Table of Contents

Introduction

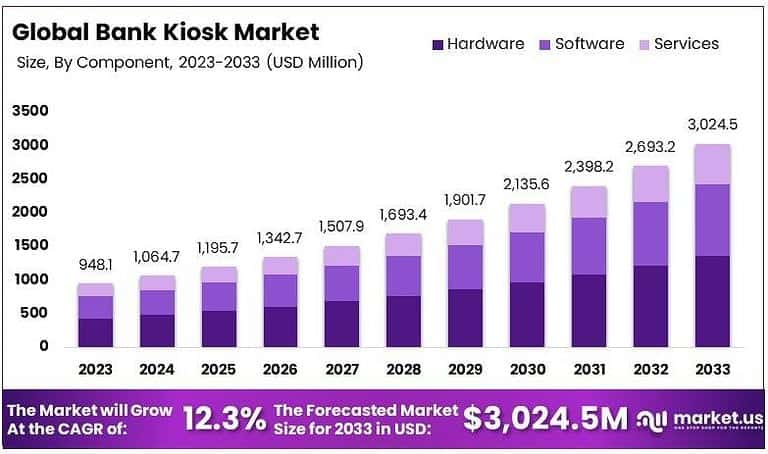

The global bank kiosk market is projected to experience robust growth, reaching a value of approximately USD 3,024.5 million by 2033, up from USD 948.1 million in 2023. This growth is attributed to the increasing adoption of self-service banking solutions, technological advancements, and enhanced customer experience initiatives by financial institutions.

With a compound annual growth rate (CAGR) of 12.3% from 2024 to 2033, the market is poised for significant expansion, driven by the growing demand for contactless transactions, operational efficiency, and reduced reliance on traditional banking channels.

How Growth is Impacting the Economy

The growth of the bank kiosk market has significant implications for the global economy, particularly in the financial services sector. By adopting kiosk solutions, banks can reduce operational costs, enhance customer service, and improve transaction efficiency.

The increasing adoption of self-service kiosks is expected to drive further automation in banking, reducing the need for physical branches and associated overheads. This, in turn, supports economic growth by enabling financial institutions to focus on digital services, reducing labor costs, and enhancing scalability. Moreover, bank kiosks cater to a growing preference for contactless transactions, boosting the shift towards digital economies.

➤ Uncover best business opportunities here @ https://market.us/report/bank-kiosk-market/free-sample/

Impact on Global Businesses

The rise of bank kiosks is leading to notable shifts in global businesses, particularly in the context of rising costs and evolving supply chains. As businesses increasingly integrate self-service banking solutions, they face reduced transaction costs and the ability to provide round-the-clock services.

However, the shift to automated solutions may also pose challenges, such as the rising costs of maintaining sophisticated kiosk technologies and the need to adapt to new regulations. Sector-specific impacts include improvements in retail banking and financial services, where kiosks are expected to streamline operations, while other industries, like retail and logistics, might see shifts in customer engagement and payment processes.

Strategies for Businesses

To leverage the growth of the bank kiosk market, businesses must focus on integrating kiosks into their existing infrastructure, ensuring seamless user experiences through easy navigation and secure transaction methods. Fostering partnerships with technology providers will be key in staying ahead of trends and deploying the latest innovations.

Additionally, businesses should prioritize customer feedback to continually improve kiosk interfaces, ensuring they meet evolving demands for speed, accessibility, and convenience. Investing in kiosks will not only enhance operational efficiency but also create an opportunity for businesses to stay competitive in the increasingly digitized financial services sector.

Key Takeaways

- The global bank kiosk market is expected to grow from USD 948.1 million in 2023 to USD 3,024.5 million by 2033, at a CAGR of 12.3%.

- Bank kiosks are transforming the financial services industry by reducing operational costs and improving customer experience.

- Self-service kiosks enable 24/7 banking, enhancing convenience for consumers and increasing operational efficiency.

- The demand for contactless, automated services is driving the adoption of kiosks in emerging markets.

