Table of Contents

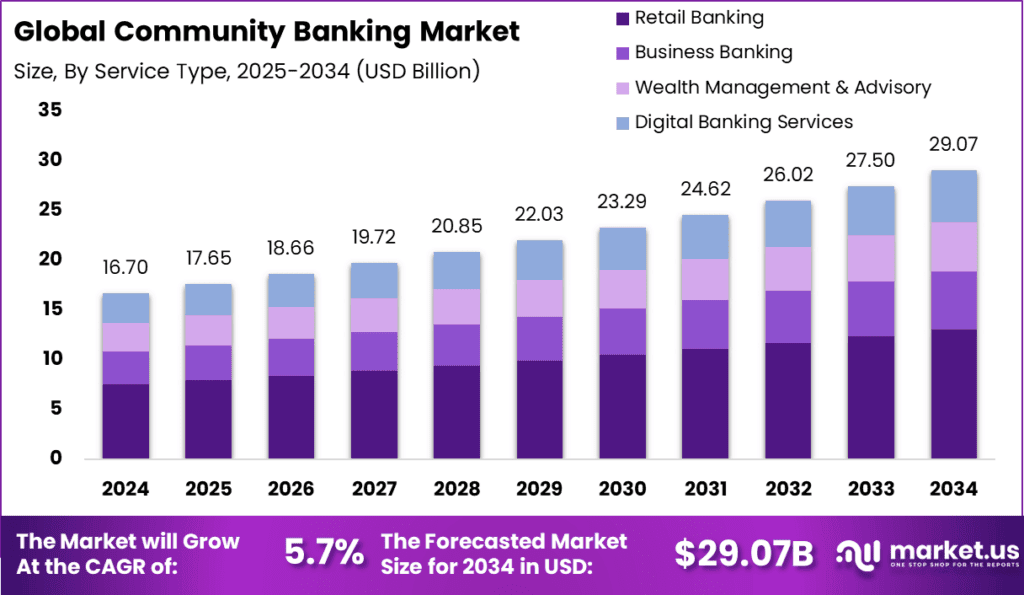

In 2024, the global community banking market was valued at USD 16.7 billion, with North America dominating the landscape by capturing over 40% market share, equivalent to USD 6.68 billion in revenue. The market is expected to grow at a steady CAGR of 5.7% from 2025 to 2034, reaching an estimated USD 29.07 billion by 2034.

This growth is driven by rising demand for localized banking services, increased financial inclusion initiatives, and the adoption of digital banking platforms tailored to community needs. The market benefits from the emphasis on personalized customer experience and support for small and medium enterprises (SMEs).

How Growth is Impacting the Economy

The community banking sector’s growth bolsters economic development by enhancing access to financial services in underserved areas. These banks play a critical role in supporting local businesses, fostering entrepreneurship, and stimulating job creation, particularly in rural and semi-urban regions. Increased lending to SMEs boosts economic activity and innovation at the grassroots level.

Digital transformation efforts reduce operational costs and improve efficiency, enabling competitive interest rates and wider outreach. Moreover, community banks contribute to financial stability by focusing on relationship banking and prudent risk management. Governments’ financial inclusion policies further amplify economic growth by integrating marginalized populations into the formal banking system, ultimately improving overall economic resilience.

➤ Get more detailed insights in this sample @ https://market.us/report/community-banking-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Community banks face rising operational costs linked to regulatory compliance and cybersecurity investments. Supply chain disruptions in technology hardware also impact digital transformation timelines.

Sector-Specific Impacts

- SMEs: Easier access to credit fosters business expansion.

- Agriculture: Tailored financial products support farmers and rural enterprises.

- Real Estate: Localized lending accelerates residential and commercial development.

- Retail: Enhanced banking services improve consumer spending capacity.

Strategies for Businesses

Community banks should:

- Invest in robust digital platforms to enhance customer experience

- Strengthen cybersecurity frameworks to protect sensitive data

- Develop partnerships with fintech firms to expand service offerings

- Customize products for local demographics and SME needs

- Focus on community engagement and trust-building initiatives

Key Takeaways

- Market expected to reach USD 29.07 billion by 2034

- CAGR of 5.7% from 2025 to 2034

- North America leads with over 40% market share in 2024

- Growth driven by digital adoption and SME financing

- Community banks vital for financial inclusion and local economies

Analyst Viewpoint

Community banking remains a cornerstone of regional economic development due to its personalized approach and strong customer relationships. The sector is gradually embracing digitalization to improve efficiency and accessibility.

Looking ahead, integration with fintech innovations and regulatory technology (RegTech) will enhance compliance and service delivery. The market outlook is positive, with sustained growth expected as banks balance traditional relationship banking with modern digital tools, thereby strengthening local economies and promoting inclusive growth.

Regional Analysis

North America dominates owing to mature banking infrastructure, supportive regulatory frameworks, and high digital banking penetration. Europe exhibits steady growth driven by similar factors alongside a focus on sustainability.

Asia Pacific shows emerging potential as expanding middle classes and financial inclusion initiatives increase demand for community banking. Latin America and the Middle East are gradually adopting community banking models to bridge gaps in underserved populations, supported by government-led digital financial initiatives.

Business Opportunities

Opportunities exist in developing tailored digital banking platforms focusing on SME lending, mobile banking, and microfinance. Fintech collaborations can facilitate innovative loan underwriting and credit scoring.

Expansion into underserved rural and semi-urban markets offers growth potential. Additionally, integrating AI and data analytics to enhance customer profiling and risk management can boost operational efficiency. Offering value-added services such as financial education and community development programs can also differentiate providers and build long-term loyalty.

Key Segmentation

Product Type

- Commercial Loans

- Retail Loans

- Deposit Services

- Treasury and Investment Services

End-User

- Small & Medium Enterprises (SMEs)

- Agricultural Sector

- Individual Consumers

- Real Estate Developers

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Player Analysis

Leading market players focus on digital innovation, community outreach, and strong regulatory compliance. Investments in cloud-based banking platforms and cybersecurity strengthen service reliability.

Strategic partnerships with fintech companies enable product diversification and faster digital adoption. Emphasis on local market understanding and personalized service remains a competitive advantage. Regional expansion and product customization are key priorities to address diverse customer needs and sustain growth.

Top Key Players Covered

- S. Bancorp

- First Republic Bank

- New York Community Bancorp

- SVB Financial Group

- Comerica Bank

- Crédit Mutuel

- Rabobank

- Nationwide Building Society

- HDFC Bank

- Others

Recent Developments

In 2024, several community banks launched enhanced mobile banking apps with AI-driven customer support features. Regulatory bodies introduced frameworks encouraging fintech collaboration to improve financial inclusion.

Conclusion

The global community banking market is poised for steady growth, driven by digital transformation and increasing SME financing. Banks that balance technology adoption with community-centric approaches will successfully capitalize on emerging opportunities and foster inclusive economic development.