Table of Contents

Introduction

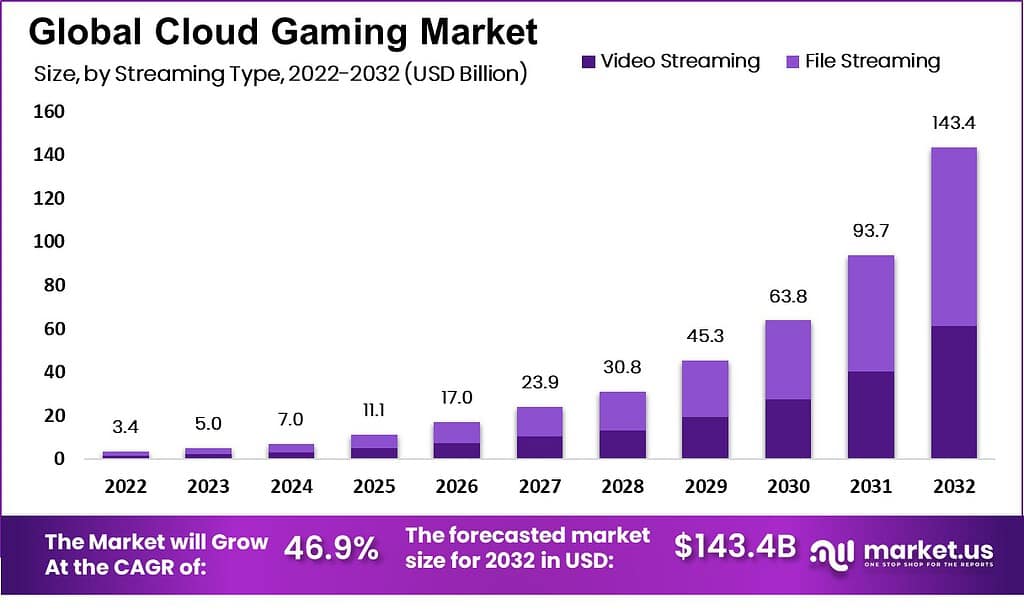

The Cloud Gaming Market is projected to witness remarkable growth, with an expected value of USD 143.4 billion by 2032, surging from USD 5.0 billion in 2023, at an impressive CAGR of 46.9%. Cloud gaming, leveraging cloud-based technology, revolutionizes gaming by enabling users to access and play games via web servers, reducing the need for extensive local storage. Smartphone gaming emerges as a dominant force in the market, attributed to its cost-effectiveness and performance enhancements, especially with the advent of 5G networks. File streaming takes precedence in the streaming type segment, offering cost savings for developers and driving rapid growth rates.

The Cloud Gaming Market is experiencing significant growth, driven by the increasing availability of high-speed internet and the proliferation of mobile devices, enabling gamers to access games from anywhere at any time without the need for high-end hardware. This democratization of gaming has opened the market to a wider audience, contributing to its expansion. The integration of cloud technology in gaming also allows for real-time streaming of games, reducing the need for physical copies and downloads, which, in turn, lowers the barriers to entry for new gamers and increases the market’s potential customer base.

However, the market faces challenges, notably in the form of latency issues and the requirement for a continuous high-speed internet connection, which can detract from the gaming experience. Additionally, the initial setup cost for cloud gaming platforms and the ongoing investment in server and network infrastructure pose significant barriers to entry for new companies looking to penetrate the market.

Despite these challenges, opportunities abound for new entrants who can innovate in reducing latency, improving streaming quality, and offering competitive pricing models. The growing trend towards mobile gaming and the increasing consumer demand for convenient, on-the-go gaming options present a fertile ground for new players. Furthermore, partnerships with game developers and publishers to expand the library of available games on cloud platforms can also serve as a strategic entry point for new market participants.

Key Takeaways

- The cloud gaming industry is set to soar, with an anticipated market value reaching a staggering USD 143.4 billion by 2032. This growth trajectory represents a robust compound annual growth rate (CAGR) of 46.9% from 2023 to 2032.

- Smartphones emerge as the frontrunners, commanding the highest market share due to their affordability and enhanced performance. They are poised to maintain this lead, especially with the advent of 5G networks and unlimited data plans, making mobile gaming more accessible than ever before.

- File streaming asserts dominance in the streaming type segment of the cloud gaming market. Its cost-effectiveness for game developers and the ability to deliver patches swiftly to players contribute to its rapid compound annual growth rates.

- Asia Pacific emerges as the powerhouse, dominating the global cloud gaming market with a substantial revenue share of almost 33.7%. This dominance is fueled by factors such as demographics, a large gaming population, and increasing acceptance of cloud gaming services, particularly in countries like China, India, and Japan.

Cloud Gaming Statistics

- The number of cloud gaming users worldwide is estimated to be around ~295.1 million in 2023, a significant increase from ~102.7 million in 2021.

- The 3D Gaming Console market value is expected to grow from USD 11.3 billion in 2022 to USD 44.1 billion by 2032, at a CAGR of 15%.

