Table of Contents

Introduction

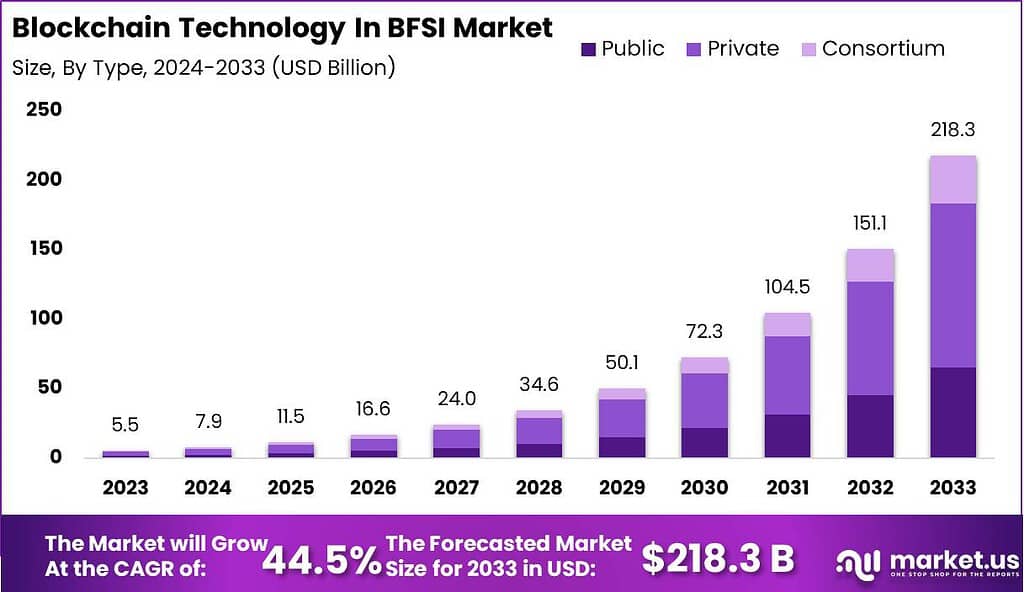

According to Market.us, The global Blockchain Technology in BFSI market is projected to reach approximately USD 218.3 billion by 2033, up from USD 5.5 billion in 2023. This represents a compound annual growth rate (CAGR) of 44.5% during the forecast period from 2024 to 2033.

Blockchain technology in the Banking, Financial Services, and Insurance (BFSI) sector refers to the use of a decentralized digital ledger for managing transactions and data securely. In simple terms, it’s like a notebook where all transaction records are written down and verified by multiple parties, ensuring no single person or entity can alter past entries. This technology helps make financial transactions faster, cheaper, and more secure because each entry is encrypted and linked to the previous one, creating a chain that is extremely difficult to tamper with.

The blockchain technology market in BFSI is a segment that focuses on how banks, insurance companies, and other financial services are adopting blockchain to improve their operations. This market explores how these institutions use blockchain to manage everything from payments and loans to insurance claims and asset management. The market growth is driven by the need for better security measures, faster transaction processing, and more efficient service delivery in the financial sector. It looks at the sale of blockchain solutions, the development of new applications, and how widespread the adoption of this technology is within the industry.

The growth of the blockchain technology market in the Banking, Financial Services, and Insurance (BFSI) sector is primarily driven by the increasing demand for enhanced security and the need for streamlined and efficient operational processes. Blockchain technology offers significant advantages in terms of transparency, immutability, and reduced transaction costs, which are critical in the financial sector.

Additionally, the growing adoption of digital assets and the expansion of decentralized finance (DeFi) solutions are contributing to the market expansion. Regulatory bodies are also beginning to recognize the potential benefits of blockchain in enhancing financial security and compliance, further supporting market growth.

The blockchain technology market in BFSI presents several opportunities for growth and innovation. One major opportunity lies in the development and adoption of cross-border payment solutions, which can benefit from blockchain’s ability to facilitate faster and more cost-effective transactions. Additionally, there is potential for blockchain to revolutionize insurance processes through smart contracts that automate claims and policy management, enhancing efficiency and transparency.

