Table of Contents

Introduction

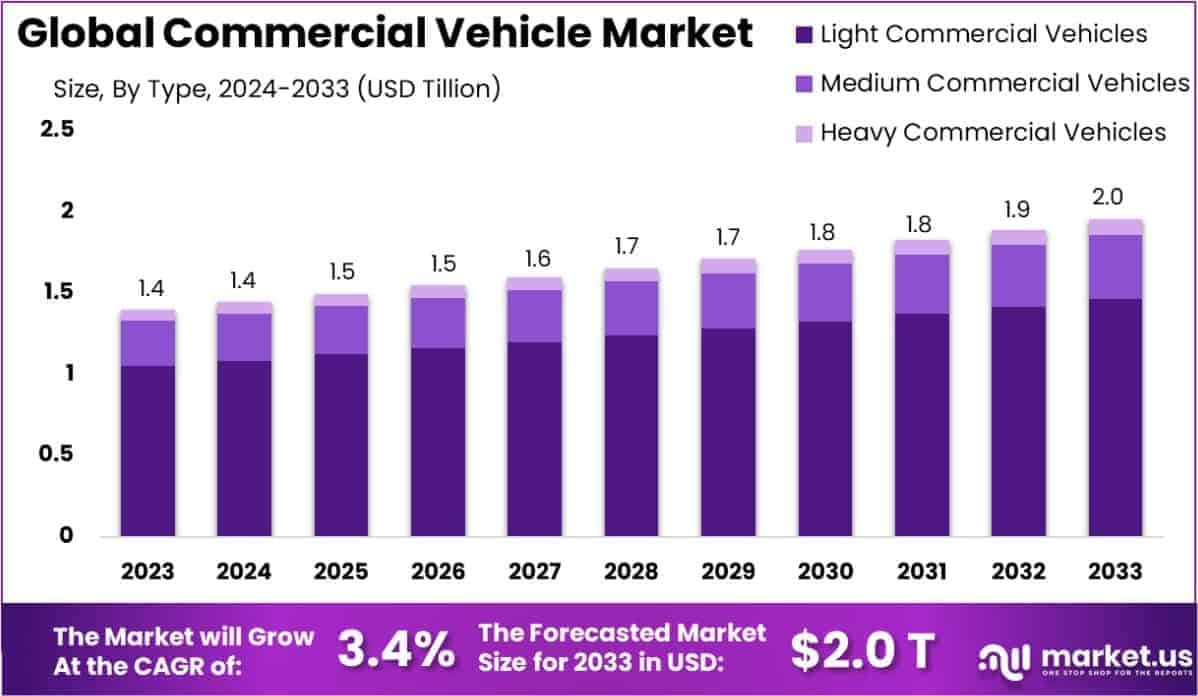

The global commercial vehicle market is projected to grow significantly, reaching an estimated valuation of USD 2.0 trillion by 2033, up from USD 1.4 trillion in 2023. This growth reflects a steady compound annual growth rate (CAGR) of 3.4% over the forecast period from 2024 to 2033.

A commercial vehicle is designed primarily for transporting goods, passengers, or providing specialized services in industries such as logistics, construction, agriculture, and public transportation. These vehicles range from light-duty trucks, vans, and buses to heavy-duty trucks and specialized vehicles like tankers and trailers. Unlike private vehicles, commercial vehicles are often tailored to meet the needs of businesses and governments, offering durability, higher load capacities, and operational efficiency for professional use.

The commercial vehicle market encompasses the production, sale, and distribution of vehicles that serve business-oriented purposes. This includes light commercial vehicles (LCVs), such as pickup trucks and delivery vans, as well as medium and heavy commercial vehicles (MHCVs), such as freight trucks, buses, and construction equipment.

The market is shaped by factors such as infrastructure development, industrial growth, urbanization, and the evolving needs of sectors like e-commerce and logistics. It represents a critical component of the global transportation and logistics ecosystem, with its performance directly linked to economic activity and industrial production.

Several factors are driving growth in the commercial vehicle market. The expansion of e-commerce has significantly increased demand for last-mile delivery vehicles, while rising urbanization and infrastructure projects in developing regions are fueling the need for construction and heavy-duty trucks.

Additionally, government policies promoting fleet modernization and the adoption of cleaner technologies, such as electric and hybrid commercial vehicles, are influencing market dynamics. Advances in vehicle technologies, including telematics and autonomous driving systems, are also creating new growth opportunities by enhancing operational efficiency and reducing long-term costs for businesses.

