Table of Contents

Introduction

According to Buy Now Pay Later Statistics, Buy Now Pay Later (BNPL) is a contemporary payment method gaining popularity for its ability to let consumers purchase items and delay payments, usually in installments, without incurring traditional credit card interest charges. It offers an easy application process, low to no interest rates, and flexibility in payment schedule, making it convenient for online and offline shopping.

Users select BNPL at checkout, undergo a quick approval process, choose a suitable payment plan, and receive automatic payment schedules. While BNPL provides affordability and budgeting advantages, it also presents challenges, such as the potential for overspending and late fees, which have attracted regulatory scrutiny.

Editor’s Choice

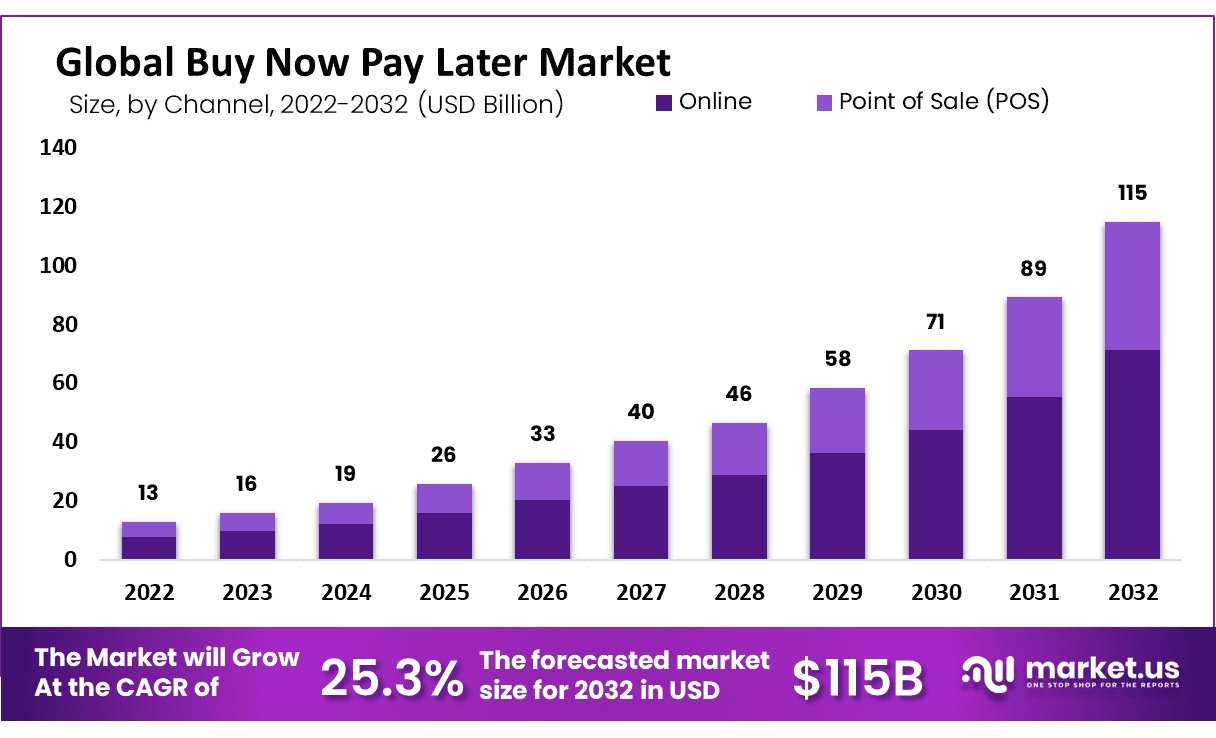

- The Buy Now Pay Later (BNPL) market has demonstrated substantial growth over the forecasted years at a CAGR of 25.3%.

- In 2022, the BNPL market recorded a revenue of 13 billion, which marked the beginning of its upward trajectory.

- In 2021, approximately 17% of consumers with a credit history opted to utilize a Buy Now, Pay Later (BNPL) service for at least one purchase.

