Table of Contents

Report Overview

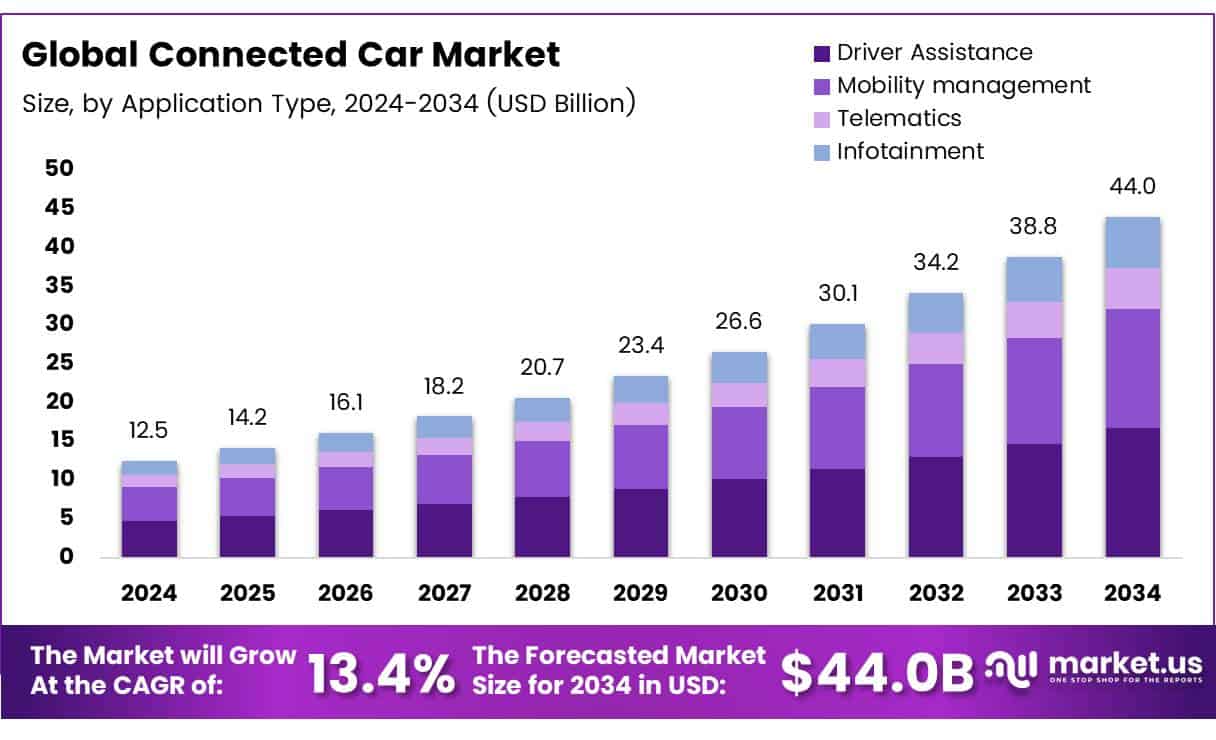

The Global Connected Car Market size is expected to be worth around USD 44.0 Billion by 2034, from USD 12.5 Billion in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034.

The Connected Car Market is experiencing robust growth, driven by rapid technological advancements and increasing consumer demand for enhanced safety, infotainment, and real-time data services. With over 400 million connected cars anticipated on roads soon, automakers are capitalizing on this trend to boost revenue streams and strengthen customer loyalty through innovative offerings.

Significant opportunities lie in expanding vehicle-to-everything (V2X) communication, autonomous driving integration, and predictive maintenance services. These developments not only improve user experience but also create new revenue models for manufacturers and service providers. By 2030, 96% of new vehicles globally are expected to be connected, emphasizing the market’s critical role in the future automotive landscape.

Furthermore, government investments and regulatory frameworks are accelerating market adoption. Many countries are promoting smart transportation initiatives and allocating funds to improve digital infrastructure, supporting safer and more efficient connected vehicle ecosystems. Regulatory emphasis on data privacy and cybersecurity also fosters consumer trust and market stability.

Key Takeaways

- The global connected car market is projected to reach USD 44.0 Billion by 2034, growing from USD 12.5 Billion in 2024 at a CAGR of 13.4%.

- Driver assistance systems commanded the largest application share at 36.1% in 2024, driven by safety regulations and advanced features.

- 5G networks dominate connectivity, enabling real-time communication and autonomous driving functionalities.

- OEMs control 82.3% of the connected car sales channel through built-in connectivity solutions.

