Table of Contents

Introduction

Commercial Drones Statistics: Commercial drones, unmanned aerial vehicles (UAVs). Remotely piloted aircraft systems (RPAS) have rapidly become essential tools across various industries.

These drones are comprised of essential components like frames, propellers, sensors, onboard computers, and communication systems.

They serve diverse purposes, including agriculture, photography, construction, infrastructure inspection, search and rescue, and environmental monitoring.

The use of commercial drones is subject to regulations enforced by aviation authorities, which provide guidelines and safety measures.

Market trends include technological advancements such as integrating artificial intelligence and swarming technology.

Looking ahead, the future promises even wider adoption of drones in everyday operations. Offering cost-effective and efficient solutions for industry-specific challenges.

Editor’s Choice

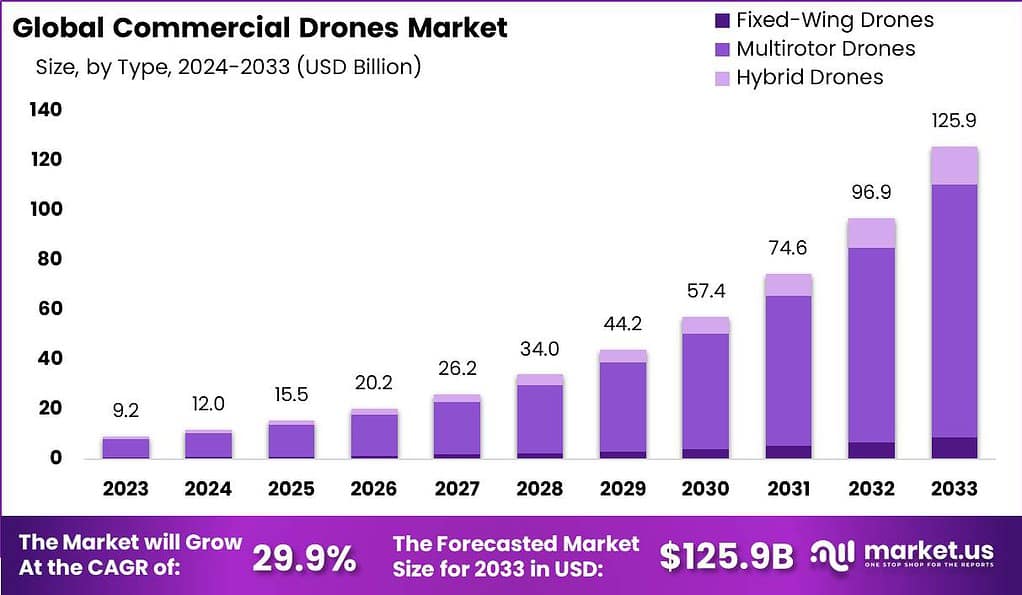

- The commercial drone market has grown impressive in recent years at a CAGR of 29.9%.

- In 2022, the market generated a revenue of USD 30.6 billion, and this figure is expected to soar to USD 34.5 billion in 2023.

- By 2026, the commercial drone market is to produce 35.37 billion USD. This ascent continues into 2027, where revenues are forecasted to reach 38.20 billion USD.

- As of 2023, DJI is dominant, with over 70% of the global drone market share. This is due to their excellence in aerial photography and videography gear.

- In May 2019, Parrot achieved a significant milestone by securing a contract valued at $11 million from the U.S. military to produce reconnaissance drones.

- As reported by Statista, the agriculture industry ranks among the foremost adopters of commercial drones, constituting a substantial 26% of the overall market share.

- As reported by Statista, North America is the dominant hub for commercial drones, representing roughly 40% of the worldwide market.

- Europe ranks as the second-largest commercial drone market, holding a share of around 30%.

Commercial Drones Market Overview Statistics

Commercial Drones Market Statistics

- The global drone market is experiencing remarkable growth. With revenues steadily increasing yearly at a compound annual growth rate (CAGR) of 12.7%.

- In 2022, the market generated a revenue of USD 30.6 billion. This figure is expected to soar to USD 34.5 billion in 2023, reflecting a significant upswing.

- Projections for the coming years are equally promising, with anticipated revenues of USD 38.9 billion in 2024, USD 43.8 billion in 2025, and USD 49.4 billion in 2026, indicating a substantial expansion.

