Table of Contents

Introduction

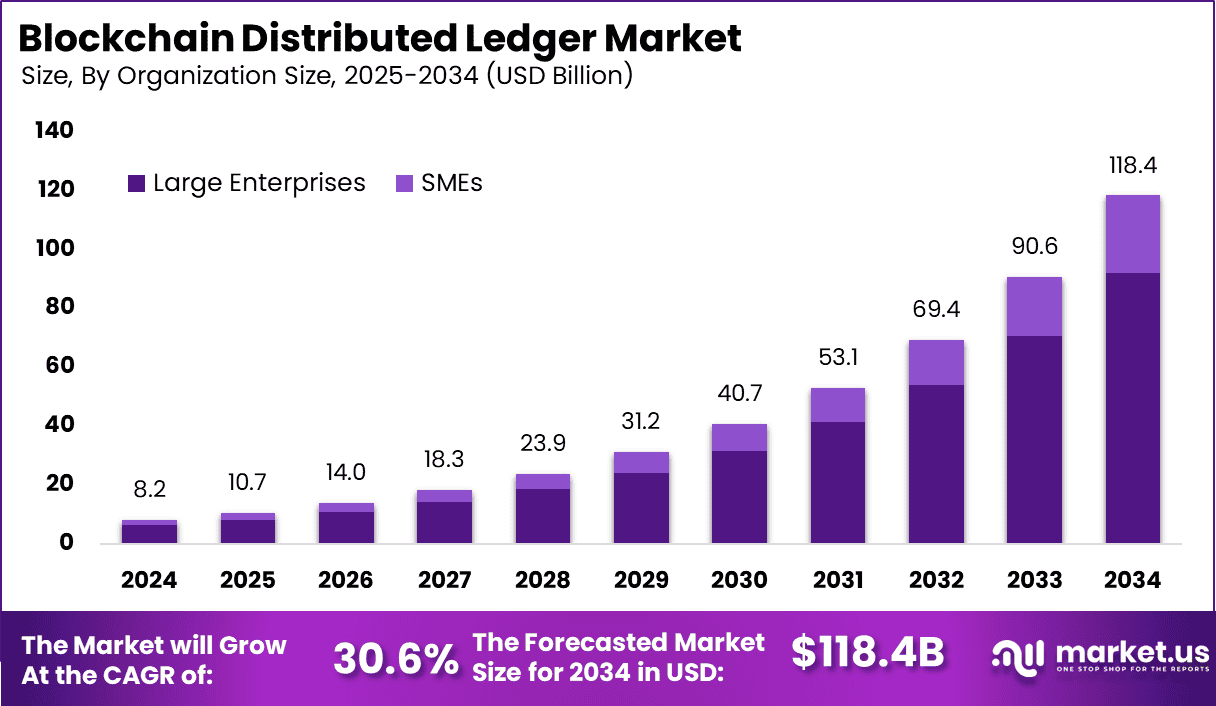

The global blockchain distributed ledger market was valued at US$8.2 billion in 2024 and is projected to reach US$118.4 billion by 2034, growing at an impressive CAGR of 30.6%. North America leads the market, holding a 37.3% share and generating US$3.0 billion in revenue.

The rapid adoption of blockchain technology across various industries, including finance, supply chain, healthcare, and government, is driving this growth. Blockchain’s ability to provide transparency, reduce fraud, and streamline operations has made it a transformative technology. As more businesses explore decentralized systems, the market for distributed ledgers continues to expand rapidly.

How Growth is Impacting the Economy

The rapid expansion of the blockchain distributed ledger market is having a profound impact on the global economy. Blockchain’s ability to increase operational efficiency, enhance transparency, and reduce transactional costs is improving productivity across industries. As businesses adopt decentralized systems, they can access faster, more secure, and cost-effective transactions. This shift is reducing friction in cross-border payments, which, in turn, is stimulating international trade. Blockchain also fosters trust in digital transactions, driving innovation and consumer confidence.

Additionally, blockchain-based platforms are lowering entry barriers for SMEs, enabling them to compete with larger players. Government adoption of blockchain for regulatory compliance, digital currencies, and secure public records is further accelerating economic growth by enhancing digital infrastructure and public sector innovation. As blockchain technology becomes integral to business processes, it is creating a digital economy that will benefit organizations, consumers, and governments alike.

➤ Unlock growth! Get your sample now! @ https://market.us/report/blockchain-distributed-ledger-market/free-sample/

Impact on Global Businesses

The growth of blockchain distributed ledger technology is influencing global businesses by offering new ways to enhance security, transparency, and efficiency in transactions. While the initial cost of adopting blockchain infrastructure is high, businesses are increasingly realizing the long-term benefits of decentralization. Rising costs are also associated with regulatory compliance and the need for skilled blockchain developers. Supply chains are undergoing significant shifts as businesses integrate blockchain for real-time tracking, reducing delays and inefficiencies.

Industry-specific impacts are evident in the financial sector with the rise of blockchain-based digital currencies and smart contracts. In supply chain management, blockchain enables enhanced traceability and accountability, reducing fraud and errors. Healthcare organizations are also leveraging blockchain for secure data sharing, improving patient care. However, businesses must navigate challenges such as regulatory uncertainty, high energy consumption in blockchain mining, and the need for standardization across platforms.

