Table of Contents

- Overview

- Editor’s Choice

- Blockchain Statistics 2026

- Business Blockchain Statistics

- Blockchain Statistics – Demographic

- Regional Analysis

- Essential Blockchain Trends & Statistics

- People Owning Bitcoins

- Blockchain Statistics – Popular Companies

- Cryptocurrency Statistics

- Blockchain Statistics – Concerns

- Companies Banking the Most on Bitcoin

- Blockchain Statistics – Ethereum Specific

- The Lowdown on Blockchain Statistics

- Blockchain Statistics Market Size

- Recent Developments

- Conclusion

- FAQ’s

Overview

Blockchain Statistics – Blockchain is a decentralized and distributed digital ledger that records transactions across numerous computers or nodes.

It is the technology that underpins cryptocurrencies such as Bitcoin and Ethereum, but its potential applications go beyond digital money.

A blockchain, at its heart, is a chain of blocks, each of which contains a list of transactions. These blocks are connected via cryptographic hashes, resulting in an immutable and transparent record of all transactions.

Editor’s Choice

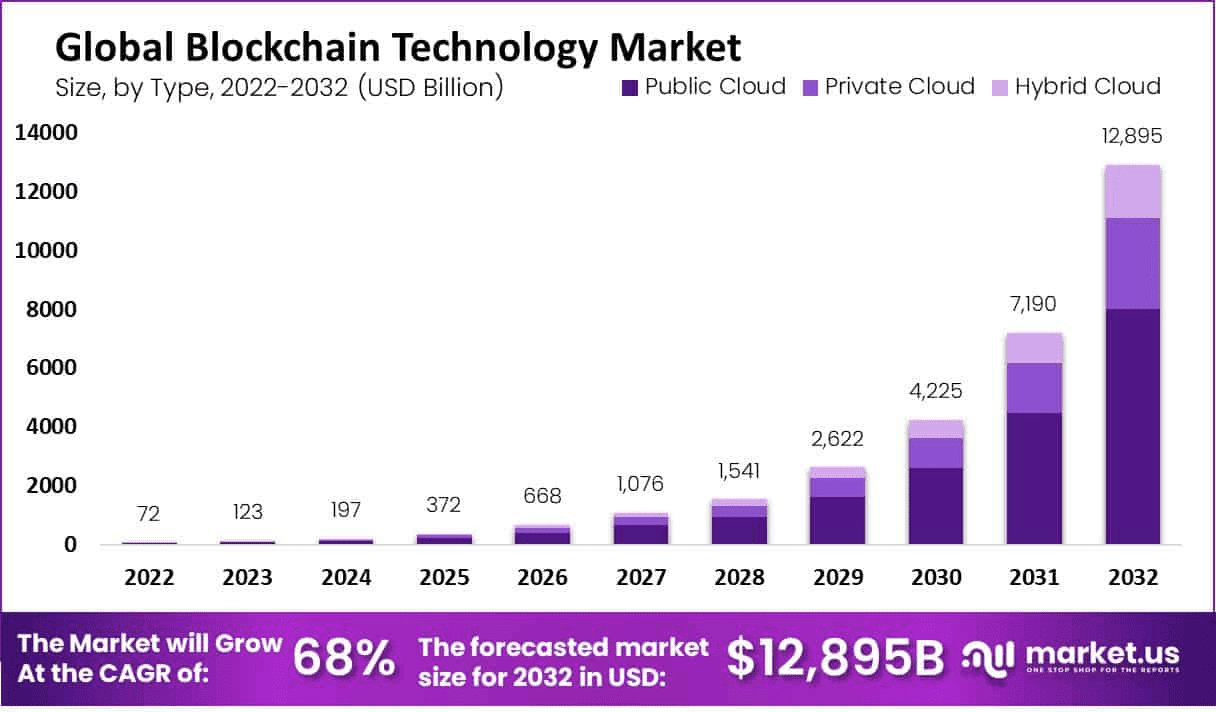

- The worth of the blockchain market will be at least US$12,895 billion by 2032, which is an annual increase of 68%. growth, and 170 million cryptocurrency wallets (Blockchain.com as well as Coinbase customers).

- Blockchain-related technology spending is projected to surpass $19 billion in 2024. In March 2023, there were 85 million Bitcoin block explorer blockchain.com users around the world, with 336,600 Bitcoin transactions being conducted each day.

- At present, one-quarter of the world’s population has Bitcoin.

- 16% of Americans have invested in crypto.

- Financial institutions could reduce their costs by up to $11.2 billion annually by using blockchain.

- Blockchain technology in healthcare is predicted as worth $231.0 million by 2023. It is expected to have the potential for a compound annual increase of around 63% over the next 6 years.

- Transferring securities to blockchains could reduce the cost of $17 billion to $24 billion in global trade processing costs annually.

Blockchain Statistics 2026

- Between 2022 and 2030, the worldwide blockchain technology market is expected to expand at an 85.9% CAGR.

- In 2026, the global blockchain market is expected to be worth $67.4 billion.

