Table of Contents

- Introduction

- Editor’s Choice

- Construction Software Market Statistics

- Construction and Design Software Market Overview

- Construction Software Usage Statistics

- Construction Software Spending in Companies Statistics

- Enterprises Using Cloud Computing Services in the Construction Industry

- Preferred Building Information Modeling Software Used in the Construction Sector

- Adoption of Technologies in the Construction Industry

- Use of the Internet of Things (IoT) by Construction Companies

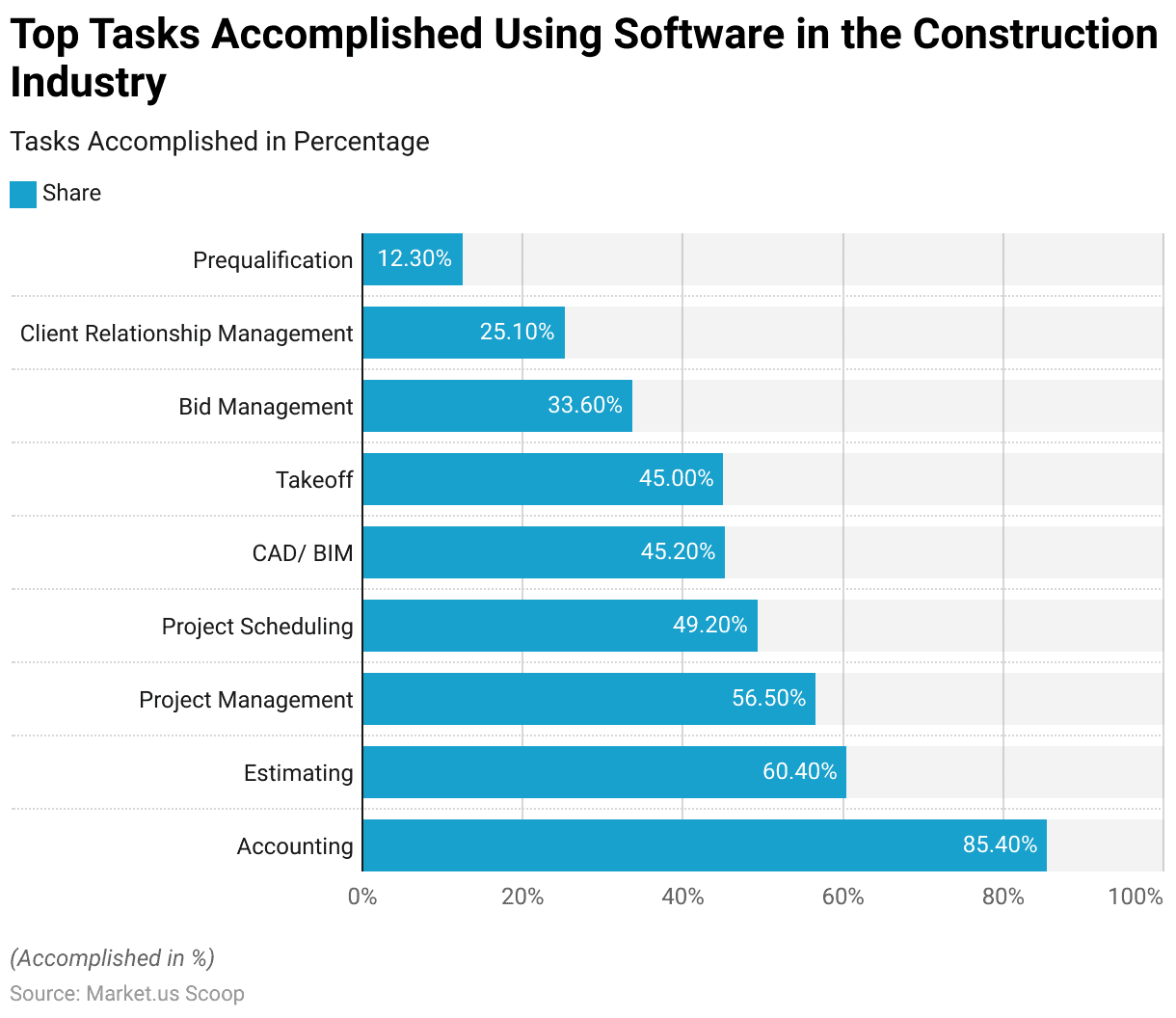

- Top Tasks Accomplished Using Software in the Construction Industry

- Top Requested Construction Software Functionalities by Contractors Statistics

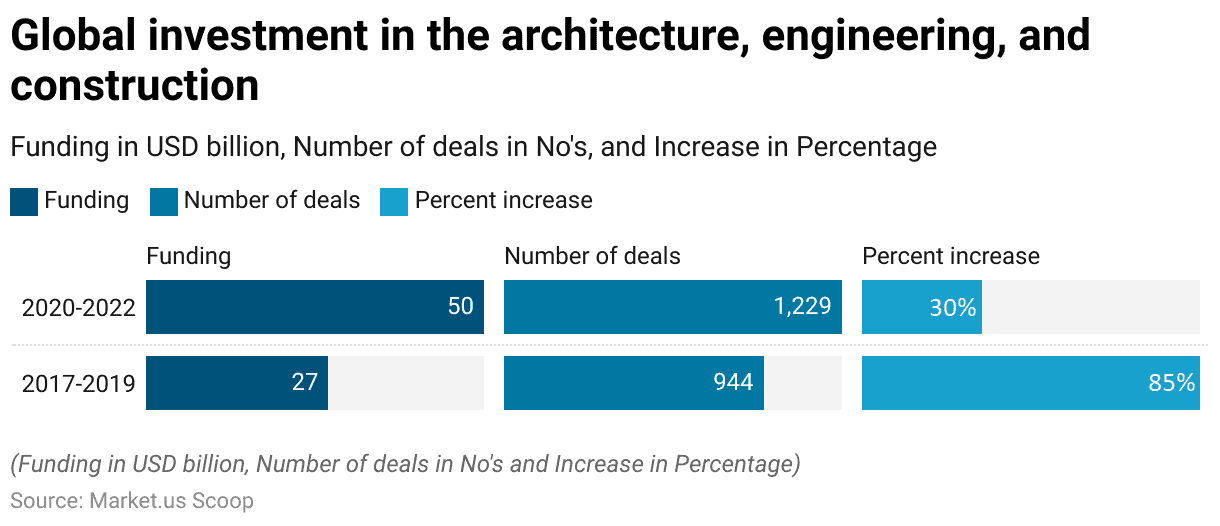

- Key Investment Statistics

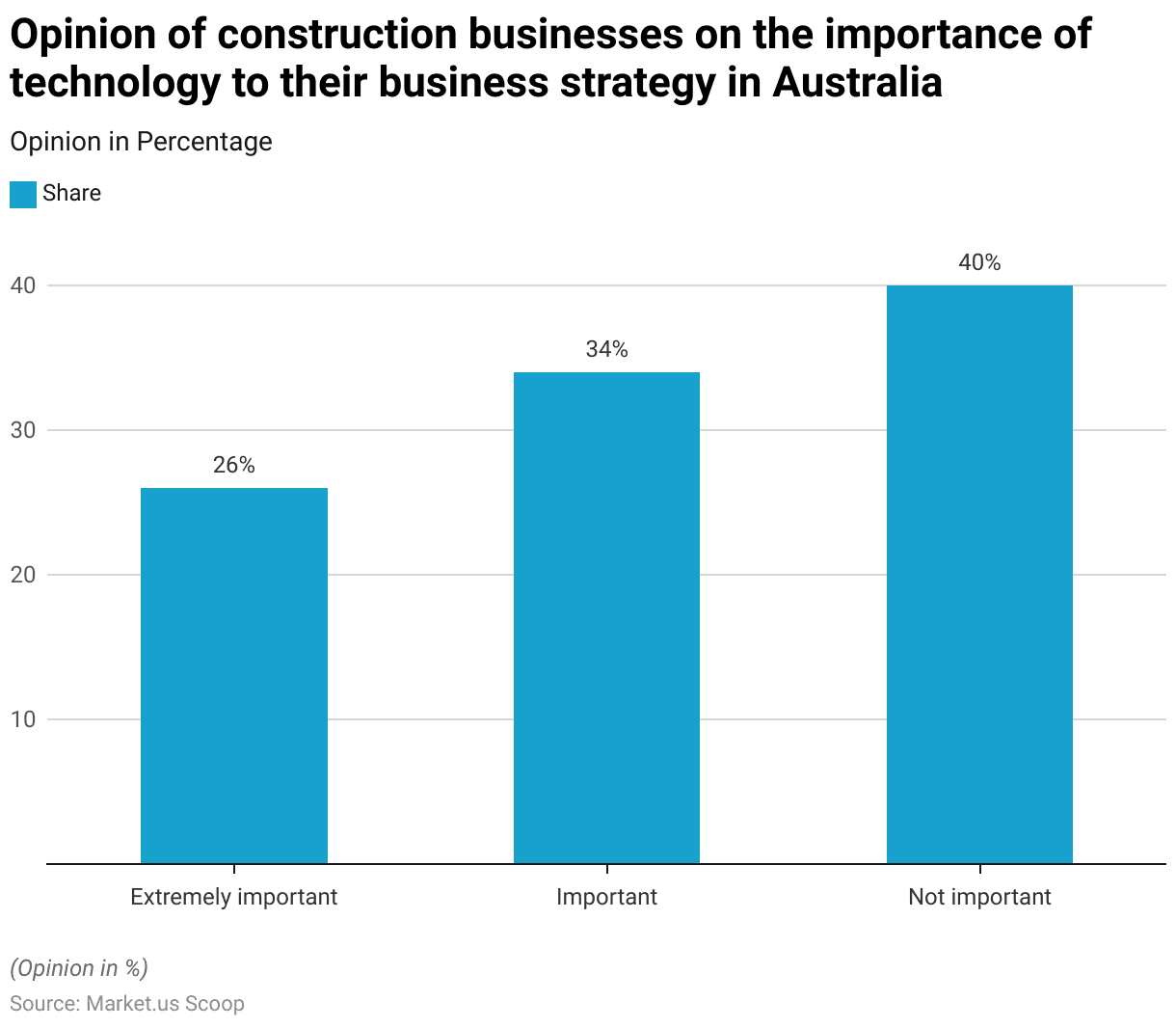

- Importance of Technology to Construction Business Strategy

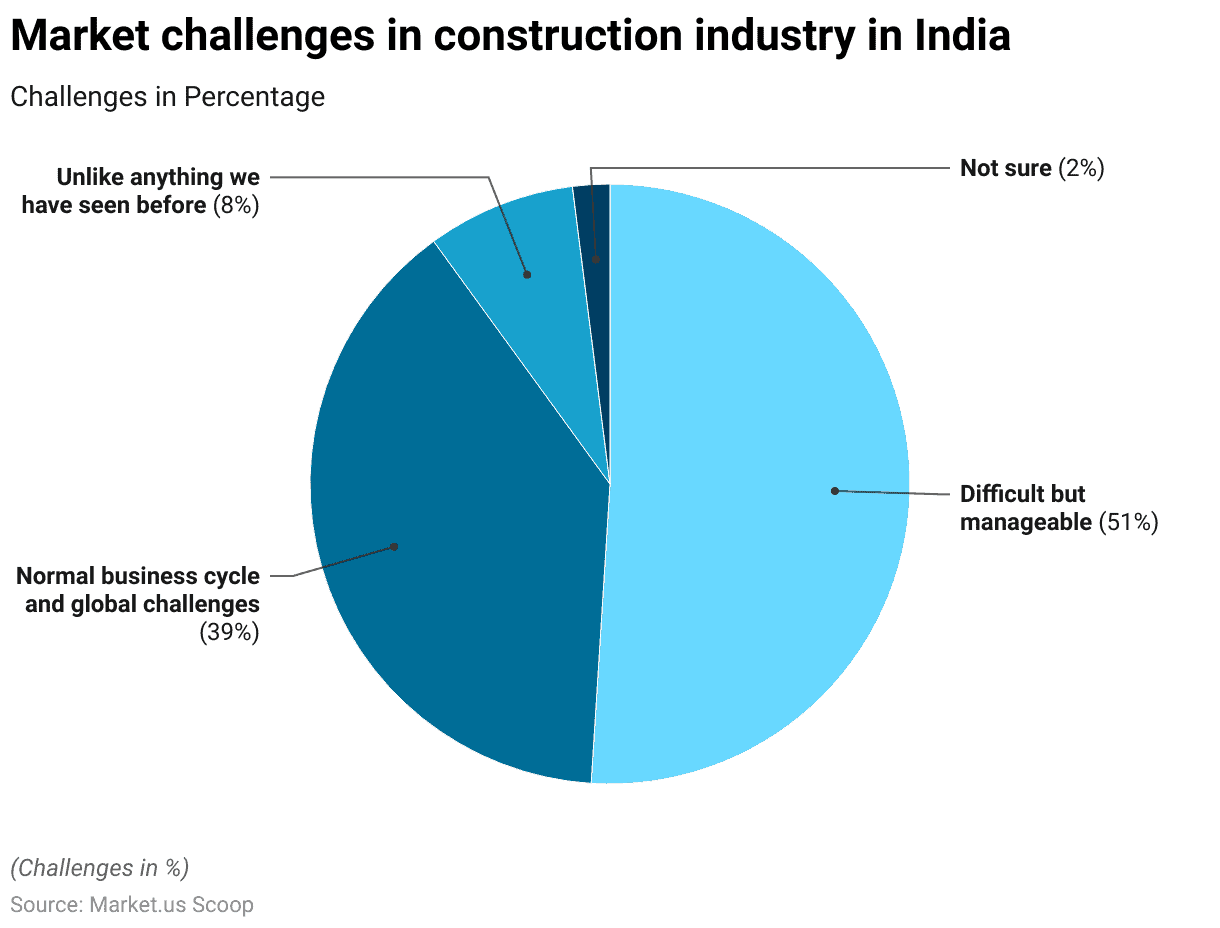

- Challenges and Concerns

- Technological Innovations in Construction Software Statistics

- Regulations for Construction Software

- Recent Developments

- Conclusion

- FAQs

Introduction

