Table of Contents

Introduction

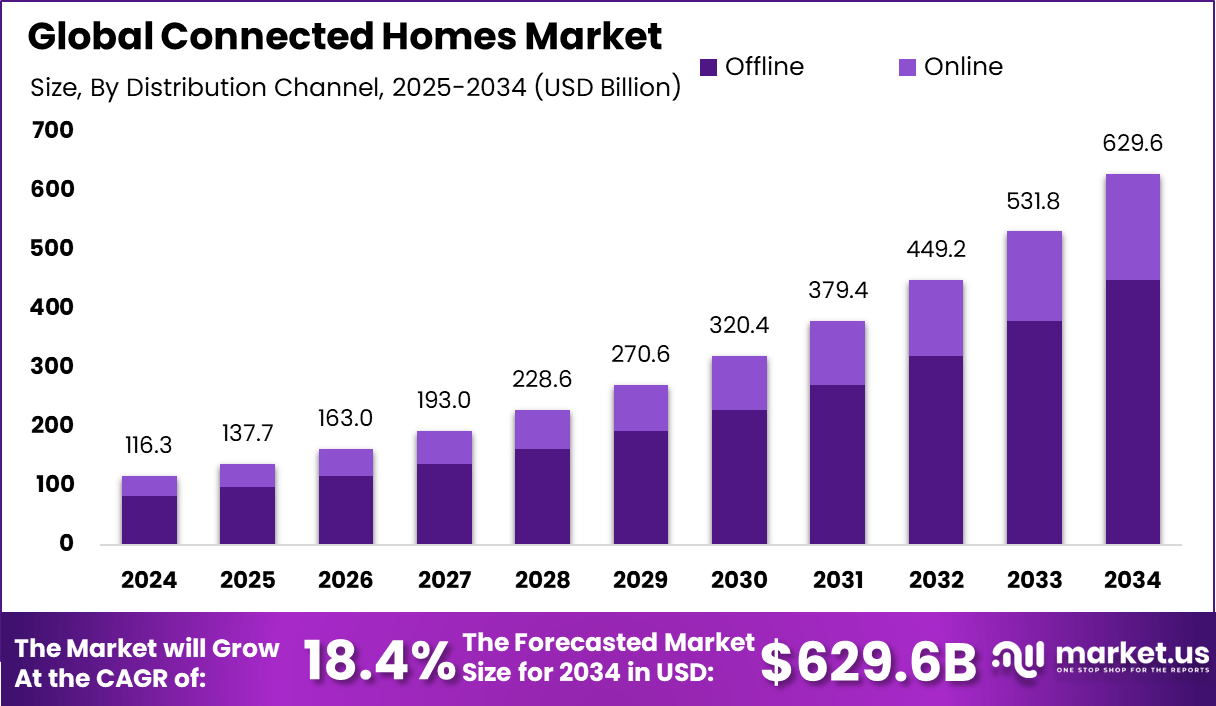

The global connected homes market generated USD 116.3 billion in 2024 and is projected to grow to USD 137.7 billion in 2025 before reaching approximately USD 629.6 billion by 2034, representing a robust CAGR of 18.4 %. In 2024 the Asia Pacific region held a dominant position, capturing over 45.3 % of the market share with revenues of around USD 52.6 billion. This expansion is driven by strong growth in IoT-enabled devices, rising consumer demand for smart appliances and home automation, increasing broadband penetration and enhanced connectivity infrastructure across emerging economies.

How Growth is Impacting the Economy

The growth of the connected homes market is expected to have meaningful economic ripple effects across manufacturing, services, and infrastructure sectors. Investment in IoT devices, broadband networks, cloud analytics and smart appliance manufacturing supports job creation in hardware production, software engineering and installation services. With households upgrading to connected systems, consumer spending shifts toward smart devices, enhancing retail and e-commerce volumes.

Increased adoption of energy management and home automation technologies leads to higher efficiency and reduced utility bills, which can free consumer income for other economic activities. Infrastructure build-out—such as fibre broadband, wireless networks and smart-meter roll-outs—benefits telecommunications and construction sectors while stimulating demand for ancillary components. Furthermore, export opportunities for connected-home equipment and service models can improve trade balances in manufacturing economies. Overall, the expansion contributes to industrial diversification, enhanced productivity and stronger consumer demand dynamics.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses entering the connected homes value chain face elevated costs associated with R&D for smart devices, compliance with connectivity standards, certification, and ongoing software updates. Supply chains are shifting toward IoT component manufacturing, smart appliance integration, cloud service platforms and home-gateway devices rather than traditional hardware alone. Vendors and installers must evolve to support full system solutions, including software, sensors, connectivity, installation and maintenance models.

Sector-Specific Impacts

Appliance manufacturers are redesigning white goods and electronics to embed connectivity, sensors and AI-capabilities, requiring new supplier relationships and higher specification components. Telecom and broadband providers are integrating home-automation bundles into their residential offerings, thus reconceptualising their business models around recurring service revenue rather than connectivity alone. Home-security and energy-management firms are expanding into smart-home ecosystems, combining devices, platforms and services. Real-estate developers are incorporating connected-home infrastructure into new builds as a differentiator. Across sectors, companies must adapt to higher service expectations, interoperability standards and software-driven value propositions.

Strategies for Businesses

Businesses targeting the connected homes market should adopt four strategic pillars: firstly, build modular ecosystems that integrate hardware, connectivity and software with recurring service models. Secondly, form strategic partnerships across device manufacturers, connectivity providers and cloud/AI firms to create seamless consumer experiences. Thirdly, focus on scalability and upgrade-capability so that offerings remain future-proof as standards evolve (e.g., emerging protocols like Matter).

