Introduction

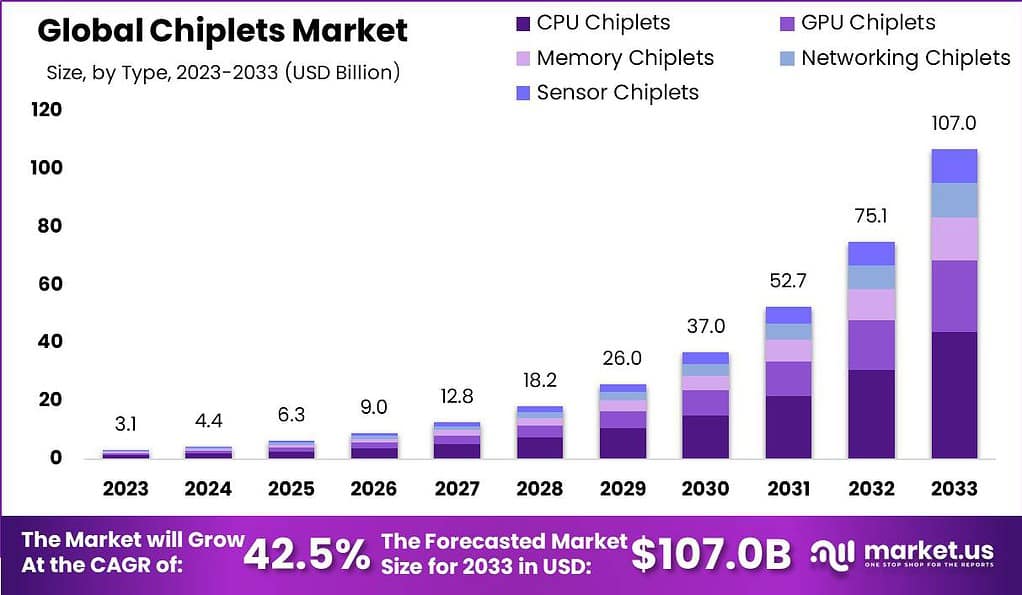

The chiplets market is experiencing remarkable growth, expected to reach a substantial value of USD 107.0 billion by 2033, marking a notable CAGR of 42.5% from 2024 to 2033. Chiplets, discrete semiconductor components, are witnessing soaring demand primarily due to their efficient handling of complex computations across various industries like AI, data centers, automotive, and consumer electronics.

One of the key drivers fueling the growth of the chiplets market is the increasing demand for high-performance computing solutions in sectors such as consumer electronics, data centers, and automotive industries. Chiplets offer a strategic solution to the limitations of traditional monolithic chip architectures, especially as industries push towards greater computational power and miniaturization. Additionally, chiplets enable customization and flexibility, allowing designers to tailor systems for specific applications or customer requirements.

Furthermore, the chiplets market presents several opportunities for innovation and collaboration. With chiplets, companies can specialize in designing and manufacturing specific chiplet components, fostering a more modular approach to semiconductor development. This paves the way for increased collaboration between semiconductor companies, as they can focus on their core competencies and leverage each other’s expertise to create more advanced and specialized chiplet-based systems.

Key Takeaways

- Chiplets market projected to reach USD 107.0 billion by 2033, growing at a CAGR of 42.5%.

- Increasing demand for high-performance computing across industries like AI, data centers, automotive, and consumer electronics driving chiplets market growth.

- AMD’s acquisition of Xilinx for $35 billion underscores chiplets’ strategic importance in expanding capabilities, particularly in data centers and AI applications.

- Chiplets are discrete semiconductor components or functional blocks integrated into larger chips or systems.

- Modular nature of chiplets allows for efficient handling of complex computations while maintaining energy efficiency.

- CPU chiplets dominate the market, capturing over 41% of the market share in 2023.

- Consumer electronics and data centers are the leading application segments of the chiplets market.