- The upward trajectory continues, with expected revenues of USD 55.6 billion in 2027, USD 62.7 billion in 2028, and USD 70.7 billion in 2029, showcasing sustained growth.

- As we look further ahead, the drone market is poised to break new records. With projections of USD 79.6 billion in 2030, USD 89.8 billion in 2031, and an impressive USD 101.1 billion in 2032.

- This data underscores the burgeoning role of drones in various industries and their increasing importance in the global economy.

(Source: Market.us)

Global Commercial Drones Market Size Statistics

- The global drone market is experiencing remarkable growth, with revenues steadily increasing yearly at a compound annual growth rate (CAGR) of 12.7%.

- In 2022, it reached a notable 26.20 billion USD, marking the beginning of this upward trajectory.

- Building on this momentum, the market is projected to achieve revenues of 28.08 billion USD in 2023, indicating a promising expansion trend.

- Looking further ahead, the forecast for 2024 stands at 30.33 billion USD. By 2025, the market is expected to reach 32.75 billion USD, illustrating sustained growth.

- As we progress into 2026, the commercial drone market is anticipated to yield 35.37 billion USD. This ascent continues into 2027, where revenues are forecasted to reach 38.20 billion USD.

- These figures underscore the sector’s remarkable growth and increasingly significant role in various industries.

(Source: Statista)

Commercial Drones Key Players Statistics

DJI (Dà-Jiāng Innovations Science and Technology Co., Ltd.)

- DJI is a Chinese technology company and one of the most recognizable names in the drone industry. It is a relatively young company, just 16 years old as of 2023.

- It was founded in 2006 by Frank Wang while he was still in college.

- In 2009, DJI made a name for itself by flying a drone prototype to the peak of Mount Everest. This daring feat helped them gain widespread attention.

- DJI faced challenges in its early years, including high turnover and financial issues. Frank Wang’s family friend, Lu Di, invested $90,000 in the company and took over financial management, saving DJI.

- DJI expanded its reach to the Western market in 2010. They hired marketing experts and even moved some operations to the US under DJI North America.

- In 2013, DJI launched the Phantom, a game-changing drone. This led to some internal conflicts but marked a significant step in their growth.

- DJI’s Phantom 3, was released in 2015 with live-streaming capabilities. Skyrocketed the company’s sales and reputation, making DJI the world’s top drone brand.

- DJI’s focus on camera technology paid off when they received a Technology & Engineering Emmy Award in 2017 for their contributions to aerial cinematography.

- As of 2023, DJI is dominant, with over 70% of the global drone market share. This is due to their excellence in aerial photography and videography gear.

- Additionally, DJI’s drone sales are expected to grow, reaching an estimated $55 billion by 2030, thanks to their wide range of applications across various industries.

(Source: Shotkit)

Parrot

- Parrot SA, a French corporation headquartered in Paris, France, was founded in 1994 by a team composed of Jean-Pierre Talvard, Christine/M De Tourvel, and Henri Seydoux.

- Beginning in 2017, Parrot redirected its primary focus exclusively toward manufacturing drones.

- In 2014, Parrot gained notable recognition by introducing the mini-drones Jumping Sumo and Rolling Spider at the prestigious CES event in Las Vegas.

- During this same timeframe, Parrot also expanded its ownership share in Pix4D to reach 57%. Remarkably, at the AUVSI conference conducted in Orlando in May 2014, Parrot unveiled its AR Drone 3.0.

- In May 2019, Parrot achieved a significant milestone by securing a contract valued at $11 million from the U.S. military to produce reconnaissance drones.

- This accomplishment distinctly highlighted Parrot’s outstanding expertise in the field, with the contract being awarded by the Department of Defense.

- Parrot, the French drone manufacturer headquartered in Paris, witnessed fluctuations in its revenue over the years. In 2016, the company generated a substantial revenue of 166.5 million euros, reflecting a robust performance.

- However, in the subsequent years, Parrot faced revenue declines. In 2017 decreased to 151.9 million euros, followed by a further drop to 109.2 million euros in 2018.

- The trend continued in 2019 when the company’s revenue decreased to 76.1 million euros. The impact of these challenges persisted into 2020, as Parrot reported a revenue of 57.3 million euros.

- The declining revenue trend continued into 2021 when the company’s revenue decreased to 54.3 million euros.

(Source: Drone Insight, Statista)

Yuneec International

- Yuneec International is a Chinese aircraft manufacturer founded in 1999 in Hong Kong and is a leader in electronic aviation.

