Table of Contents

Introduction

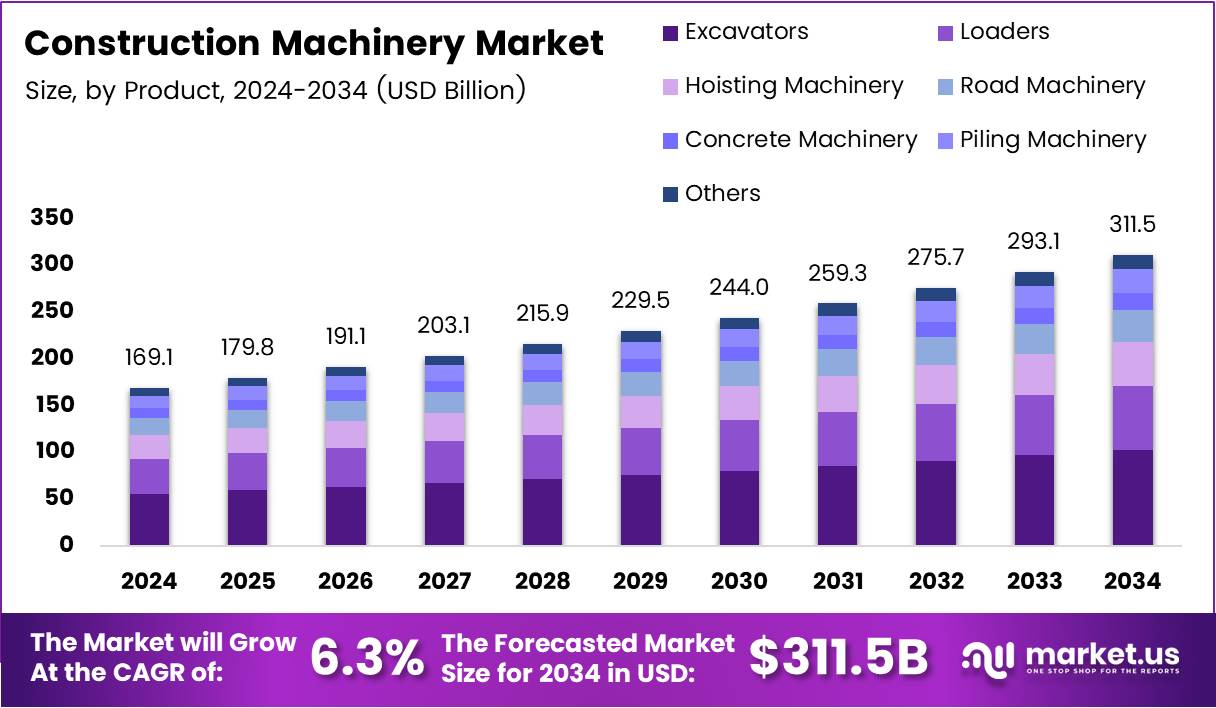

The global construction machinery market is entering a transformative growth phase, fueled by rapid urbanization, infrastructure expansion, and technological advancements. Valued at USD 169.1 Billion in 2024, the sector is expected to climb to USD 311.5 Billion by 2034, showcasing resilience and strong demand.

As nations invest heavily in sustainable and smart infrastructure, machinery like excavators, cranes, and loaders are proving indispensable. Transitioning toward automation, electrification, and AI integration, the market is redefining efficiency, sustainability, and safety in construction practices worldwide.

Key Takeaways

- Global Construction Machinery Market size is projected to reach USD 311.5 Billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034.

- Excavators dominate the By Product Analysis segment with a 35.3% market share in 2024.

- Internal Combustion Engine (ICE) leads the By Propulsion Type Analysis segment with a 67.9% share in 2024.

- Replacement segment holds the highest share in By Share of Replacement Analysis with 61.2% in 2024.

- Asia Pacific dominates the global market with 45.2% share, valued at USD 76.4 billion in 2024.

Market Segmentation Overview

In 2024, excavators held a commanding 35.3% share of the market, driven by their unmatched versatility across earthmoving, demolition, and material handling applications. Their adaptability across residential, commercial, and infrastructure projects cements their leadership position.

ICE propulsion dominated with a 67.9% market share in 2024, supported by reliability, cost-effectiveness, and widespread infrastructure. While electric and alternative fuels are rising, ICE remains the backbone of construction fleets worldwide.

Replacement machinery accounted for 61.2% share in 2024, highlighting a mature market where aging fleets are replaced for better efficiency, compliance, and productivity. New purchases grow steadily in emerging economies but replacement cycles remain the dominant driver globally.

Drivers

A major growth driver is the surge in infrastructure projects across emerging economies, particularly in India, China, and Brazil. Mega projects, including smart cities, highways, and airports, create sustained demand for advanced machinery.

Additionally, global urbanization is fueling demand for residential and commercial buildings. Governments’ push for resilient, green infrastructure is directly boosting the need for modern, efficient, and eco-friendly construction machinery.

Use Cases

Construction machinery plays a critical role in smart city developments, where advanced excavators, loaders, and concrete machinery streamline large-scale housing and transport infrastructure projects.

Another significant use case is in renewable energy installations. Machinery like cranes and piling equipment are vital for building wind farms, solar parks, and hydropower stations, linking the industry directly with the clean energy transition.

Major Challenges

The industry faces cost pressure from fluctuating raw material prices, especially steel and aluminum. Such volatility affects production and pricing, straining profitability for both manufacturers and buyers.

A shortage of skilled machinery operators is another challenge. With older workers retiring and fewer young entrants, companies must invest heavily in training, delaying project efficiency and adoption of advanced machinery.

Business Opportunities

Expanding rental services create significant opportunities, especially for small and mid-sized contractors. Renting high-performance machinery offers cost savings while driving demand for flexible, short-term solutions.

Adoption of smart, IoT-enabled construction machinery also presents vast opportunities. Predictive maintenance, real-time performance monitoring, and automated efficiency improvements are reshaping the industry with reduced downtime and lower operating costs.

Regional Analysis

Asia Pacific, with 45.2% share valued at USD 76.4 Billion, remains the epicenter of market growth. Infrastructure projects in China and India, coupled with rapid urbanization, ensure the region’s dominance for the foreseeable future.

North America continues to hold a strong position, underpinned by U.S. and Canadian infrastructure renewal programs. Integration of automation, digitization, and advanced safety features strengthens demand across residential, commercial, and industrial projects.

Recent Developments

- Sep 2025: Indian government announced a Rs 13,000-crore incentive plan to boost the construction equipment sector.

- Dec 2024: Pai Machines acquired L&T Construction Equipment Facilities, expanding its industry footprint.

- Nov 2024: Hitachi Construction Machinery subsidiary H-E Parts acquired Brake Supply Inc to strengthen its North American presence.

- Jun 2025: Volvo CE acquired Swecon, enhancing its European retail operations and regional reach.

Conclusion

The global construction machinery market is entering a dynamic era shaped by technology, sustainability, and infrastructure megaprojects. With a projected value of USD 311.5 Billion by 2034, the industry is well-positioned for steady growth. Companies that invest in eco-friendly innovation, operator training, and smart machinery solutions will lead the next decade of transformation.