- The Global Generative AI in Gaming Market is predicted to register the highest CAGR of 23.3% between 2023 and 2032, reaching a valuation of USD 7,105 million by 2032.

- The Global Online Gaming Market is projected to be worth around USD 276.0 billion by 2033, growing at a CAGR of 11.2% from 2024 to 2033.

- Cloud gaming subscriptions revenue increased from USD 234 million in 2018 to USD 1,500 million in 2023 due to the demand for faster internet and cloud gaming.

- The United States is expected to generate the most revenue from cloud gaming in 2024, reaching approximately USD 1,938 million.

- Xbox Game Pass is the preferred gaming service for 13% of American gamers as of May 2023.

- PC is the top choice for game developers in 2023, with 64% of them selecting it as their preferred platform.

- PlayStation Plus is the largest cloud gaming service, boasting ~47.4 million subscribers globally as of March 2023.

- Game developers primarily focus on PC (65%), PlayStation 5 (33%), and Xbox X/S (30%) platforms in 2023.

- 87% of gamers using Google Stadia platform have voted it for providing a positive gaming experience.

- The user penetration rate for global cloud gaming was 3.8% in 2023.

- The total number of gaming users in 2023 was ~295 million.

- As of 2021, over half (51%) of cloud gamers are classified as casual gamers, representing the dominant segment in the market share. This demographic is projected to experience a robust Compound Annual Growth Rate (CAGR) exceeding 40%, indicating significant growth potential.

- Nearly 50% of online users in the USA are aware of cloud gaming.

- The market is projected to have a user penetration rate of 5.1% in 2024, expected to rise to 6.2% by 2029.

- The Average Revenue per User (ARPU) in the Cloud Gaming market is projected to be ~USD 17.46.

Emerging Trends

- 5G Technology Integration: The rollout of 5G networks significantly enhances cloud gaming experiences by reducing latency and improving game streaming quality. This enables smoother gameplay and supports higher resolution games.

- Cross-Platform Playability: Cloud gaming services are increasingly offering cross-platform playability, allowing gamers to start playing on one device and seamlessly continue on another. This flexibility is changing how and where games are played.

- Subscription-Based Models: Many cloud gaming platforms are adopting subscription models, providing gamers with access to a wide library of games for a monthly fee. This trend is making gaming more accessible and affordable.

- Rise of Casual and Social Gaming: Cloud gaming is popularizing casual and social gaming experiences, attracting a broader audience. These games often require less time investment and are accessible to a wider range of players.

- Integration with Other Media Services: Cloud gaming platforms are integrating with other media services, offering bundles that include music, movies, and TV shows alongside gaming. This creates a comprehensive entertainment package for consumers.

Top Use Cases

- Accessibility for Casual Gamers: Cloud gaming allows casual gamers to play high-quality games without needing high-end hardware, making gaming more inclusive.

- Gaming on the Go: Players can enjoy their favorite games on any mobile device, eliminating the need to carry dedicated gaming hardware.

- Multiplayer and Social Gaming: Enhanced by cloud technology, multiplayer games offer real-time interaction and collaboration, making gaming a social experience.

- Game Development and Testing: Developers can use cloud platforms to test games across various hardware configurations and locations, simplifying the development process.

- Educational and Training Applications: Cloud gaming technology is being used for educational purposes, offering interactive learning experiences and simulations for training.

Challenges

- Dependency on Internet Speed and Stability: The quality of cloud gaming experiences heavily depends on the user’s internet connection, limiting accessibility in areas with poor connectivity.

- Data Privacy and Security Concerns: Storing personal and payment information on cloud servers raises concerns about data privacy and security.

- Latency Issues: Despite advancements, latency remains a challenge, especially in fast-paced games where real-time responses are critical.

- Limited Game Titles: Some cloud gaming platforms may offer a limited selection of games, affecting the variety of available content.

- Monetization and Pricing Models: Finding the right balance between cost for consumers and profitability for providers is challenging, particularly in competitive markets.

Market Opportunity

- Expanding Internet Access: Improvements in internet infrastructure globally are making high-speed connections more widely available. This expansion broadens the potential customer base for cloud gaming services.

- Cross-Platform Play: Cloud gaming allows players to access games on any device, breaking down the barriers between different gaming platforms. This flexibility can attract a broader audience, including casual gamers.

- Subscription Models: Offering games as a service through subscription models can provide steady revenue streams. This approach also makes gaming more accessible to a wider audience by reducing the upfront cost of gaming hardware.

- Emerging Markets: Developing countries present a significant growth opportunity for cloud gaming. As internet access and speeds improve, these markets could drive considerable expansion.

- Technological Advances: Innovations in cloud technology and data compression can reduce latency and bandwidth requirements, making cloud gaming more viable and appealing to a larger market.

Key Player Analysis in Cloud Gaming

Cloud gaming, a revolutionary concept in the gaming industry, has witnessed significant growth with the advent of powerful cloud infrastructure and high-speed internet connectivity. The market leaders in this domain have played a pivotal role in shaping its trajectory. Here, we analyze the key players in the cloud gaming landscape and their impact on the industry.