The demand for commercial vehicles is closely tied to economic growth and industrial activity. Key sectors driving demand include logistics, construction, agriculture, and public transportation. The ongoing growth of urban populations has led to a surge in demand for buses and vans to support efficient public transit systems, while the rapid expansion of trade and e-commerce has heightened the need for reliable and versatile transport solutions. Globally, developing countries are witnessing higher demand for commercial vehicles as industrialization accelerates and governments invest in large-scale infrastructure development.

The commercial vehicle market offers significant opportunities, particularly in areas like electrification, automation, and digitalization. The push toward reducing carbon emissions has created a growing demand for electric and alternative fuel-powered commercial vehicles, offering businesses an opportunity to align with environmental regulations while lowering operational costs.

Emerging markets present untapped potential, as rising industrialization and urbanization create new demands for transport infrastructure. Furthermore, digital solutions like fleet management software and connected vehicle technologies are opening avenues for enhancing efficiency, safety, and cost-effectiveness, making these sectors highly attractive for investment and innovation.

Key Takeaways

- The global commercial vehicle market is projected to grow from USD 1.4 trillion in 2023 to USD 2.0 trillion by 2033, at a CAGR of 3.4% from 2024 to 2033.

- In 2023, Light Commercial Vehicles (LCVs) dominated the market by type, accounting for 75% of the total share.

- The Internal Combustion Engine (ICE) segment led the market by drive type in 2023, holding a 60% share.

- The logistics segment was the largest contributor in the end-use category, representing 26% of the market in 2023.

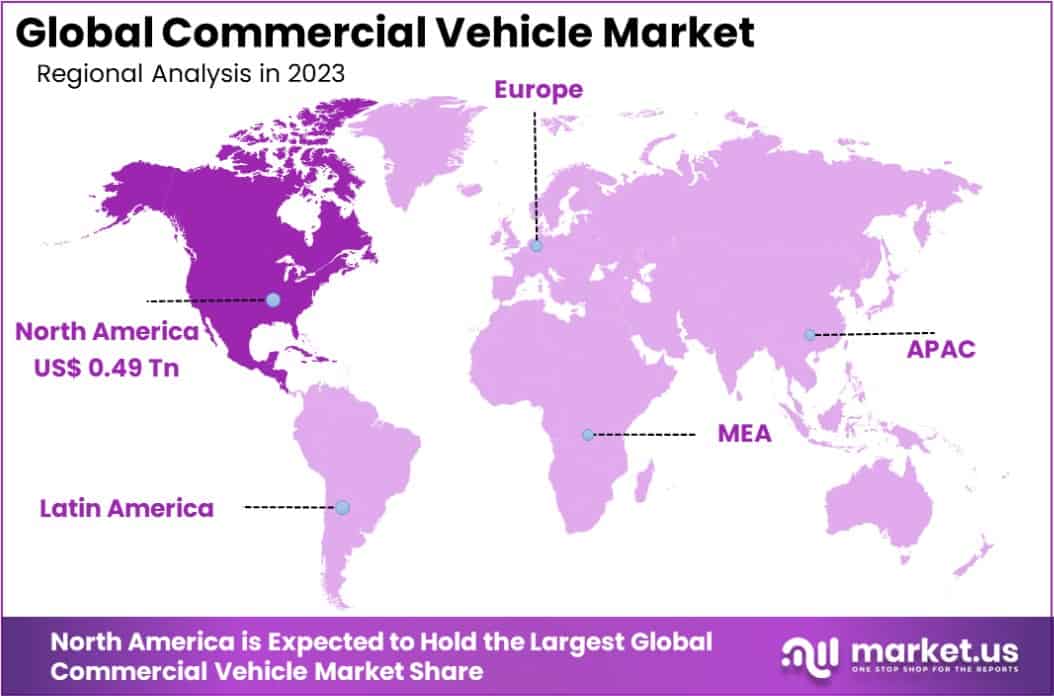

- North America was the leading regional market in 2023, with a 35.3% share, generating USD 0.49 trillion in revenue.

Commercial Vehicle Statistics

- Light commercial vehicle sales in August 2024 were 42,496 units, down from 45,257 in August 2023.

- Heavy commercial vehicle sales in August 2024 dropped to 21,221 units from 23,114 in August 2023.

- Medium commercial vehicle sales in August 2024 fell 0.58% YoY, reaching 6,137 units compared to 6,173 units in August 2023.

- Tata Motors recorded an 11.9% YoY decline in retail sales in August 2024, selling 24,817 units compared to 28,198 units in August 2023.

