Table of Contents

- Introduction

- Editor’s Choice

- Global Robotics Industry Statistics

- Collaborative Robots Market Size Statistics

- Collaborative Robots Sales Volume Statistics

- Mobile Collaborative Robots Market Volume Statistics

- Deployment of Industrial Robots

- Industrial and Collaborative Robots Regional Statistics

- Latest Trends in the Robotics Industry

- Recent Developments

- Conclusion

- FAQs

Introduction

Collaborative Robots Statistics: Collaborative robots, or cobots, are specialized industrial robots designed to work safely alongside humans in shared workspaces.

They feature advanced safety mechanisms, easy programming, flexibility for various tasks, and affordability. Making them significant across manufacturing, logistics, healthcare, agriculture, food, construction, and education industries.

Cobots improve efficiency, safety, and productivity while facilitating human-robot collaboration. Their adaptability to different tasks makes them valuable assets in today’s industrial automation landscape.

Editor’s Choice

- The global robotics market is expected to witness high growth in revenue, with a target of about $37.37 billion by 2023.

- Service robotics is poised to lead the way within this expansive market. With an estimated market size of roughly $28.49 billion in the same year.

- In 2022, the collaborative robots market accounted for $815.4 million.

- The mobile cobots market is forecasted to grow rapidly, with 15,778 units in 2026, 20,758 units in 2027, and an impressive 26,828 units in 2028.

- In 2018, the number of traditional industrial robot installations increased to 406 thousand. Collaborative robot installations also grew, reaching 16 thousand units.

- In 2019, the global landscape of industrial robot installations saw China leading the pack with a significant figure of 140.5 thousand units.

- In 2019, the operational stock of industrial robots in China surged by an impressive 21%, reaching a remarkable 783,000 units.

Global Robotics Industry Statistics

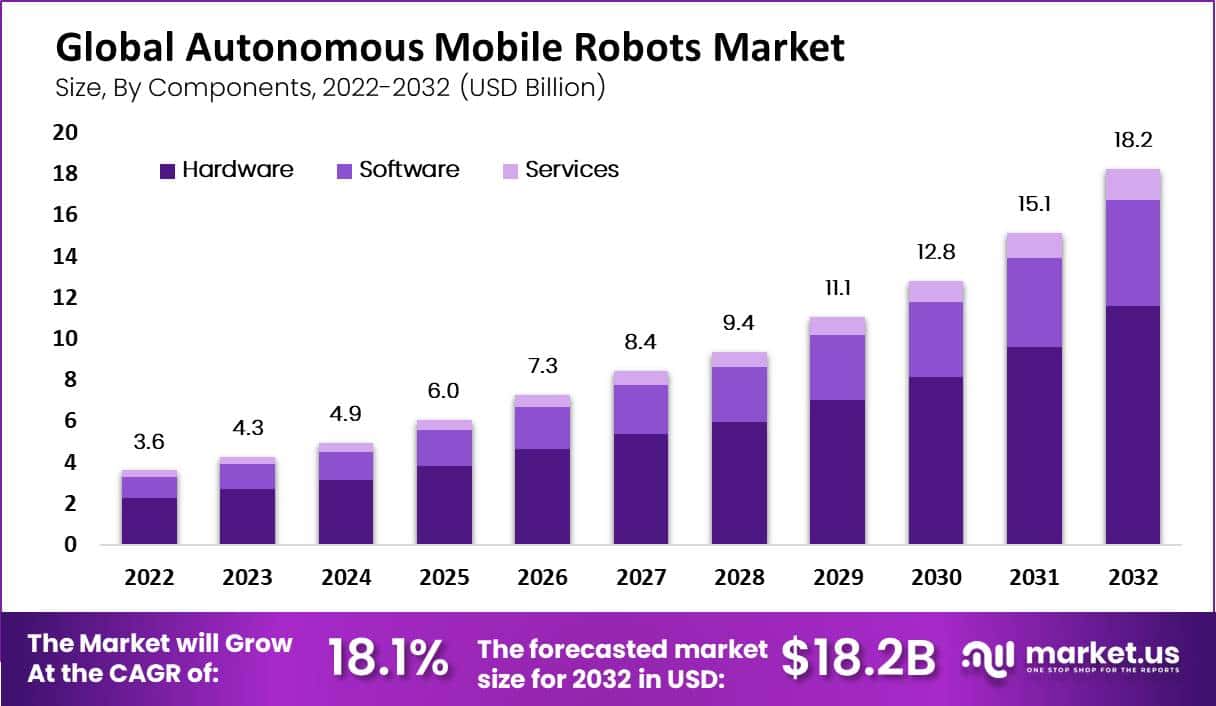

- The Autonomous Mobile Robots Market is valued at USD 18.2 Billion by 2032

- The global robotics market is expected to witness high revenue growth. With a target of about $37.37 billion by 2023.