- The typical amount financed by BNPL users within a year amounted to $1,000.

- Notably, individuals with higher annual incomes exceeding $200,000 were less inclined to utilize BNPL platforms, with only 9% having used such services.

- Furthermore, BNPL usage appeared to be more prevalent among renters, as 22% of BNPL users identified as renters compared to 15% who were homeowners.

- Additionally, it was observed that women were somewhat more likely to embrace BNPL platforms, with 22.7% of women having used them, while the figure stood at 14.3% for men.

Global BNPL Market Overview

Market Size and Growth Trends

- The Buy Now Pay Later (BNPL) market has demonstrated substantial growth over the forecasted years at a CAGR of 25.3%.

- In 2022, it recorded a revenue of 13 billion, which marked the beginning of its upward trajectory.

- The market’s remarkable ascent culminated in impressive figures of 89 billion in 2031 and a staggering 115 billion in 2032.

Global Buy Now Pay Later (BNPL) Market Revenue- By Channel

- The Global Buy Now Pay Later (BNPL) market has grown remarkably across different channels over the forecasted years.

- In 2022, the total revenue reached 13 billion, with 8 billion generated online and 5 billion at point-of-sale locations.

- The growth pattern persisted through subsequent years, culminating in an impressive total revenue of 115 billion in 2032.

Regional Analysis of the Global Buy Now Pay Later (BNPL) Market

- Regarding Buy Now, Pay Later (BNPL) services’ domestic e-commerce market share, Sweden takes the top spot with a commanding 23%, followed closely by Germany at 19%.

- Norway secures the third position with a 15% market share, while Finland and Australia share the fourth and fifth spots, each contributing 12% and 10% to the market, respectively.

- New Zealand joins Australia in the fifth place, holding a 10% market share.

- Moving down the rankings, the Netherlands follows with a 9% market share, and Denmark is not far behind with 8%.

- Belgium claims the ninth position with 7% of the domestic e-commerce market, while the United Kingdom rounds out the top 10 with a 5% market share.

- France and Japan share the 11th position, each with a 4% market share.

- Several countries, including India, Indonesia, Singapore, and the Philippines, hold a 3% market share, placing them in the 12th position.

Different BNPL Services

- Different Buy Now, Pay Later (BNPL) services come with varying terms regarding interest rates and late fees, which are crucial considerations for users.

- Affirm offers an interest rate of up to 36%, though it does not impose late fees.

- Afterpay, known for its 0% interest rate, charges late fees of up to 25% of the initial order value per purchase.

- FuturePay adopts a unique approach, levying $1.25 for every $50 in unpaid balance and late fees of up to $38 per payment.

- Klarna, another 0% interest rate provider, imposes late fees of up to $7 per payment.

Most Popular BNPL Providers

- Among Buy Now, Pay Later (BNPL) users, certain providers have garnered more significant popularity, according to the percentage of respondents.

- Afterpay emerges as the frontrunner, with half of the BNPL users, or 50% of respondents, choosing this service for their payment needs.

- Klarna closely follows, with 45% of users opting for its offerings. Affirm secures the third spot, with 41% of respondents choosing it as their BNPL provider.

- PayPal Credit and Pay In 4 collectively garnered 35% of BNPL users’ preferences. Zip/Quad Pay and Sezzle share the spotlight with 11% each, reflecting a portion of the user base.

Demographic Analysis of BNPL Users

Age Distribution of BNPL Users

- The age distribution of Buy Now Pay Later (BNPL) users has seen notable shifts over the years, reflecting changing consumer preferences.

- In 2021, most BNPL users belonged to Generation Z, accounting for 36.80% of the user base, followed by Millennials at 30.30%.

- Fast forward to 2023, and Gen Z’s representation grew to 46.50%, while Millennials increased to 39.50%.

- This trend continued into 2025, with Gen Z comprising 47.40% of BNPL users and Millennials at 40.60%.

