pricing and specialized service offerings.

- OEMs and Airline Operator MRO units also maintained strong positions, benefiting from integrated service packages and in-house maintenance capabilities.

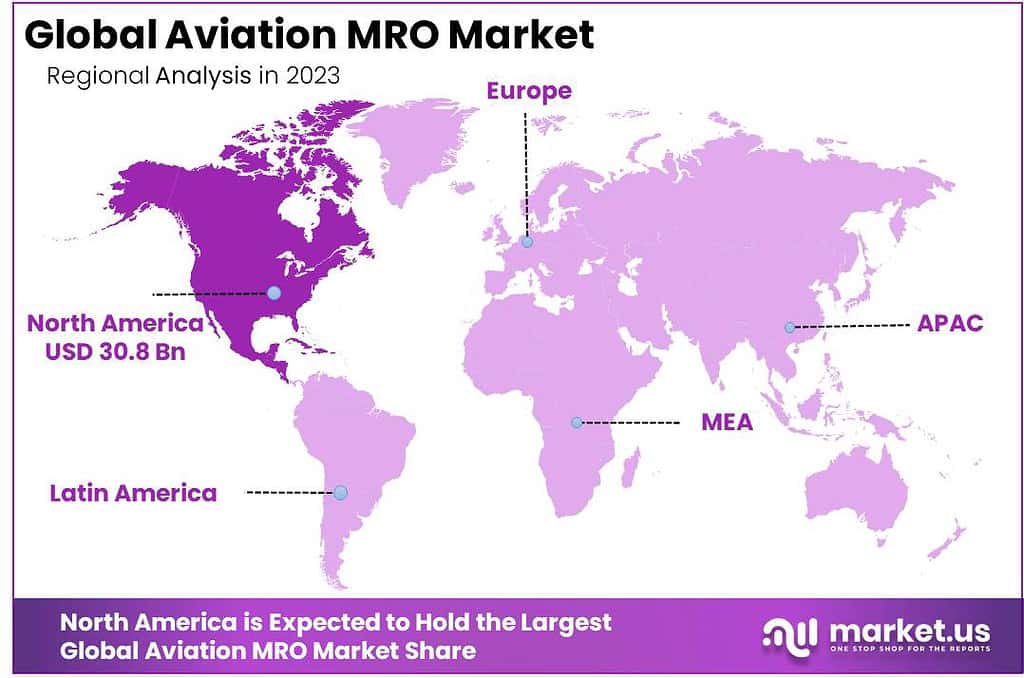

- North America remained the leading regional market, commanding a share of over 39.3% in 2023, supported by a mature aviation ecosystem and large commercial aircraft base.

Regional Analysis

In 2023, North America firmly maintained its leadership in the global Aviation MRO market, capturing a substantial 39.3% share, with regional demand valued at approximately USD 30.8 billion. This dominance can be attributed to a combination of structural, regulatory, and economic factors that have long positioned the region as a cornerstone of the global aviation maintenance landscape.

A key driver behind this commanding share is the region’s expansive fleet of commercial and military aircraft, which consistently requires routine and complex maintenance services. The United States, in particular, houses some of the world’s busiest air travel hubs and largest airline operators, all of which contribute to the steady flow of MRO activity. In addition, North America’s deep-rooted commitment to stringent aviation safety regulations and compliance frameworks creates a high baseline demand for regular inspection, overhaul, and system upgrades.

Emerging Trends

- Digital transformation and AI adoption – Integration of predictive maintenance, digital twins, and AI-powered troubleshooting is accelerating. For example, generative AI copilots and compliance automation are being piloted by airlines and MRO providers.

- Paperless, mobile-enabled operations – MRO software is now integrated with ERP systems and accessed on mobile devices, improving visibility and reducing human error.

- Sustainability push – Increasing adoption of eco‑friendly materials, energy‑efficient processes, and waste reduction is becoming mainstream.

- Consolidation and partnerships – The fragmented MRO landscape is seeing mergers, strategic alliances, and regional hubs emerging (e.g., Queensland aiming to be a key Asia‑Pacific center).

Top Use Cases

- Predictive engine maintenance – AI analytics process sensor data to predict failures, reduce downtime, and shorten turnaround on engines.

- Digital inspections and remote audits – Drone-based inspections (e.g., Donecle) and chatbot copilots enable faster checks and compliance.

- Mobile-assisted line maintenance – Technicians access digital technical manuals and work orders via tablets, boosting efficiency .

- Supply chain optimization – AI-driven systems improve inventory forecasting and parts procurement, mitigating disruptions.

- Base and heavy maintenance hubs – Centralized heavy checks in strategic regions (e.g., Asia-Pacific, Australia) are growing to serve aging fleets locally.

Attractive Opportunities

- Narrow‑body fleet servicing – The dominant share of narrow‑body aircraft in operation offers a large repair market and engine overhaul demand.

- Emerging market expansion – APAC and Latin America regions are experiencing fast fleet growth, encouraging local MRO investment .

- AI‑as‑a‑service for MRO – Providers can commercialize AI tools like predictive analytics and chatbot assistants, generating new revenue streams .

- Sustainable MRO solutions – Offering green services-such as energy‑saving processes and recyclable materials – can attract eco‑conscious airlines.

- Strategic consolidation – SMEs can benefit from partnerships or acquisition by larger MRO players to enhance scale and global reach.

Major Challenges

- Skilled‑labor shortages – Aging technician workforce and insufficient recruitment are constraining capacity .

- Parts & supply chain disruptions – Scarcity of specialized parts causes delays and revenue loss.

- Rising maintenance times & costs – Engine service times have increased up to 150 % for new-gen engines and 35 % for legacy models.

- High capital expenditure – Investments in digital systems, sustainable technologies, and certification are capital-intensive .

- Regulatory complexity – Compliance with evolving global aviation standards and certifications demands agility and expertise

Key Market Segments

MRO Type

- Line Maintenance

- Engine Maintenance

- Component Maintenance

- Base Maintenance

- Other MRO Types

Aircraft Type

- Commercial Aircraft

- Military Aircraft

- General Aviation

Service Provider

- OEMs (Original Equipment Manufacturers)

- Independent MRO Providers

- Airlines Operator MRO

Top Player’s Company Profiles

- AAR Corp.

- Airbus SE

- Delta Airlines, Inc.

- Lufthansa Technik AG

- Raytheon Technologies Corporation

- ST Engineering Aerospace

- The Boeing Company

- GE Aerospace

- Emirates Engineering

- Hong Kong Aircraft Engineering Company Limited

- SIA Engineering Company Limited

- MTU Aero Engines AG

- Other Key Players

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)