- Service robotics is poised to lead the way within this expansive market. With an estimated market size of roughly $28.49 billion in the same year.

- This sector is expected to maintain a consistent annual growth rate. With a compound annual growth rate (CAGR) of 3.83% projected from 2023 to 2028.

- As a result, the market size is anticipated to reach approximately $45.09 billion by 2028.

- Worldwide, the United States is expected to emerge as the foremost revenue generator in robotics. With an anticipated value of roughly $7,722.00 million in 2023.

- This underscores the pivotal role that robotics plays across various industries globally. Motivating countries worldwide to increase their investments in robotics technology to boost productivity and efficiency.

(Source: Statista)

Collaborative Robots Market Size Statistics

- The collaborative robot (cobot) market experienced significant growth worldwide in recent years at a CAGR of 12%, with notable figures for 2020 to 2021.

- In 2020, the market reached $590.5 million, demonstrating its substantial presence in various industries.

- However, the growth didn’t stop there, as 2021 saw a remarkable increase in market revenue to $700.1 million.

- Looking ahead, the forecast for the cobot market from 2022 to 2030 shows a continuing upward trajectory.

- In 2022, it is expected to reach $815.4 million, and this growth is projected to continue steadily. With revenues reaching $923.7 million in 2023 and surpassing the $1 trillion mark in 2024. With a figure of $1,034.2 million.

- The growth trend persists throughout the forecast period, with the market size estimated to reach $1,990.2 million by 2030.

- This data underscores the growing importance of collaborative robots in various industries and their role in shaping the future of automation and smart manufacturing.

(Source: Statista)

Collaborative Robots Sales Volume Statistics

- The global sales of collaborative robots, also known as cobots, have been on a significant upward trajectory from 2018 to the projected figures for 2025.

- In 2018, there were 60.9 thousand units sold, reflecting the growing interest in these versatile automation tools.

- The following year, 2019, sales continued to rise, reaching 66.15 thousand units. However, it was in 2020 that a substantial leap was witnessed. With sales soaring to 126 thousand units businesses increasingly recognized the benefits of cobots in various industries.

- This trend continued in 2021, with sales doubling to 242.03 thousand units. The growth is projected to continue in the years ahead.

- By 2022, sales are expected to reach 353.33 thousand units, and the momentum persists. With forecasts of 508.2 thousand units in 2023 and 637.35 thousand units in 2024.

- The cobot market is set to remain robust, with an estimated 735 thousand units projected to be sold in 2025. Indicating the growing integration of collaborative robots into the global industrial landscape.

(Source: Statista)

Comparison of Traditional Industrial Robot Installations and Collaborative Robots Installations Statistics

- Over the 3 years from 2017 to 2019, there was a notable contrast in the installations of traditional and collaborative industrial robots.

- In 2017, 389 thousand traditional industrial robots were installed. While the installations of collaborative robots stood at a relatively modest 11 thousand units.

- The following year, in 2018, the number of traditional industrial robot installations increased to 406 thousand. Collaborative robot installations also grew, reaching 16 thousand units.

- By 2019, the installations of traditional industrial robots decreased slightly to 365 thousand units. While collaborative robots continued their upward trend, with 18 thousand units installed.

- This data underscores the shifting landscape in automation, with an increasing focus on collaborative robots alongside traditional industrial robot systems.

(Source: International Federation of Robotics)

Mobile Collaborative Robots Market Volume Statistics

- The global mobile cobots market is experiencing significant growth, with the number of units steadily increasing from 2021 to 2030.

- In 2021, there were 3,311 mobile robots in this category, expected to rise substantially in the coming years.

- By 2022, the market volume is projected to reach 4,588 units; by 2023, it will expand to 6,335 units.

- This growth trend continues, with the number of mobile cobots expected to reach 8,689 units in 2024 and a substantial 11,793 units by 2025.

- As we look further into the future, the market is forecasted to grow even more rapidly. With 15,778 units in 2026, 20,758 units in 2027, and an impressive 26,828 units in 2028.

