Table of Contents

Introduction

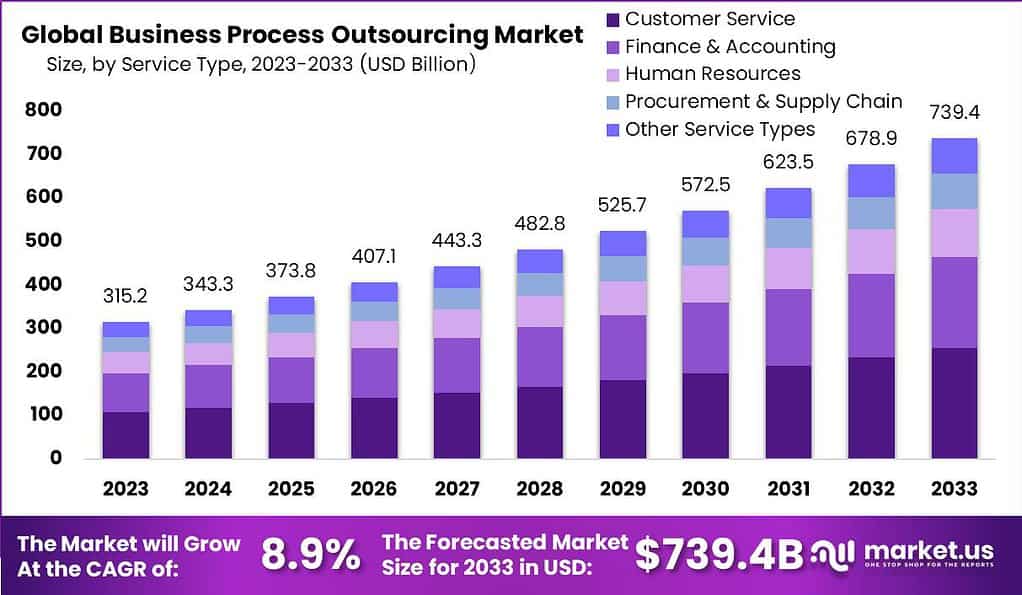

The Business Process Outsourcing (BPO) Market is expected to experience significant growth, increasing from a valuation of USD 315.2 billion in 2023 to an estimated USD 739.4 billion by 2033. This growth reflects a CAGR of 8.9% throughout the forecast period from 2024 to 2033. This expansion is driven by the rising trend of outsourcing by businesses aiming to enhance their operational efficiencies and focus on core competencies.

Several factors contribute to this growth, including the burgeoning demand across sectors such as finance and accounting, human resources, and IT & telecommunications. The finance and accounting segment, in particular, is expected to see robust growth due to the increasing number of banking facilities and the stringent regulatory requisites within the banking sector. Outsourcing in this segment helps significantly reduce operating costs. Similarly, the human resources sector is projected to grow substantially, driven by the increasing need for services encompassing payment processing, recruitment, administration, and employee benefits.

In recent developments within the Business Process Outsourcing (BPO) industry, mergers and acquisitions have played a pivotal role in shaping market dynamics. For instance, there has been a significant level of M&A activity in the broader commercial and industrial sectors. Companies such as Mallory Safety and Supply and Bridgestone HosePower have expanded their market presence and service offerings through strategic acquisitions, such as Mallory’s acquisition of Rocky Mountain Industrial Supply and Safety Station, and Bridgestone’s purchase of Cline Hose & Hydraulics. These moves indicate a growing trend of consolidation within industries, aimed at enhancing capabilities, reaching new markets, and achieving operational efficiencies.

Key Takeaways

- The business process outsourcing market is projected to reach a value of USD 739.4 billion by 2033, with a robust CAGR of 8.9% during the forecast period.

- In 2023, the market was valued at USD 315.2 billion, indicating significant growth potential over the forecast period.

- Customer service outsourcing held a major market share of 5% in 2023, reflecting the importance of high-quality customer support across industries.

- Large enterprises accounted for a substantial market share of 67% in 2023, highlighting their reliance on outsourcing to maintain efficiency and competitiveness.

- The IT & Telecommunications segment dominated the market with a revenue share of 36.1% in 2023, driven by the sector’s need for innovation and operational efficiency.

- The Philippines’ BPO sector contributes significantly to the nation’s economy, accounting for 9% of its GDP, showcasing the economic importance of outsourcing in emerging markets.

- Approximately 37% of small businesses have embraced outsourcing, recognizing its benefits in enhancing operational agility and competitiveness.

