Table of Contents

- Introduction

- Editor’s Choice

- Communication Services Overview

- Worldwide Communication Software Market Size

- Unified Communications & Collaboration Market Size Worldwide

- Communication Tools and Channels Used for Work

- Communication Platform as a Service Market Statistics

- Communication Platform as a Service (CPaaS) Companies Statistics

- Communication Platform as a Service (CPaaS) Technology Statistics

- CPaaS – A2P Messaging Statistics

- Usage Trends

- Spending and Investments

- Innovations and Developments in Communication Platform as a Service Sector Statistics

- Regulations for Communication Platform as a Service Sector Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Communication Platform as a Service Statistics: CPaaS is a cloud-based platform that enables businesses to integrate communication features. Such as voice calling, messaging, and video conferencing, directly into their applications through a suite of APIs and SDKs.

This approach offers numerous benefits, including scalability, cost-effectiveness, flexibility, faster time to market, and enhanced user experience.

Further, common use cases include customer support, e-commerce, and telehealth. With organizations leveraging CPaaS to improve customer engagement and operational efficiencies.

The CPaaS market is experiencing significant growth, driven by the increasing demand for real-time communication solutions. Particularly in the wake of the COVID-19 pandemic.

Editor’s Choice

- The global Communication Platform as a Service (CPaaS) market revenue reached USD 14.0 billion in 2023.

- In 2032, the IT & Telecom sector is forecasted to contribute USD 24.93 billion. Followed by BFSI (USD 21.78 billion), Retail & E-commerce (USD 22.99 billion), Transportation & Logistics (USD 18.15 billion), Travel & Hospitality (USD 22.99 billion), and other end users (USD 10.16 billion).

- In the global Communication Platform as a Service (CPaaS) market. Organization size plays a significant role in determining market share distribution. Large enterprises dominate the market, holding a 57% share.

- The Communications Platform as a Service (CPaaS) market has shown significant revenue growth across various regions from 2020 to 2025. North America consistently led the market. With revenues increasing from USD 3.4 billion in 2020 to an expected USD 11.62 billion by 2025. Underscoring the strong adoption of CPaaS solutions in this region.

- On aggregate, the CPaaS market has a combined market capitalization of USD 30.0 billion. With an overall revenue CAGR of 34.4% (FY17-22) and a projected CAGR of 18.0% (FY22-25E).

- In FY22, the revenue of major global communications platforms as a service (CPaaS) providers varied significantly, led by Twilio. Which reported the highest revenue at USD 2.842 million.

- In Norway in 2020, the daily use of media and communication platforms varied by generation. Millennials, born between 1983 and 1999, reported the highest usage, with an average of 26.1 platforms utilized each day.

Communication Services Overview

Global Communication Services Market Revenue

- The global communication services market has shown a gradual yet steady increase in revenue from 2017 to 2028.

- Beginning at USD 1.3 trillion in 2017, the market grew to USD 1.32 trillion in 2018 and maintained this level in 2019.

- In 2020, revenues rose slightly to USD 1.34 trillion, reflecting modest growth amid increasing demand for digital communication services.

- This upward trend continued in 2021, with revenue reaching USD 1.37 trillion. Followed by further increments to USD 1.4 trillion in 2022 and USD 1.43 trillion in 2023.

- Forecasts suggest that the global communication services market will continue expanding. With projected revenues of USD 1.46 trillion in 2024 and USD 1.49 trillion in 2025.

- By 2026, the market is expected to grow to USD 1.52 trillion. Reaching USD 1.55 trillion in 2027 and USD 1.58 trillion by 2028.

- This consistent growth trajectory underscores the increasing demand for communication services worldwide. Driven by the proliferation of digital technologies, remote work trends, and the expanding need for reliable connectivity.

(Source: Statista)

Global Communication Services Revenue – By Segment

- From 2018 to 2028, global revenue in the communication services market has shown distinct trends across its primary segments: mobile data, fixed data, mobile voice, and fixed voice.

- Mobile data revenue has exhibited steady growth. Starting at USD 0.49 trillion in 2018, and is expected to reach USD 0.76 trillion by 2028. This increase reflects the rising demand for mobile internet services driven by smartphone penetration and mobile applications.

- Fixed data services also experienced a consistent upward trend. With revenue increasing from USD 0.33 trillion in 2018 to a projected USD 0.47 trillion in 2028. Indicating the continued importance of fixed broadband infrastructure for home and business connectivity.

- In contrast, mobile voice revenue has seen a gradual decline, decreasing from USD 0.32 trillion in 2018 to an anticipated USD 0.22 trillion by 2028. As users increasingly rely on data-based communication services over traditional voice calls.

- Fixed voice services have similarly declined over this period, from USD 0.17 trillion in 2018 to a projected USD 0.12 trillion in 2028, reflecting the shift away from landline telephony.

