Table of Contents

Introduction

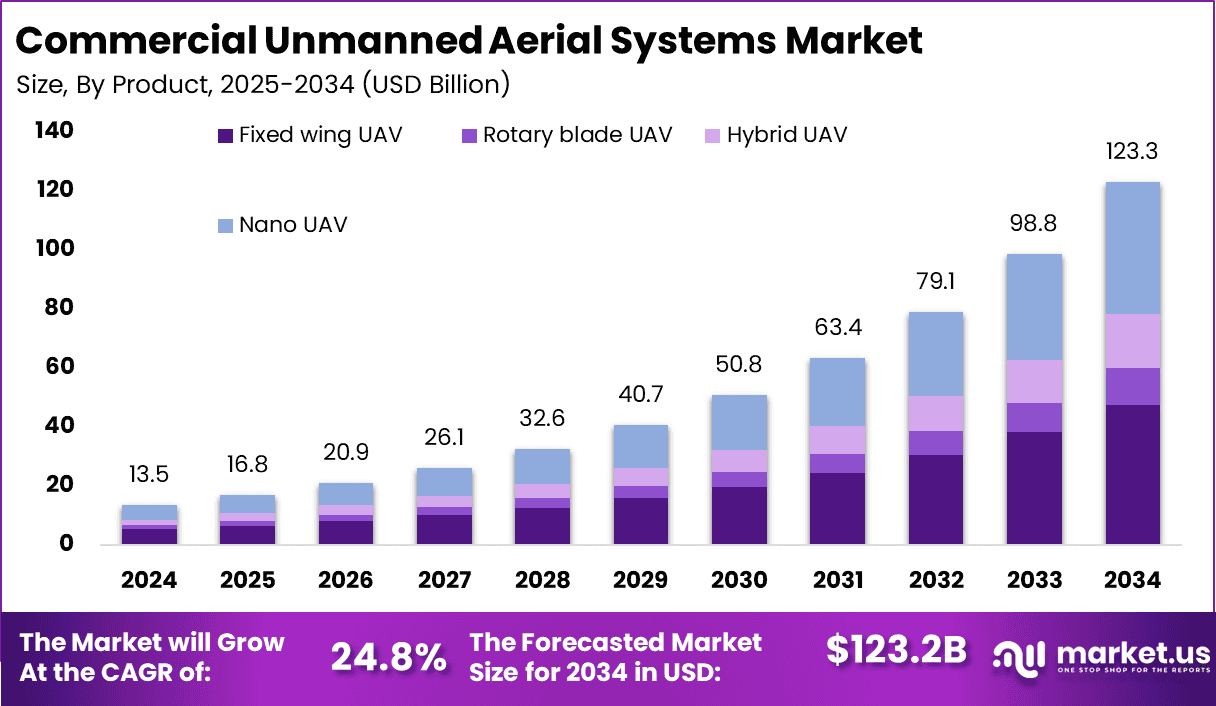

The global commercial unmanned aerial systems (UAS) market is projected to grow from USD 13.5 billion in 2024 to USD 123.3 billion by 2034, registering a CAGR of 24.8%. North America led the market in 2024 with a 39.2% share, equivalent to USD 5.2 billion. This growth is propelled by rising applications in logistics, agriculture, surveillance, and infrastructure inspection.

Increasing integration of AI, advanced sensors, and 5G connectivity enhances the operational capabilities of drones. Regulatory support, combined with growing private and government investments, positions commercial UAS as a transformative technology reshaping industries worldwide.

How Growth is Impacting the Economy

The rapid expansion of commercial UAS is significantly influencing the global economy by unlocking efficiencies and creating new revenue streams. Agricultural drones optimize crop monitoring and spraying, boosting food production and reducing resource wastage. Logistics companies benefit from last-mile delivery solutions, cutting transportation costs and carbon emissions. Infrastructure sectors use drones for faster inspections, reducing downtime and maintenance expenses. This efficiency accelerates GDP contributions in both developed and emerging economies.

The industry also fosters job creation in software development, manufacturing, and drone operations. Rising demand fuels investment in data centers, AI systems, and training programs. Governments recognize drones as tools for smart city management and disaster response, channeling funding into regulatory frameworks and innovation hubs. Collectively, commercial UAS adoption enhances productivity, reduces costs, and strengthens national competitiveness in the global economy.

➤ Unlock growth! Get your sample now! – https://market.us/report/commercial-unmanned-aerial-systems-market/free-sample/

Impact on Global Businesses

Businesses face rising costs linked to drone hardware, advanced sensors, and cloud-based data analytics platforms. Subscription fees for flight management software and integration with AI-driven platforms further increase expenses. Supply chains are shifting toward specialized UAS vendors, maintenance providers, and regulatory compliance consultancies. In agriculture, drones are transforming precision farming practices. Logistics and e-commerce firms deploy drones for efficient last-mile delivery, while construction and energy sectors rely on drones for monitoring and surveying. Media and entertainment companies benefit from aerial photography and live broadcasting. Each sector leverages drones for operational speed, efficiency, and enhanced decision-making.