- The company’s commercial drones include the H520, used for aerial inspection and mapping, and the Typhoon H Plus, used for aerial photography and videography. Yuneec has a strong presence in the European market and is expanding globally.

- In 2003, the company expanded globally and opened offices in Hong Kong, Shanghai, Los Angeles, and Hamburg.

- In 2010, Yuneec won the Lindbergh Electric Aircraft Prize for its two-seater electric aircraft.

- In 2013, the company’s single-seat electric aircraft, the E-Spyder, was certified as an electric aircraft.

- 2019, the company worked with Leica and FLIR to make the ION L1 Camera. It’s perfect for taking photos and has special tech to clear the images.

- They also made thermal and zoom cameras for its H520 drone.

(Source: Yuneec)

Autel Robotics

- Autel Robotics is a Chinese drone manufacturer that produces drones for commercial use.

- The company was established in 2014.

- The company’s commercial drones include the EVO II. Used for aerial photography and videography, and the Dragonfish, used for search and rescue missions.

- Autel has generated a revenue of $16 million in 2022.

- Autel Robotics is known for its high-quality drones and is gaining popularity in the commercial drone market.

(Source: Autel Robotics)

Skydio

- Skydio, an American drone manufacturer headquartered in San Mateo, California, was established in 2014 by three individuals who had completed their studies at the Massachusetts Institute of Technology: Adam Bry, Abe Bachrach, and Matt Donahoe.

- In 2018, the company marked its foray into the consumer market with the launch of the Skydio R1, a drone priced at $2,500.

- The Skydio R1 boasted a design featuring 12 cameras situated around its body and a 4K main camera with gimbal stabilization. Notably, it offered functionalities such as subject tracking and obstacle avoidance.

- A significant milestone for Skydio came in March 2021 when the company achieved unicorn status, signifying its valuation surpassing $1 billion, a first for a U.S. drone manufacturer.

- Subsequently, on February 27, 2023, Skydio’s valuation further soared to $2.2 billion following a successful additional funding round that injected $230 million into the company.

(Source: Skydio)

Commercial Drones by Industry Statistics

Agriculture Industry Commercial Drones Statistics

- As reported by Statista, the agriculture industry ranks among the foremost adopters of commercial drones, constituting a substantial 26% of the overall market share.

- In agriculture, drones find extensive utility in tasks such as crop health monitoring, yield estimation, and the enhancement of irrigation practices.

- Projections from DroneSourced indicate that the global market for agricultural drones is poised for significant growth, with an anticipated size reaching $864.4 million by 2022.

(Source: Statista, DroneSourced)

Construction Industry Commercial Drones Statistics

- The construction sector has experienced notable growth in the adoption of commercial drones.

- These drones are employed for surveying construction sites, tracking project advancement, and conducting structural inspections.

- Projections from Statista indicate that by 2025, the construction industry is forecasted to represent 12% of the total market share for commercial drones.

- Furthermore, DroneSourced estimates the global market size for construction drones to reach $11.96 billion by 2025, underscoring the industry’s increasing reliance on drone technology.

(Source: Statista, DroneSourced)

Delivery and Logistics Commercial Drones Industry Statistics

- Delivery and logistics enterprises have embraced commercial drones to expedite and enhance package deliveries.

- As per Statista projections, by 2025, the delivery and logistics sector is anticipated to comprise 7% of the overall market share for commercial drones.

- Furthermore, DroneSourced predicts that the global market for delivery drones is set to achieve a value of $11.2 billion by 2022.

- This underscores the growing significance of drones in streamlining and improving the efficiency of delivery and logistics operations.

(Source: Statista, DroneSourced)

Real Estate and Surveying Commercial Drones Industry Statistics

- The real estate and surveying sectors have experienced a growing adoption of commercial drones to enhance their operations.

- These drones are deployed for tasks such as capturing aerial imagery of properties, generating 3D models, and conducting land surveys.

- According to Statista’s projections, the real estate industry is poised to represent 5% of the overall market share for commercial drones by 2025.

- Additionally, DroneSourced forecasts that the global market for real estate drones is expected to achieve a value of $4.2 billion by 2025.

- This highlights the increasing relevance of drones in streamlining processes and improving outcomes in real estate and surveying.