- Total commercial vehicle retail sales in August 2024 declined 6.05% YoY to 73,253 units, down from 77,967 units in August 2023.

- Commercial vehicle sales in July 2024 increased 5.93% YoY to 80,057 units compared to 75,573 units in July 2023.

- Heavy commercial vehicle sales in July 2024 grew 11.80% YoY, with 24,066 units sold versus 21,525 units in July 2023.

- Light commercial vehicle sales in July 2024 rose 2.04% YoY, reaching 45,336 units compared to 44,428 units in July 2023.

- Medium commercial vehicle sales in July 2024 increased 9.45% YoY, selling 7,124 units compared to 6,509 units in July 2023.

- Construction equipment vehicle sales in July 2024 grew 13.50% YoY, reaching 3,531 units compared to 3,111 units in July 2023.

- DC fast charging stations currently support power levels of 250-350 kW.

- Reducing vehicle weight by 10% can improve fuel economy by 6%-8%.

- Advanced materials like magnesium and carbon fiber composites can cut component weight by 50%-75%.

- Lightweight materials now account for 35% of commercial vehicle body composition.

- E-commerce growth has driven a 30% rise in demand for light commercial vehicles.

- 55% of commercial vehicle manufacturers face challenges in hiring technologically skilled workers.

- 70% of commercial vehicle manufacturers have adopted blockchain for supply chain transparency.

- The global commercial vehicle aftermarket, including parts and services, was valued at $300 billion in 2023.

- Out-of-state trucks account for nearly 50% of all combination truck miles in California and are projected to contribute 75% of medium and heavy-duty vehicle GHG emissions by 2050.

- Medium and heavy-duty ZEVs offer lifetime fuel and maintenance savings of $48,000-$84,000, depending on model year.

- By 2040, medium and heavy-duty ZEVs are expected to save $47,000 in net lifecycle costs per vehicle.

- California’s commercial fleet comprises 1.86 million vehicles, traveling 33.7 billion miles annually and consuming 3.7 billion gallons of petroleum-based fuels.

- Demand for used commercial vehicles grew by 15% in developing markets in 2023.

- By 2024, over 20% of global commercial fleets are expected to be fully or partially electric.

- Women make up 33% of the workforce in the Commercial Vehicle Group, while men account for 67%.

- The Commercial Vehicle Group employs 8,355 individuals.

- Of 4,811 fatal crashes in the U.S., 2,976 involved at least one large truck or bus.

- A commercial vehicle accident occurs every 8 minutes on average in the U.S., resulting in over 4,000 accidents daily.

Emerging Trends

- Shift to Electric Commercial Vehicles (e-CVs): The adoption of electric commercial vehicles is rapidly gaining momentum, driven by regulatory mandates and growing environmental awareness. For instance, global EV sales, including light commercial vehicles, are projected to surpass 30 million annually by 2030. Key trends include improvements in battery technology, reduced charging times, and increasing ranges of over 300 miles for some models. Governments and corporations are also providing incentives for transitioning to electric fleets.

- Integration of Advanced Driver-Assistance Systems (ADAS): The inclusion of features such as lane-keeping assistance, collision warnings, and automated emergency braking is becoming standard in commercial vehicles. Research suggests that these systems could reduce road accidents by up to 30%. ADAS adoption is being fueled by safety regulations, as well as fleet operators seeking to lower insurance costs and minimize accidents.

- Digital Connectivity and Telematics: Commercial vehicles are increasingly equipped with telematics and IoT devices, enabling real-time tracking, predictive maintenance, and improved fleet management. For instance, data shows that over 40% of fleets globally now use telematics systems to optimize delivery routes and monitor driver behavior, resulting in cost savings and operational efficiency.

- Rise of Autonomous Commercial Vehicles: Autonomous trucks and delivery vans are entering pilot programs worldwide, with Level 4 autonomy being tested in controlled environments. Autonomous vehicles promise to address driver shortages while reducing fuel consumption and delivery times. For example, the autonomous vehicle market is estimated to reach millions of units annually by 2040.

- Focus on Hydrogen Fuel-Cell Technology: Hydrogen-powered commercial vehicles are emerging as a viable alternative to battery electric vehicles, particularly for long-haul trucking. Hydrogen fuel cell trucks can achieve ranges of over 600 miles and refuel in under 10 minutes, making them attractive for industries requiring high mileage and efficiency. Several countries are now investing in hydrogen infrastructure to support this transition.

