Table of Contents

Introduction

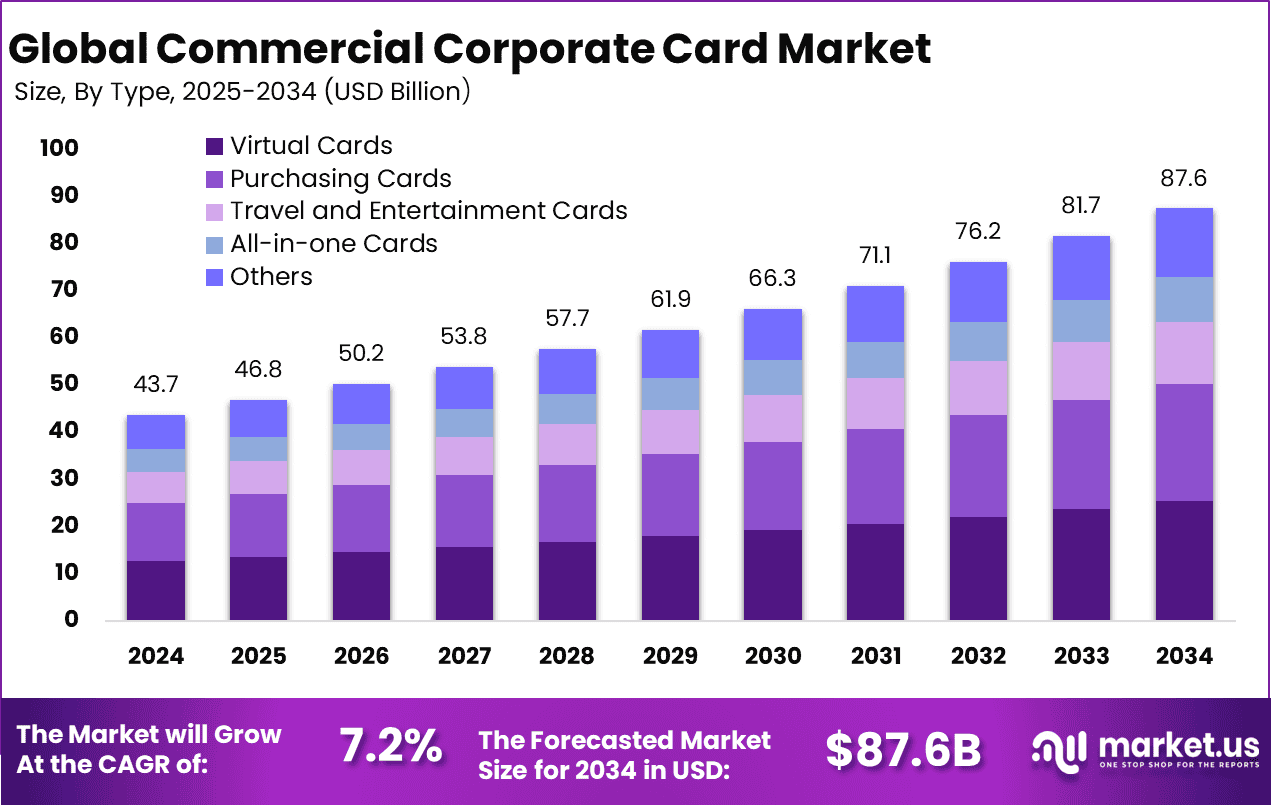

The global Commercial Corporate Card market is poised for significant growth, expected to reach USD 87.6 billion by 2034, up from USD 43.7 billion in 2024, growing at a robust CAGR of 7.2%. North America currently leads the market with a 40% share, generating USD 17.4 billion in revenue in 2024.

The rising adoption of digital payment solutions, corporate expense management systems, and evolving business requirements are driving the demand for corporate cards globally. The shift toward cashless transactions, increased corporate travel, and higher expenditure on operational expenses are also contributing factors to the market’s expansion.

How Growth is Impacting the Economy

The rapid growth of the Commercial Corporate Card market is having a broad impact on the global economy. As businesses increasingly adopt digital payment solutions, the need for streamlined corporate expense management has intensified. This shift is encouraging financial institutions and technology providers to invest in innovative products and services, boosting economic activity in the finance and tech sectors. Additionally, the growth is driving increased demand for related services like fraud prevention, analytics, and customer support, generating employment opportunities.

The proliferation of commercial cards also aids in better tracking of business expenses, leading to improved financial efficiency for corporations. Moreover, businesses are capitalizing on the enhanced cash flow management and reward systems offered by corporate cards. This, in turn, contributes to broader financial stability, benefiting businesses, financial institutions, and the economy overall. As digital payment trends gain momentum, this growth fosters both innovation and employment opportunities, contributing to sustained economic development.

➤ Unlock growth! Get your sample now! – https://market.us/report/global-commercial-corporate-card-market/free-sample/

Impact on Global Businesses

The growing adoption of Commercial Corporate Cards is influencing global businesses in multiple ways. Rising operational costs due to inflation and supply chain disruptions have encouraged companies to adopt more efficient financial management solutions like corporate cards, helping them manage cash flows better. However, this also means that businesses may face increasing fees associated with these payment solutions, which could impact smaller organizations with limited budgets.

On the supply chain front, businesses are finding it easier to manage cross-border payments, but fluctuations in exchange rates and regional financial regulations are posing challenges. In sector-specific terms, industries such as travel, hospitality, and manufacturing are seeing substantial benefits from corporate card solutions due to better expense tracking and optimization. On the other hand, sectors with high compliance needs, such as healthcare and finance, are adapting to more secure and controlled corporate card systems, ensuring financial integrity and reducing fraud risks.

