Table of Contents

Introduction

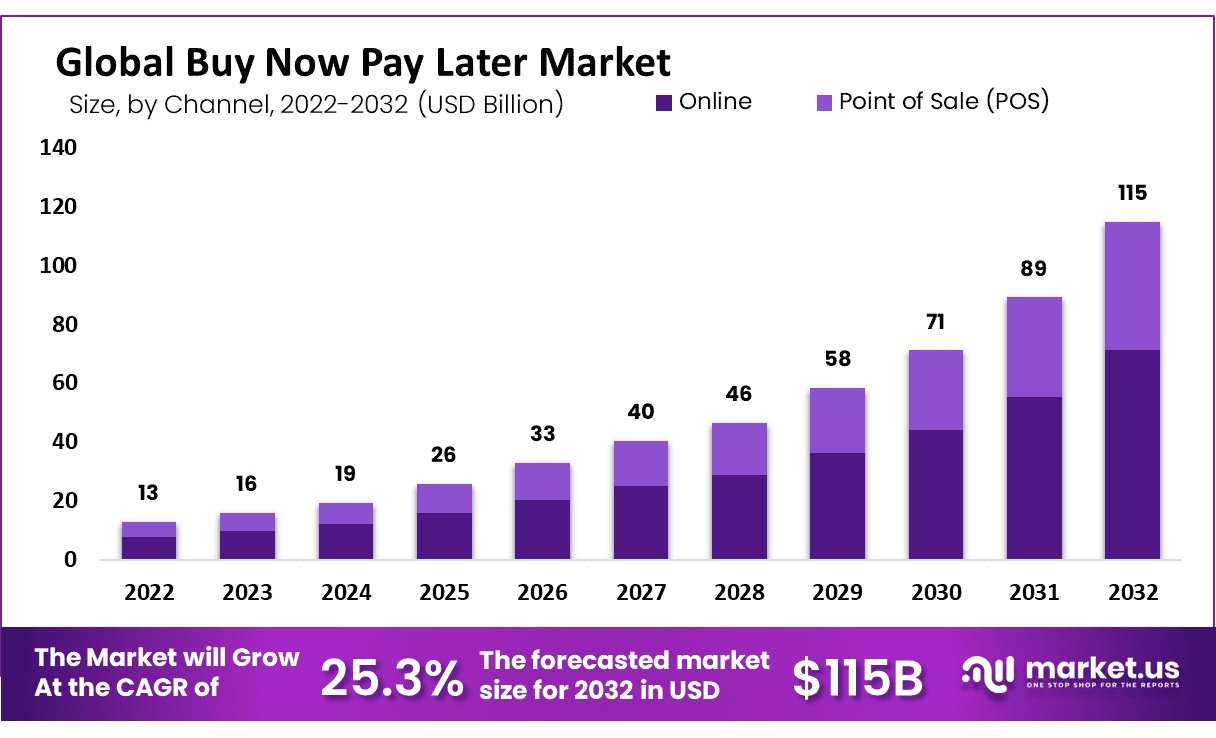

The Buy Now Pay Later (BNPL) market is experiencing significant growth due to technological advancements and evolving consumer behaviors. In 2023, the market was valued at USD 16 billion and is expected to reach USD 115 billion by 2032, with a projected CAGR of 25.3%. This growth trajectory highlights the increasing adoption of BNPL services across various sectors, including retail, healthcare, and consumer electronics, offering consumers financial flexibility and convenience.

The Buy Now Pay Later market’s key growth drivers include the surge in online shopping, especially post-pandemic, and the growing demand for more flexible and accessible payment solutions. The retail sector, particularly in consumer electronics, has emerged as a leading adopter of BNPL services, driven by the increase in online sales of items such as smartphones, smart TVs, and gaming consoles. The retail industry’s embrace of BNPL is due to its ability to enhance customer purchase experiences, increase conversion rates, and facilitate higher average order values. Additionally, the SMEs segment is poised for rapid growth, leveraging BNPL to boost sales, save on merchant discount rates, and increase cart conversion rates.