Fourthly, target regional roll-outs with localisation of device compatibility, language, connectivity infrastructure and regional compliance. Businesses should emphasise subscription-based services to capture recurring revenue, bundle energy-saving, security and entertainment features to drive adoption, and invest in strong after-sales support and data security to build consumer trust.

Key Takeaways

- Strong projected CAGR of 18.4 % through 2034 underlines robust growth in the connected homes market.

- Asia Pacific currently leads with over 45.3 % share in 2024, highlighting regional dominance.

- Value chain transformation: from standalone devices to integrated ecosystems involving hardware, connectivity and services.

- Businesses must manage supply-chain shifts, higher technology complexity and service expectations.

- Strategic partnerships, modular upgrade-ready designs and recurring service models will determine market winners.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161855

Analyst Viewpoint

At present the connected homes market is at an inflection point where consumer acceptance, smart-device affordability and connectivity infrastructure are aligning to drive scale. The market’s trajectory presents a positive outlook: the leap from USD 116.3 billion in 2024 to approximately USD 629.6 billion by 2034 signals strong long-term potential. Vendors that deliver integrated solutions—combining smart appliances, home gateways, connectivity and value-added services—stand to capture substantial share. The emphasis on energy efficiency, security, convenience and interoperability suggests that the connected homes sector will transition from early-adopter phase to mass market. Overall, the future is favourable for businesses that prioritise innovation, ecosystem build-out and consumer-centric service models.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Smart energy management and HVAC automation | Rising consumer focus on energy efficiency and cost-savings in homes |

| Connected security and monitoring systems | Growing demand for home safety, remote monitoring and IoT-enabled surveillance |

| Smart entertainment and appliance ecosystems | Increased broadband penetration, streaming consumption and smart-appliance adoption |

Regional Analysis

The Asia Pacific region dominated the connected homes market in 2024 with revenue of approximately USD 52.6 billion and share exceeding 45.3 %, supported by rising consumer incomes, rapid urbanisation, expanding broadband and strong appliance penetration. North America and Europe continue to hold substantial share owing to mature markets, high device adoption and strong service ecosystems. Latin America, Middle East & Africa are expected to grow at higher rates from lower bases, driven by increasing connectivity, smart-home awareness and falling device costs. Regional dynamics demand localisation of connectivity protocols, device compatibility and service models to address distinct regulatory, cultural and infrastructure contexts.

➤ More data, more decisions! see what’s next –

Business Opportunities

The connected homes market offers manifold opportunities for hardware manufacturers, IoT platform providers, connectivity specialists, subscription-service operators and installation/maintenance service firms. Manufacturers can capitalise by embedding smart capability into appliances and securing OEM partnerships. IoT platform providers and cloud-service firms can monetise recurring services around home automation, analytics and user experience.

Connectivity providers have the opportunity to bundle smart-home services with broadband subscriptions. Installers and service providers specializing in smart-home installation, retrofits and ongoing maintenance will benefit from rising retrofit demand. Regional expansion presents untapped potential in emerging economies where connectivity upgrades and smart-home adoption are accelerating.

Key Segmentation

Key market segments in the connected homes domain include components (hardware, software, services), functionality (energy & utilities management, security & safety, smart appliances, entertainment, wellness & monitoring), device type (appliances, home gateways, sensors/actuators), connectivity protocol (Wi-Fi, Zigbee, Z-Wave, Thread/Matter, cellular/5G) and end-user (residential new build, retrofit homes, multi-dwelling units).

Hardware remains the foundational segment but services and software are increasingly critical for value capture. Functionality wise, energy management and security modules are expected to grow fastest as utility & safety concerns deepen. Connectivity protocols that support interoperability and ease of integration are gaining traction, reinforcing the importance of platform and service businesses.

Key Player Analysis

Leading firms in the connected homes market are focusing on integrated offerings that bundle devices, connectivity and recurring services rather than isolated products. These companies are leveraging partnerships across appliance OEMs, connectivity networks and cloud/AI providers to build end-to-end ecosystems.

Differentiation is shifting toward software platforms, subscription models and service-based revenue rather than hardware alone. They are investing in interoperability standards, device ecosystems and regional roll-outs to capture broad market share. Competitive dynamics suggest that success will favour those able to deliver integrated user experiences, strong after-sales service and scalable solutions across regions.

- Sony Corporation

- Panasonic Corporation

- ADT Inc.

- Vivint Smart Home, Inc.

- Comcast Corporation

- Johnson Controls International plc

- Bosch Security Systems GmbH

- Samsung Electronics Co., Ltd.

- Google LLC

- Amazon.com, Inc.

- Apple Inc. Company Profile

- LG Electronics Inc.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Others

Recent Developments

- A major electronics manufacturer launched a unified smart home hub supporting multiple protocols (Matter, Thread, Zigbee, Wi-Fi) to enhance interoperability.

- A broadband provider introduced bundled smart-home connectivity packages with installation and monitoring services for residential subscribers.

- A regional government initiated a smart-city retrofit programme including connected-home incentives aimed at energy efficiency across residential districts.

- An IoT platform provider announced multi-year subscription models for smart appliance service and analytics in collaboration with appliance manufacturers.

- A standards group released updated specifications for home-automation interoperability, enabling greater device compatibility and simpler consumer installation.

Conclusion

The connected homes market is positioned for transformative growth and broad-based adoption across regions and functionalities. Businesses that deploy ecosystem strategies, service-based models and region-specific offerings stand to gain significantly. The era of truly connected living is rapidly unfolding.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)