- These trends highlight the shift in consumer and business preferences toward data-driven services over traditional voice communication. Shaping the revenue landscape within the global communication services market.

(Source: Statista)

Communication Services Revenue Worldwide – By Country

- Between 2017 and 2028, the global communication services revenue demonstrated varied growth across major countries, led by the United States.

- In 2017, the United States had the highest revenue in the sector at USD 317,860.97 million. Which gradually rose over the years, reaching an expected USD 356,670.80 million by 2028.

- China, the second-largest contributor, recorded USD 193,275.83 million in 2017. Increasing to an anticipated USD 266,022.20 million by 2028. Reflecting the growing demand for communication services in the country.

- Japan’s revenue in the communication services market remained relatively stable. Starting at USD 95,491.25 million in 2017, and is expected to rise slightly to USD 101,588.75 million by 2028.

- Germany experienced a steady increase, with revenues rising from USD 46,052.10 million in 2017 to an estimated USD 62,612.58 million in 2028.

- Brazil also showed consistent growth, beginning at USD 38,563.04 million in 2017 and reaching an anticipated USD 46,119.24 million by 2028.

- This steady growth across countries reflects the expanding need for communication services globally, although the pace varies by country.

- The data indicates that developed markets, such as the United States and Germany, continue to see robust growth. In contrast, emerging markets like China show strong demand as communication infrastructure expands and digital adoption rises.

(Source: Statista)

Worldwide Communication Software Market Size

- The global communication software and application market has shown steady growth from 2018 to 2025.

- In 2018, the market size was valued at USD 9,806 million, and it grew to USD 10,053 million in 2019. Reflecting a consistent increase in demand for communication solutions.

- Although there was a slight decrease in 2020, with the market dipping marginally to USD 10,045 million, the upward trend resumed in subsequent years.

- By 2021, the market had reached USD 10,236 million, followed by an increase to USD 10,430 million in 2022.

- In 2023, the market continued to expand, reaching USD 10,629 million, and is projected to grow further, with estimations of USD 10,830 million in 2024 and USD 11,033 million in 2025.

- This steady growth pattern underscores the increasing reliance on communication software and applications to support evolving business needs and digital transformation initiatives across various industries.

(Source: Statista)

Unified Communications & Collaboration Market Size Worldwide

- The global unified communications and collaboration market has demonstrated a robust growth trajectory from 2018 to 2028.

- Starting at USD 32.97 billion in 2018, the market expanded to USD 38.8 billion in 2019. Driven by the rising need for integrated communication and collaboration solutions across enterprises.

- This growth continued into 2020, with the market reaching USD 47.2 billion as businesses increasingly adopted digital solutions to facilitate remote work and connectivity.

- By 2021, the market size had further increased to USD 53.5 billion. Followed by USD 59.3 billion in 2022, reflecting sustained demand as organizations sought efficient communication tools.

- In 2023, the market reached USD 64.2 billion and is projected to grow to USD 69.1 billion by 2024.

- Looking further ahead, the market is anticipated to reach USD 85 billion by 2028.

- This continued expansion underscores the importance of unified communications and collaboration technologies in supporting modern work environments and enhancing productivity through streamlined communication.

(Source: Statista)

Communication Tools and Channels Used for Work

- As of the third quarter of 2022, professionals worldwide demonstrated a high reliance on various communication channels and digital tools for work. With significant usage frequency across several platforms.

- Phone calls were the most widely used tool, with 94.3% of professionals utilizing them overall and 74.2% relying on them daily.

- Email followed closely, used by 94.1% overall and 73.8% daily.

- Office software, such as Google Docs and Microsoft Office, was also widely adopted, with 90.8% of professionals using it and 71% engaging daily.

- Video calls were used by 87.5% of professionals, though only 55.2% did so daily.

- Messenger services and chat applications, like WhatsApp and Skype. They were used by 85.9% of professionals overall, with a daily usage rate of 67.4%.

- SMS text messaging showed similar trends, with 85.8% overall usage and 60% daily engagement.

- Collaboration tools, including platforms like Microsoft Teams and Slack. It had an 85.1% overall usage rate, with 60.7% of users accessing them daily.

- Social media tools were used by 83.6% of professionals, with 61.4% engaging daily. Indicating their integration into work routines.

- Finally, product and task management tools, such as Trello and Jira, were utilized by 77.7% of professionals, with a daily usage rate of 53.4%.

- These trends underscore the diversity and frequency of tool usage among professionals. Reflecting a broad reliance on digital tools to support efficient work practices.