- The upward trajectory continues, with 34,023 units in 2029, and by 2030. It is estimated that there will be 42,184 mobile cobots worldwide. Highlighting the increasing adoption of these versatile robotic systems in various industries.

(Source: Statista)

Deployment of Industrial Robots

Annual Installations of Industrial Robots

- The annual installations of industrial robots saw significant fluctuations over the decade from 2009 to 2019.

- In 2009, 60,000 units were installed, which doubled to 121,000 in 2010, indicating a sharp uptick in adoption. This growth continued into 2011, with 166,000 installations.

- However, 2012 saw a slight dip to 159,000 units. The trend reversed in 2013, as installations surged to 178,000 units. Subsequently, 2014 marked a substantial increase, with 221,000 units installed.

- The momentum continued in 2015 and 2016, with 254,000 and 304,000 installations, respectively.

- The year 2017 witnessed a significant milestone, with a record-breaking 400,000 installations.

- Although 2018 saw a slight dip to 422,000 units, it remained robust. In 2019, there were 373,000 installations, reflecting a still substantial presence of industrial robots in various industries.

- This decade-long data reflects the dynamic nature of industrial robotics adoption and its evolving role in manufacturing and automation.

(Source: World Robotics 2020 Report)

Operational Stock of Industrial Robots By Industry

- Industrial robots’ operational stock varied by industry from 2017 to 2019.

- There was a steady increase in the automotive sector, starting at 762,000 units in 2017. Growing to 847,000 units in 2018, and further expanding to 923,000 units in 2019.

- Similarly, the electrical/electronics industry grew, with operational robot stock rising from 509,000 units in 2017 to 597,000 in 2018, reaching 672,000 units in 2019.

- Metal and machinery also grew consistently, increasing from 216,000 units in 2017 to 248,000 in 2018 and 281,000 in 2019.

- The plastic & chemical products industry experienced modest growth. With operational stock going from 171,000 units in 2017 to 176,000 in 2018 and 182,000 in 2019.

- In the food industry, operational robots rose from 64,000 units in 2017 to 74,000 in 2018 and 81,000 in 2019.

- The “All Others” category also steadily increased, from 121,000 units in 2017 to 149,000 in 2018 and 174,000 in 2019.

- Finally, the unspecified category showed substantial growth. With operational stock climbing from 282,000 units in 2017 to 349,000 units in 2018 and 410,000 units in 2019.

- These figures highlight the varying degrees of robot adoption across different industries during these three years.

(Source: World Robotics 2020 Report)

Industrial and Collaborative Robots Regional Statistics

- In 2019, the global landscape of industrial robot installations saw China leading the pack with a significant figure of 140.5 thousand units.

- Japan followed as the second-largest contributor with 49.9 thousand installations, showcasing its strong presence in the robotics industry.

- The United States secured the third spot with 33.5 thousand installations, reflecting its commitment to automation.

- South Korea, Germany, and Italy also demonstrated substantial involvement, with 27.9 thousand, 20.5 thousand, and 11.1 thousand installations, respectively.

- Further down the list, France, China, Taipei, Mexico, and India recorded industrial robot installations ranging from 6.7 thousand to 4.3 thousand units.

- Spain, Canada, Thailand, Poland, and the Czech Republic also made notable contributions. Emphasizing the global adoption of industrial robots to enhance manufacturing and production processes across various countries.

(Source: World Robotics 2020 Report)

Asia-Pacific Collaborative Robots Statistics

- Asia continues to dominate the industrial robot market, with China leading the charge as the region’s largest adopter.

- In 2019, the operational stock of industrial robots in China surged by an impressive 21%, reaching a remarkable 783,000 units.

- Japan followed closely as the second-largest player with approximately 355,000 units, marking a 12% increase from the previous year.

- While not at the top, India demonstrated remarkable growth, setting a new record with around 26,300 units, a remarkable 15% increase.

- Particularly noteworthy is that India doubled its industrial robot count within just five years.

- The Asian market accounted for a significant share of the global supply, with nearly two-thirds of newly installed robots finding their home in the region.

- Although China’s sales of nearly 140,500 new robots in 2019 were slightly below the records set in 2018 and 2017, they still more than doubled the numbers from five years prior in 2014, which stood at 57,000 units.

- However, it’s worth mentioning that installations in the top Asian markets, particularly China (down 9%) and Japan (down 10%), did show a slowdown compared to previous years.

- Despite this, Asia remains a powerhouse in the world of industrial robotics.