Construction Software Statistics: Construction software encompasses a range of digital tools designed to enhance efficiency and collaboration across various stages of construction projects.

Key types include project management, Building Information Modeling (BIM), cost estimation, accounting, field management, contract management, and procurement software.

These tools automate tasks, improve communication, and provide accurate reporting, leading to cost savings and better risk management.

Recent trends highlight a shift towards cloud-based solutions, mobile compatibility, and the integration of artificial intelligence and machine learning. Which are expected further to drive innovation and efficiency in the construction industry.

Editor’s Choice

- The global construction software market revenue reached USD 1,723 million in 2023.

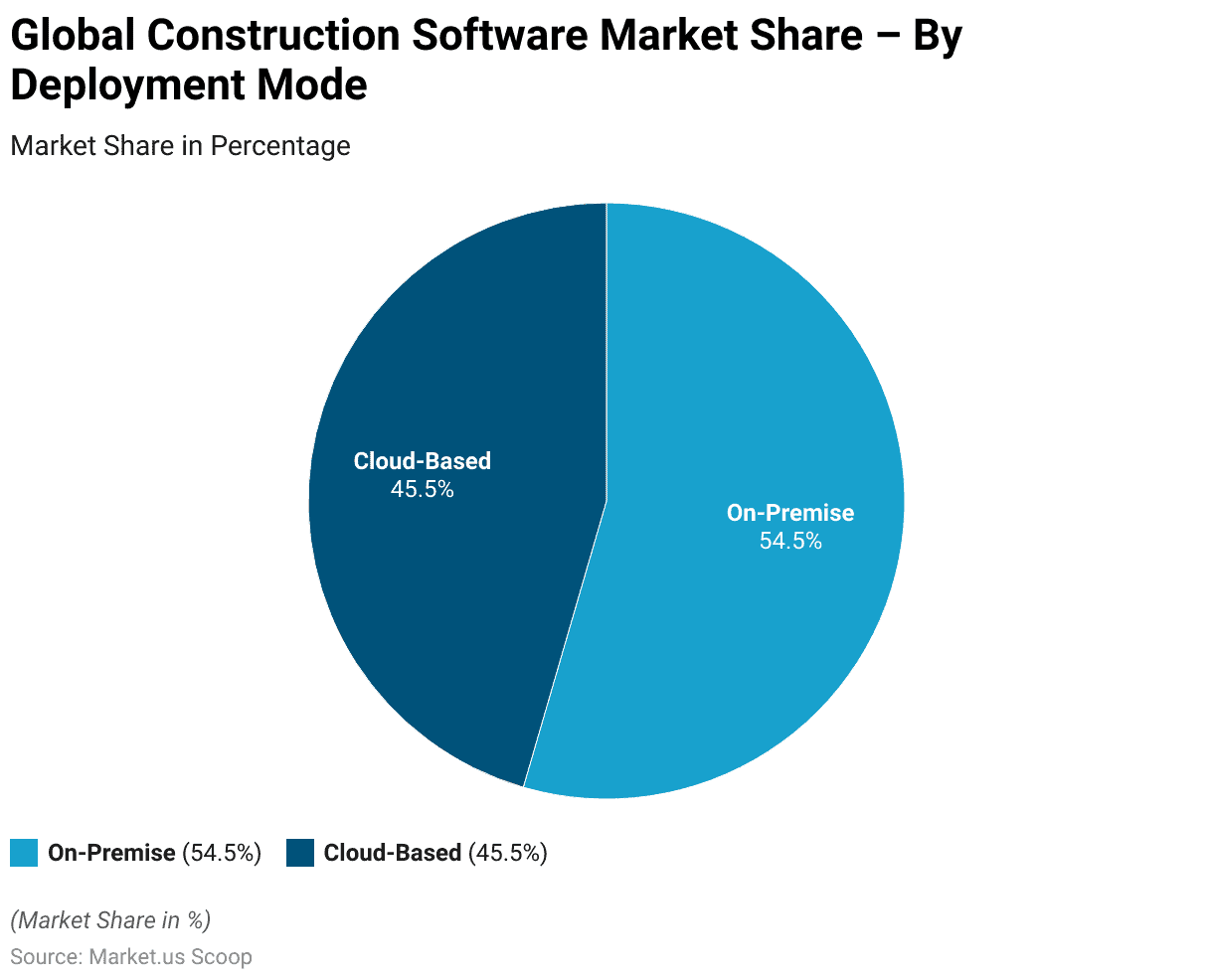

- In the global construction software market, the deployment mode is divided between on-premise and cloud-based solutions. On-premise solutions currently hold the majority market share, accounting for 54.5% of the total market.

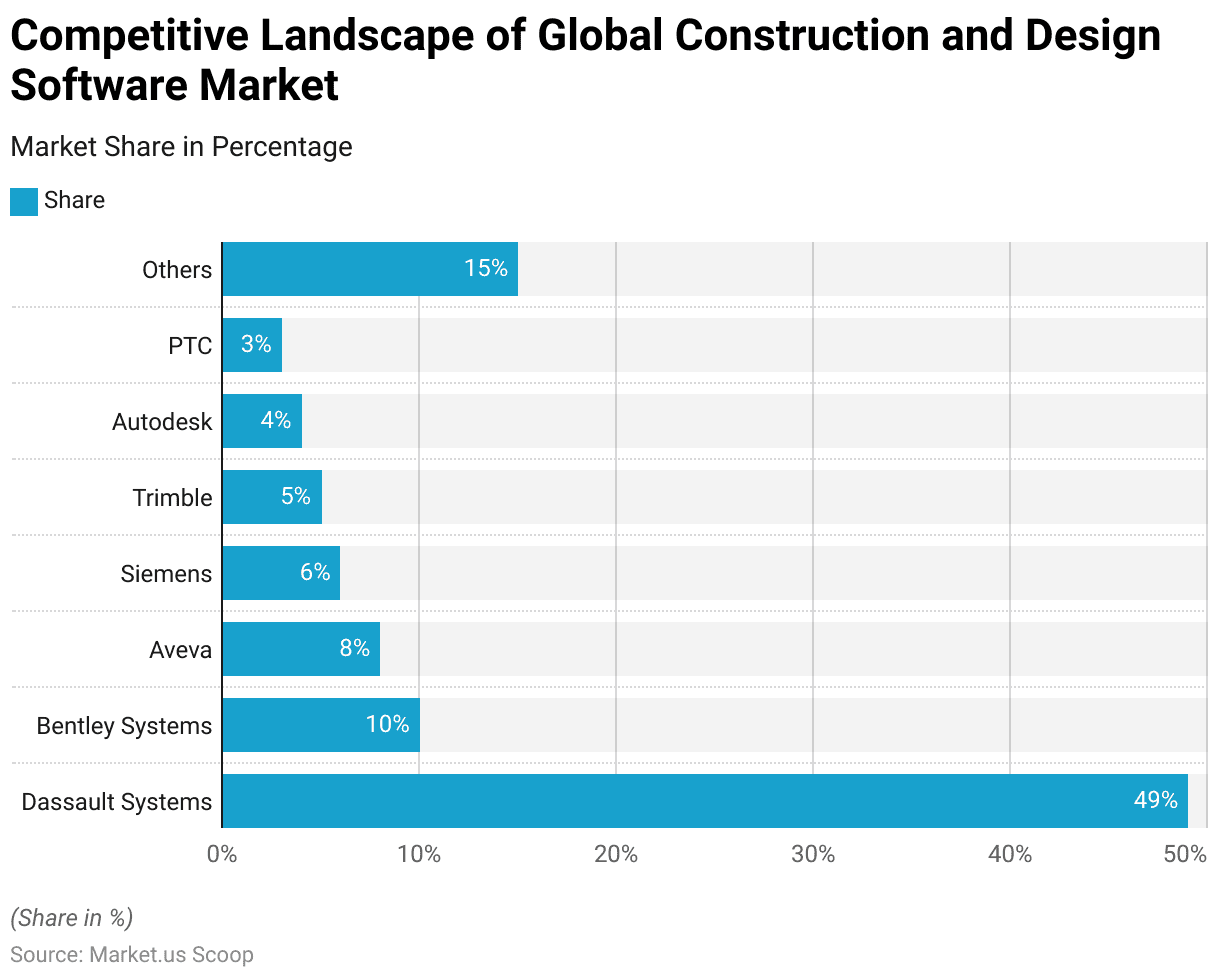

- The global construction and design software market is dominated by a few key players. Dassault Systems holding the largest market share at 49%.

