Table of Contents

Introduction

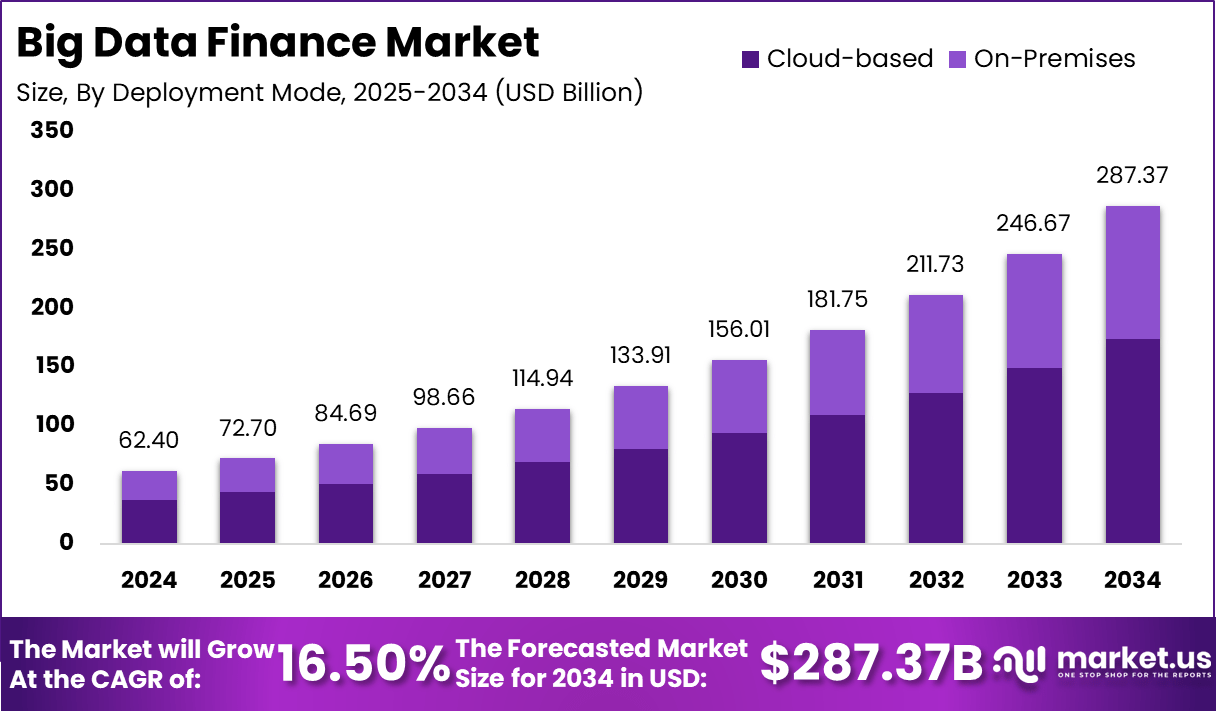

The global Big Data Finance Market was valued at USD 62.4 billion in 2024 and is projected to reach approximately USD 287.37 billion by 2034, expanding at a CAGR of 16.5%. The surge in financial data volumes, coupled with the integration of AI-driven analytics, predictive modeling, and real-time risk management systems, is transforming financial operations worldwide.

North America dominated with a 40.2% share in 2024, valued at USD 25.08 billion, due to its robust fintech ecosystem and technological adoption. The US market alone, valued at USD 22.47 billion, is projected to reach USD 89.34 billion by 2034, reflecting significant growth potential.

How Growth is Impacting the Economy

The expansion of big data finance is significantly strengthening the global digital economy by enhancing transparency, decision-making accuracy, and financial efficiency. It enables real-time fraud detection, predictive risk analysis, and improved asset management, reducing systemic financial risks. Increased data utilization fosters innovation in credit scoring and digital lending, improving credit accessibility and financial inclusion, especially in developing regions.

The demand for data engineers, financial data scientists, and AI modelers is creating high-value employment opportunities. Additionally, big data adoption is increasing capital flow efficiency in global financial markets by enabling faster transactions and smarter portfolio allocations. Governments and central banks benefit from advanced data analytics for economic forecasting and monetary policy assessment. Overall, the sector’s expansion contributes to productivity gains, investment diversification, and the long-term stability of global financial systems.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/big-data-finance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Global financial firms are facing increasing costs for data storage, AI infrastructure, and cybersecurity compliance as regulatory requirements tighten. Cloud migration and data integration across multiple geographies demand new partnerships between financial institutions and technology providers. These shifts are pushing banks and investment firms to adopt hybrid data management systems to mitigate latency and operational risks.

Sector-Specific Impacts

In banking, big data is transforming customer experience through AI-driven personalization and predictive credit models. Insurance companies are using data analytics for dynamic pricing and claims optimization, while investment firms leverage algorithmic trading and sentiment analysis for real-time decisions. Payment and fintech players are harnessing predictive analytics to detect fraud, improve transaction security, and enhance customer loyalty programs.