(Source: Statista, DroneSourced)

Emergency Services Commercial Drones Industry Statistics

- Emergency services have embraced the utility of commercial drones in their operations. Particularly in search and rescue missions, disaster response, and firefighting efforts.

- Drones have become invaluable tools for providing crucial aerial perspectives of disaster-affected areas. Identifying and locating missing individuals, and facilitating real-time monitoring of wildfires.

- According to Statista’s projections, the emergency services sector is set to make up a noteworthy 4% of the overall market share for commercial drones by 2025.

- Furthermore, DroneSourced anticipates significant growth in the global market size for emergency services drones, forecasting it to reach an impressive $1.8 billion by the same year.

- These statistics highlight the substantial impact of commercial drones within the emergency services industry. Underscoring their vital role in enhancing disaster response and public safety.

(Source: Statista, DroneSourced)

Commercial Drones Statistics By Region

North America

- As reported by Statista, North America is the dominant hub for commercial drones, representing roughly 40% of the worldwide market.

- The United States takes the lead within this region with an impressive market share exceeding 85%.

- Notably, the commercial drone sector in North America is poised for substantial growth. With an anticipated compound annual growth rate (CAGR) of 19.5% from 2021 to 2028.

- These figures underscore North America’s significant influence and promising trajectory in the commercial drone industry.

(Source: Statista)

Europe

- Europe ranks as the second-largest commercial drone market, holding a share of around 30%.

- This market’s momentum is chiefly fueled by the growing integration of drones in sectors like agriculture, construction, and infrastructure.

- As per DroneSourced’s insights, it is projected that the count of commercial drones in Europe will reach 1.2 million by 2025, demonstrating a robust compound annual growth rate (CAGR) of 25.6%.

- These statistics emphasize Europe’s prominent position in the commercial drone industry, driven by its expanding applications and advancing technologies.

(Source: DroneSourced)

Asia-Pacific

- The Asia-Pacific area is witnessing the most rapid expansion in the commercial drone market, experiencing a noteworthy compound annual growth rate (CAGR) of 28.4% from 2021 to 2028, as per Statista.

- This surge is primarily attributed to the growing incorporation of drones in agriculture, construction, and infrastructure sectors.

- Notably, China is the largest market within this region, commanding a market share exceeding 60%.

- These observations underline the remarkable growth and influence of the commercial drone sector in the Asia-Pacific region, propelled by its expanding applications and innovations.

(Source: Statista)

Latin America

- In Latin America, the market for commercial drones is on an upward trajectory, demonstrating a significant compound annual growth rate (CAGR) of 21.7% between 2021 and 2028, as reported by Statista.

- This growth is predominantly propelled by the rising utilization of drones across agriculture, construction, and infrastructure sectors.

- Notably, Brazil leads the way as the largest market within the region, commanding more than half of the market share.

- These findings highlight the notable expansion and prominence of the commercial drone industry in Latin America, driven by its increasing applications and adoption.

(Source: Statista)

Middle East and Africa

- In the Middle East and Africa, the commercial drone market is on an upward trajectory. Displaying a significant compound annual growth rate (CAGR) of 23.1% between 2021 and 2028, as noted by Statista.

- This expansion is chiefly attributed to the increasing adoption of drones across sectors like agriculture, construction, and infrastructure.

- Notably, the United Arab Emirates is the largest market within this region, representing more than 40% of the market share.

- On a global scale, the commercial drone market is anticipated to exhibit robust growth, with an overall CAGR of 23.8% from 2021 to 2028, as per Statista’s projections.

- These findings underscore the notable progress and influence of the commercial drone industry across regions, driven by its widening applications and adoption.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- AeroVironment acquires Arcturus UAV: In early 2023, AeroVironment completed its $405 million acquisition of Arcturus UAV. This acquisition aims to expand AeroVironment’s portfolio in the commercial drone market, particularly in providing solutions for agriculture and environmental monitoring.

- AgEagle acquires MicaSense: AgEagle acquired MicaSense, a provider of advanced drone sensors, for $23 million in late 2023. This merger is expected to strengthen AgEagle’s offerings in precision agriculture and environmental monitoring by integrating MicaSense’s high-quality imaging technology.

New Product Launches:

- DJI Matrice 300 RTK: In mid-2023, DJI introduced the Matrice 300 RTK, a new commercial drone with enhanced flight performance, AI capabilities, and multiple payload configurations, targeting applications in public safety, inspection, and surveying.