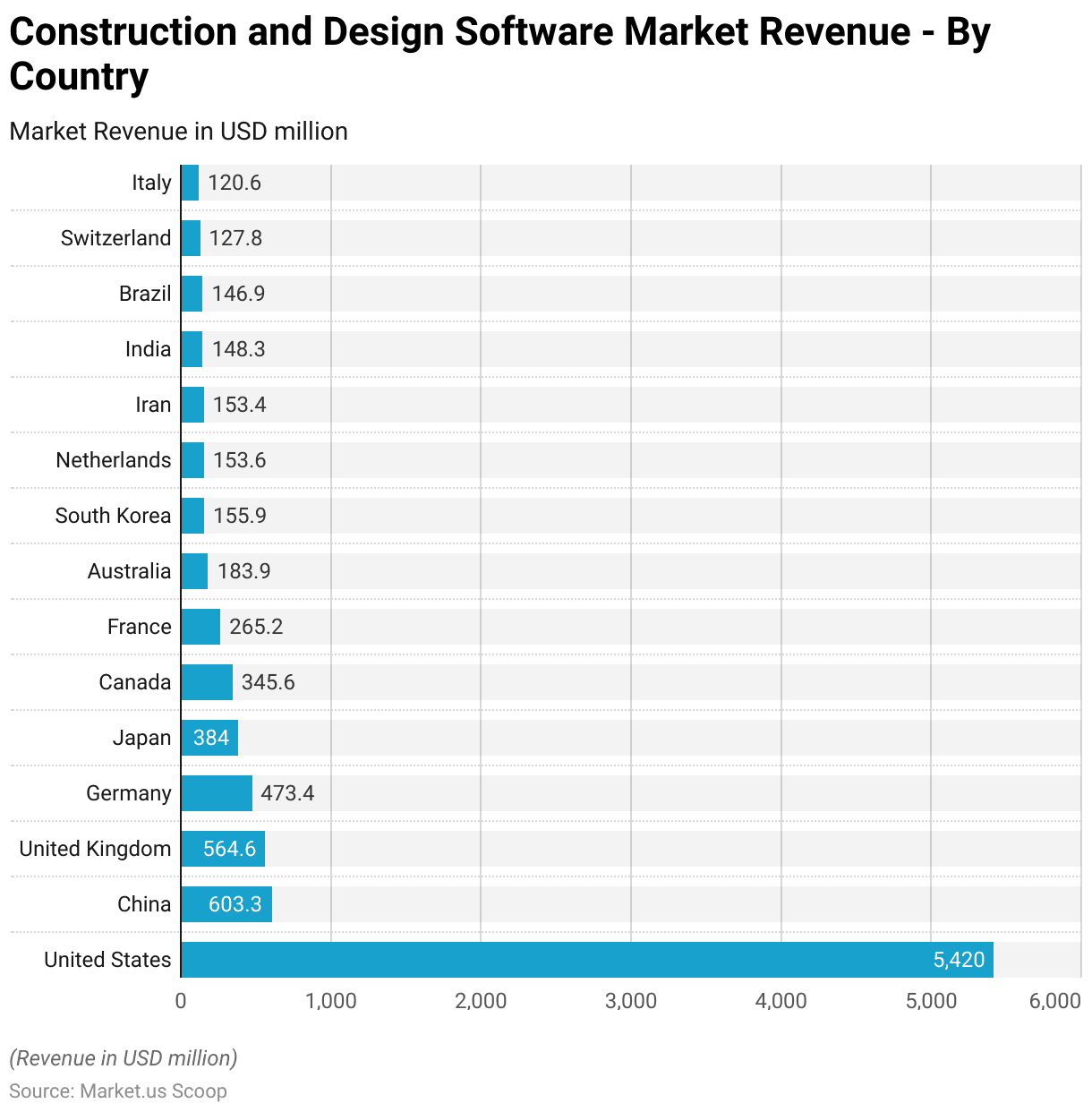

- The global construction and design software market sees significant contributions from various countries. The United States is leading the market with an impressive USD 5,420 million in revenue.

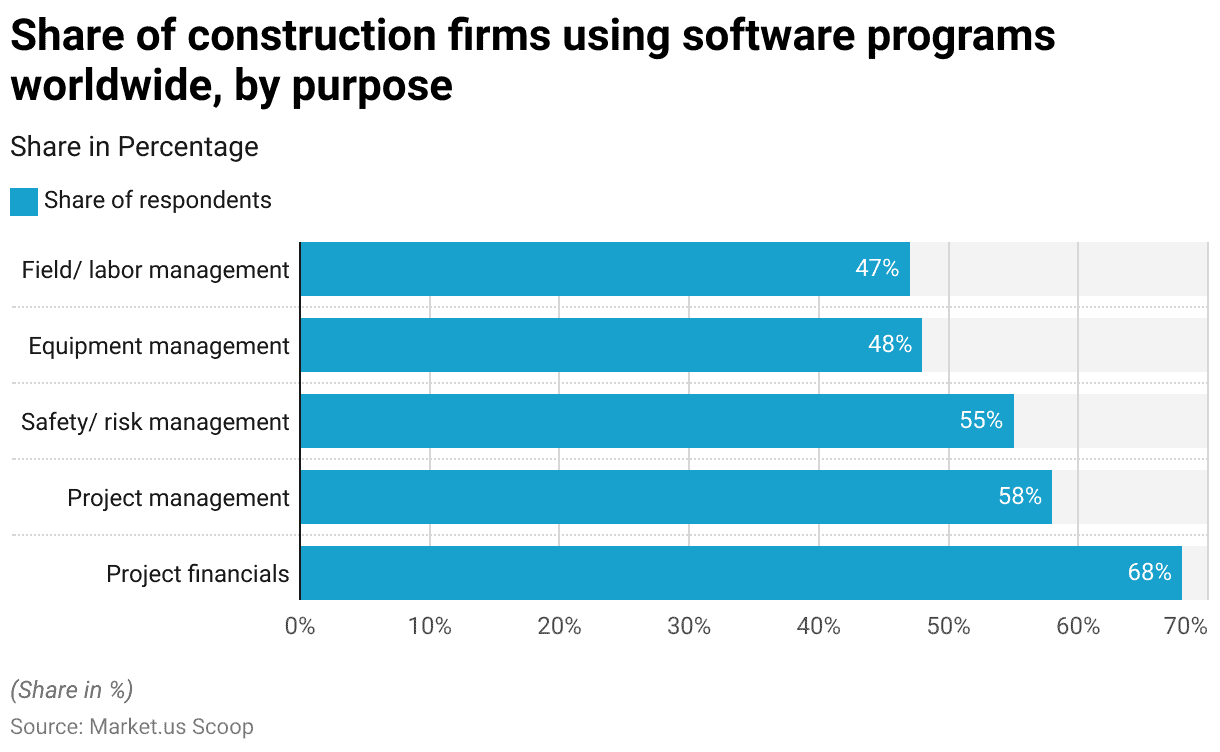

- As of 2019, construction firms worldwide have increasingly adopted software programs for various operational purposes. A significant 68% of firms reported using software for project financials, indicating a strong focus on managing costs and budgets.