Top Use Cases

- Last-Mile Delivery Services: With e-commerce sales expected to grow by over 15% annually in many regions, commercial vehicles play a critical role in ensuring efficient last-mile delivery. Vans and smaller trucks are increasingly used in urban areas for parcel delivery, with demand surging in densely populated cities where consumer expectations for same-day delivery are high.

- Cold Chain Logistics: Commercial vehicles equipped with refrigeration systems are essential for transporting perishable goods, including food and pharmaceuticals. For instance, the global cold chain logistics market is anticipated to grow significantly as industries like healthcare rely on precise temperature controls during the transport of vaccines and biologics.

- Construction and Infrastructure Projects: Heavy-duty commercial vehicles such as dump trucks, cement mixers, and excavators are indispensable for construction activities. Global infrastructure spending is expected to exceed $94 trillion by 2040, with demand for commercial vehicles closely tied to these investments.

- Ride-Sharing and Passenger Transport Services: Light commercial vehicles, such as minibusses, are increasingly used in shared mobility solutions and public transport systems. Demand is particularly high in urban areas, where ride-hailing services and electric minibusses contribute to easing congestion and improving public transport accessibility.

- Agricultural Transport and Logistics: In many regions, commercial vehicles are heavily relied upon for transporting crops, livestock, and agricultural machinery. The global demand for agricultural transport vehicles is projected to increase as food production is expected to grow by 60% to feed a population of nearly 10 billion by 2050.

Major Challenges

- Rising Fuel Costs: Fuel accounts for approximately 30–40% of the total operating costs for commercial vehicles. With global fluctuations in fuel prices, fleet operators face growing pressure to manage costs, driving the need for fuel-efficient and alternative fuel-powered vehicles.

- Driver Shortages: The trucking industry faces a global shortfall of drivers, with estimates suggesting a gap of over 80,000 drivers in the U.S. alone. Aging workforces, high turnover rates, and lifestyle challenges are contributing to this issue, impacting the efficiency of supply chains worldwide.

- Stringent Emission Regulations: Governments across the globe are enforcing strict emissions standards, requiring fleet operators to upgrade their vehicles or adopt cleaner technologies. For instance, regulations such as Euro VI in Europe and similar standards in Asia and the Americas are significantly increasing compliance costs for businesses.

- Infrastructure Limitations for EVs: The adoption of electric commercial vehicles is hindered by inadequate charging infrastructure, particularly in rural or underdeveloped regions. Only a fraction of the required EV charging stations are currently available, delaying broader adoption of electric commercial vehicles.

- Supply Chain Disruptions: Global commercial vehicle production has faced disruptions due to shortages of critical components like semiconductors. This issue has resulted in extended delivery times, with some manufacturers experiencing delays of up to 12 months for new orders.

Top Opportunities

- Electrification of Fleets: Transitioning to electric commercial vehicles represents a significant growth opportunity. For example, some logistics companies have committed to converting over 50% of their fleet to electric vehicles by 2030. This trend is creating demand for electric vans, trucks, and supporting infrastructure like charging networks.

- Expansion in Emerging Markets: Developing economies in Asia, Africa, and South America are seeing rapid urbanization and infrastructure growth, driving demand for commercial vehicles. For instance, vehicle sales in these regions are projected to grow by double digits, fueled by construction, agriculture, and logistics sectors.

- Growth in Shared Mobility Services: The rise of shared and subscription-based vehicle services is opening new revenue streams for manufacturers. Businesses are increasingly leasing commercial vehicles for flexible use, which reduces upfront costs and encourages adoption in smaller enterprises.

- Development of Smart Fleet Management Solutions: The integration of telematics and AI-powered analytics offers significant growth opportunities. Smart fleet management solutions can reduce operating costs by up to 15%, enabling companies to monitor vehicle performance, optimize routes, and predict maintenance needs.

- Hydrogen Fuel Cell Adoption: Governments and corporations are investing billions in hydrogen technologies, creating new opportunities for fuel-cell-powered commercial vehicles. Hydrogen is expected to play a critical role in long-haul transportation, with several pilot projects underway to establish hydrogen refueling infrastructure globally.

Key Player Analysis

- Daimler AG: Daimler AG is one of the largest global manufacturers of commercial vehicles, producing trucks and buses under brands like Mercedes-Benz and Freightliner. In 2022, the company reported revenues of approximately €150 billion, with its Trucks division contributing around €50 billion. Daimler’s innovation in electric trucks, such as the eActros, positions it as a leader in sustainable commercial vehicles.

- Volvo Group: Volvo Group is a prominent player in heavy-duty trucks, construction equipment, and buses. In 2022, the company generated SEK 473 billion (approximately $46 billion) in net sales. Volvo has a significant focus on electrification, exemplified by its Volvo FH Electric truck series, and is a key player in autonomous vehicle development.

