Table of Contents

Introduction

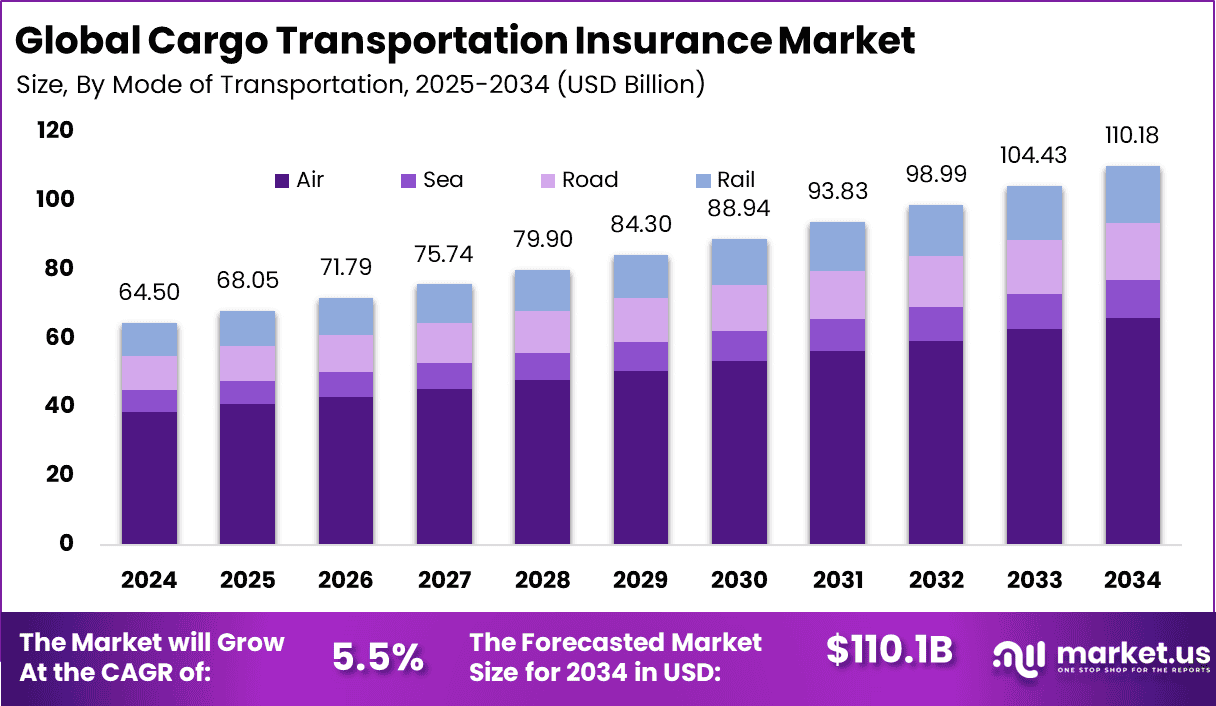

The Global Cargo Transportation Insurance Market is projected to reach USD 110.18 billion by 2034, growing from USD 64.5 billion in 2024, with a CAGR of 5.5% during the forecast period. North America is expected to maintain a dominant position, holding 36.6% of the market share in 2024, contributing USD 23.6 billion in revenue. The growth of the cargo transportation industry, driven by global trade and e-commerce, is expected to fuel the demand for comprehensive insurance solutions. This market expansion is also driven by increased concerns regarding cargo safety, regulatory compliance, and the rise in international shipping activities.

How Growth is Impacting the Economy

The growth of the Cargo Transportation Insurance Market is directly influencing global trade and supply chain dynamics. As international trade volumes increase, the demand for cargo insurance is expanding to protect goods in transit from potential risks, including damage, theft, and natural disasters. This sector’s growth is creating a more robust insurance ecosystem, offering stability and security to businesses involved in shipping and logistics. Furthermore, the growing e-commerce sector contributes to the demand for reliable cargo insurance solutions, driving investments in technology and risk management strategies. These developments are also creating job opportunities in logistics, shipping, and insurance services, leading to broader economic benefits.

➤ Unlock growth! Get your sample now! – https://market.us/report/global-cargo-transportation-insurance-market/free-sample/

Impact on Global Businesses

Rising operational costs, especially due to fluctuating fuel prices and global supply chain disruptions, are affecting the cargo transportation insurance industry. The increased cost of shipping and logistics is leading businesses to seek more tailored and cost-effective insurance products. Additionally, with shifting supply chains and increased international trade, companies are adjusting their risk management strategies to accommodate more complex logistics networks. Sector-specific impacts include the increased need for insurance solutions in high-risk shipping lanes and regions prone to natural disasters. The rise in e-commerce also requires new insurance models, particularly in last-mile deliveries and high-value goods transportation.