- These figures indicate a significant shift towards younger generations embracing BNPL services. Gen Z and Millennials show the most substantial growth, experiencing an increase of approximately 10.6% and 10.3%, respectively, from 2021 to 2025.

BNPL Usage by Gender

- The usage of Buy Now Pay Later (BNPL) services varies by gender, with distinct patterns emerging.

- As of the latest data, females have demonstrated a higher utilization rate of BNPL, accounting for 22.7% of users, while males make up 14.3%.

- This indicates a notable disparity in adoption, with more females embracing BNPL as a payment option than their male counterparts.

BNPL Use by Household Income

- Household income levels significantly influence Buy Now Pay Later (BNPL) usage patterns.

- The data reveals a substantial discrepancy in BNPL adoption based on income brackets.

- Among households with an income of less than $75,000, a significant majority, representing 72.60%, utilize BNPL services.

- In contrast, households with an income of $75,000 and over have a notably lower adoption rate, accounting for 17.60% of BNPL users.

Consumer Adoption and Behavior

Frequency of Buy Now, Pay Later Use

- The frequency of Buy Now, Pay Later (BNPL) usage has exhibited varying patterns over the past four years, from 2020 to 2023.

- In 2020, 19% of users reported using BNPL at least once a week, and this percentage remained consistent in 2021.

- Lastly, the least frequent usage category, once a year or less frequently, declined from 25% in 2020 to 16% in 2023.

Main Reasons People Use BNPL

- People opt for Buy Now, Pay Later (BNPL) for various reasons, and the data illustrates the motivations behind its usage.

- A significant portion, representing 45% of users, choose BNPL because it simplifies the payment process, making it more convenient.

- Additionally, 44% of users value its flexibility, allowing them to manage their finances more efficiently.

- Another substantial group, comprising 36% of users, is attracted to BNPL due to its lower interest rates than traditional credit cards.

- Furthermore, the easy approval process appeals to 33% of users, offering accessibility to those who may have faced challenges with traditional credit.

- Notably, 33% also turn to BNPL when their credit cards are maxed out.

Most Common Use Categories of BNPL

- The most common use categories for Buy Now, Pay Later (BNPL) services encompass a range of consumer needs and preferences.

- Among these categories, clothing and fashion emerge as the top choices, with 43% of BNPL users utilizing this payment method for apparel purchases.

- Following closely behind is furniture and appliances, representing 31% of users, indicating a preference for financing larger household items.

- Personal care items and cosmetics rank third, with 28% of users opting for BNPL for their beauty and grooming products.

- Meanwhile, household essentials, including everyday items, garner 27% usage, while groceries secure a substantial 24% share, reflecting BNPL’s versatility in covering everyday needs.

- Further down the list, 22% of users turn to BNPL for books, movies, music, and games, indicating its appeal in the entertainment sector.

BNPL in Retail Sector Statistics

- The Buy Now, Pay Later (BNPL) usage in the retail sector is projected to experience robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 25.6% expected through 2030.

- In 2019, apparel and beauty products dominated BNPL’s Gross Merchandise Value (GMV), accounting for a substantial 80.1% share.

- However, this figure decreased to 58.6% in 2021, indicating a shift in consumer preferences.

- The fashion sector significantly contributes to global BNPL revenue, making up more than 43% of the total.

- Notably, the fashion and garments category is expected to lead in CAGR at 27.2%, surpassing other spending categories.

BNPL in E-Commerce Statistics

- The global transaction value of Buy Now, Pay Later (BNPL) in the e-commerce sector has experienced remarkable growth.

- In 2019, it stood at 34 billion USD, signaling its emergence as a popular payment method.

- This figure saw a significant leap to 60 billion USD in 2020, indicative of its rapid consumer adoption.

- By 2021, the BNPL transaction value in e-commerce doubled, reaching an impressive 120 billion USD.

- The growth trajectory continued into the forecasted years, with estimates of 214 billion USD in 2022, 309.2 billion USD in 2023, 386 billion USD in 2024, 481 billion USD in 2025, and 565.8 billion USD in 2026.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)