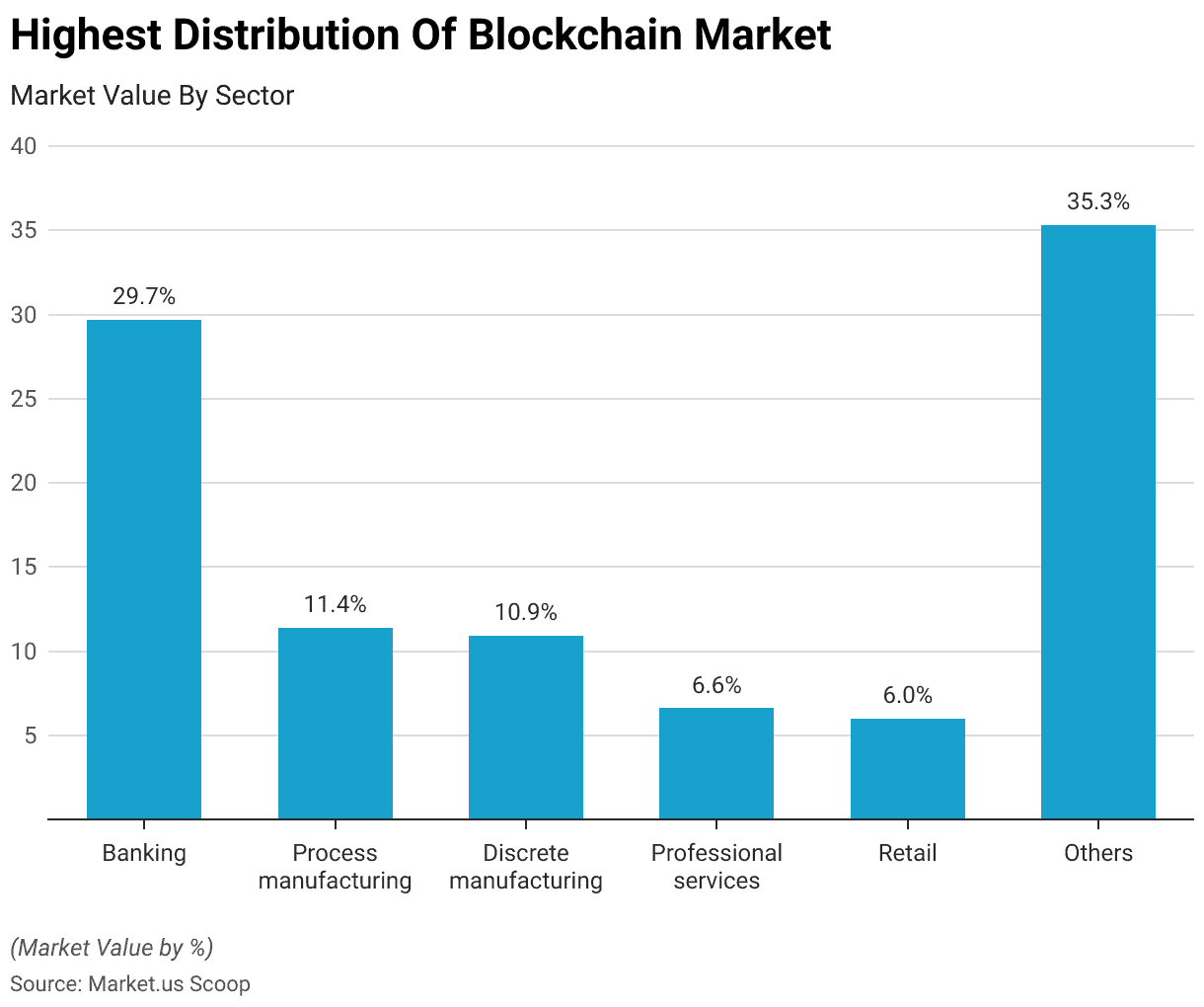

- Banking is the industry that has the largest spread of the market value of blockchain.

Here is a graph showing the highest distribution of blockchain market value by sector.

- Blockchain is mainly used for international payments and settlements.

- According to a Pwc “time to trust” report in 2030, blockchain technology will boost the world’s GDP by $1.76 trillion.

- Blockchain-based cryptocurrency could generate upwards of $1 billion in earnings for the banking industry by itself.