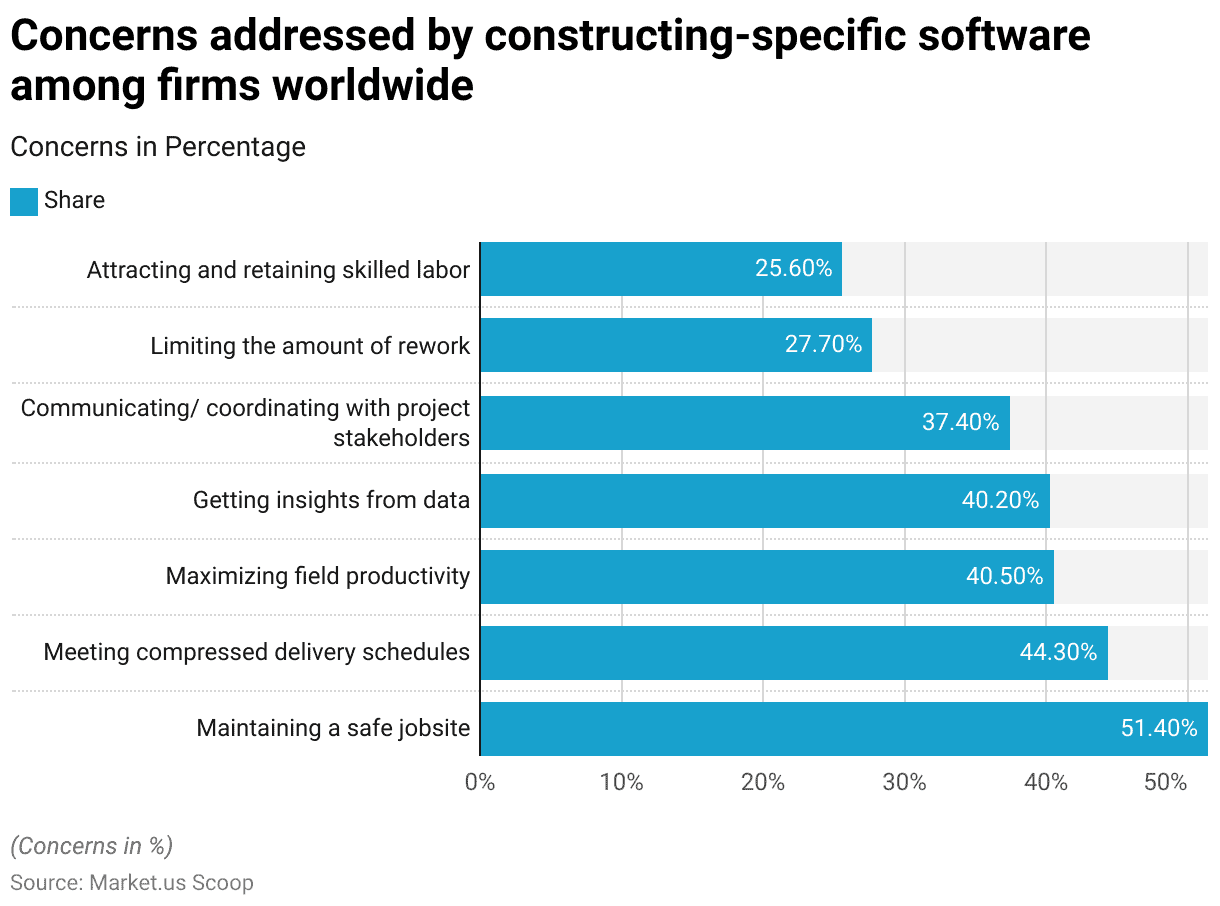

- As of 2019, construction-specific software has been instrumental in addressing a range of key concerns for firms worldwide. The primary concern, reported by 51.40% of respondents, was maintaining a safe job site. Highlighting the importance of safety management in the industry.

- Contractors in the construction industry have specific software functionalities they prioritize to improve efficiency and project management. The most requested feature, cited by 60% of respondents, is the ability to calculate costs quickly.

Construction Software Market Statistics

Global Construction Software Market Size Statistics

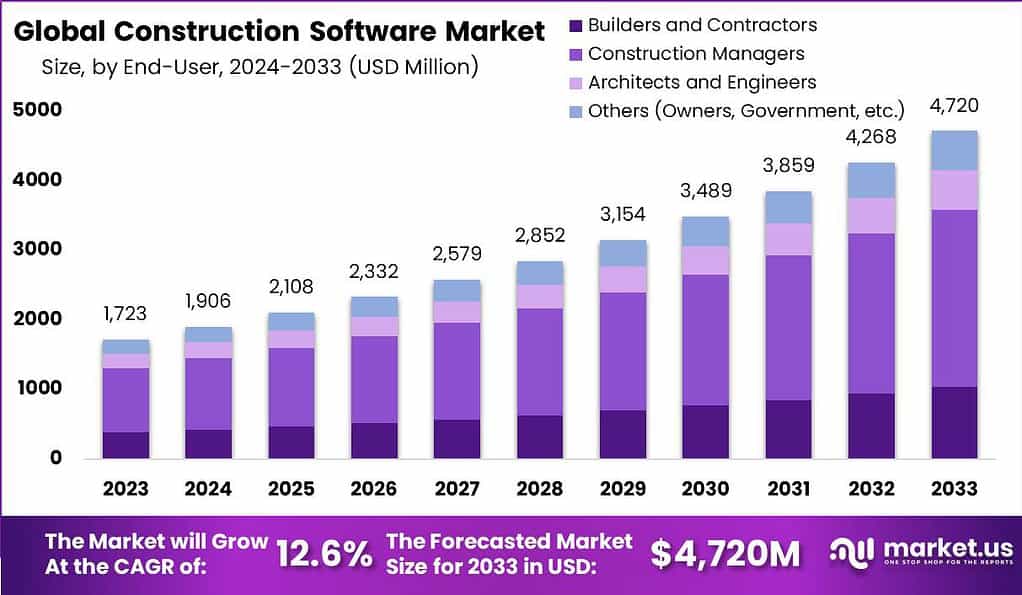

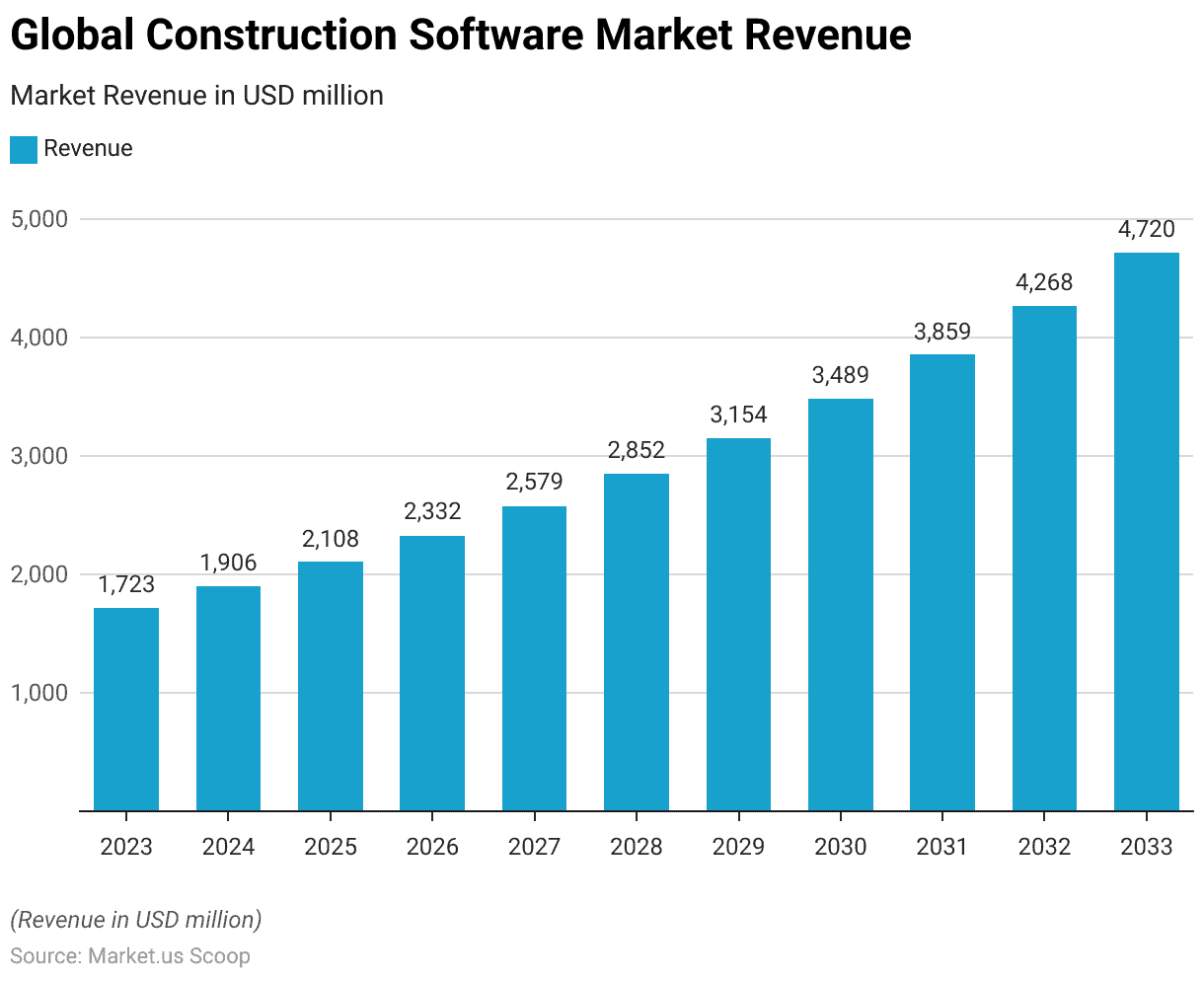

- The global construction software market is projected to experience significant growth over the next decade at a CAGR of 12.6%.

- In 2023, the market is estimated to reach USD 1,723 million.

- This upward trajectory continues, with revenues expected to grow to USD 1,906 million in 2024 and USD 2,108 million in 2025.

- By 2026, the market is forecasted to reach USD 2,332 million. With further growth leading to USD 2,579 million in 2027.

- The expansion accelerates over the following years, with revenues projected to reach USD 2,852 million in 2028, USD 3,154 million in 2029, and USD 3,489 million in 2030.

- By 2031, the market is expected to generate USD 3,859 million. Reaching USD 4,268 million in 2032 and culminating in a projected revenue of USD 4,720 million by 2033.

- This consistent growth trend reflects increasing demand for construction software solutions. Driven by advancements in technology and the ongoing digital transformation of the construction industry.

(Source: market.us)