(Source: World Robotics 2020 Report)

Europe Collaborative Robots Statistics

- In 2019, Europe strengthened its position in the global industrial robotics landscape, boasting an operational stock of 580,000 units, representing a 7% increase.

- Among European nations, Germany emerged as a standout user, boasting an operational stock of approximately 221,500 units.

- This figure significantly outpaced Italy’s stock of 74,400 units, surpassed France’s 42,000 units by a factor of five, and even exceeded the United Kingdom’s 21,700 units by a remarkable tenfold.

- Examining robot sales in the largest European Union markets reveals a diverse picture.

- With around 20,500 installations, Germany saw a dip from its record year 2018, declining by 23%, but remained consistent with levels observed between 2014 and 2016.

- In contrast, France experienced a 15% increase in robot sales, Italy enjoyed a 13% uptick, and the Netherlands recorded an 8% rise.

- However, the United Kingdom lagged, witnessing a 16% drop in new installations.

- The 2,000 units installed in the UK fell significantly short of the numbers seen in Germany (20,500 units), Italy (11,100 units), and France (6,700 units).

- This data underlines the diverse landscape of robotics adoption within the European Union.

(Source: World Robotics 2020 Report)

Americas Collaborative Robots Statistics

- Across the Americas, the United States emerged as the prominent user of industrial robots, boasting a fresh operational stock record of around 293,200 units in 2019.

- This represents a noteworthy 7% increase, underscoring the nation’s robust adoption of automation technology.

- In second place, Mexico also demonstrates impressive growth, with an 11% rise, resulting in an operational stock of 40,300 units.

- While showing a more modest 2% increase, Canada ranks third with an operational stock of approximately 28,600 units.

- It’s worth noting that the United States experienced a 17% slowdown in new robot installations in 2019 compared to the record-setting year 2018.

- However, with 33,300 shipped units, the country still maintains a strong position, recording the second-highest sales result in its history.

- Interestingly, a significant portion of the robots used in the USA are imported from Japan and Europe, as there are relatively few North American robot manufacturers. Nevertheless, the region boasts a multitude of crucial robot system integrators.

- In Mexico, the second-largest market in North America, there was a 20% slowdown in new installations, resulting in nearly 4,600 units. Meanwhile, Canada saw a 1% increase in sales, achieving a new record with about 3,600 shipped units.

- Turning to South America, Brazil takes the lead with an operational stock of nearly 15,300 units, reflecting an 8% growth rate.

- Despite a 17% decrease in sales, which amounted to about 1,800 installations, it’s noteworthy that this figure still stands as one of the best results ever, surpassed only by the record-breaking shipments in 2018.

(Source: World Robotics 2020 Report)

Latest Trends in the Robotics Industry

- The world of robotics is experiencing a profound transformation, with the next generation of robots, including collaborative and service robots, poised to dominate the market, accounting for an impressive two-thirds of unit robot sales by 2025.

- This marks a substantial leap from the mere 22 percent they represented in 2015, underscoring the ever-expanding role of robots across diverse industries.

- Venture capital investment in robotics technology has been on an upward trajectory since 2013, culminating in a substantial sum of over $3.5 billion since 2012.

- This substantial influx of funding reflects the soaring expectations surrounding innovation and development in the dynamic field of robotics.

- Toyota, a global automotive giant, is making a significant commitment to advancing artificial intelligence and robotics, with a whopping $1 billion earmarked for establishing a dedicated R&D arm over the next five years. This substantial investment is poised to catalyze groundbreaking progress in these cutting-edge technologies.

- Kuka, a renowned industrial robot manufacturer, is boldly venturing into new markets by introducing robot assistants designed to provide invaluable support, including caregiving for older people. This strategic diversification underscores the remarkable adaptability of robotics in addressing a wide spectrum of societal needs.

- Meanwhile, in Europe, members of the European Parliament are actively championing the creation of a specialized European agency dedicated to robotics and artificial intelligence. The agency’s pivotal mission would be to furnish public authorities with essential technical expertise, ethical guidance, and regulatory insights.

(Source: Deloitte Insights)

Recent Developments

Acquisitions and Mergers:

- ABB acquires ASTI Mobile Robotics: In mid-2023, ABB acquired ASTI Mobile Robotics, a leading global provider of autonomous mobile robots (AMRs), for $200 million. This acquisition aims to enhance ABB’s robotics portfolio by integrating ASTI’s mobile solutions with ABB’s collaborative robots, providing more versatile automation options.

