Table of Contents

Introduction

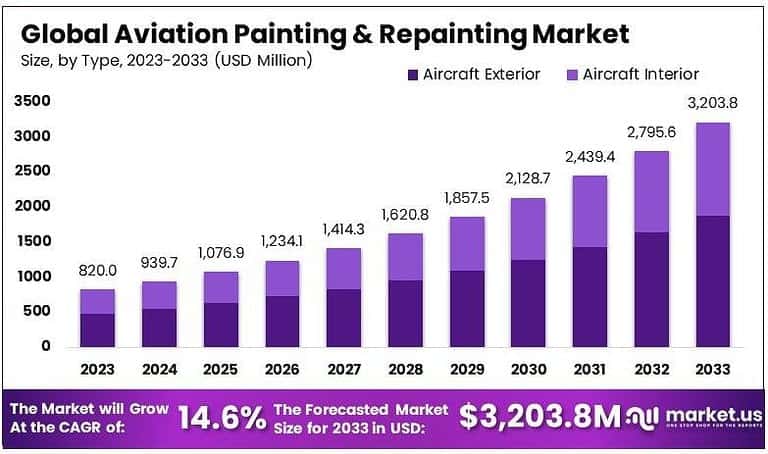

The global aviation painting and repainting market reached USD 820 million in 2023 and is projected to grow at a CAGR of 14.6%, reaching approximately USD 3,203.8 million by 2033. The growth is driven by rising aircraft deliveries, increased fleet maintenance activities, and expanding MRO (Maintenance, Repair, and Overhaul) operations worldwide. Demand for eco-friendly coatings, lightweight materials, and advanced surface technologies is also fueling the market. Airlines are investing in repainting programs to enhance aesthetics, branding, corrosion protection, and fuel efficiency, particularly as air travel rebounds post-pandemic.

How Growth is Impacting the Economy

The expansion of the aviation painting and repainting industry is contributing significantly to the global aerospace economy. As aircraft fleets increase, repainting cycles—typically every five to seven years—drive recurring demand for coatings and specialized labor. According to the International Air Transport Association (IATA), global passenger traffic grew by over 36% in 2023, prompting higher maintenance activity across commercial fleets.

This surge benefits local economies through job creation in hangar operations, paint manufacturing, and MRO services. Eco-friendly and low-VOC paints are also stimulating investments in green chemistry and manufacturing innovation. Economically, the market’s growth strengthens supply chains across aviation hubs like the US, France, and Singapore, and drives regional industrial development in emerging economies seeking to expand MRO capabilities.

➤ Unlock growth! Get your sample now! – https://market.us/report/aviation-painting-repainting-market/free-sample/

Impact on Global Businesses

Rising raw material costs—particularly titanium dioxide, resins, and solvents—are increasing operating expenses for paint manufacturers and MRO service providers. Supply chain disruptions in chemicals and aluminum-based coatings are affecting timely deliveries. Sector-specific impacts include heightened demand from commercial airlines and private jet operators seeking brand differentiation, while military fleets are focusing on radar-absorbing and corrosion-resistant coatings.

Business jet repainting frequency has increased due to aesthetic upgrades and resale value enhancement. Environmental regulations, such as REACH in Europe, are compelling manufacturers to develop sustainable waterborne and powder coating solutions, adding R&D costs but improving long-term efficiency and compliance.

Strategies for Businesses

To maintain competitiveness and profitability, companies in the aviation painting and repainting sector are focusing on:

- Adopting eco-friendly, low-VOC, and chrome-free coatings to meet environmental regulations

- Investing in automation and robotics for precision painting and reduced labor time

- Expanding MRO hangar capacity to handle growing fleet demand

- Collaborating with OEMs and airlines for long-term maintenance contracts

- Integrating nanotechnology-based coatings for improved durability and heat resistance