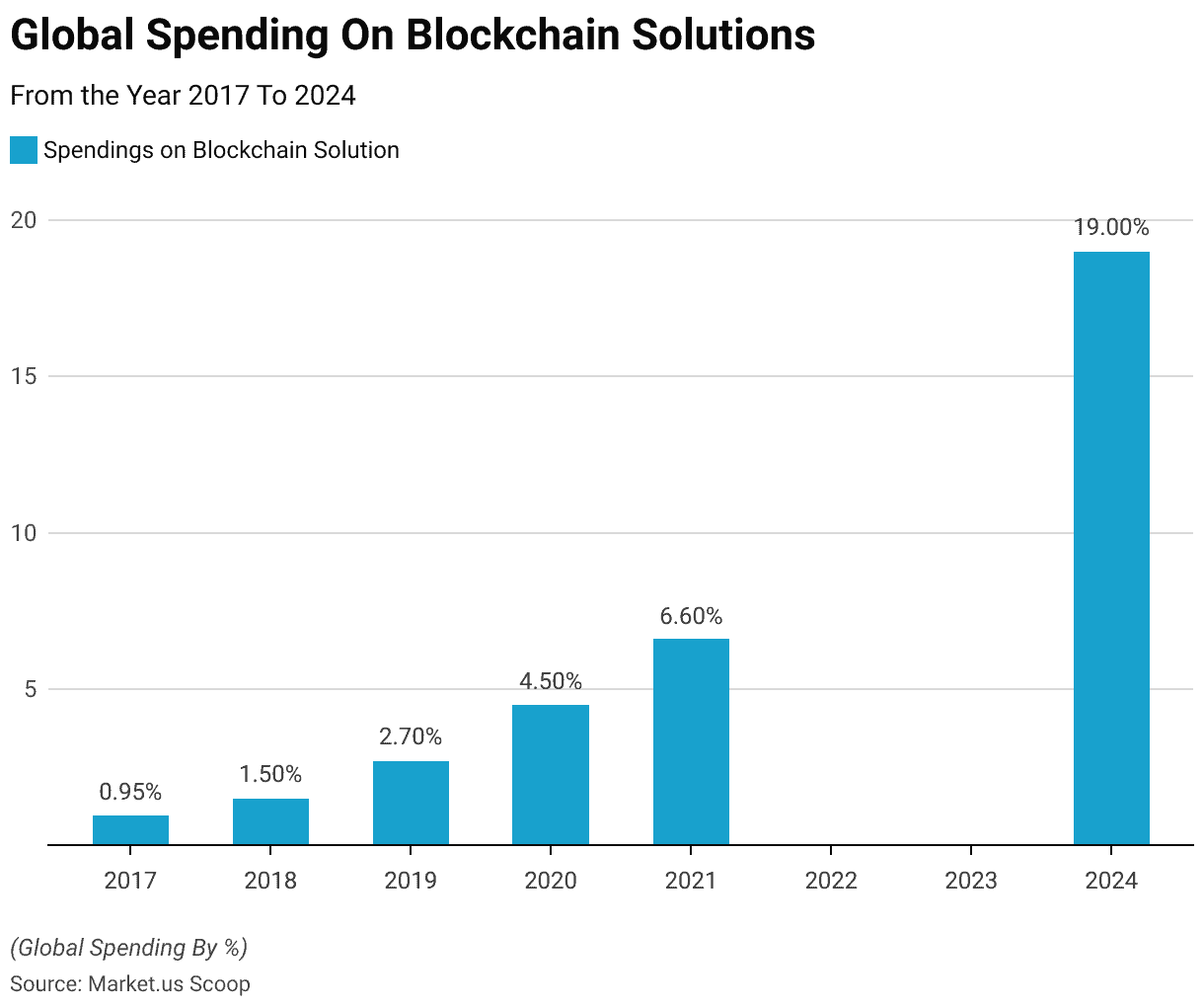

- The worldwide spending on blockchain technology will hit $19 billion by 2024.

The graph shows the global spending on blockchain solutions from 2017 to 2024.

- Consumers tend to favor mobile currency wallets over other forms of blockchain wallets

- according to data since March 17th, 2023 when 3.937 Bitcoin transactions occurred every second.

- By 2025, using blockchain in healthcare may cost $5.61 billion.

(Sources: Statista, BIS, Ycharts, Economic Times, Binance, Deloitte)

Business Blockchain Statistics

- According to a Deloitte survey, 86% of individuals believe Blockchain technology will help us move toward more touchless corporate processes.

- In the same research, 91% of respondents expected a meaningful, verifiable return on their blockchain investments over the next five years.

- Across industries, 60% of CIOs are on the verge of implementing blockchain into their infrastructure.

- 53% of C-level executives believe blockchain is a crucial component of corporate infrastructure.

- By 2026, the food and agriculture industries will be worth $1.48 billion thanks to blockchain.

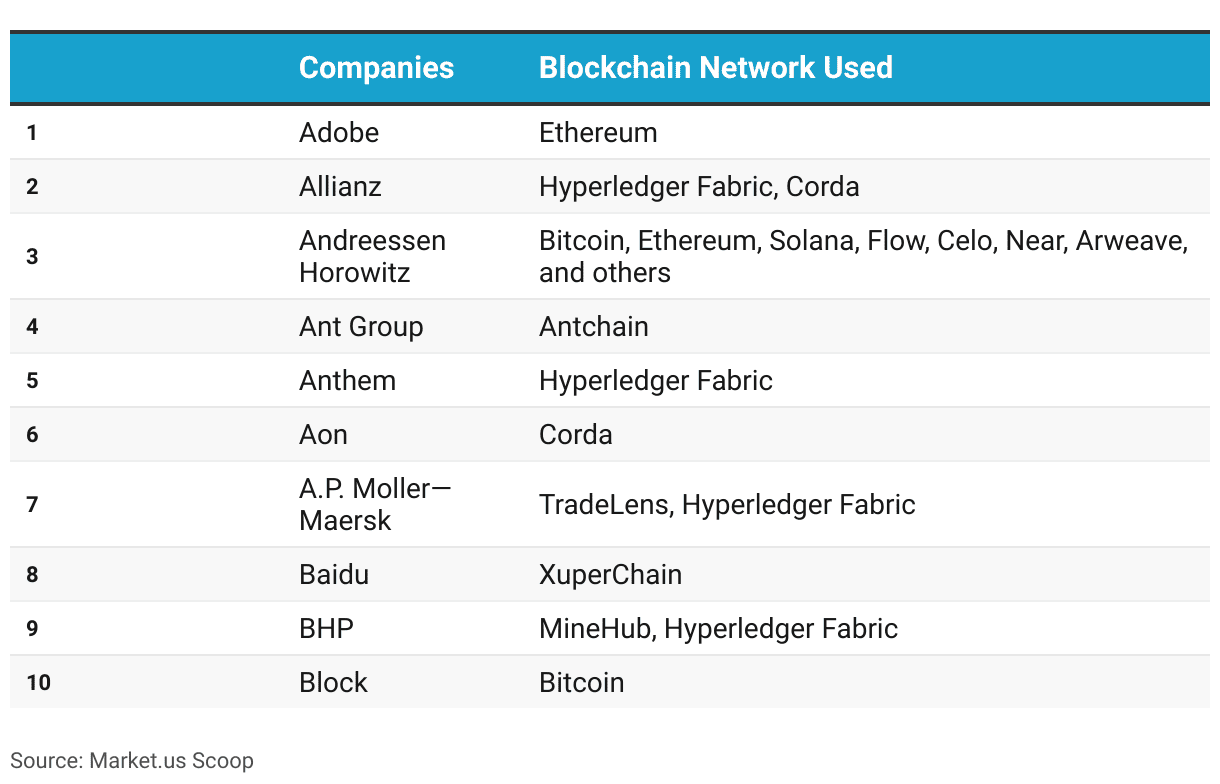

- The following are the top ten companies that utilize blockchain technology.

- The size of the industrial blockchain market will increase to $85.64 billion in 2023.