In the dynamic landscape of Buy Now Pay Later (BNPL) and broader fintech sectors, recent developments have been marked by strategic mergers, acquisitions, and significant funding activities, as companies seek to expand their capabilities and market presence. For instance, Visa has broadened its fintech reach through acquisitions such as the Brazilian fintech Pismo and is planning to acquire a majority stake in the Mexican payments processor Prosa, focusing on international assets to navigate around regulatory scrutiny in the U.S. PayPal, under its new CEO Alex Chriss, has shown a keen interest in broadening its services beyond traditional payment systems, venturing into loyalty and marketing areas, exemplified by its divestiture of the returns software business Happy Returns to UPS for $465 million.

Another notable transaction is Global Payments’ acquisition of Evo Payments for $4 billion, as it divests its Netspend consumer unit for $1 billion while securing a $1.5 billion investment from Silver Lake Partners. These moves illustrate the sector’s vibrancy and the strategic realignments underway as companies aim to strengthen their positions in the evolving digital payments ecosystem.

Regulatory scrutiny and the need for robust risk assessment mechanisms are challenges that are shaping the market. Companies are investing in cutting-edge technologies such as AI and machine learning to refine risk assessments and offer personalized services.

Key Takeaways

- The global Buy Now Pay Later Market is projected to reach a revenue of USD 115 billion by 2032, up from USD 16 billion in 2023, reflecting a significant growth rate of 25.3%.

- Online channels dominate the buy now pay later market, contributing to 62% of global revenues.

- Large enterprises hold a substantial share of over 61% in the buy now pay later market as of 2022.

- Retail emerges as the most lucrative end-use segment, accounting for more than 71.3% of revenue during the forecast period.

- North America leads the market, contributing approximately 32% to global revenue.

- The point of sale (POS) channel is anticipated to grow, offering transparent installment loan options to enhance customer experience.

Buy Now Pay Later Statistics

- BNPL users worldwide are growing fast, expected to hit 900 million by 2027 from 360 million in 2022.

- In the US, more than 94 million people will be using BNPL by 2024, reaching over 100 million by 2026.

- US BNPL payments will jump to $71.9 billion in 2023, up nearly 20% from 2022.

- The whole BNPL market will grow by 25.5% every year, reaching $309.2 billion in 2023.

- US BNPL deals will grow 14.8% yearly from 2023 to 2027, thanks to companies like Klarna and Affirm.

- Half of US shoppers have tried BNPL, up a lot since 2020.

- 17% of people used BNPL in the year before February 2022.

- North America and Europe make up 70% of the world’s BNPL deals, with 40% from North America.

- More women (20%) use BNPL than men (14%).

- Black and Hispanic shoppers are more likely to use BNPL than white shoppers.

- Most BNPL users are millennials, making up 56% of all users.

- The 25-34 age group, mostly millennials, is 40% of BNPL users.

- People making $20,000 to $50,000 a year are the most likely to use BNPL, at 21%.

- 62% of users think BNPL could one day replace credit cards.

- 48% use BNPL to buy things they can’t afford right away.

- BNPL users spend more than credit card users, with $1,692 on BNPL compared to $1,006 on credit cards in 90 days.

- About a quarter of BNPL users have missed payments.

- Only half are very sure they can pay back BNPL loans on time.

- 32% use BNPL at least once a month.

- On average, BNPL users have borrowed over $2,000.

- Klarna is the biggest BNPL service with 150 million users.

- Clothing is the top thing people buy with BNPL, at 46%.

- The average BNPL purchase is $135.

- Stores offering BNPL see a 2% boost in sales each year.

- BNPL boosts electronics sales, with 26.7% of users saying they wouldn’t buy without it.

- BNPL app use shot up nearly 200% between 2021 and 2022.