Global Construction Software Market Size – By End-user Statistics

2023-2027

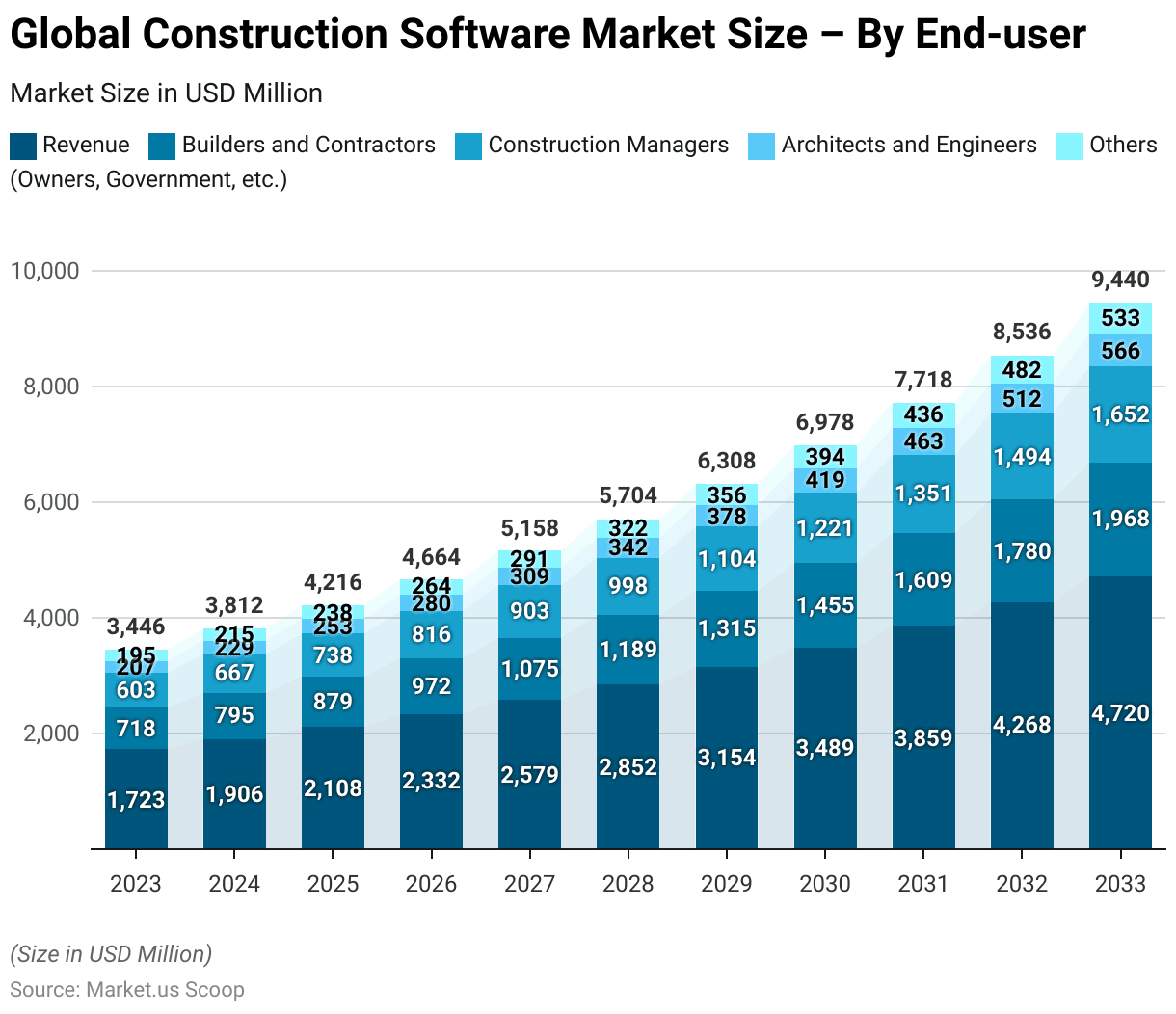

- The global construction software market is expected to see substantial growth across various end-user segments from 2023 to 2027.

- In 2023, the total market revenue was estimated at USD 1,723 million. With builders and contractors contributing USD 718.49 million, and construction managers generating USD 603.05 million. Architects and engineers account for USD 206.76 million, and other stakeholders, such as owners and government entities, add USD 194.70 million.

- By 2024, the market is projected to reach USD 1,906 million, with USD 794.80 million coming from builders and contractors. USD 667.10 million from construction managers, USD 228.72 million from architects and engineers, and USD 215.38 million from other stakeholders.

- This growth trend continues into 2025, when the market size is expected to rise to USD 2,108 million, with builders and contractors contributing USD 879.04 million. Followed by construction managers at USD 737.80 million, architects and engineers at USD 252.96 million, and other stakeholders at USD 238.20 million.

- By 2026, the market is forecasted to generate USD 2,332 million, with USD 972.44 million from builders and contractors, and USD 816.20 million from construction managers. USD 279.84 million from architects and engineers, and USD 263.52 million from others.

- The market growth continues through 2027, reaching USD 2,579 million, and by 2028, it is projected to generate USD 2,852 million.

2028-2032

- The contributions of builders and contractors are expected to increase from USD 1,075.44 million in 2027 to USD 1,189.28 million in 2028. While construction managers’ share rises from USD 902.65 million to USD 998.20 million during the same period.

- Architects and engineers are expected to contribute USD 309.48 million in 2027 and USD 342.24 million in 2028. With other stakeholders adding USD 291.43 million in 2027 and USD 322.28 million in 2028.

- By 2029, the market is forecasted to grow to USD 3,154 million, and by 2030, it is expected to reach USD 3,489 million.

- In 2029, builders and contractors are projected to generate USD 1,315.22 million, and construction managers USD 1,103.90 million. While architects, engineers, and other stakeholders will contribute USD 378.48 million and USD 356.40 million, respectively.

- These figures are expected to rise further by 2030, with builders and contractors contributing USD 1,454.91 million. Construction managers USD 1,221.15 million, architects and engineers USD 418.68 million, and other stakeholders USD 394.26 million.

- By 2031, the total market size is forecasted to reach USD 3,859 million, and by 2032, USD 4,268 million.

- In 2033, the market is expected to grow to USD 4,720 million, with builders and contractors contributing USD 1,968.24 million, and construction managers USD 1,652.00 million. Architects and engineers USD 566.40 million, and other stakeholders USD 533.36 million.

- This overall growth across all end-user segments demonstrates the increasing demand for construction software solutions over the next decade.

Global Construction Software Market Share – By Deployment Mode Statistics

- In the global construction software market, the deployment mode is divided between on-premise and cloud-based solutions.

- On-premise solutions currently hold the majority market share. Accounting for 54.5% of the total market.

- Meanwhile, cloud-based solutions are gaining significant traction, representing 45.5% of the market.

- This distribution reflects the ongoing transition toward cloud-based technologies. However, on-premise solutions remain dominant due to factors such as security, control, and customization preferences among some enterprises.

(Source: market.us)

Construction and Design Software Market Overview

Global Construction and Design Software Market Size Statistics

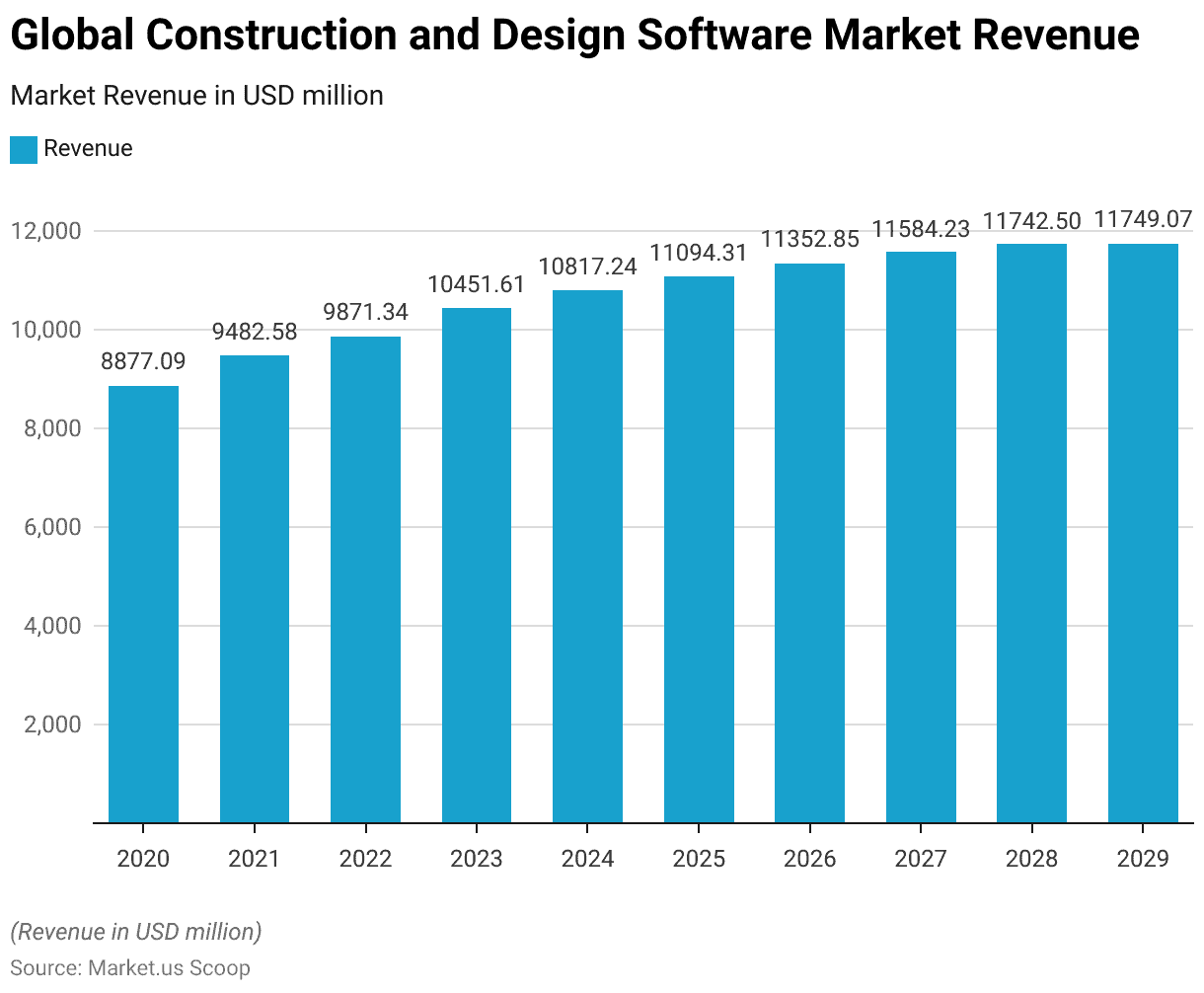

- The global construction and design software market has exhibited steady growth over the past decade and is expected to continue this trend.

- In 2020, the market revenue stood at USD 8,877.09 million, increasing to USD 9,482.58 million in 2021.

- By 2022, the market will reach USD 9,871.34 million, with further growth projected to USD 10,451.61 million in 2023.

- This positive momentum is expected to continue. With market revenues anticipated to reach USD 10,817.24 million in 2024 and USD 11,094.31 million in 2025.

- In subsequent years, the market is forecasted to maintain its upward trajectory. Reaching USD 11,352.85 million in 2026 and USD 11,584.23 million in 2027.

- By 2028, the global construction and design software market is expected to generate revenues of USD 11,742.50 million. Culminating in an estimated USD 11,749.07 million by 2029.

- This consistent growth highlights the increasing reliance on digital solutions for construction and design processes. Driven by technological advancements and the industry’s focus on efficiency and innovation.

(Source: Statista)

Competitive Landscape of Global Construction and Design Software Market Statistics

- The global construction and design software market is dominated by a few key players. With Dassault Systems holding the largest market share at 49%.

- Bentley Systems follows with a 10% share, while Aveva holds 8% of the market.

- Siemens accounts for 6%, and Trimble has a 5% market share.

- Autodesk and PTC have smaller shares, with 4% and 3%, respectively.

- The remaining 15% of the market is held by other companies, reflecting a competitive landscape with several smaller players.

- These figures underscore the significant influence of leading firms in driving technological advancements and shaping the market.

(Source: Statista)

Regional Analysis of Global Construction and Design Software Market Statistics

- The global construction and design software market sees significant contributions from various countries. The United States is leading the market with an impressive USD 5,420 million in revenue.