(Sources: Deloitte, Forbes, BIS, PwC, Statista, Coingecko, Finances Online)

Blockchain Statistics – Demographic

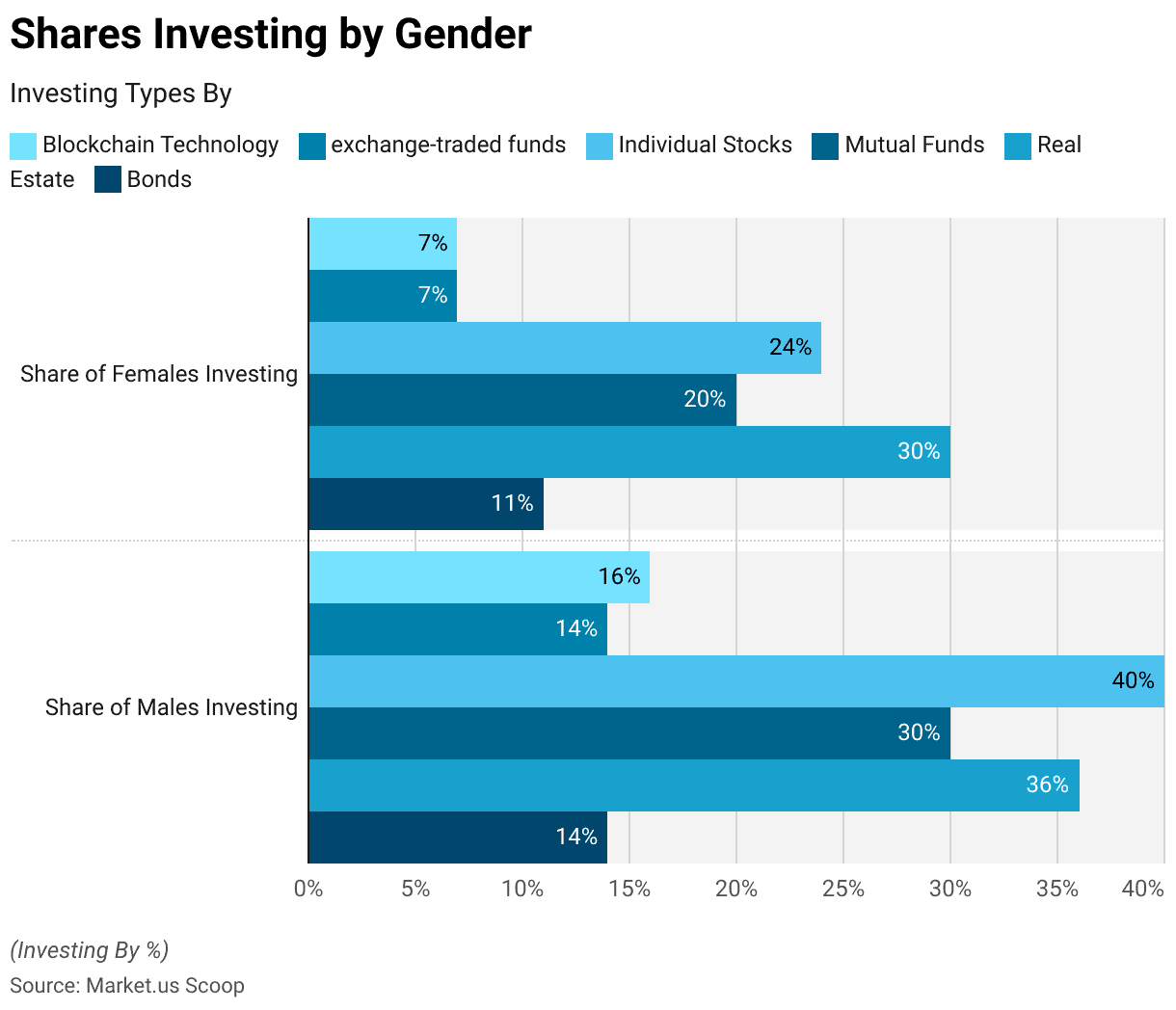

- Men are twice as likely to invest in cryptocurrency as women.

- 36% of blockchain users earn $100,000 or more per year.

- The gender disparity in cryptocurrency is larger than the gender gap in regular assets.

- According to a CNBC and Acorn survey, 16% of males and 7% of women invest in blockchain technology.

Here are the findings from that survey in table form.