Strategies for Businesses

To navigate the challenges of rising costs and supply chain disruptions, businesses in the Cargo Transportation Insurance Market must focus on providing customized, flexible insurance products tailored to specific industries and shipping needs. Companies should invest in digital transformation by adopting technology such as blockchain and AI-driven solutions for better risk assessment, pricing accuracy, and claims management. Partnerships with logistics providers and shipping companies can also create integrated solutions that offer more value to customers. Additionally, expanding into emerging markets and providing specialized insurance products for high-value or high-risk shipments will help businesses remain competitive.

Key Takeaways

- The Cargo Transportation Insurance Market is expected to grow to USD 110.18 billion by 2034, with a CAGR of 5.5%.

- North America will dominate the market with a 36.6% share, generating USD 23.6 billion in 2024.

- Rising operational costs and supply chain shifts are increasing the need for tailored insurance solutions.

- The growth of the e-commerce industry is driving demand for innovative last-mile delivery insurance models.

- The demand for insurance solutions in high-risk shipping regions and disaster-prone areas is rising.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=158068

Analyst Viewpoint

The Cargo Transportation Insurance Market is set for sustained growth, driven by global trade expansion and the increasing complexity of supply chains. In the future, the adoption of digital solutions such as AI and blockchain will streamline risk management and claims processing, improving operational efficiency. Businesses that innovate with customized insurance offerings and integrate new technologies will lead the market. With a strong emphasis on cybersecurity, global compliance, and sustainability, the industry will be well-positioned for long-term growth.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| E-Commerce & Retail Shipping | Increased demand for reliable insurance solutions for high-value goods. |

| Freight and Cargo Logistics | Rising international trade and complex global shipping routes. |

| High-Risk Shipment Insurance | Growth in demand for coverage in disaster-prone regions and high-risk shipping lanes. |

| Container Insurance | Expansion of containerized shipping and need for coverage during transit. |

Regional Analysis

In 2024, North America holds a dominant position in the Cargo Transportation Insurance Market, capturing 36.6% of the share, generating USD 23.6 billion in revenue. This is driven by the region’s large-scale logistics operations and high international trade volume. Europe follows closely, with rising demand for insurance in the transportation of goods within the EU and to other regions. The Asia-Pacific region is seeing rapid growth in cargo insurance due to the region’s increasing role in global manufacturing and trade, particularly in countries like China and India. Emerging markets in Latin America and Africa are also experiencing growth as global trade expands.

Business Opportunities

As the Cargo Transportation Insurance Market grows, businesses can capitalize on the increasing demand for tailored insurance products to meet the diverse needs of global shipping. The rise of e-commerce offers opportunities for providing insurance solutions specifically for last-mile delivery services. Additionally, the growth of global trade, particularly in emerging markets, creates a need for new insurance solutions in high-risk shipping lanes and regions prone to natural disasters. Companies that invest in digital tools for enhanced risk assessment, claims management, and fraud detection will be well-positioned for success in a competitive market.

Key Segmentation

The Cargo Transportation Insurance Market is segmented by:

- By Coverage Type: All-Risk, Named Perils, and Total Loss

- By End-User: E-Commerce, Retailers, Freight Forwarders, Third-Party Logistics (3PL)

- By Region: North America, Europe, APAC, Latin America, Middle East & Africa

Key Player Analysis

The Cargo Transportation Insurance Market is highly competitive, with several global players offering comprehensive solutions to businesses in logistics and transportation. These companies provide a range of insurance products, from general cargo to specialized policies for high-risk shipments. They are increasingly adopting technology solutions like AI and machine learning to enhance their risk assessment, pricing accuracy, and claims management processes. Businesses focusing on providing flexible, customizable insurance products, along with digital solutions for efficient claims processing, are poised to maintain a competitive edge.

- AIG

- Liberty Mutual Insurance

- Chubb

- Berkshire Hathaway Specialty Insurance

- The Hartford

- Allianz Global Corporate & Specialty

- AXA XL

- Zurich Insurance Group

- Lloyd’s of London

- RSA Insurance Group

- HDI Global SE

- Tokio Marine Holdings

- Mitsui Sumitomo Insurance

- Samsung Fire & Marine Insurance

- Ping An Insurance

- China Pacific Insurance Company – CPIC

- QBE Insurance

- Oman Insurance Company

- Qatar Insurance Company – QIC

- AXA Gulf

- Jubilee Insurance

- Porto Seguro

- Bradesco Seguros

- Sura Insurance

- Other Major Players

Recent Developments

- 2024: North America holds 36.6% of the market share, generating USD 23.6 billion in revenue.

- Companies are increasingly adopting AI-driven solutions for risk assessment and claims processing.

- The growth of e-commerce is driving the demand for insurance solutions in last-mile deliveries.

- New blockchain technologies are being integrated to enhance transparency and reduce fraud in claims processing.

- There is a rising demand for specialized insurance solutions in disaster-prone and high-risk regions.

Conclusion

The Cargo Transportation Insurance Market is poised for steady growth, driven by expanding global trade and the need for tailored insurance products. With rising demand for digital solutions and a growing focus on e-commerce, businesses that innovate and offer flexible, scalable insurance options will thrive. The market is expected to remain dynamic, with increasing opportunities for companies to capitalize on emerging trends and regional growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)