Strategies for Businesses

Financial enterprises must prioritize investment in AI-driven analytics, machine learning frameworks, and real-time data processing to enhance predictive accuracy. Partnering with cloud service providers ensures scalable and compliant data environments. Companies should strengthen data governance frameworks to comply with GDPR, CCPA, and Basel III guidelines. Adopting hybrid cloud solutions improves flexibility while reducing operational risks. Training employees in financial data science and leveraging blockchain for secure transactions can further optimize processes. Integrating advanced analytics with customer engagement platforms will help build trust and drive sustained business value in an increasingly data-dependent financial ecosystem.

Key Takeaways

- Market projected to reach USD 287.37 billion by 2034 at a 16.5% CAGR

- North America held a 40.2% share in 2024, led by the US at USD 22.47 billion

- AI, cloud computing, and predictive analytics are driving rapid adoption

- Enhanced fraud detection and risk mitigation boost investor confidence

- Rising data security and compliance costs are shaping financial operations

- Data-driven insights improving decision-making and profitability across industries

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162525

Analyst Viewpoint

At present, the Big Data Finance Market is witnessing accelerated digitalization across all financial functions, from risk management to investment analytics. The growing reliance on AI and machine learning to process unstructured financial data presents strong prospects for innovation. Looking ahead, the market is expected to mature as open banking and decentralized finance (DeFi) integrate advanced analytics. Analysts view this expansion as a key enabler of smarter, safer, and more inclusive global financial ecosystems, with substantial opportunities for fintech startups and institutional investors alike.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Fraud Detection Systems | Increased digital transactions and need for real-time anomaly detection |

| Credit Risk Assessment | Rising AI-powered predictive credit scoring and loan automation |

| Algorithmic Trading | Growing demand for real-time analytics in capital markets |

| Insurance Underwriting | Integration of IoT data and behavioral analytics for risk evaluation |

| Regulatory Compliance | Expansion of RegTech solutions for data transparency and reporting |

Regional Analysis

North America dominated the global market in 2024 with a 40.2% share, fueled by high fintech adoption, data infrastructure investments, and the presence of major financial technology innovators. Europe follows with increasing investments in open banking and regulatory compliance analytics. Asia Pacific is the fastest-growing region, driven by financial digitalization in China, India, and Singapore. Latin America and the Middle East are gradually embracing data-driven financial operations to support emerging fintech ecosystems, supported by government-backed innovation initiatives and private equity investments.

➤ More data, more decisions! see what’s next –

- Digital Smart Education Ecosystem Market

- Virtual Private Branch Exchange (PBX) System Market

- Virtual Security Appliance Market

- Purchase-Mortgage Market

Business Opportunities

Rising demand for AI-driven credit scoring, fraud analytics, and compliance automation offers immense business opportunities. Financial institutions can leverage predictive models to optimize lending decisions and reduce default rates. Cloud service providers benefit from hosting secure financial datasets, while RegTech startups gain traction through data-compliance automation. The expansion of data marketplaces enables monetization of financial data, and cross-border partnerships with fintechs are anticipated to unlock value in decentralized finance, cross-border payments, and micro-lending solutions, particularly in emerging markets.

Key Segmentation

The Big Data Finance Market can be segmented by component (software, services), deployment (on-premise, cloud), application (risk management, fraud detection, customer analytics, portfolio optimization, compliance management, credit scoring), and end-user (banks, insurance companies, asset management firms, fintech companies). The software segment dominates due to the widespread adoption of AI analytics tools, while the cloud deployment model is gaining momentum for its scalability and cost-efficiency. Financial institutions remain the largest end-user category, leveraging analytics for operational intelligence and customer engagement.

Key Player Analysis

Leading participants are focusing on expanding AI and cloud integration capabilities to enhance data-driven financial insights. They are investing heavily in scalable data infrastructure, blockchain security, and compliance automation solutions. Collaborations with fintech innovators and research institutes are supporting advanced predictive analytics and algorithmic modeling.

Companies are diversifying product portfolios through API-based financial data platforms and real-time visualization dashboards, enabling faster decision-making. Strategic mergers, partnerships, and R&D initiatives are aimed at creating interoperable solutions across financial ecosystems, supporting both traditional institutions and digital-native firms.

- Microsoft Corporation

- Amazon Web Services (AWS)

- IBM Corporation

- Oracle Corporation

- SAS Institute

- SAP SE

- Salesforce

- Databricks

- Snowflake

- Cloudera

- Alteryx

- Palantir

- Others

Recent Developments

- March 2025: A Global fintech consortium announced a cloud-based financial analytics hub to support real-time data collaboration.

- February 2025: Leading AI platform introduced predictive compliance software for cross-border financial transactions.

- August 2024: Major insurer deployed AI-based underwriting models, reducing claim-processing time by 30%.

- October 2024: The Central Bank initiated a big data-driven risk assessment program for commercial banks.

- December 2024: Investment firms launched blockchain-backed platforms to ensure transparency in asset tokenization.

Conclusion

The Big Data Finance Market is rapidly transforming global financial operations through AI and real-time analytics. Its steady growth, technological integration, and regulatory advancements are driving efficiency, transparency, and inclusivity, marking a decisive shift toward a smarter and data-centric financial future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)