Table of Contents

In 2025, the United States implemented sweeping tariffs, including a 145% levy on Chinese imports, as part of a broader protectionist trade agenda. These measures have led to a significant increase in consumer prices, with apparel costs rising by 64% in the short term. The tariffs are projected to reduce U.S. real GDP by 1.1 percentage points in 2025, translating to a $170 billion annual loss in economic output.

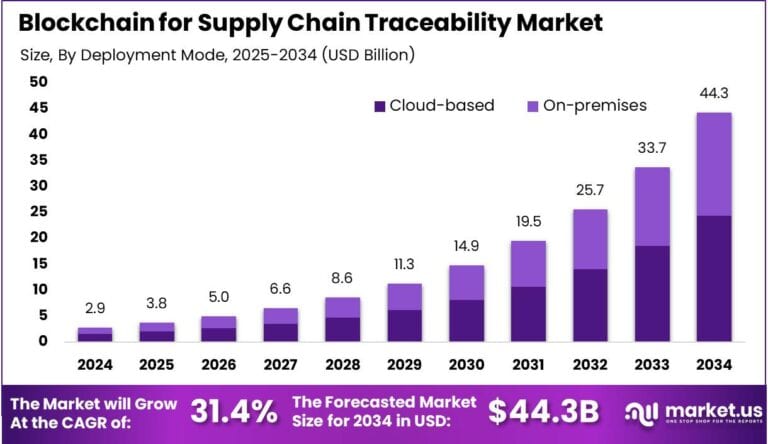

The global blockchain for supply chain traceability market is projected to reach a value of approximately USD 44.3 billion by 2034, up from USD 2.89 billion in 2024, reflecting a compound annual growth rate (CAGR) of 31.40% from 2025 to 2034. In 2024, North America accounted for more than 35% of the market, generating around USD 1.01 billion in revenue. The U.S. market, valued at approximately USD 0.9 billion, is expected to experience rapid expansion, with a projected CAGR of 29.6%.

How Tariffs Are Impacting the Economy

The imposition of tariffs has led to a surge in consumer prices, particularly in sectors reliant on imported goods. Apparel prices, for instance, have increased by 64% in the short term. This inflationary pressure has eroded household purchasing power, with average losses estimated at $3,800 per household.

Additionally, the U.S. economy is projected to experience a persistent 0.6% reduction in GDP annually, amounting to a $170 billion loss. The Federal Reserve faces challenges in balancing inflation control with economic growth, as the tariffs contribute to increased inflation expectations.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/blockchain-for-supply-chain-traceability-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Global businesses are grappling with increased operational costs due to higher tariffs on imported materials and products. Companies are reassessing their supply chains, seeking alternative suppliers, and adjusting logistics strategies to mitigate the impact of these tariffs. The reconfiguration of global value chains is leading to less efficient and more opaque trade systems.

Sector-Specific Impacts

Certain sectors are more adversely affected by the tariffs. The apparel industry, for example, faces significant challenges due to the high reliance on imported textiles and garments. Similarly, the automotive industry is experiencing disruptions as supply chains are realigned to comply with new trade policies.

Strategies for Businesses

To navigate the challenges posed by tariffs, businesses are adopting several strategies:

- Supply Chain Diversification: Sourcing materials and products from countries with lower or no tariffs to reduce dependency on high-tariff regions.

- Nearshoring: Relocating manufacturing operations closer to home markets to minimize transportation costs and mitigate tariff impacts.

- Product Innovation: Developing new products or modifying existing ones to reduce reliance on imported components subject to tariffs.

- Cost Absorption: Absorbs some of the increased costs to maintain competitive pricing and customer loyalty.

➤ Get Full Access Purchase Now @ https://market.us/purchase-report/?report_id=147573

Key Takeaways

- Economic Contraction: Tariffs are projected to reduce U.S. GDP by 1.1 percentage points in 2025.

- Consumer Impact: Households are expected to lose an average of $3,800 in purchasing power due to increased prices.

- Global Supply Chain Disruptions: Businesses are experiencing increased costs and are reevaluating their supply chains.

- Sector-Specific Challenges: Industries like apparel and automotive are facing significant disruptions.

- Strategic Adaptations: Companies are diversifying supply chains, nearshoring operations, and innovating products to mitigate tariff impacts.

Analyst Viewpoint

Currently, the economic outlook is cautious, with tariffs contributing to inflation and economic contraction. However, in the medium to long term, there is potential for positive outcomes if businesses successfully adapt by diversifying supply chains and investing in domestic manufacturing. Strategic adjustments could lead to a more resilient economy and reduced dependency on imports.

Regional Analysis

The impact of U.S. tariffs varies across regions. Canada has experienced a 2.2% reduction in its economy due to both U.S. tariffs and retaliatory measures. In contrast, the European Union and the United Kingdom have seen slight economic gains of 0.1% and 0.2%, respectively, as they benefit from shifts in trade patterns.

Business Opportunities

Despite the challenges, new opportunities are emerging. Companies that can adapt to the changing trade environment by diversifying supply chains, investing in automation, and focusing on innovation may find new avenues for growth. Additionally, the push for domestic manufacturing presents opportunities for investment in U.S.-based production facilities.

➤ Discover More Trending Research

Key Segmentation

The impact of tariffs varies across different sectors:

- Apparel: Significant price increases due to reliance on imported textiles.

- Automotive: Disruptions in supply chains and increased production costs.

- Pharmaceuticals: Potential for higher drug prices as companies reconsider offshore manufacturing.

- Technology: Shifts in global supply chains affecting component availability and costs.

Key Player Analysis

Companies in sectors heavily reliant on imports, such as electronics and textiles, are facing increased costs and supply chain disruptions. Firms that can quickly adapt by diversifying suppliers and investing in automation are better positioned to mitigate the impact of tariffs.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Accenture PLC

- VeChain

- Amazon Web Services (AWS)

- Infosys Ltd.

- Auxesis Group

- PixelPlex

- Huawei Technologies Co., Ltd.

- TIBCO Software Inc.

- OpenXcell

- SAP SE

- Guardtime

- Other Key Players

Recent Developments

The U.S. has imposed a 145% tariff on Chinese imports, leading to significant economic repercussions. China has retaliated with a 125% tariff, escalating tensions between the two nations.

Conclusion

The implementation of tariffs has introduced significant challenges to the global economy, leading to increased costs and supply chain disruptions. While the immediate outlook is cautious, strategic adaptations by businesses could pave the way for a more resilient economic future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)