- BNPL’s share in online shopping will grow to over 5% by 2025.

- In-store BNPL will reach $940 billion by 2025, especially in the US and Europe.

Use Cases

- Healthcare and B2B: BNPL is branching into healthcare and business-to-business (B2B) sectors. The flexibility of installment payments is appealing for managing expenses in these areas. In the B2B realm, BNPL is seen as a $1 trillion market, offering significant benefits such as fast payments to suppliers and flexible payment terms for businesses.

- Consumer Protections and Regulations: In Australia and the UK, regulatory concerns over BNPL, such as late fees and debt “stacking,” have prompted the largest industry players to self-regulate, introducing codes of conduct for affordability checks, fee transparency, and financial hardship assistance. This proactive approach aims to address regulatory concerns and protect consumers.

- Technological Integration and Shopping Apps: Leading BNPL providers are transforming into comprehensive shopping apps, enabling consumers to start their purchase journeys within these apps. This deep integration into the shopping experience allows users to access BNPL payment options even at merchants not directly partnered with BNPL services. For example, consumers can shop using Klarna within its app at merchants like Amazon, despite Klarna not being integrated into Amazon’s checkout.

- Credit Cards vs. BNPL: BNPL is positioned as a more equitable credit model, especially appealing to younger consumers. BNPL offers more flexible payment terms and potentially cheaper credit across all customer statuses, challenging the traditional credit card model. While credit card profitability has declined, BNPL is attracting users who prefer debit over credit for digital payments, including a significant portion of millennials and Gen Z consumers who do not have credit cards.

- Expansion into Education: The BNPL model is also finding applications in the education sector, with Affirm partnering with learning platforms like Udacity to fund “nanodegrees” in finance and technology. This expansion highlights the versatility of BNPL financing beyond traditional retail purchases.

Recent Developments

- PayPal’s Acquisition: PayPal expanded its BNPL offerings by acquiring the Tokyo-based BNPL group Paidy for approximately $2.7 billion, marking a significant move in the industry.

- Dominance in Sweden: Sweden leads the BNPL market share, with notable growth also seen in Germany and Norway. Australia and New Zealand are prominent non-European countries in the BNPL space, demonstrating the global appeal and adoption of BNPL services.

- Klarna’s User Growth: Klarna, a Swedish fintech, has seen its monthly active users dramatically increase from under 20,000 in January 2019 to approximately 970,000 by September 2021. Klarna’s active user base and its innovative approach have made it a leader in the BNPL market.

- PayPal Credit’s Popularity in the US: PayPal Credit emerges as the most popular BNPL service in the US, with a user base of 34.6 million in 2020, significantly outpacing other services like Klarna. This demonstrates PayPal Credit’s strong foothold in the US BNPL market.

- Consumer Demographics: BNPL services are more popular among men than women, with younger consumers aged 18-34 being three times more likely to use BNPL regularly compared to those over 55. This highlights the demographic trends favoring BNPL’s growth among younger, tech-savvy consumers.

- Usage Frequency: Around one in three BNPL users utilize the service each month, indicating a high level of engagement and reliance on BNPL for managing purchases and payments.

- Clarity of Fees: The most important factor for BNPL users is the clarity of fees or interest rates, with nearly half of the respondents citing it as a key reason for choosing BNPL over other payment methods.

Key Players Analysis

PayPal Holdings, Inc.

PayPal Holdings, Inc. has been actively expanding its Buy Now Pay Later (BNPL) offerings, reflecting its commitment to providing flexible payment solutions for consumers and merchants alike. Key developments in PayPal’s BNPL initiatives include:

- Acquisition of Paidy: In September 2021, PayPal announced the acquisition of Paidy, a leading Japanese BNPL provider, for approximately $2.7 billion. This move is aimed at enhancing PayPal’s presence in Japan, the third-largest e-commerce market globally, complementing its existing cross-border e-commerce business in the country. Paidy’s technology enables consumers to shop online and pay monthly at convenience stores or via bank transfer, fostering a safer online shopping environment and increasing merchant conversions and customer loyalty.