Amazon Inc.

Amazon, a giant in the technology and e-commerce sectors, has made considerable strides in cloud gaming with its offering, Amazon Luna. Leveraging its robust cloud infrastructure provided by Amazon Web Services (AWS), Luna allows users to stream games seamlessly across various devices. With Luna, Amazon aims to capture a significant share of the burgeoning cloud gaming market.

Apple Inc.

Apple, renowned for its innovation and customer-centric approach, entered the cloud gaming arena with Apple Arcade. While Apple Arcade differs from traditional cloud gaming platforms, it offers users access to a curated selection of high-quality games across Apple devices. Through Apple Arcade, the company seeks to bolster its ecosystem and cater to the growing demand for subscription-based gaming services.

Electronic Arts, Inc.

Electronic Arts (EA), a prominent player in the gaming industry, has embraced cloud gaming with its EA Play service. EA Play provides subscribers with access to an extensive library of EA games, including popular franchises like FIFA and Battlefield. By offering a diverse range of titles across multiple platforms, EA aims to capitalize on the growing trend of on-demand gaming experiences.

Google Inc.

Google, known for its innovative products and services, has entered the cloud gaming market with Google Stadia. Stadia leverages Google’s cloud infrastructure to deliver high-quality gaming experiences without the need for specialized hardware. With Stadia, Google aims to redefine the gaming landscape by making gaming accessible to a broader audience.

Intel Corporation

Intel, a leading provider of semiconductor solutions, has ventured into cloud gaming through its hardware offerings. As cloud gaming relies heavily on server infrastructure and hardware acceleration, Intel’s processors and server technologies play a crucial role in ensuring smooth and immersive gaming experiences. By catering to the infrastructure needs of cloud gaming providers, Intel solidifies its position as a key player in the ecosystem.

IBM Corporation

IBM, a pioneer in the field of computing and cloud services, provides essential infrastructure and solutions for cloud gaming providers. With its robust cloud platform, IBM Cloud, the company offers scalable and secure infrastructure for hosting gaming workloads. IBM’s expertise in cloud computing and data analytics enables cloud gaming providers to deliver high-performance gaming experiences to users worldwide.

Microsoft Corporation

Microsoft, a technology powerhouse, has made significant investments in cloud gaming through its Xbox Cloud Gaming service. Formerly known as Project xCloud, Xbox Cloud Gaming allows users to stream Xbox games to various devices, including consoles, PCs, and mobile devices. With its extensive library of games and robust cloud infrastructure provided by Azure, Microsoft aims to dominate the cloud gaming market.

NVIDIA Corporation

NVIDIA, a leader in graphics processing units (GPUs) and artificial intelligence (AI), has entered the cloud gaming space with GeForce NOW. GeForce NOW enables users to stream games from NVIDIA’s cloud servers to compatible devices, delivering high-quality graphics and low-latency gameplay. With its expertise in GPU technology, NVIDIA enhances the gaming experience for users while expanding its presence in the cloud gaming market.

Sony Interactive Entertainment

Sony Interactive Entertainment, a subsidiary of Sony Corporation, has established itself as a key player in the gaming industry with its PlayStation brand. While Sony has not ventured extensively into cloud gaming, its PlayStation Now service offers users access to a library of PlayStation games via streaming. Sony’s strong foothold in the console market and loyal fanbase position it as a potential contender in the evolving cloud gaming landscape.

Ubitus Inc.

Ubitus Inc., a pioneer in cloud gaming solutions, offers white-label cloud gaming platforms for telecom operators, gaming companies, and content providers. With its cloud gaming technology, Ubitus enables partners to deliver gaming experiences across a wide range of devices, including smart TVs, set-top boxes, and mobile devices. By partnering with Ubitus, companies can quickly enter the cloud gaming market and capitalize on the growing demand for on-demand gaming services.

Tencent Holdings Ltd.

Tencent Holdings Ltd., a Chinese multinational conglomerate, has a significant presence in the gaming industry through its subsidiary Tencent Games. While Tencent has primarily focused on traditional gaming, the company has shown interest in cloud gaming through investments and partnerships. With its vast resources and expertise in online gaming, Tencent has the potential to shape the future of cloud gaming in the Asian market and beyond.

Conclusion

The cloud gaming market is poised at the crossroads of significant challenges and compelling opportunities. While the demands of high bandwidth, latency reduction, and substantial infrastructure investment pose real hurdles, the evolving landscape of internet accessibility and technological advancement opens new doors. The shift towards subscription models and the appeal of cross-platform play cater to a growing audience of diverse gamers, promising a broadened market reach. Additionally, the untapped potential in emerging markets offers a fertile ground for expansion. As the industry navigates these challenges, the opportunities for innovation and growth in cloud gaming are both substantial and promising. The successful exploitation of these opportunities, coupled with effective solutions to the encountered challenges, could redefine the future of gaming.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)