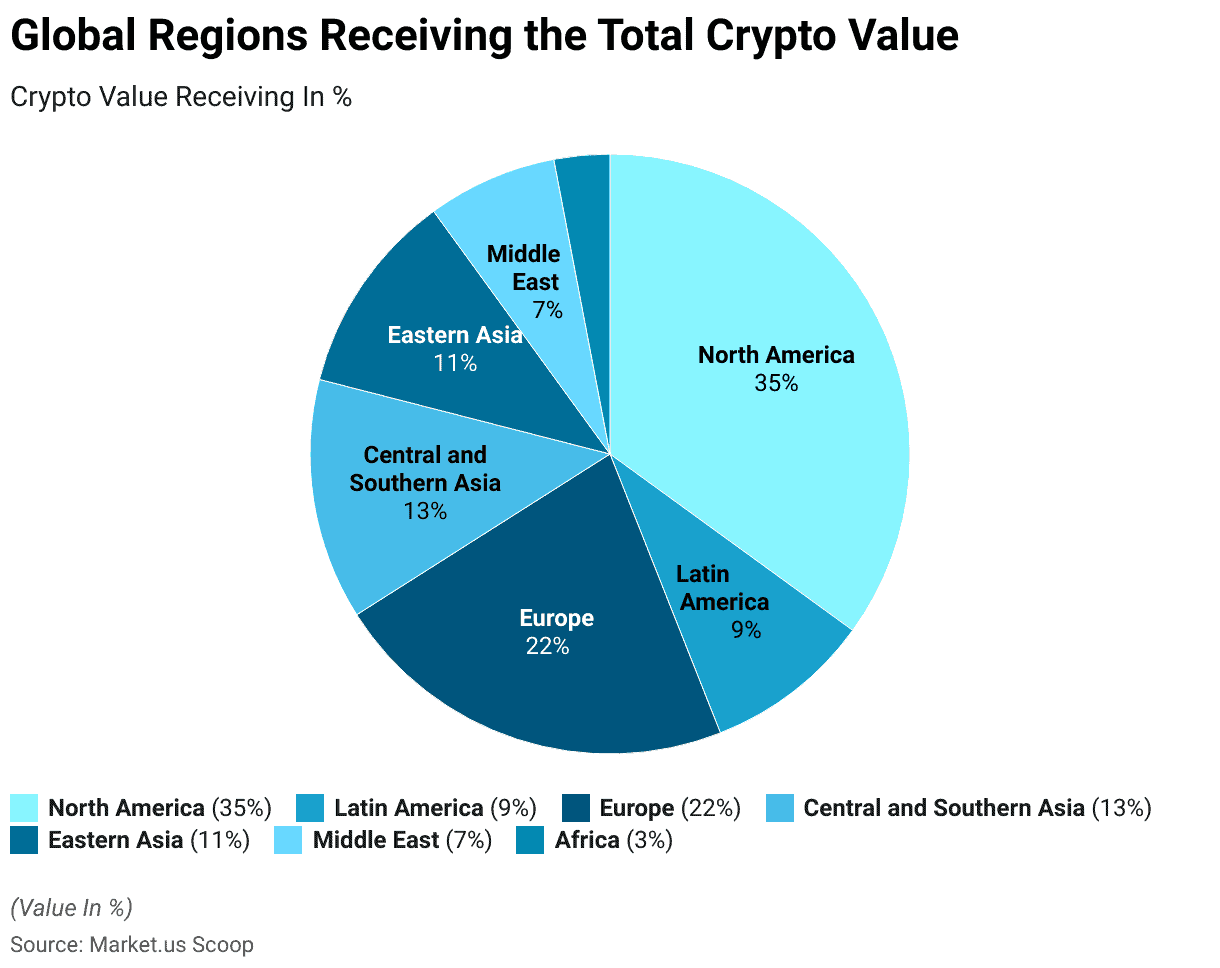

Regional Analysis

The United States of America receives the most Bitcoin value in contrast to the remaining regions of the world.

- At least 86% of Americans have heard about blockchain technology at least once, with 24% hearing a lot regarding the technology.

- 82% of cryptocurrency users hold a bachelor’s degree or more.

- 13% of adults in the United States admit that they know little about cryptocurrency.

- Asian, Black, and Hispanic American people are more likely to have previously invested in, transacted in, or used blockchain technology than White American adults.

- 58% of cryptocurrency holders are under 34 years old.

(Sources: Statista, Blockchain.com, Exploding Topics, Binance, Economic Times, Forbes)

Here is the pie chart showing global regions receiving the total crypto value.

Essential Blockchain Trends & Statistics

- The most important reason driving the adoption of blockchain is secure data sharing. Improved access to transactions and financial products are other major drivers of the adoption of blockchain technology.

- Almost 80% of central banks worldwide are considering developing their cryptocurrency.

- Blockchain is expected to produce more than $3.1 trillion in business value by 2030.

- The Internet of Things (IoT) is projected to be worth approximately $1,463.2 billion by 2027.

- Blockchain would be beneficial for customer verification, according to 52% of FSIs.

- A Deloitte research found that 86% of knowledgeable technology teams believe Blockchain provides considerable benefits.

- According to a Deloitte survey, 68% of CEOs believe that privacy and security of data are the most important areas for improvement to speed up blockchain use.

- By 2025, 55% of healthcare applications will be using blockchain.

- In the actual economy, more than 100 Chinese enterprises offer blockchain applications.

- Over $270 billion in assets have been transferred via blockchain.

- The South Korean blockchain market began at around $20.1 billion in 2016 and is expected to reach $356.2 billion by 2023.

- By 2025, the blockchain gaming business is anticipated to be worth $39.7 billion.

(Sources: Deloitte, Coindesk, Economic Times, Binance, Statista, PwC)

People Owning Bitcoins

- Blockchain.com is a website for purchasing Bitcoin; as of March 2023, about 85 million individuals had created individual Bitcoin wallets. This represents a 102% increase in users over the previous year and a 42 million increase from 2019.

- Coinbase, which has over 108 million Bitcoin users, is another popular site for accessing Bitcoin. This equates to about 193 million Bitcoin wallets.

- As of March 2023, the Bitcoin blockchain is 464.83 Gigabytes in size. In February 2012, its size was 1.02 Gigabytes.

- The FBI owns 1.5% of the world’s bitcoins.

- There can be 21 million bitcoins in existence at the same moment.

- By 2023, over 90% of Bitcoins will have been mined.

- A single Bitcoin transaction uses 2,188 kilowatt-hours of electricity. In comparison, 100000 VISA purchases consume 148.63 kilowatt-hours of electricity.

- The final Bitcoin is projected to be mined in 2140.

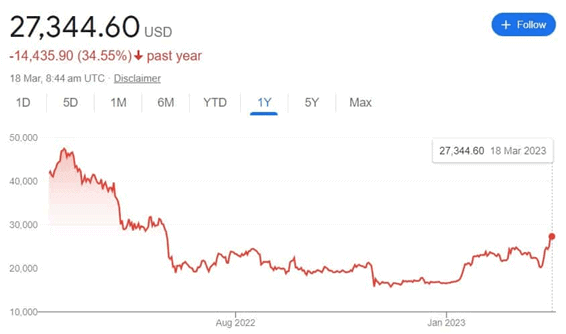

- The current price of Bitcoin is $27,344.60 as of March 18th, 2023.

- As of March 2023, there are 85 million Bitcoin blockchain explorer blockchain.com wallet users worldwide.

- As of March 2023, over 20,000 Bitcoin transactions occur in a single day.

- There are 14,915 Bitcoin ATMs (Automated Teller Machines) in operation worldwide.

- The United States has 11,386 Bitcoin ATMs.

- The United States is home to 89.4% of all Bitcoin ATMs in the globe.