Furthermore, as financial institutions increasingly prioritize digital transformation, blockchain can play a crucial role in developing secure, efficient, and customer-focused services. Lastly, the ongoing evolution of regulatory frameworks around blockchain technology presents an opportunity for pioneering regulatory-compliant blockchain solutions in the financial sector.

Key Takeaways

- The global Blockchain Technology in BFSI (Banking, Financial Services, and Insurance) market is projected to reach USD 218.3 billion by 2033, a significant increase from USD 5.5 billion in 2023. This growth is driven by a robust CAGR of 44.5% from 2024 to 2033.

- Simultaneously, the broader Global Blockchain Technology market is forecasted to expand to USD 12,895 billion by 2033, starting from USD 123 billion in 2023. This market is anticipated to grow at an impressive CAGR of 68% over the same period.

- In 2023, the Private Blockchain segment dominated the blockchain technology market in BFSI, accounting for more than 54.2% of the market share.

- Similarly, the Cloud segment led the market with a commanding share of 56.6% in 2023.

- Furthermore, SMEs (Small and Medium-sized Enterprises) held a significant market position in 2023, capturing over 57.8% of the market share within the BFSI sector.

- Geographically, North America was the leading region in 2023, securing more than 38.5% of the market share in the blockchain technology market in BFSI.

Blockchain Technology In BFSI Statistics

- The Blockchain Technology Market size is expected to be worth around USD 12,895 Billion by 2033, growing from USD 123 Billion in 2023 at a CAGR of 68% during the forecast period from 2024 to 2033.

- The Generative AI in Fintech Market size is expected to reach approximately USD 16.4 Billion by 2032, rising from USD 1.1 Billion in 2023 with a CAGR of 31% during the forecast period from 2024 to 2033.

- More than 90% of European and US banks are actively exploring blockchain technology.

- Approximately 69% of banks are experimenting with permissioned blockchains.

- Global investment in blockchain solutions is projected to reach nearly USD 16 Billion in 2023.

- Blockchain technology is reported to reduce bank infrastructure costs by 30%, potentially resulting in annual savings exceeding USD 27 Billion by 2030.

- Investment banks could save up to USD 12 Billion a year through blockchain implementation.

Emerging Trends

- Web3 Integration: The ongoing integration of Web3 with blockchain is set to revolutionize online interactions, offering users control over their digital presence and potentially monetizing their online activities through SocialFi applications.

- Enhanced Value Chain Management: Blockchain technology is increasingly being used to improve transparency and traceability across entire value chains, from production to delivery, particularly in industries like pharmaceuticals, manufacturing, and fashion.

- Regulatory Evolution: The regulatory landscape for blockchain in BFSI is expected to become more defined, aiding in widespread adoption. Various regions, including the EU and parts of Asia, are actively developing frameworks that encourage blockchain integration while ensuring compliance and stability.

- Metaverse Applications: Financial services are exploring metaverse environments to offer immersive customer experiences. Banks like JPMorgan have already established presences in virtual worlds, providing Ethereum-based services and other digital interactions.

- Decentralized Finance (DeFi) Integration: DeFi is moving from a niche market into mainstream corporate finance, offering enhanced transparency, security, and operational efficiency. This trend is expected to transform financial management practices within enterprises significantly.

Top Use Cases of Blockchain in BFSI

- Fraud Prevention: Blockchain’s inherent security features help BFSI institutions minimize fraud and enhance security, particularly through the use of immutable ledgers that provide clear transaction histories.

- Smart Contracts: These automatically execute agreements based on predefined rules, reducing the need for intermediaries and lowering transaction costs. Smart contracts are particularly useful in claims processing and other transactional operations within insurance and banking.

- Identity Verification: With increased digital transactions, blockchain offers robust solutions for identity verification, reducing the risk of identity theft and improving customer onboarding processes.

- Streamlined Payments: Blockchain facilitates faster, more secure payment processes, including cross-border transactions. This is particularly valuable in reducing transaction times and costs associated with traditional banking processes.

- Open Banking: Blockchain supports open banking frameworks by enabling secure and transparent data sharing between financial institutions and third-party providers, enhancing customer experiences through personalized financial services.