(Source: Statista)

Communication Platform as a Service Market Statistics

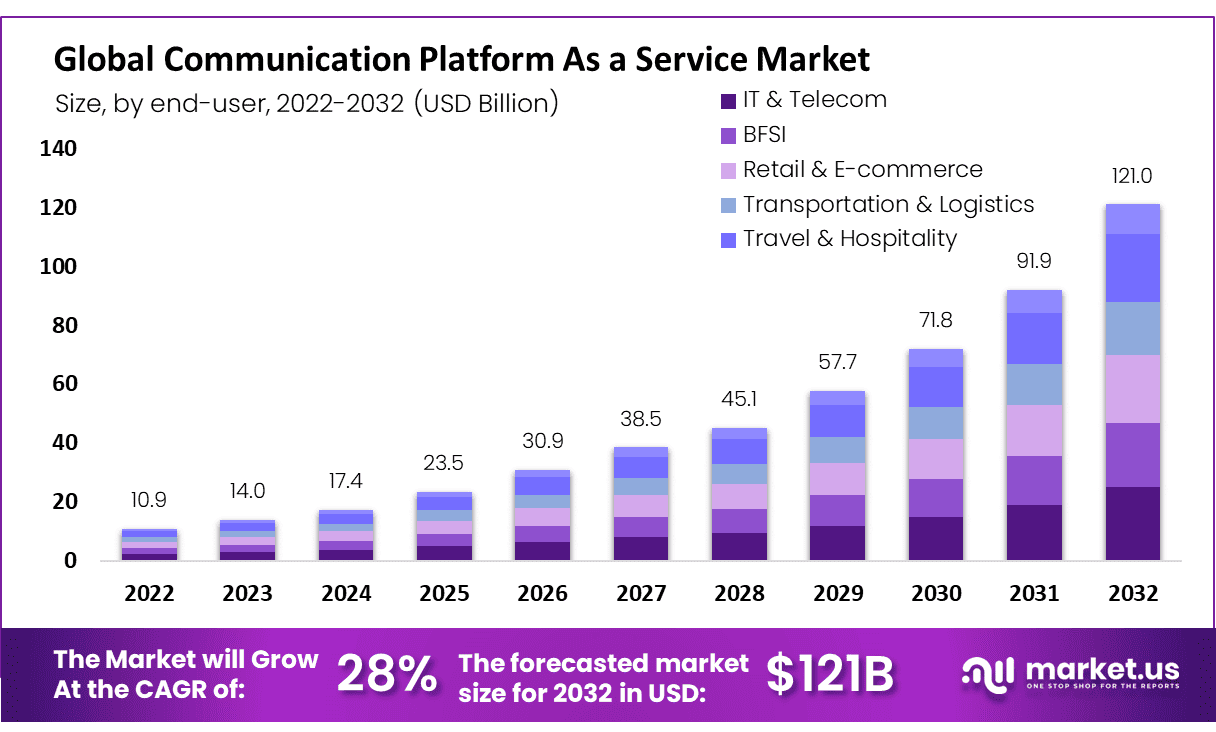

Global Communication Platform as a Service Market Size Statistics

- The global Communication Platform as a Service (CPaaS) market is projected to witness substantial growth over the next decade at a CAGR of 28%.

- In 2022, the market was valued at USD 10.9 billion, and it is anticipated to expand at a significant pace, reaching USD 14.0 billion in 2023.

- The upward trend is expected to continue, with the market size projected at USD 17.4 billion in 2024, followed by a leap to USD 23.5 billion in 2025.

- By 2026, the market is forecasted to reach USD 30.9 billion, further increasing to USD 38.5 billion in 2027.

- This growth trajectory suggests that the market will continue its expansion. Hitting USD 45.1 billion by 2028 and USD 57.7 billion by 2029.

- The market is expected to experience rapid acceleration, reaching USD 71.8 billion by 2030 and USD 91.9 billion in 2031.

- By 2032, the market size is projected to nearly double from the 2030 level. Achieving a valuation of USD 121.0 billion.

- This steady growth highlights the increasing adoption and integration of CPaaS solutions across various industries. Driven by the need for streamlined and flexible communication services.

(Source: market.us)

Global Communication Platform as a Service Market Size – By End-user Statistics

2022-2026

- The global Communication Platform as a Service (CPaaS) market is projected to witness robust growth across various end-user industries between 2022 and 2026.

- The market, valued at USD 10.9 billion in 2022, saw significant contributions from sectors such as IT & Telecom (USD 2.25 billion), BFSI (USD 1.96 billion), Retail & E-commerce (USD 2.07 billion), Transportation & Logistics (USD 1.64 billion), Travel & Hospitality (USD 2.07 billion), and other end users (USD 0.92 billion).

- By 2023, the overall market size grew to USD 14.0 billion, with IT & Telecom and BFSI segments contributing USD 2.88 billion and USD 2.52 billion, respectively.