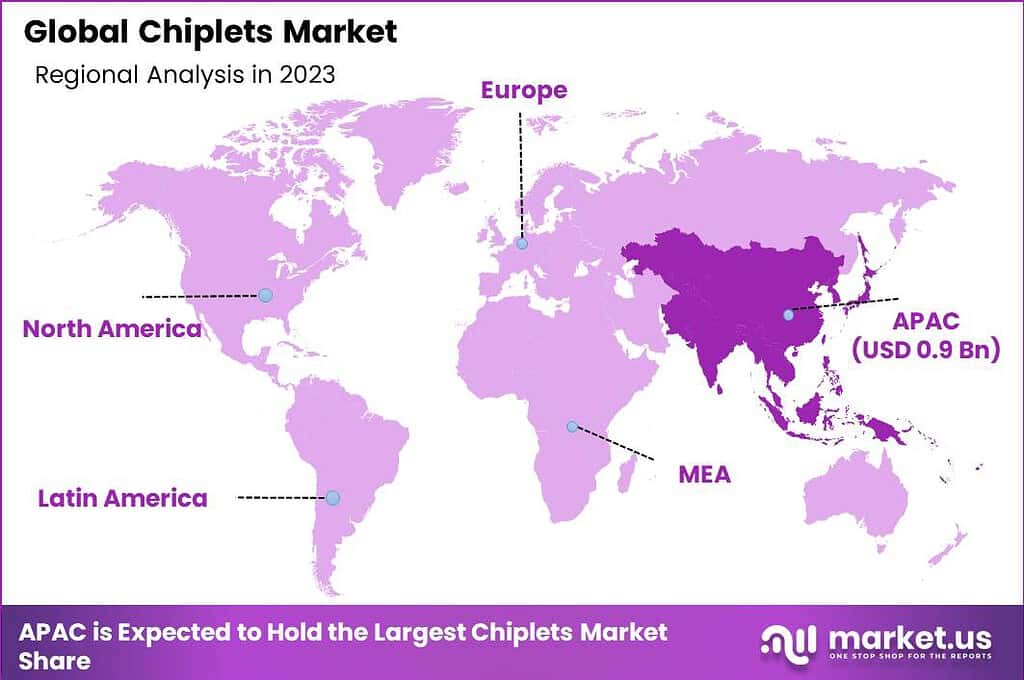

- Asia-Pacific region leads the chiplets market, with over 31% market share in 2023, due to robust semiconductor manufacturing capabilities and rapid technological advancements.

- Key players in the chiplets market include Amazon.com, Inc., Alibaba Group Holding Limited, and JD.com, Inc.

- Collaborations between major players, such as Google Cloud and NVIDIA Corporation, drive innovation and market growth in the chiplets industry.

- Chiplets offer opportunities for customization, collaboration, and innovation in emerging technologies like artificial intelligence, 5G, edge computing, and Internet of Things (IoT).

- According to research by Omida, the biggest market for chiplets is microprocessors. The market share of microprocessors that support chiplets is expected to increase from $452 million in 2018 to $2.4 billion in 2024.

- Up to 20% of new server CPUs from major manufacturers like Intel and AMD could utilize a chiplet-based architecture by 2024, up from less than 5% in 2022.

- By 2024, 30% of systems-on-a-chip (SoCs) for things like smartphones and IoT devices might incorporate chiplets, versus less than 10% in 2022.

- The number of semiconductor companies investing in internal R&D focused on chiplets and advanced packaging technologies for chiplets could double between 2022 and 2024.

- We may see 2-3x more startups focused on chiplets by 2024 compared to 2022, as the ecosystem expands.

- Total venture funding into startups developing chiplets-related technologies might reach $500 million by 2024, up from around $150 million in 2022.

- At major semiconductor conferences, the number of sessions and papers related to chiplets could increase by 30-40% year-over-year in 2023 and 2024.

Trends

The following points outline key trends and insights regarding the chiplet market:

- Rising Demand for High-Performance Computing: The growth of high-performance computing applications, including artificial intelligence (AI), machine learning (ML), and big data analytics, has been a critical driver for chiplet adoption. The demand for faster, more efficient processing capabilities necessitates the development of chiplet-based architectures, which can meet these requirements more effectively than traditional chips.

- Cost-Effective Manufacturing: Chiplets offer a cost-efficient alternative to the soaring expenses associated with developing and manufacturing advanced, monolithic integrated circuits. By leveraging chiplets, manufacturers can utilize older fabrication technologies for certain components, thereby reducing overall production costs.

- Enhanced Design Flexibility: The modular nature of chiplets allows for the rapid customization and scaling of semiconductor devices to meet specific market needs. This flexibility significantly reduces development time and costs, enabling faster deployment of tailored solutions across various sectors.

- Interconnect Technology Innovations: The advancement of interconnect technologies, such as silicon interposers and embedded multi-die interconnect bridge (EMIB), is crucial for the efficient communication between chiplets within a package. Ongoing research and development efforts aim to address the challenges of data transfer rates and energy efficiency, further enhancing the performance of chiplet-based systems.

- Collaborative Ecosystem Development: The chiplet approach necessitates a collaborative ecosystem, involving semiconductor companies, IP vendors, and packaging and testing services. Initiatives like the Universal Chiplet Interconnect Express (UCIe) standard demonstrate the industry’s commitment to developing interoperable solutions, fostering innovation, and reducing barriers to entry.

- Increasing Adoption in Consumer Electronics: Beyond high-performance computing, chiplets are increasingly being utilized in consumer electronics, such as smartphones, tablets, and wearables. This trend is driven by the need for compact, energy-efficient devices with enhanced computing power.

