Table of Contents

Introduction

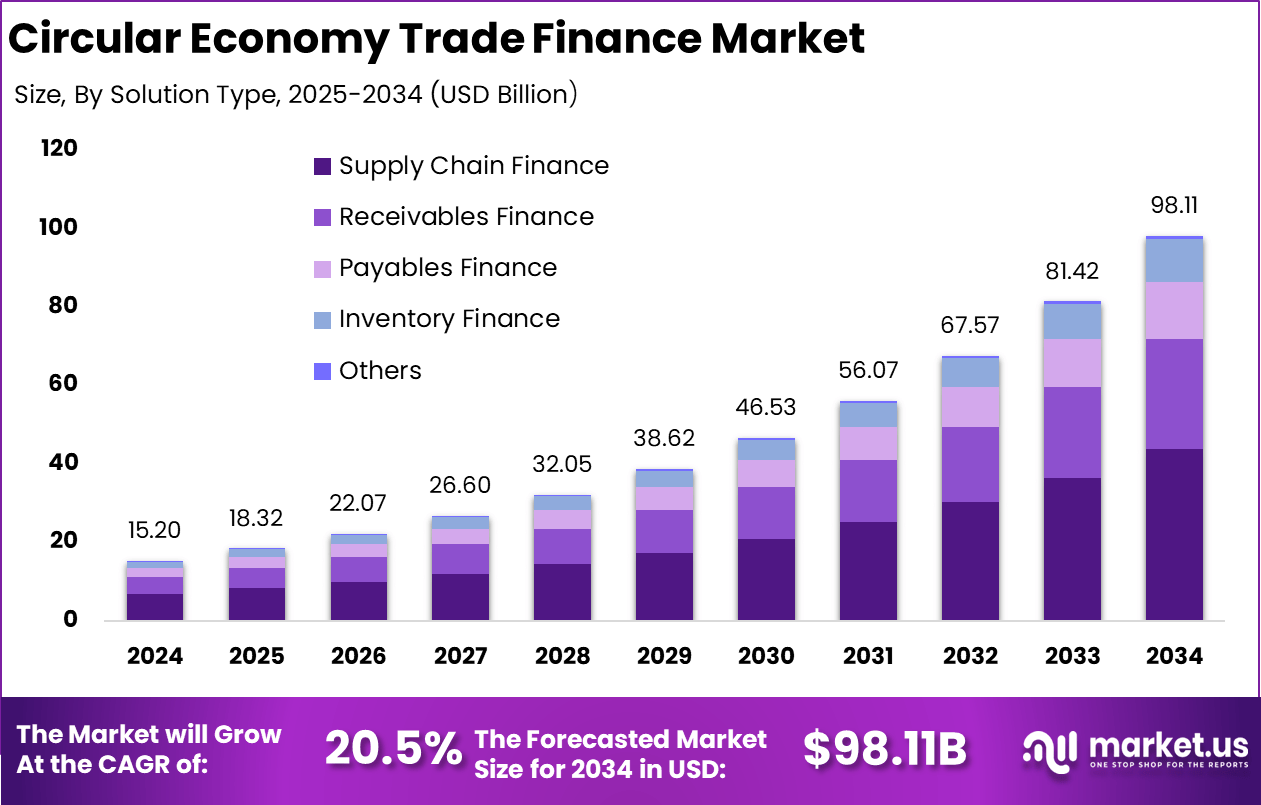

The Global Circular Economy Trade Finance Market is expected to reach USD 98.11 billion by 2034, increasing from USD 15.20 billion in 2024, expanding at a CAGR of 20.5%. North America accounted for more than 38.6% of the 2024 revenue, contributing USD 5.86 billion. This surge reflects accelerating demand for resource-efficient systems, regulatory support for low-waste business models, and growing adoption of closed-loop production. Rising investor interest, sustainability-linked financing, and green credit frameworks are strengthening market traction across global supply chains.

How Growth Is Impacting the Economy

Rapid expansion is strengthening global economic productivity by accelerating the shift toward resource-efficient manufacturing, reducing waste-driven losses, and supporting long-term asset value retention. The rising availability of circular finance instruments is anticipated to stimulate capital allocation into recycling plants, remanufacturing hubs, and renewable material ecosystems. Manufacturing nations are observing improved cost competitiveness due to reduced raw material dependency, enhancing trade balance stability.

Financial institutions are integrating circular valuation models, fostering new credit lines and investment mechanisms. The market’s growth is also encouraging job creation in recycling, refurbishment, and digital traceability services, supporting labor-intensive sectors of the green economy. These advancements collectively reinforce global GDP expansion and reduce economic vulnerabilities linked to commodity volatility.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/circular-economy-trade-finance-market/free-sample/

Impact on Global Businesses

Rising costs associated with raw materials, compliance mandates, and sustainable sourcing are reshaping corporate strategies. Supply chains are shifting toward recycled inputs, traceable procurement, and digital monitoring platforms to reduce operational risks. Manufacturing, automotive, electronics, packaging, and consumer goods sectors are experiencing significant transformation as companies integrate repair, reuse, and refurbishment cycles to remain competitive. Financial institutions are adapting lending models to performance-based sustainability criteria. Meanwhile, exporters and importers are modernizing workflows through blockchain-backed documentation and circular trade financing, reinforcing transparency and efficiency.