Strategies for Businesses

To maximize opportunities, businesses are adopting multi-use UAS fleets, integrating drones into IoT ecosystems for real-time data insights. Strategic partnerships with software providers and cloud platforms enhance analytics capabilities. Companies invest in training programs to build a skilled workforce while ensuring compliance with aviation regulations. Hybrid models combining autonomous drones with human oversight reduce operational risks. Investing in cybersecurity safeguards drone data integrity. Furthermore, diversifying vendors and engaging with local regulators ensures resilience against supply chain disruptions and compliance-related hurdles.

Key Takeaways

- Market projected at USD 123.3 billion by 2034, CAGR 24.8%

- North America dominates with 39.2% share in 2024

- Agriculture, logistics, and surveillance drive adoption

- Costs rising due to sensors, AI, and compliance systems

- Strategic partnerships and workforce training are critical for growth

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=158211

Analyst Viewpoint

The commercial UAS market is on an exponential growth path, driven by adoption in logistics, agriculture, and infrastructure monitoring. Currently, drone applications are focused on enhancing efficiency and reducing costs. Future developments are expected to be powered by AI, 5G, and autonomous fleet management. With regulatory frameworks becoming clearer and infrastructure investments increasing, adoption among SMEs and large enterprises is anticipated to accelerate. Overall, the outlook remains highly positive, reflecting strong sectoral integration, innovation in drone technology, and expanding global acceptance of unmanned systems as critical business enablers.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Precision Agriculture | Yield optimization, smart spraying, crop health monitoring |

| Logistics & Delivery | Last-mile delivery efficiency, reduced fuel costs |

| Infrastructure Inspection | Cost reduction, faster project monitoring |

| Security & Surveillance | Border safety, crowd management, law enforcement |

| Media & Entertainment | Aerial filming, live event broadcasting |

Regional Analysis

North America leads due to strong investments, FAA-backed regulations, and robust demand in logistics and agriculture. Europe follows, driven by EU funding in smart city initiatives and drone-enabled public safety. Asia-Pacific is the fastest-growing region, fueled by China’s dominance in drone manufacturing, India’s digital transformation policies, and Japan’s integration of drones in agriculture. Latin America and the Middle East show emerging opportunities, particularly in oil & gas inspection and border security. Growing adoption across all regions is supported by improving connectivity, government-led drone regulations, and sector-specific demand.

Business Opportunities

Opportunities lie in SaaS platforms for drone fleet management, AI-powered analytics, and drone-as-a-service (DaaS) models for SMEs. Startups and enterprises can target agriculture and logistics by offering subscription-based drone solutions. The energy and construction sectors present a strong demand for aerial inspection tools. The rise of autonomous drone taxis and cargo delivery systems opens futuristic markets. Governments investing in surveillance, disaster relief, and infrastructure monitoring create procurement opportunities. Emerging economies with large agricultural bases and infrastructure development needs offer untapped growth potential. Businesses integrating drones with AI, blockchain, and IoT can differentiate and expand globally.

Key Segmentation

By Component: Hardware, Software, Services

By Application: Agriculture, Logistics & Transportation, Infrastructure Inspection, Media & Entertainment, Security & Surveillance, Others

By End-User: Commercial Enterprises, Government & Public Safety, Energy & Utilities, Construction, Retail & E-commerce

By Deployment: Cloud-Based, On-Premises

This segmentation highlights agriculture and logistics as major growth drivers, while government and public safety use cases are expected to expand rapidly with regulatory adoption and national security investments.

Key Player Analysis

Leading market participants are advancing R&D to enhance flight endurance, payload capacity, and AI-based autonomy. Companies are focusing on integrating drones with advanced sensors, cloud platforms, and geospatial software for real-time analytics. Expansion strategies include partnerships with logistics firms, telecom operators, and government agencies. Firms are also investing in modular drone architectures to support multi-sector applications. Service-based business models are being emphasized, enabling organizations to scale without heavy capital investments. Overall, innovation in design, analytics, and compliance-driven systems underpins their competitive positioning in the market.

- AeroVironment Inc.

- Aurora Flight

- BAE Systems Plc

- Challis Heliplane UAV Inc.

- DJI Innovations

- Draganfly, Inc.

- EHang

- Elbit Systems Ltd.

- General Dynamics Corporation

- Israel Aerospace Industries

- Parrot SA

- Prox Dynamics AS

- Frigoglass SAIC

- Textron Inc.

- The Boeing Company

- Turkish Aerospace Industries Inc.

- Yuneec Holding Ltd.

- Others

Recent Developments

- Feb 2024 – Launch of AI-enabled drone fleets for precision agriculture

- May 2024 – Partnerships with e-commerce giants for last-mile delivery trials

- Aug 2024 – Expansion of drone-based surveillance solutions in smart cities

- Oct 2024 – Introduction of modular drones for multi-sector applications

- Jan 2025 – Investment in regional drone hubs to enhance supply chain resilience

Conclusion

The commercial UAS market is entering a transformative phase, driven by strong adoption across industries, rapid technological innovation, and government support. With AI integration, 5G connectivity, and expanding use cases, drones are set to reshape business operations worldwide and create sustainable opportunities for long-term growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)