- Genesis Coin is the world’s leading manufacturer of Bitcoin ATMs.

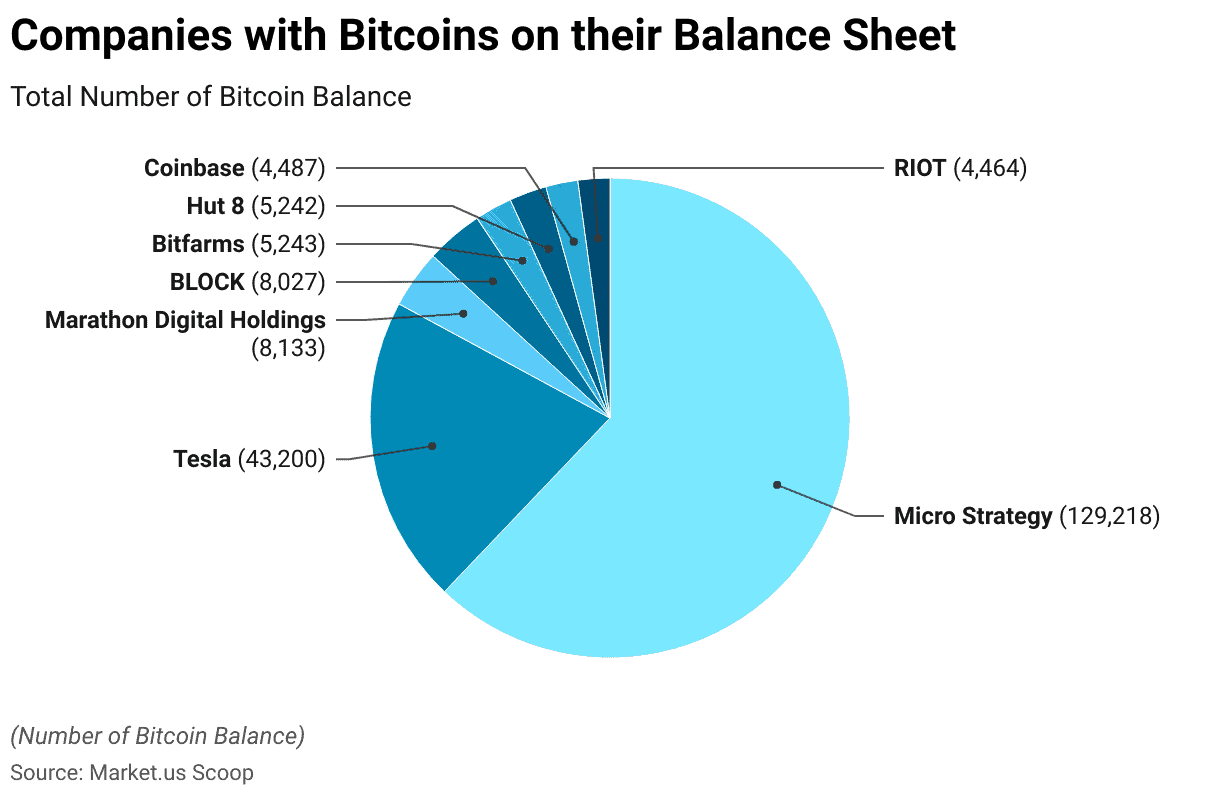

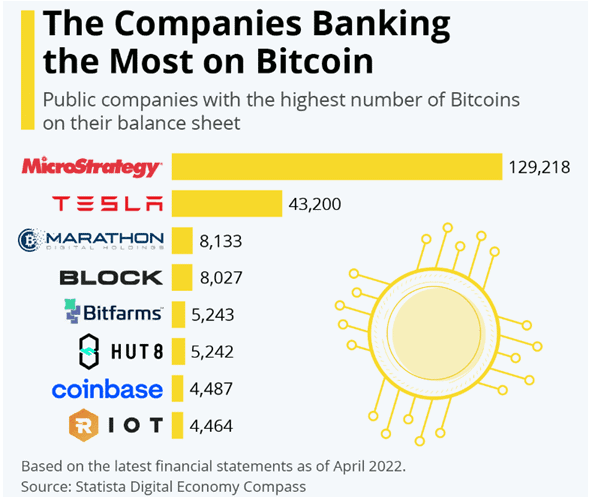

- Microstrategy is the publicly traded firm with the most Bitcoins on its books.

Here are the figures of Top Public Companies with the most Bitcoins on their balance sheet

Blockchain Statistics – Popular Companies

- Bitcoin is the costliest cryptocurrency at the moment, with one coin worth more than $55,000 as of February 2021. As a result, Bitcoin has been designated the currency for the future.

- Cashapp, developed by Square, generated $1.63 billion in Bitcoin revenue in the third quarter of 2019. Square will also invest $50 million in Bitcoin in October 2020.

- The top 3 cryptocurrency and blockchain players in China are Bitmain Technologies ($450 million in total equity funding), Hyperchain ($249 million), and Jixin Blockchain ($100 million).

- As of 2019, IBM was the largest blockchain patent holder in the United States, with 185 active invention families. Ant Financial Corporation (78), MasterCard and Walmart (50), (48), and the Bank of America (74), follow IBM.

- As of 2019, Ant Financial is the most prominent blockchain patent owner in Europe, with 202 active patent families submitted at the European Patent Office (EPO). Following Ant Financial Are Chain (81), Siemens (34), and Visa (34).