- This upward trajectory continued, with the market expanding to USD 17.4 billion in 2024, USD 23.5 billion in 2025, and USD 30.9 billion in 2026.

- During these years, the Retail & E-commerce and Transportation & Logistics sectors also exhibited growth, with contributions rising from USD 2.07 billion in 2022 to USD 5.87 billion and USD 4.64 billion, respectively, by 2026.

2027-2032

- The market’s expansion in 2027 saw it reaching USD 38.5 billion, and the IT & Telecom segment contributed USD 7.93 billion, followed closely by BFSI at USD 6.93 billion.

- Further growth projections indicate that the CPaaS market will reach USD 45.1 billion by 2028 and USD 57.7 billion by 2029, with the Retail & E-commerce sector contributing USD 10.96 billion in 2029.

- By 2030, the market is anticipated to hit USD 71.8 billion, with notable growth across all segments. Including Transportation & Logistics at USD 10.77 billion and Travel & Hospitality at USD 13.64 billion.

- This growth trend is expected to continue, culminating in a projected market size of USD 91.9 billion in 2031 and USD 121.0 billion by 2032.

- In 2032, the IT & Telecom sector is forecasted to contribute USD 24.93 billion. Followed by BFSI (USD 21.78 billion), Retail & E-commerce (USD 22.99 billion), Transportation & Logistics (USD 18.15 billion), Travel & Hospitality (USD 22.99 billion), and other end users (USD 10.16 billion).

- This growth reflects the rising adoption of CPaaS solutions across industries. Driven by the demand for flexible and scalable communication solutions.

(Source: market.us)

Global Communication Platform as a Service Market Share – By Organization Size Statistics

- In the global Communication Platform as a Service (CPaaS) market. Organization size plays a significant role in determining market share distribution.

- Large enterprises dominate the market, holding a 57% share, reflecting their substantial investments in scalable and robust communication solutions to support extensive operations and customer engagement needs.

- Small and medium-sized enterprises (SMEs) account for the remaining 43% of the market share. Driven by the growing adoption of CPaaS solutions to enhance agility and optimize customer communications.

- This division highlights the relevance of CPaaS across different organization sizes, catering to diverse operational demands and budgetary constraints.

(Source: market.us)

Communication Platform as a Service Market Revenue – By Region Statistics

- The Communications Platform as a Service (CPaaS) market has shown significant revenue growth across various regions from 2020 to 2025.

- North America consistently led the market, with revenues increasing from USD 3.4 billion in 2020 to an expected USD 11.62 billion by 2025. Underscoring the strong adoption of CPaaS solutions in this region.

- Latin America experienced steady growth as well, with revenues rising from USD 0.51 billion in 2020 to a projected USD 1.87 billion in 2025.

- Europe followed a similar upward trend, growing from USD 1.04 billion in 2020 to an anticipated USD 3.58 billion in 2025. Reflecting expanding demand across European markets.

- The Far East and China showed robust growth, with revenues projected to increase from USD 1.23 billion in 2020 to USD 5.14 billion by 2025. Highlighting the increasing penetration of CPaaS solutions in Asian markets.

- The “Rest of the World” category, encompasses regions outside of the primary markets. Also demonstrated growth, with revenues rising from USD 0.95 billion in 2020 to an expected USD 3.78 billion by 2025.

- This regional growth distribution indicates a global expansion in CPaaS adoption. Driven by the growing need for scalable communication platforms across industries worldwide.

(Source: Statista)

Global Communication Platform as a Service (CPaaS) Market Share – By Vendor Statistics

- As of the second quarter of 2021, the global Communications Platform as a Service (CPaaS) market was led by Twilio. Which held a dominant market share of 38%, reflecting its strong positioning and widespread adoption in the CPaaS space.

- Vonage followed as the second-largest vendor, capturing 11.8% of the market. While Sinch held an 8.1% share, indicating a solid market presence among enterprise clients.

- Bandwidth and MessageBird accounted for 6.5% and 5.6% of the market, respectively, demonstrating their competitive roles in the industry.

- The remaining 30% of the market was occupied by other vendors. Highlighting a diverse competitive landscape with multiple smaller players contributing to overall market dynamics.

- This distribution reflects the competitive nature of the CPaaS market, with a few major players leading and several smaller vendors actively participating.

(Source: Statista)

Communication Platform as a Service (CPaaS) Companies Statistics

Key Financial Metrics Among Leading Communication Platform as a Service Players Statistics

- The global Communications Platform as a Service (CPaaS) market, is represented by prominent players across various countries. This has shown significant financial variation and growth projections between FY17 and FY25E.

- Twilio, based in the United States, leads with a market capitalization of USD 11.0 billion, and a revenue CAGR of 59.3% from FY17 to FY22. Projected to grow at 22.4% CAGR from FY22 to FY25E. Despite a negative EBITDA margin of –21.0% in FY22, Twilio is expected to achieve a positive margin of 8.6% by FY24E, with an EV/EBITDA multiple of 21.0x and a P/S ratio of 2.5x.

