Table of Contents

Introduction

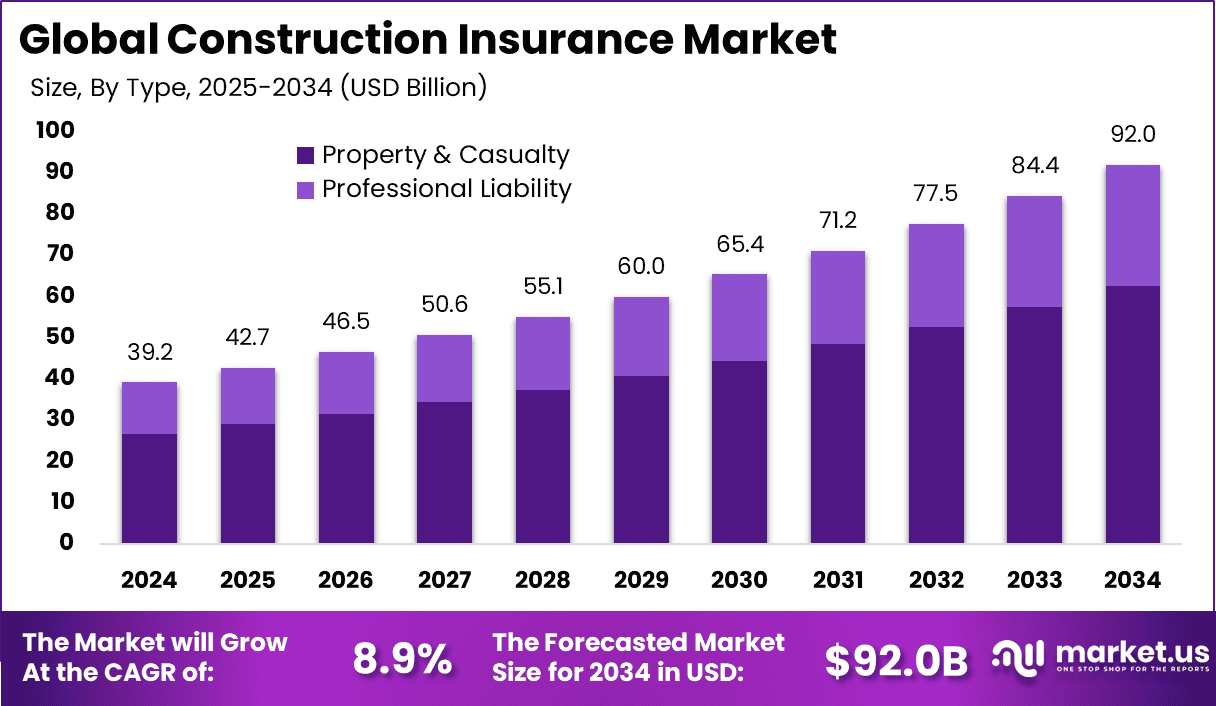

The global construction insurance market is anticipated to reach USD 92.0 billion by 2034, expanding from USD 39.2 billion in 2024. The market is projected to grow at a CAGR of 8.9% from 2025 to 2034. North America dominated the market in 2024, accounting for 37.3% of the market share with USD 14.6 billion in revenue. The sector is driven by an increase in construction activities, stringent safety regulations, and rising risks in the construction industry.

How Growth is Impacting the Economy

The growth of the construction insurance market is significantly impacting the global economy. With rising construction activities, the demand for insurance solutions is expected to surge, providing better risk management tools for businesses. As the sector expands, it contributes to job creation, economic development, and a more stable financial environment for construction projects.

The rise in construction projects across various regions also promotes the need for better risk management strategies, safeguarding assets, and mitigating potential losses. The continued expansion of infrastructure, both residential and commercial, will likely stimulate construction insurance market growth, with more focus on specialized policies like property, liability, and workers’ compensation insurance. As such, the economy is benefiting from both the growth in construction and the corresponding rise in demand for insurance products, which helps secure investments and reduces financial risks.

➤ Uncover best business opportunities here @ https://market.us/report/construction-insurance-market/free-sample/

Impact on Global Businesses

The rise in the construction insurance market growth is having significant implications for global businesses, particularly those in the construction sector. Companies face rising costs associated with managing risks, and the need to ensure adequate coverage is pushing up premiums. Additionally, supply chain shifts are affecting material costs, leading to more uncertainty in project budgeting.

Construction companies are increasingly focusing on cost-effective insurance solutions to offset these challenges, which in turn is fostering a demand for customized insurance policies. The market shift towards risk management products also opens opportunities for innovation and new offerings.