Strategies for Businesses

To capitalize on the growing Commercial Corporate Card market, businesses can employ several strategic approaches. First, they should focus on automating their expense management processes to reduce manual effort and improve accuracy. Integrating corporate card solutions with existing enterprise resource planning (ERP) systems can offer deeper insights into spending patterns and improve financial decision-making.

Companies should also prioritize selecting cards with the best reward and incentive programs tailored to their industry needs, such as travel perks for businesses with high travel expenditure. Establishing a robust fraud prevention system is essential to secure financial transactions and minimize risk. Businesses can also explore multi-currency cards to simplify cross-border payments and mitigate currency exchange risks. Additionally, fostering partnerships with financial institutions offering customized corporate card solutions can give businesses the edge in managing costs while improving operational efficiency.

Key Takeaways

- The Commercial Corporate Card market is expected to grow at a CAGR of 7.2%, reaching USD 87.6 billion by 2034.

- North America dominates the market with a 40% share, accounting for USD 17.4 billion in 2024.

- The rising adoption of cashless payments and expense management systems is a driving factor.

- Sector-specific demand is growing, especially in travel, hospitality, and manufacturing.

- Companies can benefit from integrating corporate cards with ERP systems and focusing on fraud prevention.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=154292

Analyst Viewpoint

The Commercial Corporate Card market is in a robust growth phase, driven by the increasing adoption of cashless transactions and the need for more efficient expense management solutions. Presently, North America leads the market, with growing traction in other regions like Europe and Asia-Pacific.

As companies continue to focus on digital transformation and cash flow optimization, the market is expected to see sustained growth. Looking ahead, the market is likely to expand with innovations in card technology, enhanced fraud protection, and more personalized offerings. Businesses that adapt early to these changes will gain a competitive edge, making this an exciting space for future investments.

Regional Analysis

In 2024, North America is the dominant player in the Commercial Corporate Card market, accounting for more than 40% of the global share. This dominance is attributed to the advanced financial infrastructure, higher corporate spending, and early adoption of digital payment technologies.

Europe and the Asia-Pacific (APAC) regions are also experiencing growing demand, with APAC expected to show the highest growth due to the increasing adoption of digital payment systems by emerging economies. The market dynamics in these regions are influenced by local business cultures, financial regulations, and technology advancements. The expansion of corporate cards into emerging markets like India and China further presents opportunities for market growth.

Business Opportunities

The expansion of the Commercial Corporate Card market presents numerous business opportunities across various sectors. Financial institutions and fintech companies can capitalize on the rising demand by offering tailored corporate card solutions to meet specific industry needs, such as travel perks for the hospitality sector or analytics-focused solutions for the manufacturing industry.

Additionally, the market’s growth encourages partnerships with tech firms to integrate corporate cards with enterprise systems, offering seamless expense management. Fraud prevention and cybersecurity companies also have an opportunity to innovate, as businesses are increasingly prioritizing secure transactions. Furthermore, small and medium-sized enterprises (SMEs) can benefit from these cards’ cash flow management features, providing them with more efficient financial planning.

➤ Don’t Stop Here—check our Library

- Fan Engagement Market

- RF Over Fiber Market

- Cognitive Assessment and Training Market

- AI Deception Tools Market

Key Segmentation

The Commercial Corporate Card market can be segmented based on industry, card type, and region. By industry, key segments include travel, hospitality, manufacturing, and professional services, with travel and hospitality being the largest adopters of corporate cards. Card types include single-use, multi-use, and virtual cards, with virtual cards seeing an increase due to their flexibility and enhanced security.

Regionally, North America holds the largest share, followed by Europe and APAC, where the latter is expected to witness the fastest growth due to expanding digital payment adoption. Each segment’s growth is driven by different factors, such as increasing international business travel or demand for seamless cross-border payment solutions.

Key Player Analysis

Key players in the Commercial Corporate Card market are focusing on innovations in technology to offer more secure and flexible card solutions. Financial institutions are investing heavily in the development of advanced payment systems to meet the demands of businesses seeking better expense management tools.

Some players are leveraging data analytics to offer tailored insights to clients, helping them optimize their financial operations. Additionally, there is a growing focus on customer service and fraud prevention, with some players investing in AI and machine learning to enhance card security. Collaboration with technology companies is also common to provide integrated solutions, streamlining financial operations for businesses globally.

- AirPlus International Ltd.

- Amazon.com, Inc. Company Profile

- American Express Company

- Bank of America Corporation

- Citigroup, Inc.

- JP Morgan Chase & Co. Inc.

- U.S. Bancorp

- Wex Inc.

- NGC US, LLC

- Bank of China Limited

- HDFC Bank Limited

- ICICI Bank Limited

- IndusInd Bank Limited

- Kotak Mahindra Bank Limited

- Citibank

- Hong Kong and Shanghai Banking Corporation

- Standard Chartered Bank Limited

- Other Key Players

Recent Developments

- Expansion of virtual corporate card offerings to meet growing demand for flexibility.

- Financial institutions are enhancing fraud detection mechanisms using AI and machine learning.

- Increased focus on multi-currency corporate cards to facilitate cross-border transactions.

- Introduction of integration tools with enterprise resource planning (ERP) systems for smoother expense management.

- Launch of tailored corporate card programs catering to specific industries, such as travel and manufacturing.

Conclusion

The Commercial Corporate Card market is experiencing robust growth and offers significant opportunities for businesses to optimize their financial management. With technological advancements and increasing adoption across industries, businesses can enhance efficiency and secure better financial control, paving the way for a thriving market in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)