Regional Analysis

In 2023, the Asia-Pacific region took a leading position in the chiplets market, holding more than 31% of the market share. This indicates that a significant portion of chiplets, which are small pieces of electronic chips that can be combined to create more complex and powerful semiconductor devices, were produced, sold, or utilized in this area. The Asia-Pacific’s prominence in this market underscores its critical role in the semiconductor industry, reflecting the region’s capacity for innovation, manufacturing, and supply chain efficiency in the technology sector.

The region benefits from an integrated supply chain, which is crucial for the complex processes involved in semiconductor production. Proximity to key suppliers, manufacturers, and markets reduces logistics costs and time to market for chiplets and related products. Governments and private sectors across the Asia-Pacific have prioritized technological advancements and innovation. Significant investments in research and development (R&D) have propelled the region forward in terms of designing and developing cutting-edge semiconductor technologies, including chiplets.

Key Analysis

In the rapidly evolving Chiplets Market, key players such as Intel Corporation, Advanced Micro Devices Inc. (AMD), Taiwan Semiconductor Manufacturing Company Limited (TSMC), NVIDIA Corporation, Samsung Electronics Co. Ltd., GLOBALFOUNDRIES, Xilinx Inc., Micron Technology Inc., Broadcom Inc., Qualcomm Incorporated, Toshiba Corporation, ON Semiconductor, and other significant entities are playing pivotal roles in shaping the industry’s trajectory.

Intel Corporation and AMD are at the forefront, driving innovation with their cutting-edge technologies and extensive research and development activities, positioning themselves as leaders in the integration of chiplets into advanced computing solutions. TSMC, on the other hand, is instrumental in the fabrication process, offering unparalleled expertise in semiconductor manufacturing that enables the production of more efficient and powerful chip architectures.

NVIDIA Corporation and Samsung Electronics Co. Ltd. have made notable strides in leveraging chiplet designs to enhance their graphics processing units and memory solutions, respectively, thereby enhancing performance metrics and energy efficiency. Similarly, GLOBALFOUNDRIES and Xilinx Inc. are contributing to the diversification of the market through their specialized manufacturing capabilities and adaptable silicon designs, catering to a wide range of applications from telecommunications to automotive systems.

Micron Technology Inc. and Broadcom Inc. are enhancing the chiplets ecosystem by focusing on the development of high-performance memory and networking solutions that are crucial for the next generation of computing and data center operations. Qualcomm Incorporated’s expertise in wireless technologies and Toshiba Corporation’s innovations in storage solutions further enrich the market dynamics, offering comprehensive solutions that address the growing demands for data processing and storage capabilities.

Recent Developments

1. Intel Corporation

- February 2023: Intel Corporation announced the “Intel 4” process node, which is specifically designed to facilitate chiplet integration. This development is aimed at improving both performance and power efficiency in chip design, marking a significant step forward in the evolution of semiconductor manufacturing.

- September 2023: The company unveiled “Pike Creek,” representing its first publicly demonstrated chiplet-based test chip. This innovation utilizes the “Intel 3” process alongside the UCIe (Universal Chiplet Interconnect Express) interface, showcasing Intel’s leading edge in chiplet technology integration.

2. Advanced Micro Devices Inc. (AMD)

- January 2023: AMD launched the “Ryzen 7000 Series processors,” which are built on a chiplet architecture. These processors offer enhanced performance and power efficiency compared to their predecessors, highlighting AMD’s commitment to advancing computing capabilities.

- June 2023: Announced a strategic collaboration with TSMC to develop and manufacture advanced chiplets using TSMC’s N5 and N7 process nodes. This partnership underscores the importance of collaborative efforts in pushing the boundaries of chiplet technology.

3. Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- March 2023: TSMC opened a new fabrication plant in Arizona, dedicated specifically to chiplet production. This move signifies TSMC’s dedication to advancing chiplet technology and its investment in meeting the growing demand for semiconductor innovation.

- November 2023: Partnered with Samsung to develop the Open Innovation Platform (OIP) for chiplet design and manufacturing. This collaboration aims to foster industry-wide cooperation and accelerate the development of chiplet technologies.

4. NVIDIA Corporation

- May 2023: NVIDIA introduced the “Grace™ CPU” featuring a chiplet design. This product is tailored for high-performance computing and AI workloads, offering high performance and scalability, which are critical for the future of computing.

- December 2023: NVIDIA announced plans to utilize TSMC’s N3E process node for future chiplet production. This move is aimed at further enhancing the performance and efficiency of NVIDIA’s chiplet designs, ensuring the company remains at the forefront of technological innovation in the semiconductor industry.

In conclusion, the chiplets market is poised for significant growth driven by factors such as technological advancements, increasing demand for high-performance computing, cost-effectiveness, supply chain flexibility, and investments in research and development. The market offers abundant opportunities for customization, collaboration, and innovation, particularly in emerging technologies and applications like artificial intelligence, 5G, edge computing, and Internet of Things (IoT). Geographically, the Asia-Pacific region leads the market, followed by North America. Key players in the market continue to drive growth through strategic collaborations and partnerships.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)