Major Challenges

- Interoperability and Standardization: As blockchain technologies proliferate, a significant challenge lies in the lack of standardized protocols which results in interoperability issues across different blockchain systems. This can lead to inefficiencies as users and businesses navigate multiple platforms to transact across various networks.

- Regulatory Uncertainty: The global nature of blockchain and cryptocurrencies presents complex legal and regulatory challenges. Financial institutions must navigate a landscape of varied and often uncoordinated regulatory frameworks, which can hinder the adoption and integration of blockchain solutions.

- Cybersecurity and Data Privacy: Financial sectors are prime targets for cyber-attacks. With blockchain, while security is a touted benefit, the technology also brings concerns about data privacy and the risk of sophisticated cyber threats. Financial institutions must invest in advanced security measures to safeguard against these risks.

- Technology Complexity and Integration Costs: The integration of blockchain into existing financial systems presents a complex technological challenge. It requires significant initial investment and ongoing costs in system upgrades, not to mention the need for skilled personnel to manage and maintain blockchain systems.

- Customer Adaptation and Trust: Despite its benefits, there remains a significant gap in customer understanding and trust towards blockchain technology. Financial institutions must address skepticism and foster trust by enhancing customer education and demonstrating the tangible benefits of blockchain technology.

Top Opportunities

- Enhanced Security and Efficiency: Blockchain offers superior security features that are attractive to the BFSI sector, including tamper-proof ledgers and decentralized data management, which significantly reduce the risk of fraud and cyber-attacks.

- Streamlining of Operations: Blockchain can greatly streamline operations within BFSI by automating and accelerating processes like compliance, audits, and customer verification through smart contracts and decentralized applications.

- Cost Reduction: By eliminating intermediaries and reducing transaction times, blockchain can substantially lower the costs associated with financial operations and cross-border transactions.

- Improved Transparency and Traceability: Blockchain technology provides unprecedented transparency and traceability in financial transactions, allowing for enhanced regulatory oversight and increased trust among clients.

- Innovation in Financial Products and Services: The integration of blockchain opens up innovative approaches to financial services, including peer-to-peer lending, micro-financing, and bespoke insurance services, potentially tapping into previously underserved markets.

Recent Developments

- Amazon Web Services (AWS): In January 2024, AWS expanded its Blockchain as a Service (BaaS) offerings, introducing new features that enhance the scalability and security of financial applications using blockchain technology. This update is particularly beneficial for financial institutions looking to manage large-scale blockchain networks.

- Accenture: In February 2024, Accenture announced the expansion of its blockchain services to integrate more with emerging technologies such as AI and IoT. This integration aims to provide comprehensive solutions for financial institutions, enhancing operational efficiency and security.

- Microsoft: In March 2023, Microsoft introduced an updated version of its Azure Blockchain Service, which now includes enhanced tools for compliance and regulatory reporting. This update is designed to support financial institutions in adhering to the increasingly stringent regulatory environment.

- Infosys Limited: In November 2023, Infosys launched a new blockchain-based platform specifically designed for cross-border payment solutions. This platform aims to reduce transaction times and costs significantly while increasing transparency for financial institutions.

- SAP: In June 2023, SAP released a blockchain solution focused on improving the traceability and transparency of financial transactions within the insurance industry. This new tool is part of SAP’s broader strategy to integrate blockchain across its product suite.

- JP Morgan: In October 2023, JP Morgan expanded its blockchain-based payment network, Onyx, to include more global banking partners, enabling faster and more secure cross-border transactions. This move is part of JP Morgan’s ongoing efforts to revolutionize traditional banking processes using blockchain technology.

Conclusion

In Conclusion, Blockchain technology in BFSI holds transformative potential, promising enhanced security, operational efficiency, and the advent of innovative financial products. Despite these substantial benefits, significant challenges remain, such as interoperability issues, regulatory uncertainties, and the high costs of technology integration. As the industry moves forward, these hurdles must be addressed to fully leverage blockchain’s capabilities. The ability of financial institutions to navigate these complexities will determine the extent to which blockchain can revolutionize the sector, fostering a more transparent, efficient, and customer-centric financial landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)