- Businesses must prioritize technology integration and customer feedback to maintain a competitive edge in the evolving financial services market.

➤ Buy Report Here @ https://market.us/purchase-report/?report_id=128860

Analyst Viewpoint

The bank kiosk market is expected to witness substantial growth over the next decade, driven by technological innovations and evolving consumer preferences. In the present, the sector is experiencing a shift towards self-service solutions that enhance operational efficiency.

Looking ahead, the market is poised for positive growth, with new developments and opportunities that will continue to reshape the financial services industry. As digital banking takes center stage, companies investing in self-service kiosks are likely to see enhanced customer satisfaction, reduced operational costs, and improved scalability, positioning them for future success.

Regional Analysis

The bank kiosk market is witnessing diverse growth patterns across regions. North America holds a significant share, driven by the region’s advanced infrastructure and early adoption of self-service banking solutions.

Asia-Pacific, however, is projected to experience the highest growth rate due to increasing urbanization, rising financial inclusion, and the rapid adoption of digital banking services. Europe is also seeing steady growth, fueled by the demand for contactless and automated services. As the market expands, emerging regions, particularly in Africa and Latin America, will become key players due to the need for accessible financial services and banking solutions.

➤ Discover More Trending Research

- Enterprise Session Border Controller Market

- Autonomous Last Mile Delivery Market

- AI Transcription Market

- IC Fabs Market

Business Opportunities

The global bank kiosk market presents numerous business opportunities, particularly for technology companies specializing in hardware and software solutions for self-service banking. Financial institutions are increasingly investing in kiosk technology to enhance operational efficiency and improve customer engagement.

Startups focused on providing customizable kiosk solutions, along with those offering secure payment systems and remote management tools, will find significant demand. Additionally, as digital banking expands in developing regions, there are opportunities for businesses to establish a foothold by providing affordable, scalable kiosk solutions to underserved populations.

Key Segmentation

Application:

- Retail Banking – 40%

- ATMs – 30%

- Bill Payment & Ticketing – 20%

- Others – 10%

Type:

- Indoor Kiosks – 60%

- Outdoor Kiosks – 40%

Component:

- Hardware – 50%

- Software – 30%

- Services – 20%

Key Player Analysis

Key players in the bank kiosk market include leading technology providers specializing in hardware, software, and integrated solutions for financial institutions. Companies are focusing on providing reliable, secure, and easy-to-use kiosks that streamline the banking experience for customers.

These companies are also incorporating cutting-edge technologies like artificial intelligence, biometrics, and blockchain to enhance kiosk security and functionality. Market leaders continue to innovate by developing customized solutions for various segments, such as retail banking, ATMs, and payment services, catering to the growing demand for self-service banking solutions globally.

- Diebold Nixdorf, Inc.

- Fiserv Inc. Company Profile

- NCR Atleos

- Hyosung TNS Inc.

- Olea Kiosks Inc.

- Meridian Kiosks

- GRGBanking

- Glory Global Solutions (International) Limited

- KAL ATM Software GmbH

- Maximus

- Other Key Players

Recent Developments

- In January 2025, a major financial institution introduced a new kiosk solution that integrates AI for enhanced customer service and transaction security.

- In March 2025, a leading technology provider launched a kiosk with enhanced biometric authentication features to boost security in banking transactions.

- In May 2025, a global kiosk manufacturer unveiled a modular, customizable kiosk platform that can be easily adapted for various banking environments.

- In June 2025, a software provider introduced advanced analytics tools for bank kiosks, allowing banks to monitor performance and customer interactions in real time.

- In July 2025, a financial services company rolled out eco-friendly, energy-efficient bank kiosks designed to reduce operational costs and minimize environmental impact.

Conclusion

The bank kiosk market is poised for significant growth. Driven by advancements in self-service banking technology. Financial institutions are increasingly adopting kiosk solutions to streamline operations, enhance customer experiences, and reduce costs. As the market evolves, businesses that prioritize innovation and security will find ample opportunities for expansion and success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)