- Over 400 million connected cars are expected on roads soon, with 96% of new vehicles globally projected to be connected by 2030.

- North America leads the market with a 40.1% share, valued at approximately USD 5.0 Billion.

Market Segmentation

In 2024, driver assistance systems led the connected car market applications with a 36.1% share, driven by rising safety demands and regulations promoting advanced driver-assistance features like emergency braking and lane keeping. Mobility management and telematics also grew, focusing on traffic efficiency and insurance uses, while infotainment evolved with better multimedia features.

On the network side, 5G dominated due to its speed and reliability, supporting real-time vehicle communication and autonomous functions. 4G remains important for coverage, with 3G phasing out but still used in older or budget vehicles. Satellite communication fills gaps in remote areas.

Integrated technology took the lead in vehicle connectivity by offering seamless in-car systems favored for safety and convenience. Embedded and tethered technologies serve smaller market segments with specific needs.

OEMs controlled 82.3% of sales channels by providing built-in connectivity solutions, while aftermarket products cater to upgrades and budget-conscious buyers, both shaping the connected car market’s future.

Key Market Segments

By Application Type

- Driver Assistance

- Mobility Management

- Telematics

- Infotainment

By Network Type

- 5G

- 3G

- 4G

- Satellite

By Technology Type

- Integrated

- Embedded

- Tethered

By Sales Channel

- OEM

- Aftermarket

By Communication Type

- Vehicle to Vehicle

- Vehicle to Infrastructure

Top Use Cases

- Advanced Driver Assistance Systems (ADAS): Enhances vehicle safety with features like automatic emergency braking and lane keeping assistance, reducing accidents and improving driver confidence.

- In-Vehicle Infotainment: Provides seamless access to music, navigation, and communication apps, delivering a connected and enjoyable driving experience.

- Vehicle-to-Everything (V2X) Communication: Enables cars to communicate with other vehicles, infrastructure, and pedestrians, improving traffic flow and preventing collisions.

- Remote Diagnostics and Predictive Maintenance: Allows real-time monitoring of vehicle health to predict and prevent breakdowns, reducing downtime and maintenance costs.

- Usage-Based Insurance (Telematics): Uses driving behavior data to offer personalized insurance premiums, encouraging safer driving and fairer pricing.

Major Challenges

Cybersecurity concerns are slowing the adoption of connected cars, as consumers worry about data breaches and unauthorized access. The complexity of connected car technology requires rigorous testing to ensure reliability, which delays production and market acceptance. Building consumer trust by addressing these risks is essential for faster growth.

Top Opportunities

Insurance telematics, which tailors policies based on driving behavior, is creating new growth opportunities. Health monitoring systems inside cars and Vehicle-to-Everything (V2X) communication improve safety and traffic management. Enhanced fleet management through connected technologies boosts efficiency for commercial users, opening new business opportunities in the automotive ecosystem.

Emerging Trends

In-vehicle payment systems are transforming user convenience by enabling cashless transactions for tolls and parking. Advanced Driver-Assistance Systems (ADAS) and AI technologies are making vehicles smarter and safer with features like predictive maintenance and personalized settings. Cloud services support better data management and software updates, driving innovation and reshaping the connected car experience.

Regional Analysis

The connected car market shows diverse growth patterns across global regions. North America leads with a 40.1% market share valued at around US$ 5.0 billion, driven by advanced technologies, high consumer acceptance, and strong collaborations between automakers and tech firms.

Europe follows, supported by strict safety and emissions regulations and investments from key automotive hubs like Germany and the UK. The Asia Pacific region is the fastest-growing market, propelled by rising vehicle sales, government initiatives, and a tech-savvy middle class in countries like China, Japan, and South Korea.

In the Middle East & Africa, growth is steady with smart city projects and demand for luxury connected vehicles, especially in Gulf countries. Latin America, though smaller, shows promising potential thanks to urbanization and digital upgrades focusing on vehicle connectivity and safety.

Conclusion

The global connected car market is set for robust growth driven by rapid technological advancements, increasing consumer demand for safety and convenience, and widespread adoption of connectivity solutions like 5G and AI-enabled features. Despite challenges such as cybersecurity risks and cost pressures from tariffs, strong government support, regulatory frameworks, and emerging innovations like Vehicle-to-Everything communication and in-vehicle payment systems are fueling market expansion. With North America leading and Asia Pacific emerging as the fastest-growing region, companies investing strategically in secure, advanced connected car technologies are well-positioned to capitalize on the evolving automotive landscape through 2034 and beyond.