Table of Contents

Market Overview

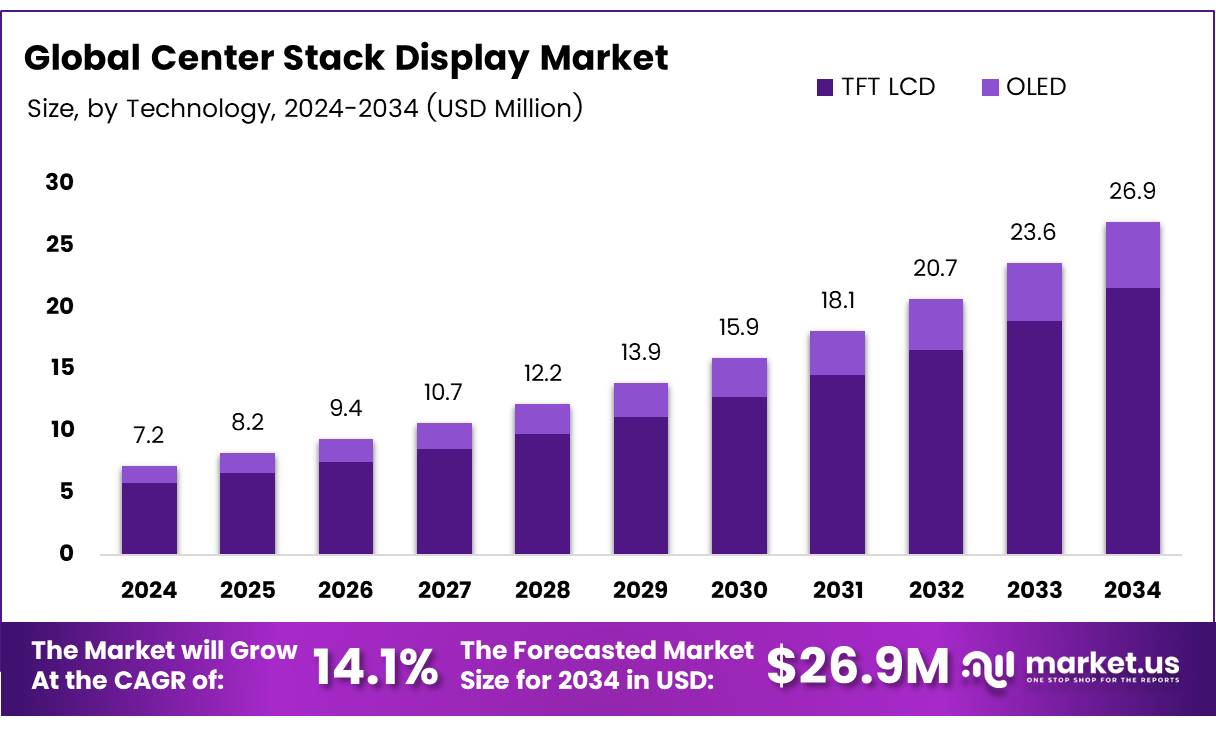

The Global Center Stack Display Market size is expected to be worth around USD 7.2 Million by 2034, from USD 26.9 Million in 2024, growing at a CAGR of 14.1% during the forecast period.

The global Center Stack Display Market is growing rapidly. Consumer demand for advanced infotainment drives this growth. The market is expected to grow at a CAGR of 12% over the next decade. More vehicles now feature large, high-resolution touchscreens. This trend boosts sales and innovation.

Opportunities arise from electric and autonomous vehicles. These cars need better driver information systems. OLED and flexible displays are gaining popularity. Emerging markets also offer strong growth potential. OEMs and suppliers focus on these new technologies.

Governments worldwide support safer driving. Regulations require driver assistance and display features. This pushes adoption of center stack displays. Investments in connected car tech further boost the market. Subsidies for smart vehicle parts help manufacturers. Overall, the market benefits from demand, tech, and rules. It is set for strong, steady growth.

Key Takeaways

- The global center stack display market will shrink from USD 26.9 million in 2024 to USD 7.2 million by 2034.

- The market declines at a CAGR of 14.1% over the forecast period.

- TFT LCD technology held an 80.1% share in 2024 for its reliability and low cost.

- Displays larger than 7 inches captured 71.3% market share for better visibility and interaction.

- Passenger cars led the market due to advanced infotainment system integration.

- Asia Pacific dominated with a 50.1% share, driven by a strong automotive industry and luxury vehicle demand.

Market Drivers

- Consumers demand seamless connectivity and customizable center stack displays.

- Advanced LCD and OLED screens with touch and haptics boost display appeal.

- Connected car features like smartphone integration raise display demand.

- EVs and autonomous vehicles rely on center stack displays for key functions.

Challenges

- Advanced displays like OLED raise production costs and vehicle prices.

- Integrating various systems into one display demands complex coordination.

- Driver distraction risks require balancing usability with safety design.

- Rapid tech changes cause obsolescence and higher update costs.

Segmentation Insights

Technology Analysis

In 2024, TFT LCD led with 80.1% market share because it is reliable and affordable. OLED offers better visuals but costs more and has durability issues. OLED use is expected to grow in luxury cars as technology improves.

Display Size Analysis

Large displays over 7 inches made up 71.3% of the market in 2024. Consumers prefer bigger screens for better visibility and advanced features. Smaller screens are used in compact cars but are less popular.

Vehicle Type Analysis

Passenger cars dominated the market in 2024 due to high demand for infotainment systems. Light commercial vehicles are growing in use for delivery services, and heavy commercial vehicles are slowly adopting these displays for safety and monitoring.

Regional Insights

Asia Pacific leads the center stack display market with a 50.1% share, thanks to strong car production and fast tech adoption in countries like China, Japan, and South Korea.

North America grows due to demand for high-end cars with advanced displays, especially in the U.S. Europe focuses on luxury vehicles with safety-driven display tech.

The Middle East & Africa is growing with more luxury car sales in places like the UAE.

Latin America shows good potential as economic recovery and a rising middle class boost demand for smart vehicle features.

Emerging Trends

- Voice-activated controls powered by AI make it easier and safer to use center stack displays.

- Some cars now feature augmented reality (AR) to show navigation and hazards directly on the screen.

- Displays are becoming more personalized, adjusting to driver preferences.

- Wireless connectivity allows over-the-air (OTA) updates, keeping software and features up to date.

- Multi-screen and curved displays improve visibility, style, and user interaction.

Recent Developments

- In May 2025, STACK Infrastructure reached a $6 billion milestone in green investments, significantly boosting sustainable growth in the data center industry. This achievement underscores the company’s commitment to eco-friendly infrastructure expansion.

- In July 2025, Meta launched a major initiative aiming to raise $29 billion to fund the expansion of AI data centers across the United States. This ambitious quest highlights Meta’s focus on scaling AI capabilities through increased infrastructure investment.

- In July 2025, Armada secured a strategic funding round totaling $131 million and announced the launch of megawatt-scale modular AI data centers. This move aims to accelerate American leadership in energy efficiency and artificial intelligence dominance.

Conclusion

The center stack display market is evolving with new technologies and growing demand in electric and autonomous vehicles. Despite a market size decline by 2034, innovations like OLED and AI controls offer strong potential. Asia Pacific leads growth, supported by government regulations and connected car investments. Challenges remain, but the market is set for steady innovation and progress.