(Source: Statista 2020|2021, U.S. News & World Report, 2021, CB Insights 2019)

Cryptocurrency Statistics

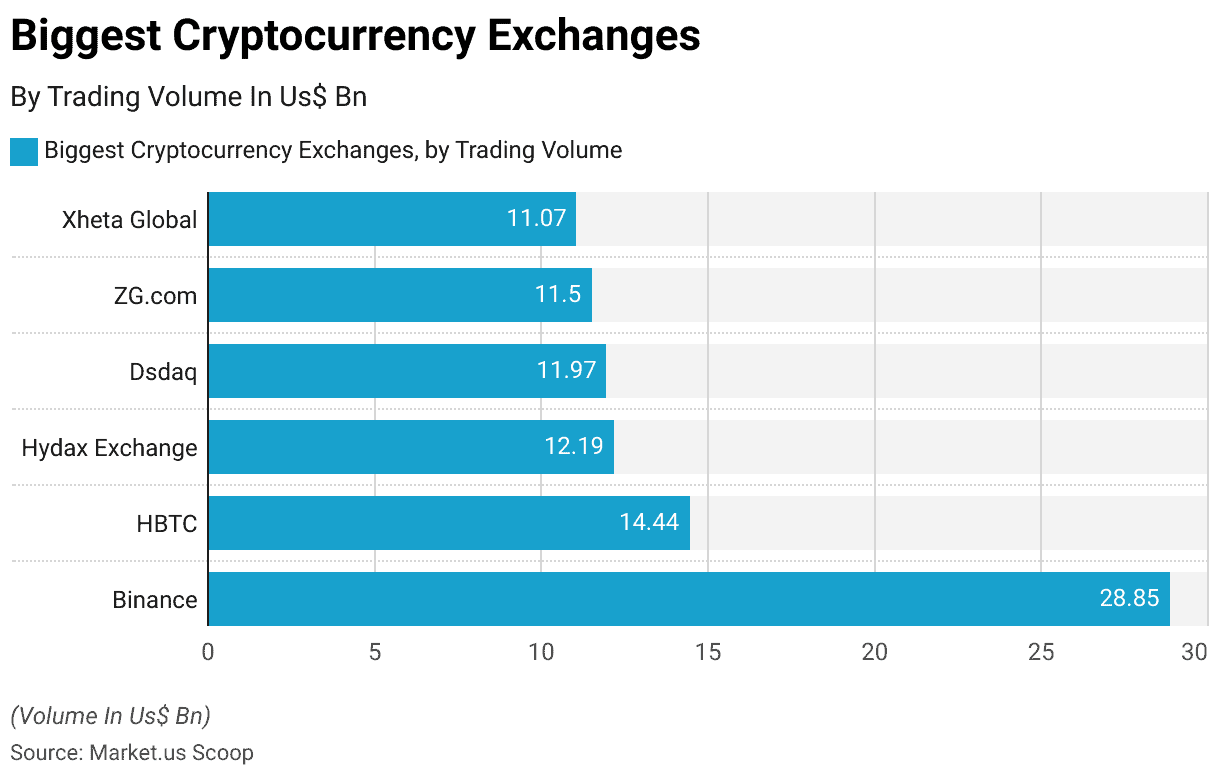

- Binance ($28.85 billion), HBTC ($14.44 billion), and Hydax Exchange ($12.19 billion) are the three largest cryptocurrency exchanges in terms of trading volume. Dsdaq ($11.97 billion), ZG.com ($11.5 billion), and Xheta Global ($11.07 billion) are all significant players.

- By 2020, Bitcoin had 66% of the market valuation, followed by Ether (8%), and Ripple (4%). Meanwhile, Litecoin had a market capitalization of 1% and Monero had a market capitalization of 0.5%. In addition, other cryptocurrencies had a combined market capitalization of 7%.

- There will be 63 million distinct Blockchain.com wallets by the end of 2020. Since 2015, the number of blockchain wallets has been continuously expanding.

- The United States has the most crypto ATMs, with 14,112 ATMs, accounting for 83.2% of the entire world’s market. Meanwhile, Europe ranks second with 1,258 ATMs (7.4%), while Canada ranks third with 1,246 ATMs (7.3%).

- There are approximately 1.193 million Ethereum transactions per day as of February 2021. Aside from selling digital currency, Ethereum allows you to build smart contracts.

- According to the Global Crypto Adoption Index, the top countries are Ukraine, Russia, the country of Venezuela, China, Kenya, the United States, South Africa, Nigeria, the country of Colombia, and Vietnam.

- In the year 2020, Ukraine sent and received $8.2 billion in cryptocurrencies. Russia, on the other hand, has sent and received a total of $16.8 billion in cryptocurrency. The poor level of trust among citizens in the government, business, and the media is one of the reasons behind these countries’ high levels of Bitcoin adoption.

- The total number of transactions in Bitcoin as of February 21, 2021, is 272,006. Furthermore, Bitcoin had approximately 330,000 transactions in the final month of 2020 and 400,000 operations in January 2021.

(Source: Statista 2021, Blockchain.com 2021, Coin ATM Radar, undated, Chainalysis 2020)

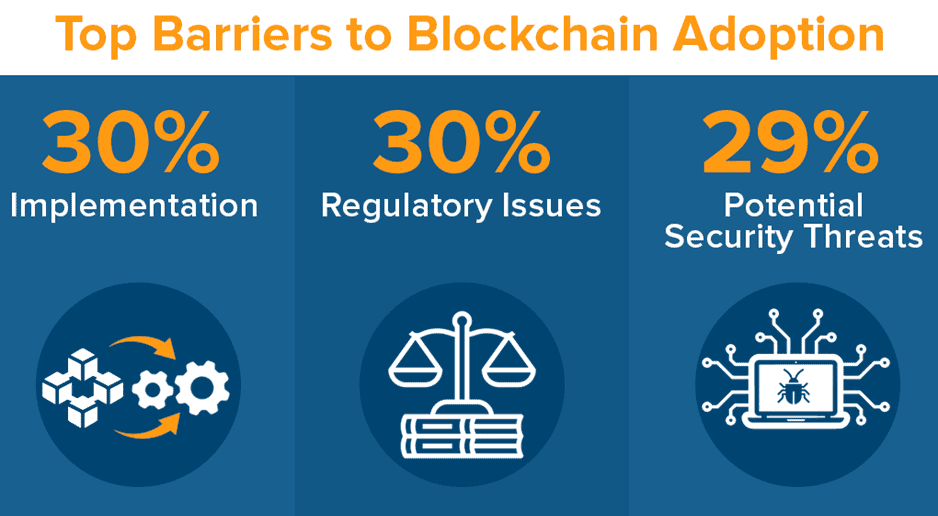

Blockchain Statistics – Concerns

The most frequently identified barriers to the adoption of Blockchain technology have to do with the implementation because it requires the replacement or adaptation of an organization’s existing system. There are other concerns about security, standardization, and interoperability.