- Other notable players include RingCentral (US), with a USD 3.7 billion market cap, a 33.2% revenue CAGR (FY17-22), and an EBITDA margin projected to reach 21.2% by FY24E. Sinch (Sweden) holds a market cap of USD 3.9 billion and shows a strong CAGR of 51.5% (FY17-22), with its EBITDA margin expected to improve to 11.9% by FY24E.

- Five9, also based in the US, has a market cap of USD 5.5 billion, a 30.3% revenue CAGR, and an expected EBITDA margin of 17.8% by FY24E. Along with an EV/EBITDA of 35.8x, one of the highest among its peers.

More Insights

- In India, Route Mobile and Tanla Platforms exhibit robust growth trajectories with projected revenue CAGRs of 36.2% and 13.1% from FY22 to FY25E, and EBITDA margins improving to 12.3% and 18.1%, respectively, by FY24E.

- Smaller players such as Link Mobility (Norway) and Kaleyra (Italy) have market caps of USD 0.3 billion and USD 0.1 billion, respectively, with lower but steady growth expectations.

- On aggregate, the CPaaS market has a combined market capitalization of USD 30.0 billion, with an overall revenue CAGR of 34.4% (FY17-22) and a projected CAGR of 18.0% (FY22-25E). EBITDA margins, though initially negative in FY22 at -3.9%, are anticipated to improve to 13.6% by FY24E.

- The aggregated EV/EBITDA and P/S ratios for FY24E stand at 11.9x and 1.6x. Reflecting the market’s growth potential despite varied financial metrics among individual players.

(Sources: Bloomberg, HSIE Research)

Revenue of Major Communication Platform as a Service Players Globally Statistics

- In FY22, the revenue of major global communications platforms as a service (CPaaS) providers varied significantly, led by Twilio, which reported the highest revenue at USD 2.842 million.

- Sinch followed with USD 1.886 million, while RingCentral generated USD 1.595 million. Positioning these three companies as the largest CPaaS revenue earners.

- Verint Systems recorded USD 0.875 million, and 8X8 reported USD 0.638 million, followed closely by Five9 with USD 0.61 million.

- Link Mobility Group Holding and Bandwidth saw revenues of USD 0.513 million and USD 0.491 million, respectively.

- Tanla Platforms generated USD 0.401 million, with Route Mobile slightly lower at USD 0.25 million.

- Kaleyra reported the lowest revenue among these players, at USD 0.268 million.

- Further, this data highlights the wide revenue spectrum among CPaaS companies. Reflecting varied market positions and business scales within the industry.

(Source: HSIE Research)

Revenue CAGR for Global Communication Platform as a Service Player Statistics

- Between FY17 and FY22, the revenue Compound Annual Growth Rate (CAGR) of global Communications Platform as a Service (CPaaS) players reflected strong growth, with Twilio leading the sector at a remarkable 59.3%.

- Sinch followed with a robust CAGR of 51.2%, and Tanla Platforms exhibited impressive growth as well, with a CAGR of 40.8%.

- Link Mobility Group Holding and Route Mobile both recorded similar growth rates, with CAGRs of 34.6% and 34.3%, respectively, slightly above the total CPaaS industry CAGR of 33.8%.

- RingCentral demonstrated consistent growth with a CAGR of 33.2%, while Five9 achieved a CAGR of 30.3%.

- Bandwidth’s revenue CAGR was 26.4%, and 8X8 showed a growth rate of 20.3%. Reflecting steady but comparatively lower growth.

- This distribution of growth rates highlights Twilio and Sinch as the most rapidly expanding players. At the same time, the industry as a whole exhibited strong expansion driven by increased adoption of CPaaS solutions across diverse markets.

(Source: HSIE Research)

Communication Platform as a Service (CPaaS) Technology Statistics

- In FY22, the Communications Platform as a Service (CPaaS) market was heavily dominated by SMS business messaging, which accounted for 95% of the market share.

- However, projections indicate a significant shift by FY27, with SMS business messaging’s share expected to decrease to 71% as other technologies gain traction.

- RCS (Rich Communication Services) business messaging, for instance, is anticipated to expand from a minimal 1% share in FY22 to 13% by FY27. Reflecting the growing adoption of more interactive and media-rich messaging solutions.

- OTT (Over-the-Top) business messaging is also expected to increase its market share from 1% in FY22 to 8% by FY27. Driven by the popularity of app-based messaging platforms.

- Voice services, which held a 3% share in FY22, are forecasted to rise to 8% by FY27 as demand for voice-enabled customer interaction grows.