- China follows with USD 603.3 million, and the United Kingdom ranks third with USD 564.6 million.

- Germany and Japan also represent substantial portions of the market, generating USD 473.4 million and USD 384 million, respectively.

- Canada contributes USD 345.6 million, while France accounts for USD 265.2 million.

- Other notable countries include Australia with USD 183.9 million, South Korea at USD 155.9 million, and the Netherlands with USD 153.6 million.

- Iran and India contribute nearly equally to the market, with revenues of USD 153.4 million and USD 148.3 million, respectively.

- Brazil generates USD 146.9 million, while Switzerland and Italy account for USD 127.8 million and USD 120.6 million, respectively.

- These figures reflect the broad global reach of the construction and design software market. Driven by varying levels of demand and investment across different regions.

(Source: Statista)

Construction Software Usage Statistics

Global Use of Software in Construction Firms Statistics

- As of 2019, construction firms worldwide have increasingly adopted software programs for various operational purposes.

- A significant 68% of firms reported using software for project financials, indicating a strong focus on managing costs and budgets.

- Additionally, 58% of respondents utilized software for project management, reflecting the importance of coordinating tasks, schedules, and resources.

- Safety and risk management were other critical areas, with 55% of firms leveraging software solutions to mitigate risks and ensure compliance.

- Equipment management software was used by 48% of firms to track and maintain machinery.

- In comparison, 47% of respondents utilized software for field and labor management. Highlighting the importance of managing on-site operations and workforce productivity.

- This widespread adoption underscores the role of software in enhancing efficiency and operational control across the construction industry.

(Source: Statista)

Global Use of Software in Construction Firms to Address Concerns: Statistics

- As of 2019, construction-specific software has been instrumental in addressing a range of key concerns for firms worldwide.

- The primary concern, reported by 51.40% of respondents, was maintaining a safe job site. Highlighting the importance of safety management in the industry.

- Meeting compressed delivery schedules was a significant challenge for 44.30% of firms. While 40.50% cited maximizing field productivity as a priority.

- Additionally, 40.20% of respondents emphasized the importance of gaining insights from data. Underscoring the growing reliance on data analytics in construction.

- Communication and coordination with project stakeholders were a concern for 37.40% of firms. While 27.70% focused on limiting rework.

- Lastly, attracting and retaining skilled labor was noted as a challenge by 25.60% of respondents, reflecting ongoing workforce concerns in the industry.

- These insights demonstrate the diverse range of operational issues that construction software is helping to mitigate.

(Source: Statista)

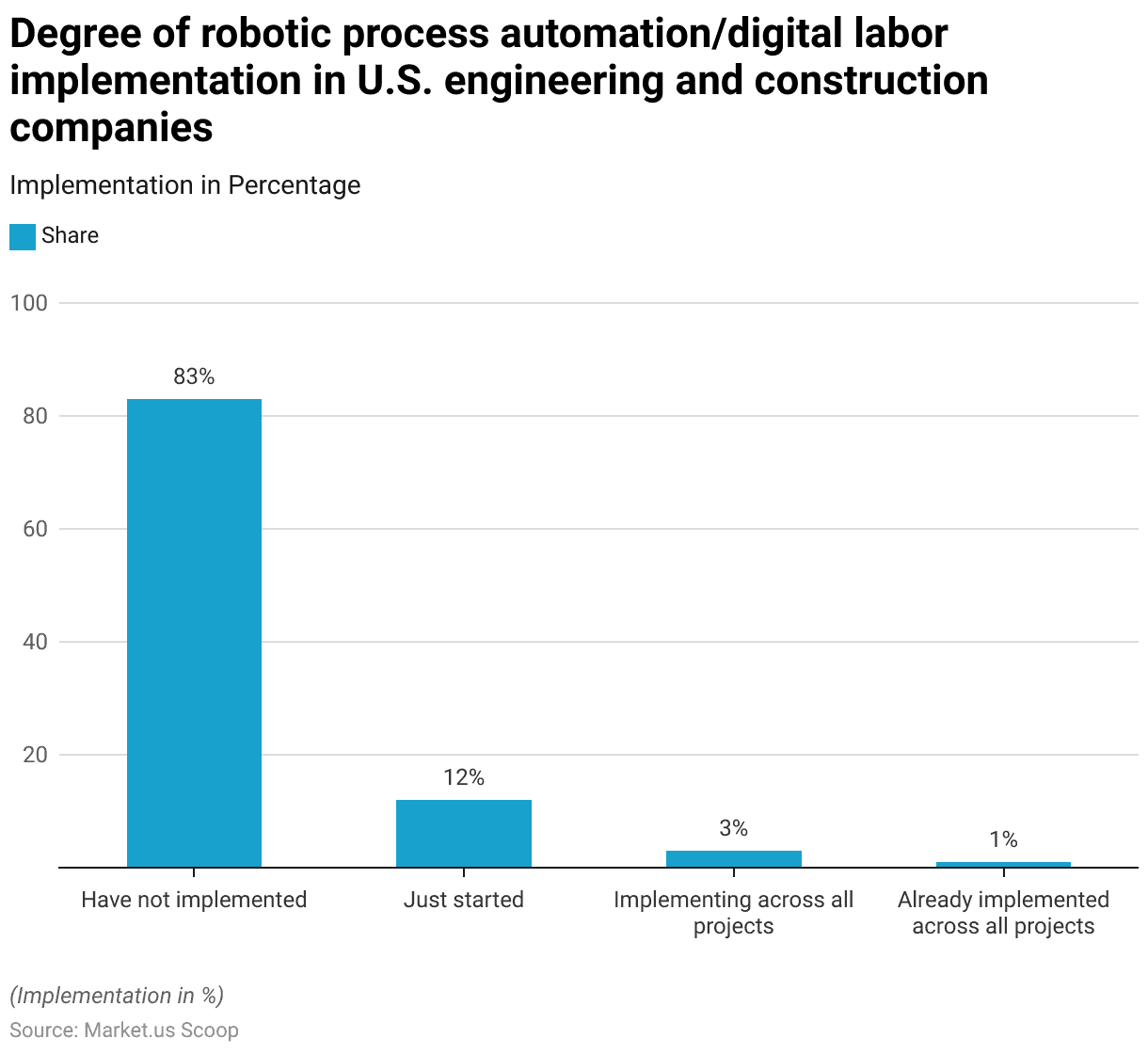

Degree of Technological Adoption in Engineering and Construction Companies

- As of 2017, the majority of U.S. engineering and construction companies had not yet implemented robotic process automation (RPA) or digital labor solutions, with 83% of respondents reporting no implementation.

- An additional 12% had just started exploring or integrating these technologies into their operations.

- Only a small percentage of companies had made more substantial progress, with 3% in the process of implementing RPA across all projects.

- Furthermore, just 1% of firms had already fully implemented RPA or digital labor solutions across all their projects, reflecting the nascent stage of adoption at the time.

(Source: Statista)

Construction Software Spending in Companies Statistics

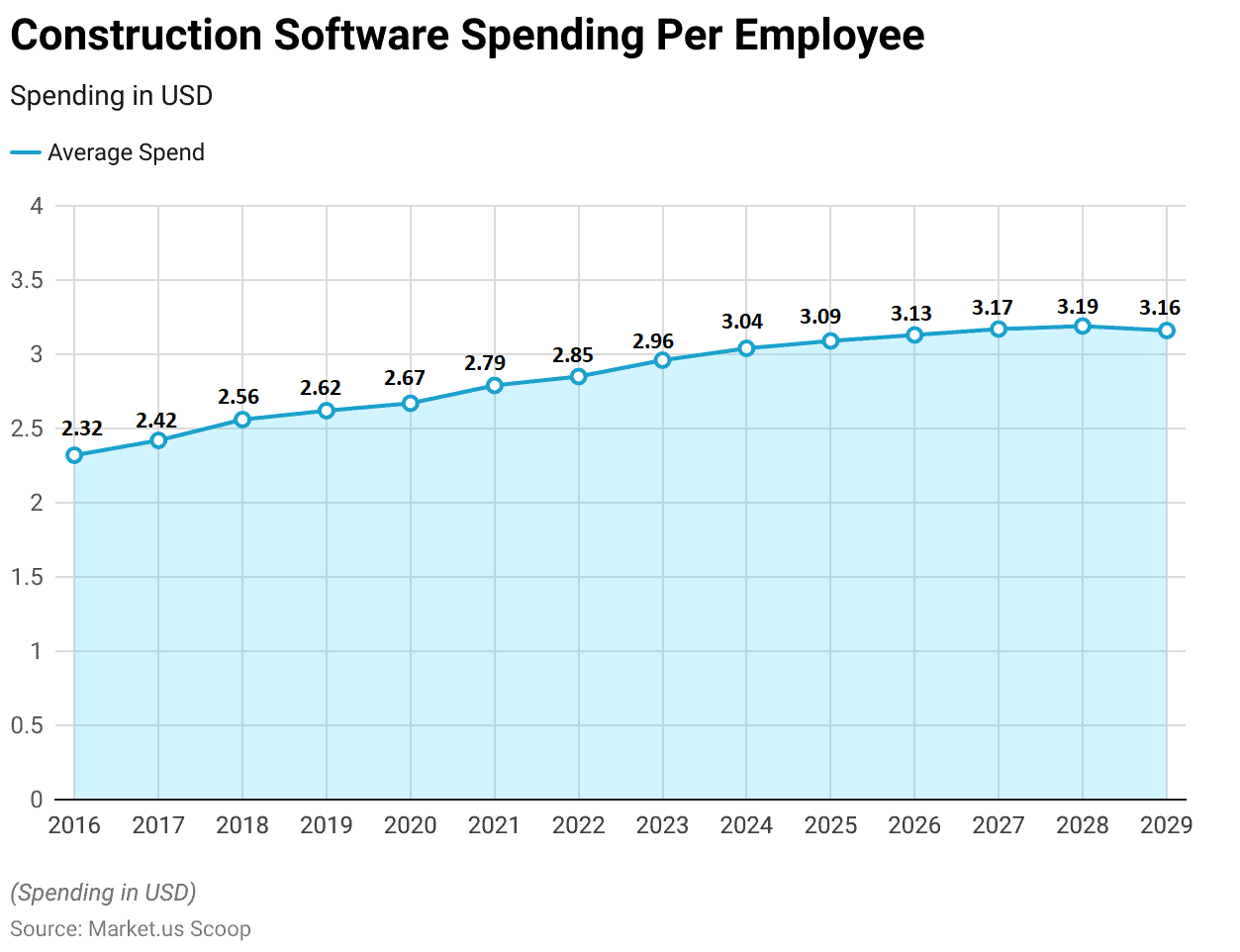

- The average spend per employee on construction software has shown a consistent upward trend from 2016 to 2029.