Strategies for Businesses

Companies should integrate digital traceability, sustainability-linked credit frameworks, and long-term circular procurement contracts. Expanding partnerships with recyclers, re-manufacturers, and green-logistics providers enhances operational efficiency. Embedding lifecycle assessments, adopting material recovery systems, and investing in automation for waste sorting increase resilience. Businesses should diversify supply chains toward low-impact materials and pursue carbon-neutral financing opportunities. Strengthening ESG reporting and leveraging blockchain-enabled trade documentation improves trade finance accessibility.

Key Takeaways

- Rapid CAGR of 20.5% strengthens global green-economy investments.

- Supply chains shift toward recycled and regenerated materials.

- North America leads with a 38.6% share in 2024.

- Sustainability-linked finance accelerates circular business transformation.

- Digital traceability improves compliance, transparency, and credit access.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=164978

Analyst Viewpoint

The market is in a highly progressive stage, driven by regulatory alignment, technological innovation, and pressure to reduce carbon footprints. In the present scenario, organizations increasingly integrate circular finance into capital planning to unlock sustainability advantages. Over the next decade, widespread adoption of AI-enabled traceability, green credit lines, and digital trade platforms is expected to enhance market maturity. Strong investor confidence and supportive policies position the sector for sustained, long-term expansion.

Use Case and Growth Factors

| Category | Details |

|---|---|

| Use Case | Financing recycling infrastructure, circular procurement, repair & refurbishment operations, sustainable supply-chain contracts, and traceable trade documentation. |

| Growth Factors | Regulatory push for low-waste systems, rising ESG financing, resource scarcity, digitalization of trade finance, and increasing adoption of recycled materials across industries. |

Regional Analysis

North America leads market adoption due to strong sustainability regulations, high circular manufacturing maturity, and large financial institutions offering green credit instruments. Europe demonstrates strong policy alignment under the EU Circular Economy Action Plan, advancing green trade finance models. Asia-Pacific is experiencing a rapid industrial transition driven by manufacturing expansion, recycling infrastructure growth, and digital trade ecosystems. Latin America and the Middle East show increasing adoption through renewable resource projects and waste-to-value initiatives.

➤ More data, more decisions! see what’s next –

- Insurance Analytics Market

- AI Annotation Market

- Smart Card in the Government Market

- Luxury Furniture Insurance Market

Business Opportunities

Significant opportunities arise in digital trade platforms, sustainability-linked lending, and blockchain-enabled circular documentation. Recycling technology financing, green-logistics credit solutions, circular procurement guarantees, and remanufacturing support services offer high-growth potential. Companies providing material recovery, repair networks, and AI-based sorting technologies can leverage rising global demand for cost-efficient, compliant, and sustainable trade operations.

Key Segmentation

The market includes segments such as circular trade credit solutions, sustainability-linked financing, recycled material procurement finance, refurbishment support, and digital circular traceability financing. These segments cater to manufacturing, electronics, automotive, packaging, and consumer goods industries. Strong adoption is observed in digital financing tools, material recovery systems, and asset reuse programs, all of which support circular trade ecosystems.

Key Player Analysis

Leading participants focus on expanding sustainability-linked financial tools, digital traceability solutions, and circular trade financing products. They invest in blockchain-backed platforms, resource-efficient credit models, and partnerships with recycling and remanufacturing networks. Strategic priorities include regulatory compliance, lifecycle-based risk assessment, and cross-border financing innovation. These players continuously enhance their portfolios through technology integration and circular-economy collaborations.

- BNP Paribas

- HSBC Holdings plc

- ING Group

- Santander Bank

- Standard Chartered

- Rabobank

- Barclays

- Deutsche Bank

- Citigroup

- JPMorgan Chase & Co.

- UniCredit

- Société Générale

- ABN AMRO

- Credit Agricole

- Sumitomo Mitsui Banking Corporation

- Mizuho Financial Group

- UBS Group AG

- Wells Fargo

- Bank of America

- Goldman Sachs

- Other Major Players

Recent Developments

- September 2025: Launch of new sustainability-linked trade credit platform for circular procurement.

- August 2025: Introduction of an AI-driven material traceability tool for recycled supply chains.

- July 2025: Expansion of circular financing partnerships with global recycling hubs.

- June 2025: Rollout of blockchain-enabled trade documentation for refurbished goods.

- May 2025: Financial institutions unveil new low-interest green-trade financing products.

Conclusion

The Circular Economy Trade Finance Market is expanding rapidly, supported by regulatory momentum, digital innovation, and sustainability-driven capital allocation. Strong multi-regional adoption ensures long-term opportunity and widespread economic impact.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)