- Introduction of ‘Pay in 4’: PayPal launched ‘Pay in 4’ in August 2020, a short-term installment payment solution allowing customers to split purchases into four interest-free payments over six weeks. This service, part of PayPal’s Pay Later suite, requires no additional fees for merchants, helping to drive conversion and customer loyalty while providing consumers with a flexible payment option. ‘Pay in 4’ integrates seamlessly with the PayPal platform, used by over 80 percent of leading U.S. retailers, and is designed to increase sales and order values for merchants.

- Launch of ‘Pay Monthly’: In June 2022, PayPal introduced ‘Pay Monthly’, further expanding its BNPL product suite. This offering enables consumers to make larger purchases between $199-$10,000 and spread the cost over 6–24 months with flexible monthly payments. ‘Pay Monthly’ is intended to meet the growing demand for more manageable payment options, allowing consumers to budget for big purchases. This service highlights PayPal’s commitment to providing diverse, flexible financial solutions to meet the evolving needs of consumers and merchants.

These initiatives underscore PayPal’s strategy to stay at the forefront of the digital payment revolution, leveraging technology to make financial services more convenient, affordable, and secure. By expanding its BNPL offerings, PayPal continues to empower consumers and merchants to thrive in the global economy.

Affirm, Inc

Affirm, Inc. is a financial technology company that aims to improve lives with honest financial products. They’re building a platform focused on digital and mobile-first commerce, making it simpler for consumers to spend responsibly and confidently. As of September 30, 2023, Affirm reported having over 16.9 million active consumers and processed more than $21 billion in gross merchandise volume. This data underscores Affirm’s significant impact in the BNPL sector and its commitment to facilitating commerce.

Afterpay Pty Ltd

Afterpay Pty Ltd, founded in 2014 by Nick Molnar and Anthony Eisen, is an Australian fintech known for its buy now, pay later service. It’s available in Australia, the UK, Canada, the US, and New Zealand. The company, part of Block, Inc. since January 2022, allows customers to buy products immediately and pay in four fortnightly installments. As of FY2021, Afterpay reported revenue of AU$924.7 million and had 16.2 million users by June 2021. The service includes late fees for missed payments but is interest-free.

Mastercard Inc.

Mastercard has launched a new Buy Now, Pay Later (BNPL) program called Mastercard Installments. This program is designed to give consumers more flexible payment options, both online and in-store, allowing them to pay through interest-free installments. It’s made to work with banks, lenders, fintechs, and wallets, making it widely accessible. Mastercard Installments aims to offer a seamless shopping experience backed by the security and consumer protections associated with Mastercard.

Amazon.com, Inc.

Amazon Business introduced Affirm as its first Buy Now, Pay Later (BNPL) payment option, targeting sole proprietors. This partnership, announced after their collaboration on Amazon.com and the Amazon mobile app in 2021, allows eligible business customers to split purchases into manageable payments over time with Affirm, without incurring late or hidden fees. The integration aims to enhance flexibility and convenience for small business owners by offering transparent, tailored payment plans ranging from three to 48 months.

Klarna Inc.

Klarna Inc., a leading fintech company, saw its revenue grow to $1.85 billion in 2022, marking a 30% increase from the previous year. The company processed $83 billion in transactions and served 150 million users globally, with 25 million in the United States. Klarna partners with over 400,000 merchants worldwide. Founded in Sweden in 2005, it’s known for its buy now, pay later service that offers zero-interest installments. Despite a significant valuation drop in 2022, Klarna remains a key player in the BNPL market.

Conclusion

The BNPL market’s rapid growth is underpinned by technological advancements, strategic business moves, and changing consumer behaviors, with significant opportunities and challenges ahead. The continued evolution of the market will likely see more innovations, partnerships, and expansions, making BNPL an integral part of the global financial landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)