- Remote work has become prevalent, with 35% of American workers operating remotely, contributing to cost savings and flexibility for employers.

- Supply chain and logistics outsourcing was adopted by 48% of organizations in 2023, driven by the increasing complexity and globalization of supply chains.

- Organizations cite pursuit of specialized skills and expertise as the primary rationale (71%) for outsourcing business processes, emphasizing the importance of accessing external talent.

- North America dominated the market in 2023, capturing the highest revenue share of 38.4%, attributed to its mature business environment and technological advancement.

- Key players in the market include Accenture plc, IBM Corporation, Amdocs Ltd., and others, showcasing a competitive landscape with established multinational corporations and emerging companies.

Business Process Outsourcing Statistics

- The military industry benefits significantly from outsourcing, generating $100 billion in revenue.

- Around 40% of help desk jobs in the banking sector are outsourced.

- The global outsourcing market was estimated at $92.5 billion before the COVID-19 pandemic.

- The United States outsources about 300,000 jobs every year.

- More than 93% of companies are considering or already using cloud services to boost their outsourcing efforts.

- Data security concerns impact 68% of organizations transitioning to cloud-based outsourcing.

- The financial services outsourcing market is valued at over $130 billion.

- Smaller companies with fewer than 50 employees are less likely to outsource, with only 29% doing so, compared to 66% of larger companies.

- 24% of small businesses outsource primarily to enhance efficiency, with accounting and IT services being the top functions outsourced.

- Over half of executives, 52%, outsource business functions, with 76% specifically outsourcing IT functions.

- A significant 89% of companies develop or deploy cloud services through third-party providers, and 96% use external data and analytics services.

- Small and medium businesses (SMBs) have an average outsourcing expenditure of $198,550.

- The business process outsourcing market is forecasted to generate $0.35 trillion in revenue, with a growth projection to $0.45 trillion.

- To concentrate on core processes, 57% of businesses use outsourcing, with 78% reporting positive relationships with their outsourcing partners.

- For 57% of companies, cost reduction is the primary reason for outsourcing, but accessing new capabilities (51%) and adapting to business strategy changes (49%) are also important.

- Challenges with transitioning to cloud infrastructure have been encountered by 68% of businesses engaging with BPOs.

- Despite concerns over data sharing with outsourcing agencies by 35% of companies, 44% of chief intelligence officers are open to collaboration.

- A top concern for 22% of executives when selecting third-party services is the potential negative impact on company culture.

- In India, the IT BPO industry generated $154 billion in revenue.

- At least one third-party team for customer interaction is used by 54% of businesses.

- Currently, 74% of firms use BPOs for their IT requirements.

- 65% of companies using BPOs for application hosting plan to increase their investment.

- The budget for operating services, managed services, and traditional outsourcing is expected to rise among 67%, 57%, and 32% of companies, respectively.

- 83% of small businesses plan to maintain or increase their BPO budget.

Use Cases

- Customer Service and Support: A cornerstone for businesses in today’s customer-centric environment, outsourcing customer service functions allows for round-the-clock support across various communication channels such as phone, email, chat, and social media. This approach not only offers scalability during peak times but also leverages specialized expertise in customer interaction, thereby improving customer satisfaction while enabling businesses to concentrate on their core competencies.

- Human Resources and Payroll: Managing the intricate details of HR and payroll is crucial for ensuring accuracy, compliance, and confidentiality. Through BPO, companies can outsource tasks such as payroll processing, recruitment, onboarding, and benefits administration. This not only streamlines these essential operations but also keeps businesses updated with the latest in labor laws and regulations, mitigating the risk of non-compliance.

- Finance and Accounting: Critical to any organization’s success, the outsourcing of finance and accounting tasks like accounts payable/receivable, financial reporting, and risk management enhances accuracy and enables timely decision-making. Automating these processes through BPO partners not only ensures cost efficiency but also supports strategic financial planning and risk management, laying a solid foundation for growth.

Recent Developments

Company Developments

- TTEC Holdings, Inc. announced the opening of a new customer experience delivery center in Cape Town, South Africa, in November 2023, aimed at providing customer experience services across various industries.

- Go4Customer introduced Conversational AI in June 2023 to enhance its BPO offerings, employing machine learning algorithms and natural language processing for human-like customer interactions.

- Delta BPO Solutions launched a Franchise Owned, Company Operated (FOCO) franchise business model in April 2023, offering entrepreneurs a comprehensive business opportunity in the BPO sector.

Emerging Trends

- A continued focus on AI-powered automation and Robotic Process Automation (RPA) to streamline workflows and automate repetitive tasks, enhancing productivity and customer experiences.