- Push notifications are projected to maintain a negligible presence in the CPaaS market. Holding a 0% share both in FY22 and FY27.

- This shift in technology share highlights an evolving CPaaS landscape, with emerging messaging formats such as RCS and OTT gradually supplementing traditional SMS as businesses diversify their communication strategies.

(Source: HSIE Research)

CPaaS – A2P Messaging Statistics

Global A2P SMS Volume

- Between 2013 and 2020, the number of Application-to-Person (A2P) SMS messages sent worldwide exhibited a steady increase. Peaking in the late 2010s before showing a slight decline by 2020.

- In 2013, approximately 956 billion A2P SMS messages were sent, growing modestly to 963 billion in 2014.

- This growth trend continued, with 1,067 billion messages in 2015 and 1,176 billion in 2016.

- By 2017, the volume reached 1,255 billion, and in 2018, it rose to 1,292 billion. Marking the highest annual volume in this period.

- However, in 2019, the number slightly declined to 1,264 billion, followed by a further decrease to 1,243 billion in 2020.

- This trend reflects the evolving dynamics in the messaging industry. Where A2P SMS usage peaked but then began to decline as alternative communication channels gained prominence.

(Source: Statista)

A2P & P2A SMS Traffic Worldwide

- From 2011 to 2018, the global volume of Application-to-Person (A2P) and Person-to-Application (P2A) SMS messages showed a consistent upward trend.

- In 2011, approximately 1,174 billion SMS messages were sent worldwide, increasing to 1,315 billion in 2012.

- This growth continued in the following years, with 1,436 billion messages recorded in 2013 and 1,540 billion in 2014.

- By 2015, the total volume reached 1,625 billion, reflecting the expanding use of SMS for both A2P and P2A communication.

- The trend persisted, with 1,688 billion messages sent in 2016 and 1,733 billion in 2017.

- By 2018, the volume of A2P and P2A SMS messages had grown to 1,762 billion. Marking a steady increase in the use of SMS as a reliable communication tool for interactions between applications and users.

- This period of consistent growth underscores the role of SMS as a versatile messaging channel widely used across industries and consumer segments.

(Source: Statista)

A2P & P2A SMS Traffic Worldwide – By Region

- From 2011 to 2018, the number of Application-to-Person (A2P) and Person-to-Application (P2A) SMS messages sent worldwide increased steadily across all regions.

- The Asia Pacific region led in message volume, starting at 490 billion messages in 2011 and growing consistently each year, reaching 665 billion in 2018.

- North America followed closely, with 453 billion messages in 2011, increasing to 641 billion by 2018, reflecting sustained demand for SMS communication in this region.

- In Europe, the volume of A2P and P2A SMS messages also saw substantial growth, from 154 billion messages in 2011 to 288 billion in 2018.

- Latin America and the Middle East & Africa, while smaller in absolute terms, experienced notable increases as well.

- Latin America’s SMS volume rose from 52 billion in 2011 to 147 billion in 2018. While the Middle East & Africa increased from 24 billion in 2011 to 81 billion by 2018.

- This growth trend across regions highlights the continued reliance on SMS as a communication tool globally. Driven by widespread mobile adoption and the utility of SMS in both business and personal communication across various markets.

(Source: Statista)

Global A2P SMS Messaging Revenues – By Type of Traffic

- Between 2020 and 2027, the global revenues from application-to-person (A2P) SMS messaging showed substantial growth across different traffic types.

- Directly connected traffic, which constituted the bulk of the revenue, started at USD 36,690.2 million in 2020 and rose steadily each year. Reaching an estimated USD 58,524.2 million by 2027. This consistent increase reflects the rising reliance on direct connections for secure and reliable A2P messaging.

- In contrast, revenue from grey route traffic—a less regulated form of SMS transmission—decreased significantly over the same period.

- Beginning at USD 1,121.7 million in 2020, grey route traffic revenue declined annually, dropping to USD 75.1 million by 2027. This trend indicates a shift towards more regulated, directly connected routes as the industry moves away from unverified channels.

- Revenues from A2P Rich Communication Services (RCS), an advanced messaging format, surged considerably. In 2020, A2P RCS generated USD 197.1 million, but this figure is expected to grow rapidly, reaching USD 19,155.5 million by 2027.

- The substantial rise in RCS revenues reflects the increased adoption of this technology. Which offers more interactive features compared to traditional SMS. This shift highlights the evolution in messaging preferences, with businesses adopting richer communication channels to enhance user engagement.

(Source: Statista)

Global A2P SMS Share – By Industry

- In 2017, the forecasted B2C SMS traffic share by industry exhibited notable regional variations across Argentina, Brazil, Germany, Spain, and the United Kingdom.