Key Takeaways

- Market projected to reach USD 3,203.8 million by 2033, growing at 14.6% CAGR

- Rising global aircraft fleet and MRO activities driving growth

- Demand for sustainable coatings increasing across regions

- Technological advancements improving operational efficiency

- Commercial aviation segment remains the largest end-user

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=129301

Analyst Viewpoint

The aviation painting and repainting market is on a strong upward trajectory, supported by fleet modernization, airline rebranding, and sustainability initiatives. Presently, manufacturers are prioritizing chrome-free and waterborne coatings to reduce emissions and improve turnaround times. Future prospects remain highly positive, driven by next-generation aircraft production and smart coating technologies that enhance thermal control and longevity. Analysts expect continuous innovation in digital color management and automated paint application systems to define the next decade of competitive advantage.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Commercial Aircraft Repainting | Growing global passenger traffic and fleet renewal programs |

| Military Aircraft Coatings | Demand for radar-absorbing and anti-corrosion technologies |

| Business Jet Customization | Rising preference for premium finishes and brand personalization |

| Eco-Friendly Coating Application | Adoption of waterborne and low-VOC paints for sustainability |

| MRO Expansion Projects | Increased investment in hangar facilities and automation |

Regional Analysis

North America dominates the global market, supported by strong airline presence, major OEM facilities, and robust MRO networks across the US and Canada. Europe follows closely, with countries like France, Germany, and the UK emphasizing sustainable coating technologies. The Asia Pacific region is witnessing rapid growth, driven by expanding commercial aviation in China, India, and Singapore. Latin America is emerging as an attractive market with airline refurbishments and increasing private jet ownership, while the Middle East & Africa continue to invest in aviation hubs and MRO centers to serve growing international traffic.

➤ Don’t Stop Here — Check Our Library

- Product Lifecycle Management Software Market

- Smart Grid Analytics Market

- Generative AI In Insurance Market

- Passenger Drones Market

Business Opportunities

The aviation painting and repainting market presents significant opportunities in sustainable coatings, robotic paint systems, and lightweight material integration. As airlines seek efficiency and eco-compliance, providers offering faster turnaround and advanced surface treatment solutions can capture higher market share. Expanding MRO networks in Asia and the Middle East provide lucrative avenues for partnerships. Moreover, the development of smart coatings—capable of thermal regulation and self-healing—offers long-term growth potential for innovators in material science and aerospace engineering.

Key Segmentation

The market can be segmented as follows:

- By Paint Type: Epoxy, Polyurethane, Acrylic, Others

- By Aircraft Type: Commercial, Military, Business, Regional

- By Application: Exterior Painting, Interior Painting, Repainting, Maintenance Coatings

- By Technology: Solvent-Based, Water-Based, Powder Coatings, Nano Coatings

- By End-User: OEMs, MROs, Airlines, Private Operators

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Player Analysis

Leading players in the aviation painting and repainting market are focusing on sustainability, efficiency, and digital transformation. They are introducing eco-efficient coating systems with enhanced adhesion, weather resistance, and color retention. Strategic collaborations with aircraft manufacturers and MRO firms are strengthening their market positions. R&D investments are concentrated on UV-resistant and chrome-free solutions to comply with global environmental standards. Automation technologies and advanced robotics are being integrated to improve precision and reduce turnaround time. Furthermore, digital color-matching tools and augmented-reality systems are enhancing quality control and customization for both commercial and defense applications.

- International Aerospace Coatings

- Satys

- MAAS Aviation

- Dean Baldwin Painting

- General Atomics AeroTec Systems

- Gameco

- Air Works

- New United Goderich

- Altitude Paint Services

- Straight Flight

- Other Key Players

Recent Developments

- April 2025: Introduction of a new chrome-free polyurethane coating for commercial aircraft.

- January 2025: Major MRO facility expansion in Singapore to accommodate wide-body repainting services.

- November 2024: Development of automated robotic painting system for precision application.

- August 2024: Collaboration announced for water-based aerospace coatings production in Europe.

- May 2024: Launch of nanotechnology-based coating to reduce drag and improve fuel efficiency.

Conclusion

The global aviation painting and repainting market is evolving rapidly as airlines, OEMs, and MROs prioritize sustainability, speed, and durability. With increasing aircraft deliveries and technological innovation, the market is set to experience dynamic growth and long-term value creation across all aviation segments.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)