Strategies for Businesses

To harness the potential of blockchain distributed ledger technology, businesses must first invest in talent and infrastructure. Establishing partnerships with blockchain solution providers can accelerate the integration of blockchain into existing business models. Companies should adopt hybrid blockchain systems that combine both private and public models to ensure security while maintaining operational flexibility.

Embracing blockchain for specific use cases, such as supply chain management, identity verification, or cross-border payments, can provide immediate returns on investment. Additionally, businesses should focus on compliance with emerging blockchain regulations, especially in areas like data privacy and financial transactions. Integrating blockchain with AI and IoT can unlock additional value by creating a more interconnected and transparent ecosystem. It is also essential for businesses to educate stakeholders on the advantages and risks of blockchain, ensuring alignment across the organization.

Key Takeaways

- The market is expected to grow from US$8.2B in 2024 to US$118.4B by 2034 at a 30.6% CAGR

- North America holds 37.3% market share in 2024

- Blockchain technology is gaining adoption across sectors: finance, healthcare, and supply chain

- Rising costs related to adoption, energy consumption, and regulatory compliance

- Increased use of blockchain for real-time tracking, fraud reduction, and transparency

➤ Stay ahead—secure your copy now @ https://market.us/purchase-report/?report_id=153681

Analyst Viewpoint

The blockchain distributed ledger market is currently experiencing rapid growth, driven by demand for decentralized solutions that offer increased security and efficiency. Presently, the technology is gaining significant traction in industries like finance, logistics, and healthcare. Moving forward, the integration of blockchain with AI, machine learning, and IoT will open up new opportunities for innovation.

As blockchain adoption becomes more widespread, the market is expected to grow at an accelerating pace, especially as regulations evolve and become clearer. The future of blockchain is bright, with increasing applications across sectors, fostering a more secure and efficient global digital economy.

Regional Analysis

North America remains the leader in the blockchain distributed ledger market, supported by the presence of tech giants, government initiatives, and the early adoption of blockchain in various sectors. The U.S. is at the forefront of blockchain innovation, particularly in finance, healthcare, and public administration.

Europe is catching up, with countries like Estonia leading the charge in digital governance and blockchain integration. Asia Pacific is expected to experience the highest growth during the forecast period, driven by the rapid adoption of blockchain in China, Japan, and India, alongside significant investments in digital infrastructure. Latin America and the Middle East are also adopting blockchain solutions, particularly in financial services and supply chain management.

Business Opportunities

The blockchain distributed ledger market presents significant business opportunities, particularly in industries like finance, supply chain, healthcare, and government. Startups can capitalize on providing blockchain-as-a-service (BaaS) solutions, allowing businesses to easily adopt blockchain without heavy upfront investments. Consulting services focused on blockchain integration, security, and compliance are also in demand.

Additionally, businesses can create solutions that integrate blockchain with IoT and AI for more efficient, automated systems. There are opportunities in building decentralized finance (DeFi) platforms, smart contract solutions, and creating blockchain-based supply chain tracking tools. As blockchain adoption grows, firms that provide reliable, scalable blockchain solutions will be well-positioned to capitalize on market demand.

Key Segmentation

The blockchain distributed ledger market is segmented by Application, End-User, Deployment Model, and Region.

- Application: Finance, Supply Chain Management, Healthcare, Government, and Others—finance and supply chain lead due to blockchain’s ability to streamline transactions and provide traceability.

- End-User: Large Enterprises, SMEs, and Governments—large enterprises dominate but SMEs are increasingly adopting blockchain for efficiency.

- Deployment Model: Public, Private, and Hybrid Blockchains—hybrid solutions are gaining popularity for balancing transparency and privacy.

- Region: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa—North America is currently the dominant market, but Asia Pacific is poised for high growth.

Key Player Analysis

Leading companies in the blockchain distributed ledger market focus on offering scalable, secure solutions for various industries. These players are developing both public and private blockchain platforms that enable secure transactions, smart contract automation, and decentralized applications.

They are also investing in hybrid solutions that combine the benefits of public and private blockchains to meet specific business needs. Many players are expanding their offerings by integrating blockchain with AI, IoT, and cloud computing to create interconnected systems. Collaboration with regulatory bodies, financial institutions, and technology providers is key to their success as they navigate the complexities of blockchain governance and adoption.

- Accenture plc Company Profile

- AlphaPoint

- Amazon Web Services Inc.(Amazon.com Inc.)

- Auxesis Services & Technologies Ltd.

- Digital Asset Holdings LLC

- Huawei Technologies Co. Ltd.

- Intel Corporation

- International Business Machines Corporation Company Profile

- iXLedger

- NTT DATA Corporation (The Nippon Telegraph and Telephone Corporation)

- Visa Inc.

- Others

Recent Developments

- Launch of hybrid blockchain solutions that provide flexibility in deployment

- Partnerships with governments to implement blockchain for public records and digital currencies

- Integration of blockchain with IoT for secure data sharing in supply chains

- Development of decentralized finance (DeFi) applications built on blockchain platforms

- Expansion of blockchain-based traceability systems in agriculture and food supply chains

Conclusion

The blockchain distributed ledger market is poised for significant growth, driven by its ability to provide secure, transparent, and efficient solutions. As blockchain technology becomes integral to various sectors, businesses that invest in its adoption will benefit from enhanced operational efficiency, reduced costs, and improved security. The future of the blockchain market is promising, with expanding applications and global adoption on the horizon.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)