- The banking sector dominated SMS traffic in Argentina (33%) and Brazil (36%), reflecting strong adoption of SMS for customer communications in these countries. In Germany and Spain, banking held a significant share as well, at 25%, while in the United Kingdom, it accounted for a lower 21%.

- The Over-the-Top (OTT) sector was particularly prominent in the United Kingdom. Representing 32% of SMS traffic, in contrast to 17% in Germany and 15% in both Argentina and Brazil.

- Retail accounted for 23% of SMS traffic in Germany and Spain, showing strong engagement with customers through SMS in these markets, compared to 18% in the United Kingdom and lower shares in Argentina (10%) and Brazil (5%).

- Health and education sectors contributed similarly across all five countries, ranging from 7% to 8%. Public administration saw the highest share in Spain (10%), with moderate shares in Argentina, Brazil, and Germany (7%) and a lower 3% in the United Kingdom.

- The transport and logistics industry maintained shares of 5% to 8% in Argentina, Brazil, Germany, and Spain but was less significant in the United Kingdom at 2%.

- The hospitality, tourism, and home services sectors showed relatively low shares across all countries, typically between 0.5% and 4%. The “Other” category contributed consistently, around 13% to 15% in each region.

- These industry distributions highlight regional preferences for SMS in B2C communication across various sectors, with banking, OTT, and retail being the leading contributors in most countries.

(Source: Statista)

Usage Trends

- In Norway in 2020, the daily use of media and communication platforms varied by generation.

- Millennials, born between 1983 and 1999, reported the highest usage, with an average of 26.1 platforms utilized each day.

- Generation X, born between 1964 and 1982, followed closely with 25.2 platforms.

- Generation Z, born in 2000 or later, used 22.3 platforms on average, aligning with the overall national average across generations.

- Baby Boomers, born between 1943 and 1963, reported a daily use of 20.5 platforms. While the Silent Generation, born in 1943 or earlier, used the fewest platforms daily, averaging 15.3.

- This data highlights a trend of higher platform usage among younger generations. Millennials and Generation X are the most active users of diverse media and communication channels in Norway.

(Source: Statista)

Spending and Investments

- From 2019 to 2028, the average per capita spend on communication services worldwide is projected to increase across mobile data and fixed data segments. While expenditures on mobile and fixed voice services are expected to decline.

- In 2019, the per capita spend on mobile data was USD 68.09, rising steadily each year to reach an anticipated USD 94.79 by 2028. Indicating growing reliance on mobile data services.

- Fixed data followed a similar upward trend, with spending rising from USD 47.32 in 2019 to a projected USD 59.18 by 2028.

- In contrast, spending on mobile voice services is forecasted to decrease from USD 40.47 in 2019 to USD 28.07 by 2028. Reflecting a shift toward data-driven communication solutions.

- Fixed voice services are expected to see an even sharper decline, from USD 21.69 per capita in 2019 to USD 15.33 by 2028.

- This trend underscores a global shift from traditional voice services to data-centric communication as digital and internet-based platforms become the preferred means of connectivity.

(Source: Statista)

Innovations and Developments in Communication Platform as a Service Sector Statistics

- In the rapidly evolving Communication Platform as a Service (CPaaS) sector. 2023 has been marked by significant advancements and transformations driven by technological innovation and strategic acquisitions.

- Notably, Twilio, Sinch, and Infobip have emerged as key players, undertaking substantial mergers and acquisitions to solidify their market positions. Indicating a trend toward consolidation within the industry.

- These companies have expanded their CPaaS capabilities beyond traditional APIs to more comprehensive solutions. Encompassing customer service, marketing, e-commerce, and contact centers, enhancing their offerings to meet the diverse needs of business users.

- Further, a significant development in CPaaS is the integration of AI and automation technologies. Which are revolutionizing customer interactions by enabling more personalized and efficient communication across various channels. Including emerging ones like WhatsApp, RCS, and Apple Business Messages.

- For instance, Twilio has integrated AI to refine the capabilities of its CPaaS solutions, offering features like real-time data analytics and enhanced customer interaction through its CustomerAI technology.

- Moreover, the sector is witnessing a shift towards embracing 5G technology. Which reduces latency and enhances the quality of video communications. A critical feature as real-time, high-quality video interactions become more prevalent in industries such as healthcare and finance.

- This technological advancement supports the development of more dynamic and responsive communication tools, further fueling the growth and adoption of CPaaS solutions globally.

- Overall, the CPaaS market is not just growing; it is being redefined by strategic innovations that enable more connected, efficient, and personalized communication solutions. Positioning it as a critical technology in the digital transformation journeys of enterprises across various sectors.

(Sources: Cpaas Alliance, Twilio, Infobip, Webex Blog)

Regulations for Communication Platform as a Service Sector Statistics

- The regulatory landscape for the Communication Platform as a Service (CPaaS) sector is shaped by evolving compliance requirements across various regions, reflecting the industry’s focus on data security and privacy.