For specific sectors, businesses are adapting by investing in digital insurance solutions to streamline processes and reduce costs. Moreover, as safety regulations tighten, the importance of robust construction insurance policies becomes more critical, pushing companies to ensure compliance while maintaining financial protection.

Strategies for Businesses

To capitalize on the growth in the construction insurance market, businesses must adopt several key strategies. First, they should focus on expanding their digital capabilities to streamline claims processing, risk management, and customer service. Second, collaborating with local and international partners can help insurers provide tailored solutions to meet diverse market needs.

Third, businesses should consider diversifying their insurance portfolios to cover a wider range of construction-related risks, including environmental hazards and cyber risks in the construction sector. Companies must also focus on educating clients about the evolving risks in construction and how insurance products can mitigate these challenges. Finally, establishing a strong global presence, particularly in emerging markets, will be essential for tapping into new growth opportunities.

Key Takeaways

- The global construction insurance market is projected to grow at a CAGR of 8.9% from 2025 to 2034.

- North America holds a significant market share, driven by high revenue in the region.

- Rising construction activities and stricter regulations are fueling the demand for comprehensive insurance policies.

- Digital solutions are becoming essential for insurers to improve efficiency and customer experience.

- The market’s growth presents opportunities for innovation in insurance products tailored to specific construction risks.

➤ Buy Report Here @ https://market.us/purchase-report/?report_id=152422

Analyst Viewpoint

Presently, the construction insurance market is showing strong growth due to rising global infrastructure development and stricter regulatory frameworks. In the future, the demand for innovative, digital-first insurance solutions is expected to increase. The market is likely to witness continued expansion, driven by the need for specialized products and solutions in diverse regions. This offers significant opportunities for insurers to improve their offerings and strengthen their position in both developed and emerging markets.

Regional Analysis

In 2024, North America held a dominant share of the global construction insurance market, followed by Europe and Asia Pacific. North America’s growth is driven by its vast construction sector, which continues to see large-scale infrastructure projects and residential developments. In Europe, the increasing focus on sustainable construction is driving demand for insurance products that cover environmental risks. Asia Pacific, on the other hand, is expected to grow significantly due to rapid urbanization and industrial expansion in countries like China and India. The demand for construction insurance solutions in emerging markets is expected to rise sharply, offering lucrative opportunities for insurers.

Business Opportunities

The expanding construction insurance market presents various business opportunities. Insurers can leverage digital technology to enhance the customer experience and improve operational efficiency. There is also a growing demand for specialized insurance products that cover the unique risks of modern construction projects, such as climate-related hazards and cyberattacks.

Furthermore, the increasing focus on sustainable construction and green building practices opens doors for insurance providers to develop policies tailored to the growing green building sector. Additionally, the rise in construction activities in emerging markets offers insurers the opportunity to expand their geographic reach and increase market penetration.

➤ Discover More Trending Research

- Data Visualization Tools in ERP Market

- IoT-Enabled ERP Platforms Market

- Derivatives and Commodities Brokerage Market

- Virtual Shopping Assistant Market

Key Segmentation

The global construction insurance market is segmented based on product type, application, and region. By product type, the market includes property insurance, liability insurance, workers’ compensation, and others. By application, the market is categorized into residential, commercial, and industrial construction projects.

Regional segmentation includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share due to its dominant construction activities, while Asia Pacific is expected to see rapid growth due to urbanization and infrastructural developments.

Key Player Analysis

Key players in the global construction insurance market are focusing on strategic partnerships, product innovation, and regional expansion. They are also investing in digital tools and technologies to enhance the efficiency of their services. As competition intensifies, companies are differentiating themselves by offering specialized, customizable insurance products that meet the evolving needs of construction firms. To maintain a competitive edge, these players are also focusing on sustainability and risk management innovations. The overall market landscape is competitive, with both established players and new entrants looking to capture market share.

- AIG

- Tokio Marine

- ACE&Chubb

- XL Group

- QBE

- Zurich Insurance

- AXA

- Beazley

- Munich Re

- Allianz SE Company Profile

- Mapfre

- Manulife

- Nationwide

- State Farm

- Berkshire Hathaway

- Liberty Mutual

- Other Key Players

Recent Developments

- The rise of digital solutions for faster claims processing and customer support.

- Increased investment in specialized insurance products for green building projects.

- Expansion of construction insurance offerings in emerging markets.

- Adoption of data analytics to predict risks and optimize pricing strategies.

- Enhanced regulatory compliance standards are influencing insurance product designs.

Conclusion

The construction insurance market is expected to continue growing, driven by demand for more specialized, digital-first solutions to mitigate emerging risks. With the right strategies, businesses can capitalize on this expansion and navigate the challenges presented by rising costs and evolving regulatory landscapes.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)