Additionally, environmental issues must be considered by those who think of implementing blockchain technology, since blockchain mining requires a lot of energy consumption.

- As per senior management from around the world, Blockchain is a challenge due to implementation (30%) regulatory concerns (30%), and security risks (29%). Other factors mentioned were the lack of internal capabilities (28%) a lack of certainty about ROI (28%) and worries about the security of information from competitors (25%).

- 58% of companies claim that cybersecurity is just one of the many aspects they are considering when incorporating blockchain technology into their strategy for digital assets.

- More than 6,500 blockchain-related projects use the majority of independent blockchain solutions and platforms. The huge quantity of blockchain networks raises the issue of standardization and interoperability.

- Blockchain miners consume 0.2% of the total energy consumed by the world which makes energy use difficult for those looking to take advantage of blockchain technology.

(Source: Deloitte 2019/20, Finextra, 2020, 101Blockchains, 2020)

Companies Banking the Most on Bitcoin

(Image Credit: Statista Sources: Statista, Binance, Coindesk, OpenSea)

Blockchain Statistics – Ethereum Specific

- As of March 2023, there are 120.45 million Ethereum in circulation.

- Unlike Bitcoin, Ethereum has no supply limit.

- As of March 18th, 2023, the Ethereum blockchain processed 1.043 million transactions per day.

- As of March 16th, 2023, there are 413904 active Ethereum addresses.

- Ethereum controls 63.4% of the whole Defi market.

- OpenSea is the most common Ethereum Blockchain address.

- At the time of writing, the price of Ethereum is $1064.81.

- Ethereum and Bitcoin account for more than half of the cryptocurrency marketplace.

- There are already over 3,000 decentralized programs (Dapps) on the Ethereum network.

- There are four major types of digital ledger networks:

- Private blockchain,

- Public blockchain,

- Hybrid blockchain,

- Consortium blockchain.

(Sources: Statista, Ycharts, Coinmarketcap, Coindesk)

The Lowdown on Blockchain Statistics

The blockchain sector is expanding and is anticipated to earn billions of dollars in revenue in the coming years.

With existing technologies that have yet to attain mass usage and developing technologies that are constantly growing their capabilities, it’s safe to conclude that these technologies will take years to fully mature.

Business executives’ diverse attitudes to the value and significance of blockchain technologies are one of the barriers to blockchain adoption.

Whatever their stance, it is impossible to deny that corporations have saved billions of dollars by embracing blockchain technology.

With use cases ranging from financial applications to fashion and healthcare, it would not be shocking to see blockchain technology adopted beyond the pandemic.

Regardless of its merits, firms considering blockchain must consider implementation issues, cybersecurity concerns, environmental effects, and other factors while adopting such solutions.

Blockchain Statistics Market Size

The global Blockchain technology market was worth USD 72 billion in 2022. This market is expected to grow at the fastest rate of 68% between 2023 and 2032. By 2032, it is predicted to have reached USD 12,895 billion.

(Source: Market.us)

Recent Developments

Mergers and Acquisitions:

Securitize’s Acquisition of Onramp Invest: This acquisition allows Securitize to integrate tokenized products such as private equity and private credit into systems used by registered investment advisors in the U.S., facilitating broader asset tokenization.

Deutsche Borse’s Purchase of FundsDLT: This deal highlights the blending of traditional finance and blockchain, where Deutsche Borse acquired a digitized fund distribution platform to streamline and reduce the cost of financial product distribution.

New Product Launches:

Decentralized Social Media Platforms: Innovations in blockchain-based social platforms like Friend. tech, Lens Protocol, and Farcaster are redefining user interaction by enhancing privacy, data ownership, and user empowerment.

Tokenization Projects: Developments in real-world asset tokenization are progressing, with companies like Securitize in Spain and collaborations between Swift and Chainlink in Europe focusing on asset tokenization.

Funding:

The blockchain sector experienced varied investment trends in 2023, with total crypto funds raised amounting to $9.615 billion across 1,174 fundraising rounds. This marks a shift towards more frequent, albeit smaller, fundraising events compared to 2022.

Technological Advances:

Smart Contracts in Legal and Other Sectors: Blockchain technology facilitates secure, transparent, and efficient transaction systems, particularly through smart contracts in sectors like real estate, insurance, and voting systems.

Conclusion

Blockchain technology has emerged as a revolutionary innovation that could disrupt various industries and sectors.

Its decentralized and transparent nature has garnered immense praise, being recognized as a breakthrough for finance, supply chain management, healthcare services delivery, and other fields.

Blockchain provides a safe and tamper-resistant method for recording and verifying transactions. Employing cryptographic techniques and distributed consensus algorithms, blockchain ensures that stored information on its network remains immutable and trustworthy.

Thus potentially eliminating intermediaries, reducing costs, increasing efficiency, and strengthening trust across numerous processes.

FAQ’s

There are more than 1,000 blockchains worldwide, and they are comprised of four major kinds of networks. These networks include public blockchain, private blockchain, Hybrid blockchain as well as Consortium blockchain.

Bitcoin, Ethereum, Tether, BNB, and USD coin are among the most popular blockchain networks in terms of market capitalization in March 2023.

Ethereum, Avalanche, Cardano Avalanche, Cardano, and Polkadot are just a few of the notable and exciting blockchain-related projects that everyone ought to consider in 2023 or beyond.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)