- An increased emphasis on Remote Workforce Management, utilizing technologies to manage remote teams effectively and investing in cybersecurity measures.

- Cloud-based Outsourcing will become more prevalent, offering scalability and flexibility while facilitating collaboration and data security.

- Data Analytics Outsourcing is set to play a crucial role in informed decision-making, with businesses harnessing data for strategic insights.

- Growing importance of Data Security and Compliance in safeguarding sensitive information and ensuring adherence to regulations.

Key Players Analysis

Accenture

Accenture is a leading provider in Business Process Outsourcing (BPO) services, focusing on transforming and optimizing operations across various functions such as finance, supply chain, procurement, and HR. With a global presence, the company employs more than 219K individuals across 50 centers, leveraging AI, technology, and innovation to deliver insights and accelerate decision-making. Accenture’s strategic approach enables businesses to achieve sustainable growth by reinventing operations, driving value, and improving performance.

IBM

IBM’s Business Process Outsourcing (BPO) services use an innovative co-creation approach to transform operational workflows with AI and automation. They focus on elevating client outcomes and productivity, offering expertise in various domains such as finance, HR, supply chain, and customer service. IBM’s BPO services are designed to modernize essential business processes, enabling organizations to leverage emerging technology and achieve competitive advantages.

Amdocs

Amdocs Ltd is enhancing the customer experience in the Business Process Outsourcing sector through innovative services. Their approach includes optimizing business processes with greater visibility, reengineering, automation orchestration, system reconciliation, and business process outsourcing. Amdocs utilizes its unique Amdocs iPaaS, an industry-focused integration framework, to leverage cloud benefits fully. This includes business process management, an integration platform, and leading robotic process automation partner integration for efficient operations and control.

Capgemini

Capgemini SE plays a strategic role in the Business Process Outsourcing (BPO) sector, focusing on harnessing technology to transform and manage business operations. The company emphasizes delivering value across customer experience, intelligent industry, and enterprise management, while embracing technologies such as cloud, data, and AI. Capgemini’s expertise spans strategy, technology, engineering, and operations, aiming to drive operational excellence and technological innovation through BPO and managed services.

Cognizant

Cognizant leverages advanced technologies and innovative approaches in the Business Process Outsourcing sector to enhance operations and deliver significant business outcomes. They focus on generating value across various industries by applying generative AI and intelligent automation, leading to improved customer satisfaction, faster processes, and substantial cost savings. Their services span multiple domains, including customer care, finance, healthcare, and more, aiming to transform operations and drive growth efficiently.

Tata Consultancy Services Limited

Tata Consultancy Services Limited (TCS), a prominent subsidiary of Tata Sons Pvt Ltd, has established itself as a significant provider of information technology (IT) services, including a comprehensive suite of business process outsourcing (BPO) services. TCS offers a wide array of services such as IT infrastructure services, engineering and industrial services, business intelligence, cloud services, quality engineering, blockchain, enterprise solutions, and Internet of Things (IoT). Their BPO services are integrated into their broader consulting and technology solutions, catering to various industries including banking, financial services, insurance, life sciences and healthcare, retail, manufacturing, and more, underscoring the company’s versatility and expertise in handling diverse client needs across the globe.

TCS’s strategic approach to BPO involves leveraging technology and innovation to deliver enhanced business outcomes. This is evident from their commitment to harnessing generative AI, cloud technologies, and strategic partnerships aimed at expanding their service offerings and enhancing operational efficiencies. Recent milestones, such as launching an AWS generative AI practice and winning multiple awards for their services in different sectors, demonstrate TCS’s leadership in integrating cutting-edge technologies to drive business transformation for their clients.

With operations spanning Latin America, North America, Europe, Asia-Pacific, the Middle East, and Africa, TCS’s global footprint is a testament to its ability to deliver high-quality IT and BPO services worldwide. The company’s focus on innovation, combined with its extensive industry expertise, positions TCS as a preferred partner for businesses looking to navigate the complexities of digital transformation.

TCS’s financial strength and market position further solidify its role as a leader in the IT and BPO sectors. With a revenue of $28.7 billion in 2023 and a market capitalization of $173.6 billion, TCS demonstrates robust performance and a strong commitment to delivering value to its clients and stakeholders alike.

Conclusion

The Business Process Outsourcing Market’s expected growth is underpinned by a blend of increasing demand for specialized outsourcing services, regional market dynamics, and the continuous integration of technological advancements to meet the evolving needs of global businesses.