- In 2016, companies spent an average of USD 2.32 per employee, which increased to USD 2.42 in 2017 and USD 2.56 in 2018.

- The upward trajectory continued through 2019, with the average spend reaching USD 2.62, followed by USD 2.67 in 2020.

- By 2021, this figure had grown to USD 2.79, and in 2022, the spending per employee was USD 2.85.

- The average spend is projected to continue increasing, reaching USD 2.96 in 2023, USD 3.04 in 2024, and USD 3.09 in 2025.

- Beyond 2025, spending growth remains steady, with the average reaching USD 3.13 in 2026, USD 3.17 in 2027, and peaking at USD 3.19 in 2028.

- By 2029, however, the average spend is expected to stabilize slightly, dipping to USD 3.16 per employee.

- This steady increase highlights the growing importance and investment in software solutions within the construction industry as companies continue to enhance their digital capabilities.

(Source: Statista)

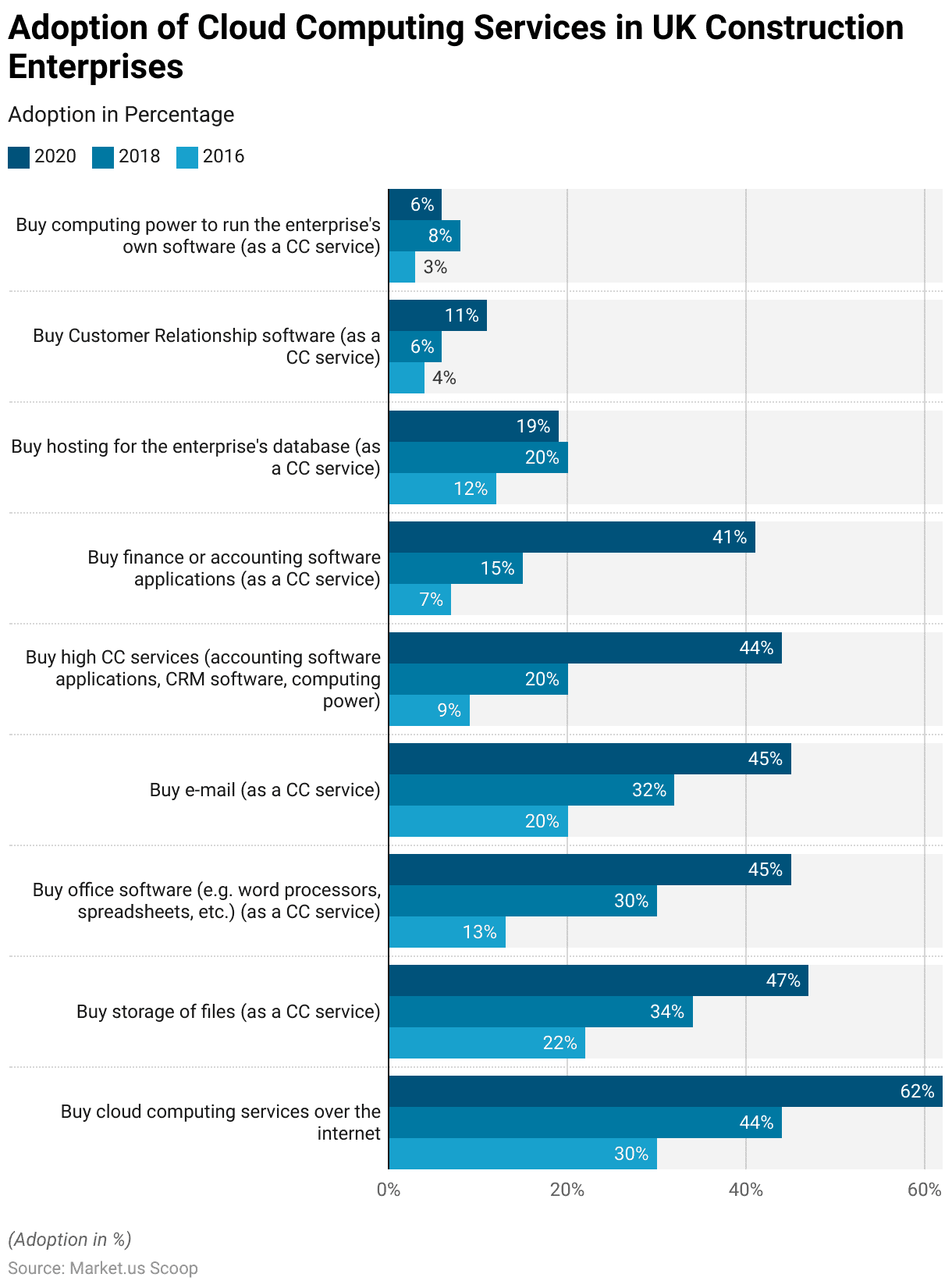

Enterprises Using Cloud Computing Services in the Construction Industry

- The adoption of cloud computing services in the construction sector of the United Kingdom has seen significant growth from 2016 to 2020.

- In 2020, 62% of enterprises reported purchasing cloud computing services over the Internet, a notable increase from 44% in 2018 to 30% in 2016.

- The use of cloud storage services also grew, with 47% of firms buying file storage services in 2020, compared to 34% in 2018 and 22% in 2016.

- Similarly, the purchase of office software as a cloud computing service rose from 13% in 2016 to 30% in 2018 and further to 45% in 2020.

- In addition, the use of cloud-based email services increased from 20% in 2016 to 32% in 2018 and 45% in 2020.

More Insights

- Enterprises buying high-end cloud computing services, such as accounting software applications, customer relationship management (CRM) software, and computing power, saw significant growth, with usage jumping from 9% in 2016 to 20% in 2018 and reaching 44% by 2020.

- The purchase of finance and accounting software applications as cloud services also expanded, rising from 7% in 2016 to 15% in 2018 and 41% in 2020.

- However, the use of cloud hosting services remained relatively stable, with 19% in 2020 compared to 20% in 2018, though still higher than the 12% recorded in 2016.

- The adoption of cloud-based customer relationship management (CRM) software increased modestly, from 4% in 2016 to 6% in 2018 and 11% in 2020.

- Finally, the use of cloud computing power to run enterprise software was adopted by only 6% of firms in 2020, compared to 8% in 2018 and just 3% in 2016.

- This data underscores the growing reliance on cloud-based services in the construction industry, with a clear shift towards embracing digital solutions across a variety of enterprise functions.

(Source: Statista)

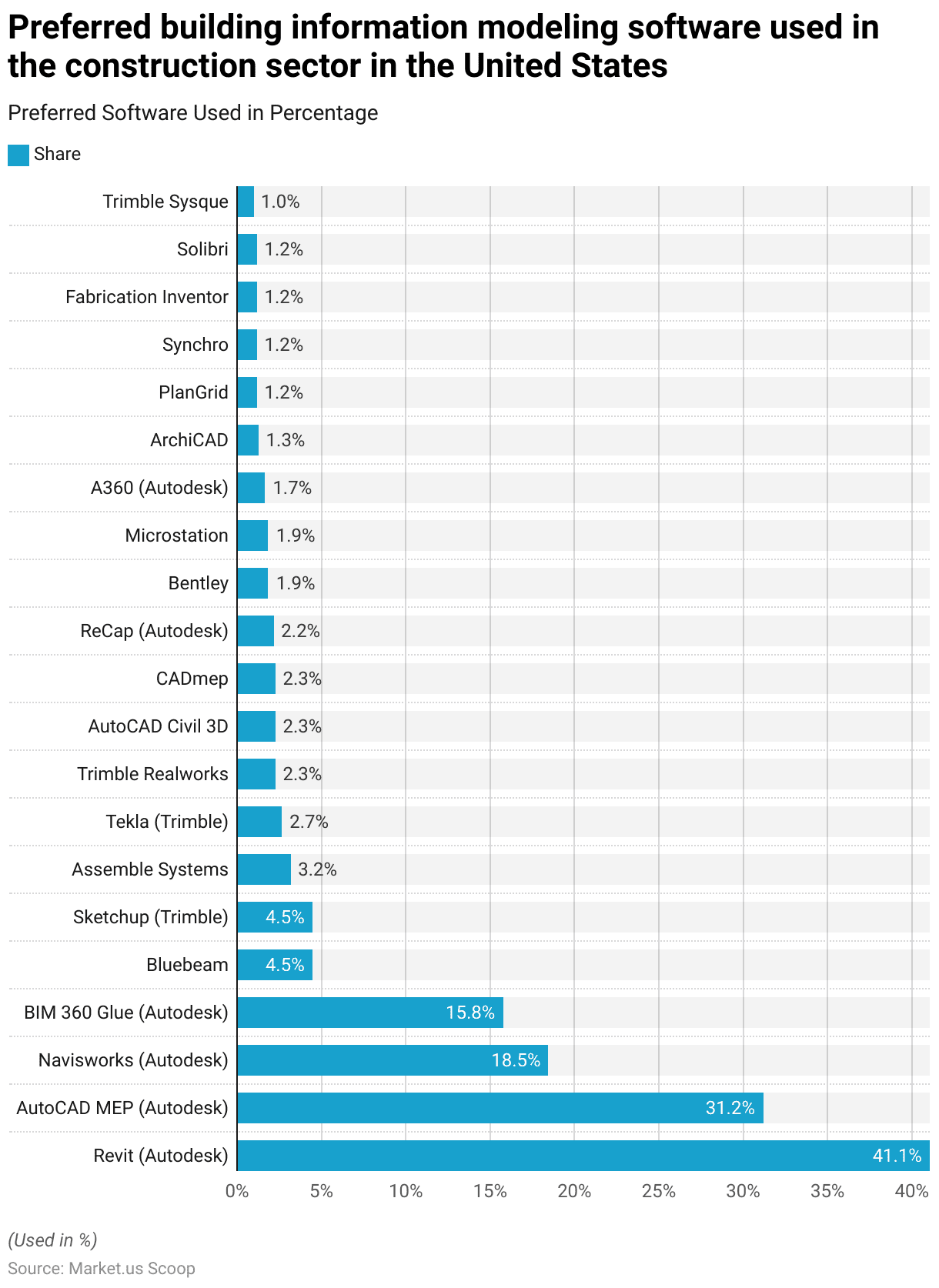

Preferred Building Information Modeling Software Used in the Construction Sector

- As of 2018, Revit, developed by Autodesk, was the most preferred building information modeling (BIM) software in the United States construction sector, with 41.10% of respondents using it.