- In North America, the market’s growth is driven by substantial investments in research and development and a robust technological infrastructure, necessitating compliance with stringent data usage and privacy regulations such as GDPR in Europe and similar frameworks globally.

- The integration of artificial intelligence (AI) and machine learning (ML) technologies is propelling demand for CPaaS solutions, particularly in enhancing customer engagement and operational efficiencies across diverse sectors such as finance, healthcare, and retail.

- However, the industry faces regulatory challenges regarding the security of cloud-based solutions and the privacy of user data, which are critical concerns for providers and users alike.

- Strategic partnerships, such as those seen with major players like Amazon Web Services and Twilio, highlight the sector’s direction toward leveraging AI to enhance service capabilities while navigating regulatory complexities.

(Sources: Infobip, Idc, Exactitude Consultancy)

Recent Developments

Acquisitions and Mergers:

- Twilio acquires Segment: In 2023, Twilio, a leading CPaaS provider, completed its acquisition of Segment, a customer data platform, for $3.2 billion. This acquisition aims to enhance Twilio’s capabilities in personalized communications by integrating customer data with messaging services.

- RingCentral merges with Dialpad: In early 2024, RingCentral, a cloud communications platform, announced a merger with Dialpad, a provider of AI-driven communication solutions, for $1 billion. This merger enhances RingCentral’s AI capabilities, focusing on improving customer interactions and business communications.

New Product Launches:

- Microsoft launches Teams Connect: In mid-2023, Microsoft introduced Teams Connect, a new feature within Microsoft Teams that allows external users to join collaborative channels securely. This feature aims to enhance communication flexibility for businesses, enabling seamless collaboration with partners and clients.

- Zoom unveils Zoom Phone with integrated CPaaS features: In late 2023, Zoom launched an enhanced version of its Zoom Phone. Which now includes CPaaS features such as programmable voice and SMS capabilities. This integration aims to offer businesses a more comprehensive communication solution.

Funding:

- Infobip raises $200 million for global expansion: In 2023, Infobip, a global CPaaS provider, secured $200 million in funding to expand its operations in North America and Asia. The investment will support the development of new communication tools and services. Catering to the growing demand for omnichannel solutions.

- MessageBird raises $100 million for platform development: In early 2024, MessageBird, was another major player in the CPaaS market. Raised $100 million to enhance its communication platform, focusing on integrating AI technologies and expanding its service offerings.

Technological Advancements:

- AI integration in CPaaS solutions: By 2025, it is projected that 50% of CPaaS solutions will integrate AI-driven functionalities. Enabling smarter customer interactions, automated responses, and enhanced analytics for businesses.

- Rise of low-code/no-code platforms: The trend towards low-code and no-code development is accelerating. By 2026, 40% of businesses using CPaaS are expected to adopt these platforms. Allowing non-developers to create and customize communication workflows without needing extensive coding knowledge.

Conclusion

Communication Platform as a Service Statistics – The Communication Platform as a Service (CPaaS) market is rapidly growing as businesses adopt digital communication tools to enhance customer engagement.

Moreover, by enabling voice, messaging, video, and other real-time communication capabilities through APIs, CPaaS allows companies to integrate these functions without extensive backend infrastructure.

Key trends include a shift from traditional SMS to richer messaging formats like RCS and OTT, as well as the impact of cloud computing and 5G expansion.

With major players like Twilio and Sinch driving innovation, CPaaS is set to evolve further, incorporating AI and machine learning for smarter. More interactive customer experiences and streamlined operations.

As digital transformation progresses, CPaaS will play a central role in supporting flexible, scalable communication solutions across industries.

FAQs

CPaaS, or Communication Platform as a Service, is a cloud-based platform that enables developers to add real-time communication features, like voice, messaging, video, and authentication, directly into applications through APIs. It eliminates the need for companies to build and maintain their backend infrastructure.

CPaaS providers offer APIs that developers can use to embed communication functions into their applications. The platform handles the necessary infrastructure, protocols, and integrations, allowing businesses to focus on using communication features rather than managing them.

CPaaS offers scalability, flexibility, and cost savings. It allows businesses to add and customize communication features quickly, enhances customer engagement through omnichannel communication, and reduces infrastructure and operational costs by using a cloud-based solution.

CPaaS supports a variety of communication channels, including SMS, voice calls, video calls, chat, push notifications, and Rich Communication Services (RCS). Many platforms also support interactive features like two-factor authentication and AI-powered chatbots.

CPaaS is widely used across industries like retail, banking, healthcare, public administration, and hospitality. It’s particularly beneficial for businesses that prioritize customer engagement, notifications, and automated communication, such as in customer support, logistics, and telemedicine.