- Parrot ANAFI USA: Parrot launched the ANAFI USA in early 2024, designed for first responders and enterprise professionals. This drone features thermal imaging, and 32x zoom, and is made to withstand harsh environments, making it ideal for search and rescue, inspection, and surveillance.

Funding:

- Skydio raises $170 million: In 2023, Skydio, an autonomous drone technology company, secured $170 million in a Series D funding round to expand its product line and enhance its AI-powered drone navigation systems.

- Zipline secures $250 million: Zipline, a company specializing in drone delivery, raised $250 million in early 2024 to scale its operations and expand its delivery network, focusing on healthcare logistics and commercial delivery services.

Technological Advancements:

- AI and Machine Learning Integration: AI and machine learning are being increasingly integrated into commercial drones to improve autonomous navigation, object detection, and real-time data processing, enhancing the efficiency and safety of drone operations.

- 5G-Enabled Drones: Advances in 5G technology are enabling faster data transmission and more reliable connectivity for commercial drones, facilitating real-time communication and control, especially in complex environments.

Market Dynamics:

- Growth in Commercial Drone Market: The global commercial drone market is projected to grow at a CAGR of 15.8% from 2023 to 2028, driven by increasing demand in sectors such as agriculture, construction, logistics, and public safety.

- Rising Adoption in Agriculture: Commercial drones are seeing increased adoption in agriculture for applications like crop monitoring, precision farming, and pesticide spraying, helping farmers improve yield and reduce costs.

Regulatory and Strategic Developments:

- FAA’s Remote ID Rule: The Federal Aviation Administration (FAA) in the US implemented the Remote ID rule in early 2024, requiring most drones to broadcast their identification and location information. This regulation aims to enhance airspace safety and facilitate drone integration into the national airspace.

- EU’s U-space Framework: The European Union introduced the U-space framework in 2023, providing a regulatory structure for the safe integration of drones into European airspace, and promoting innovation while ensuring safety and security.

Research and Development:

- Drone Swarming Technology: R&D efforts are focusing on drone swarming technology, enabling multiple drones to operate in coordination for complex tasks such as large-scale environmental monitoring and disaster response.

- Advanced Sensing and Imaging: Researchers are developing advanced sensing and imaging technologies for drones, including hyperspectral imaging and LiDAR, to enhance data collection and analysis capabilities in various commercial applications.

Conclusion

Commercial Drones Statistics – The commercial drone sector has emerged as a game-changing influence, significantly impacting many global industries.

From North America, where the United States dominates as the largest market, to Europe’s growing adoption and the swift expansion in Asia-Pacific, Latin America, the Middle East, and Africa, unmanned aerial vehicles have discovered versatile applications spanning agriculture, construction, emergency services, and beyond.

Their capacity to deliver inventive answers, heighten safety, and enhance efficiency has been pivotal. The industry’s horizon holds great promise, with the anticipation of sustained global expansion.

As technology progresses and regulations undergo evolution, commercial drones are positioned to assume an even more integral role across sectors, furnishing cost-effective, efficient, and inventive resolutions tailored to industry-specific challenges, thereby solidifying their enduring influence on society.

FAQs

A commercial drone, also known as an unmanned aerial vehicle (UAV) or remotely piloted aircraft system (RPAS), is an aircraft without a human pilot. It is used for various commercial, industrial, or professional purposes rather than recreational use.

Commercial drones have many applications, including aerial photography, agriculture and precision farming, construction and surveying, infrastructure inspection, search and rescue, environmental monitoring, and more.

The regulations for operating commercial drones vary from country to country. For example, the Federal Aviation Administration (FAA) regulates commercial drone operations in the United States. Operators often need to obtain a Remote Pilot Certificate, and there are restrictions on where and how drones can be flown, particularly near airports and populated areas.

Agriculture uses drones for crop monitoring, soil analysis, and pest control. They can capture high-resolution images and data to help farmers make informed decisions about planting, irrigation, and crop health.

Commercial drones are valuable for site surveys, progress monitoring, and safety inspections in construction. They can provide real-time aerial views of construction sites, helping project managers track progress, identify issues, and improve overall efficiency.

Privacy concerns can arise when drones are used for surveillance or photography, especially in residential areas. Many countries have regulations to address privacy issues, including restrictions on where drones can fly and how they can be used for photography.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)