- Teradyne acquires Mobile Industrial Robots (MiR): Teradyne completed its $272 million acquisition of Mobile Industrial Robots (MiR) in early 2024. This merger is expected to strengthen Teradyne’s position in the collaborative robot market by combining MiR’s autonomous mobile robots with its existing cobot offerings.

New Product Launches:

- Universal Robots’ UR16e: In late 2023, Universal Robots launched the UR16e, a collaborative robot designed for heavy-duty applications. The UR16e features a high payload capacity of 16 kg, making it suitable for tasks such as machine tending, material handling, and heavy assembly.

- Fanuc’s CRX-25iA: Fanuc introduced the CRX-25iA in early 2024, expanding its CRX series of collaborative robots. This new model offers a higher payload of 25 kg and improved safety features, targeting applications in manufacturing, logistics, and warehousing.

Funding:

- Rethink Robotics raises $60 million: Rethink Robotics, a pioneer in collaborative robotics, raised $60 million in a funding round in 2023 to expand its product line and enhance its cobot capabilities, focusing on ease of use and flexibility for various industries.

- Vecna Robotics secures $50 million: Vecna Robotics, known for its autonomous mobile robots and collaborative robotic solutions, secured $50 million in early 2024 to accelerate the development and deployment of its automation technologies, particularly in logistics and material handling.

Technological Advancements:

- AI and Machine Learning Integration: Collaborative robots are increasingly integrating AI and machine learning to improve their ability to perform complex tasks, adapt to changing environments, and collaborate more effectively with human workers.

- Enhanced Safety Features: Advances in sensor technology and real-time data processing are enhancing the safety features of cobots, ensuring they can operate safely alongside humans by detecting and responding to potential collisions.

Market Dynamics:

- Growth in Collaborative Robot Market: The global collaborative robot market is projected to grow at a CAGR of 15.5% from 2023 to 2028, driven by increasing automation in industries such as manufacturing, healthcare, and logistics, and the need for flexible and safe automation solutions.

- Increased Adoption in SMEs: Small and medium-sized enterprises (SMEs) are increasingly adopting collaborative robots to improve productivity, reduce operational costs, and enhance workplace safety, contributing to market growth.

Regulatory and Strategic Developments:

- ISO/TS 15066 Standard Updates: The International Organization for Standardization (ISO) updated the ISO/TS 15066 standard in early 2024, providing guidelines for the safe deployment and operation of collaborative robots, ensuring they meet the latest safety requirements.

- EU Robotics Strategic Plan: The European Union launched its Robotics Strategic Plan 2024-2028, aiming to promote the development and adoption of robotics technologies, including collaborative robots, to enhance industrial competitiveness and innovation.

Research and Development:

- Human-Robot Interaction (HRI): R&D efforts are focusing on improving human-robot interaction to make cobots more intuitive and user-friendly, enabling seamless collaboration between robots and human workers in various applications.

- Multi-Robot Collaboration: Researchers are exploring the potential of multi-robot collaboration, where multiple cobots work together to complete complex tasks, increasing efficiency and productivity in industrial settings.

Conclusion

Collaborative Robots Statistics – In conclusion, collaborative robots, or cobots, have emerged as a transformative force in industrial automation.

These specialized robots, designed to work safely alongside human workers, offer many benefits. They are equipped with advanced safety features, are easy to program, and demonstrate exceptional flexibility, all while remaining cost-effective.

Cobots have found applications across diverse industries, from manufacturing and logistics to healthcare, agriculture, and beyond, enhancing productivity, safety, and efficiency.

As we look ahead, the collaborative robot market is poised for substantial growth, with forecasts projecting significant revenue increases in the coming years.

FAQs

Collaborative robots, or cobots, are specialized industrial robots designed to work alongside humans in a shared workspace. They are equipped with safety features and designed to collaborate with human operators on various tasks.

Collaborative robots are designed to work safely with humans, while traditional industrial robots typically require safety barriers and operate in isolation. Cobots have advanced sensors and programming that enable them to respond to human presence and avoid collisions.

Cobots offer several advantages, including improved safety, increased productivity, flexibility for different tasks, ease of programming, and cost-effectiveness. They can also assist in tasks that may be too monotonous or physically demanding for humans.

Cobots are used in various industries, including manufacturing, logistics, healthcare, agriculture, construction, etc. They can perform tasks such as assembly, material handling, quality control, and even surgery.

Yes, cobots are designed with safety in mind. They have built-in safety features, such as sensors, vision systems, and force-limiting mechanisms, to ensure they can work alongside humans without danger.