- Scania AB: Scania, a subsidiary of Volkswagen Group, specializes in heavy-duty trucks and buses. The company recorded sales of SEK 186 billion ($18 billion) in 2022. Scania’s focus on biofuels and electrified vehicles aligns with its sustainability goals, targeting net-zero emissions by 2040.

- Paccar Inc.: Paccar, a U.S.-based leader in medium- and heavy-duty trucks, owns brands such as Kenworth, Peterbilt, and DAF. In 2022, Paccar reported revenues of $29.4 billion. Its advancements in hydrogen fuel cell technology and electric trucks, like the Kenworth T680E, underscore its innovation focus.

- Tata Motors: Tata Motors, based in India, is a significant player in commercial vehicles, offering trucks, buses, and vans. The company achieved revenues of INR 3.45 trillion (approximately $42 billion) in FY 2023. Tata’s portfolio includes the Tata Ultra Electric, emphasizing its commitment to electrification.

North America Commercial Vehicle Market

North America Leading Region in Commercial Vehicle Market with Largest Market Share of 35.3%

North America dominated the global commercial vehicle market in 2023, accounting for the largest market share of 35.3% and a market valuation of approximately USD 0.49 trillion. This robust position is attributed to the region’s advanced infrastructure, high demand for freight and logistics services, and strong presence of leading automotive manufacturers. The United States and Canada are key contributors to this dominance, benefiting from well-developed transportation networks and rising e-commerce activities, which have accelerated the need for commercial vehicles.

Additionally, stringent government regulations promoting the adoption of fuel-efficient and low-emission vehicles further drive the regional market’s growth. North America’s leadership is bolstered by its strong innovation ecosystem, including advancements in electric and autonomous commercial vehicle technologies, making it a focal point for global investments and partnerships.

Recent Developments

- In 2024, Nikola Corporation continued advancing zero-emissions transportation by delivering 200 hydrogen fuel cell trucks in the first three quarters. This brings the total to 235 units since its market debut in late 2023, showcasing the company’s commitment to sustainable heavy-duty vehicle solutions.

- In June 2024, Hyundai Motor Company achieved a milestone with its XCIENT Fuel Cell trucks, surpassing 10 million kilometers driven by Swiss fleets. This accomplishment, reached in under four years, highlights the reliability and global potential of hydrogen-powered heavy-duty trucks.

- In September 2024, Ford Pro demonstrated its leadership in electrification at IAA TRANSPORTATION in Germany. The exhibit featured an expanded lineup of electric and hybrid vehicles, including the enhanced E-Transit range and the global debut of the Ranger PHEV, reinforcing Ford’s commitment to sustainable transportation solutions.

- In 2024, Scania introduced additional configurations for its electric truck lineup, providing tailored battery-electric solutions for diverse operational needs. This expansion aligns with Scania’s strategy to offer scalable and sustainable options to meet varying customer demands.

- In January 2024, PACCAR showcased its next-generation commercial vehicles at CES in Las Vegas. These vehicles integrate advanced technologies designed to enhance efficiency and customer value, reflecting PACCAR’s forward-thinking approach to transportation innovation.

- In 2023, Rivian announced the rollout of its all-electric Commercial Van for U.S. fleets in 2024. Built on the Amazon EDV platform, the van supports zero-emissions operations, aligning with Rivian’s mission to promote sustainable fleet solutions nationwide.

- In 2024, Volvo Trucks revealed plans to launch hydrogen-powered trucks with combustion engines. Testing will begin in 2026, aiming for commercial availability later in the decade, marking a significant step toward decarbonizing long-haul transportation.

Conclusion

The commercial vehicle market is poised for substantial growth in the coming decade, driven by expanding global industrial activities, rapid urbanization, and advancements in vehicle technologies. Electrification, digitalization, and the shift toward cleaner and more efficient transport solutions are reshaping the industry landscape. As businesses increasingly prioritize sustainability and operational efficiency, the adoption of electric, hydrogen-powered, and autonomous commercial vehicles is expected to accelerate.

Meanwhile, emerging markets present untapped opportunities, fueled by infrastructure development and rising demand across logistics, construction, and public transportation sectors. However, addressing challenges such as fuel cost volatility, driver shortages, and regulatory compliance will require industry stakeholders to invest in innovation and build resilient supply chains. As commercial vehicles remain essential for global economic activity, the market is set to evolve into a more sustainable and technology-driven ecosystem.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)