- AutoCAD MEP, also from Autodesk, followed with 31.20% usage.

- Navisworks, another Autodesk product, had a significant share, with 18.50% of respondents utilizing it, while BIM 360 Glue from Autodesk was used by 15.80%.

- Other software programs, such as Bluebeam and SketchUp (Trimble), were employed by 4.50% of respondents.

- Assemble Systems accounted for 3.20% of usage, while Tekla (Trimble) and Trimble Realworks were each used by 2.70% and 2.30%, respectively.

- AutoCAD Civil 3D and CADmep each accounted for 2.30% of respondents.

- ReCap (Autodesk) was used by 2.20%, while Bentley and Microstation each had a share of 1.90%.

- Other software tools such as A360 (Autodesk) (1.70%), ArchiCAD (1.30%), PlanGrid (1.20%), Synchro (1.20%), and Fabrication Inventor (1.20%) were less commonly used.

- Solibri and Trimble Sysque rounded out the list, with 1.20% and 1.00% of respondents, respectively.

- This data reflects Autodesk’s dominance in the BIM software landscape within the U.S. construction industry, with a variety of specialized tools catering to different project needs.

(Source: Statista)

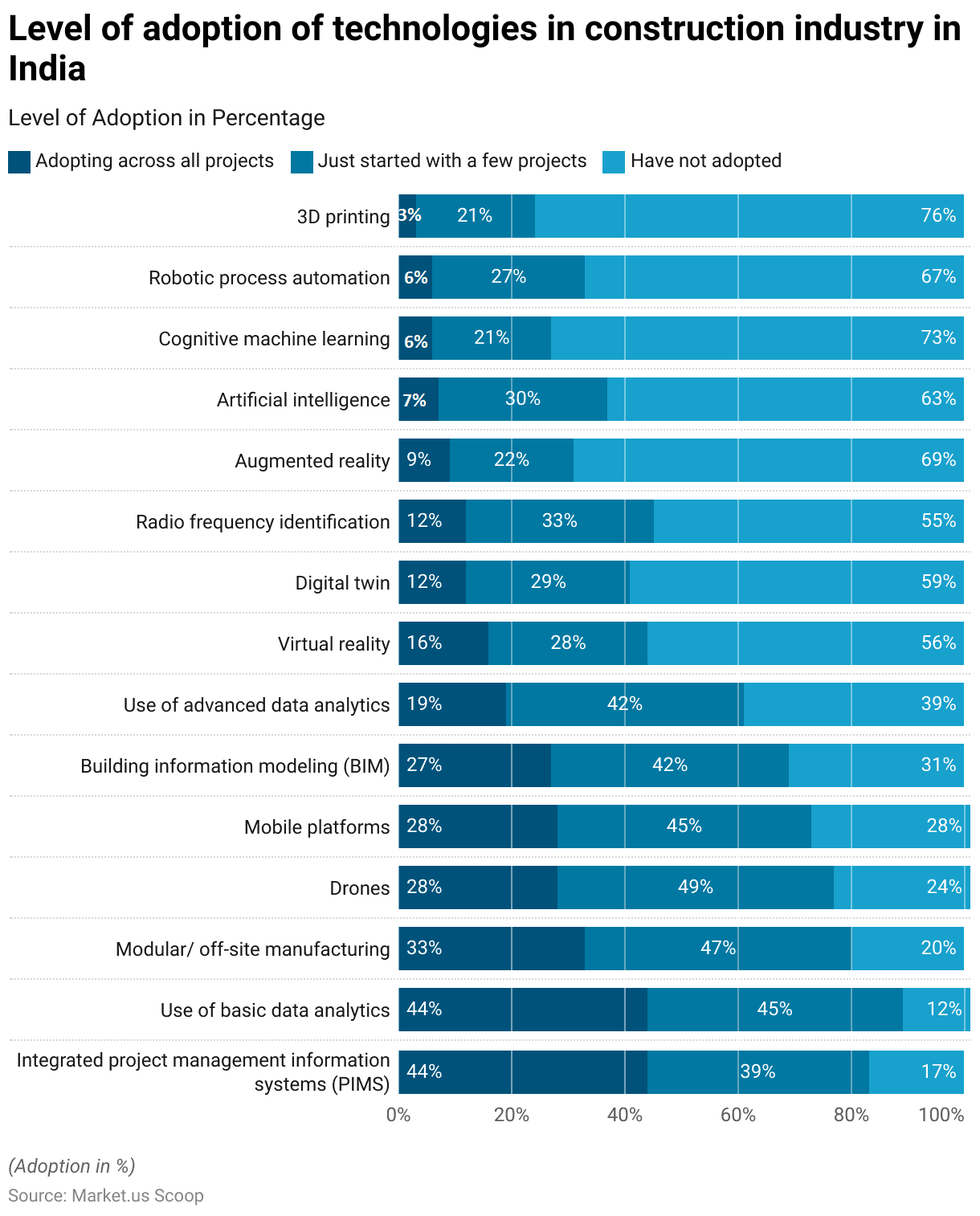

Adoption of Technologies in the Construction Industry

- As of June 2023, the adoption of various advanced technologies in the Indian construction industry has been growing at different rates.

- Integrated project management information systems (PIMS) and the use of basic data analytics are the most widely adopted technologies, with 44% of firms implementing them across all projects and another 39% and 45%, respectively, just starting with a few projects.

- Modular/off-site manufacturing has seen moderate adoption, with 33% using it across projects and 47% just starting.

- Drones and mobile platforms are being used by 28% of companies, while 49% and 45%, respectively, are beginning to integrate these technologies.

- Building information modeling (BIM) is also gaining traction, with 27% adopting it fully, though 42% have just started using it in some projects.

- More advanced technologies like data analytics, virtual reality (V.R.), and digital twin systems have slower uptake, with only 19% using advanced data analytics, 16% employing V.R., and 12% adopting digital twins.

- Technologies like radio frequency identification (RFID), augmented reality (A.R.), and artificial intelligence (A.I.) have even lower adoption, with just 12%, 9%, and 7% of firms, respectively, integrating them into their processes.

- Cognitive machine learning and robotic process automation have been adopted by 6% of firms, while 3D printing is the least adopted technology, with only 3% of companies using it across all projects.

- This data illustrates the varied pace at which new technologies are being embraced in the Indian construction sector, with many firms still in the early stages of adoption.

(Source: Statista)

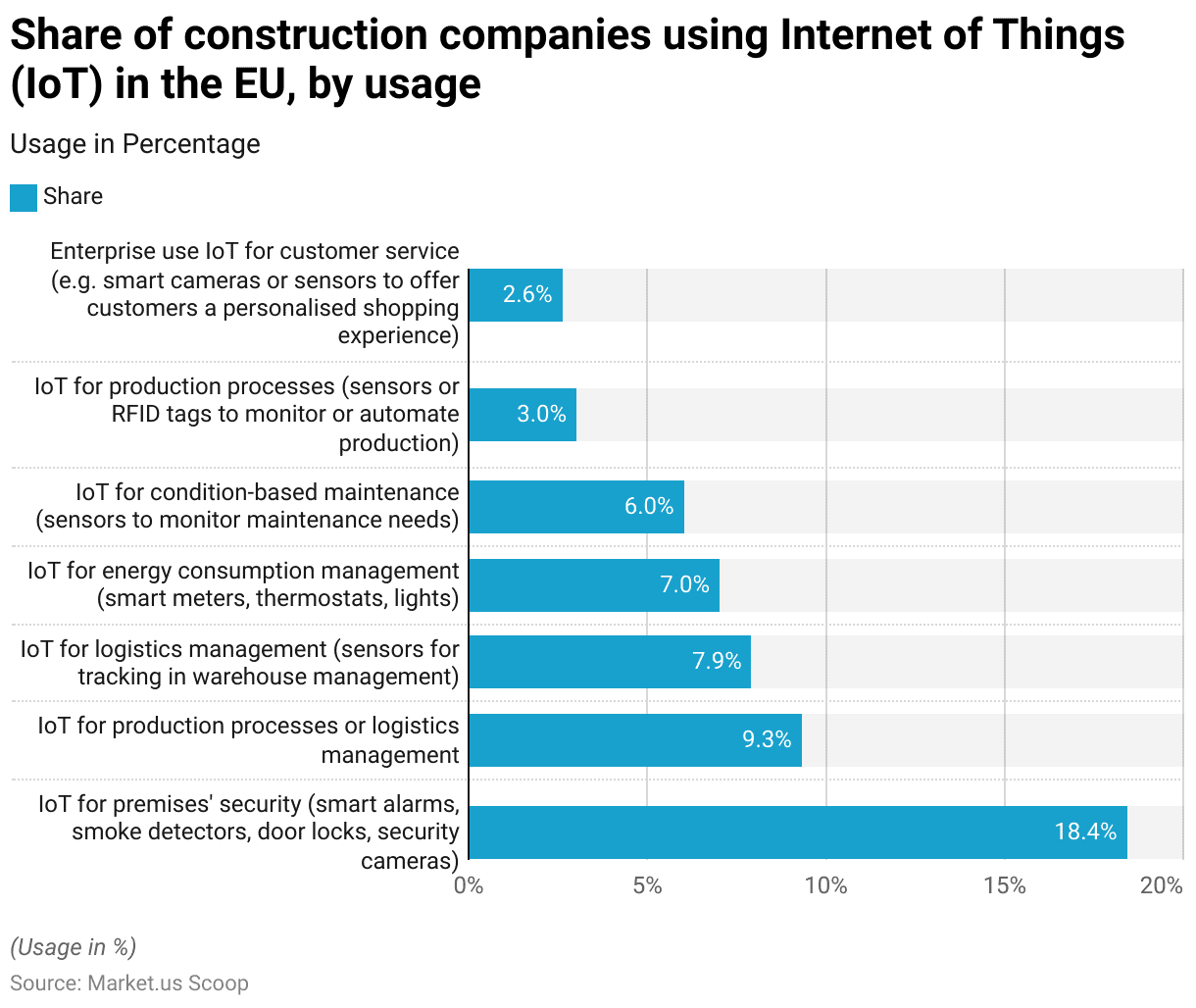

Use of the Internet of Things (IoT) by Construction Companies

- In 2021, construction companies in the European Union (EU-27) increasingly utilized the Internet of Things (IoT) across various functions.

- The most common usage was for premises’ security, including smart alarms, smoke detectors, door locks, and security cameras, with 18.40% of respondents employing IoT in this area.

- IoT was also used for production processes or logistics management by 9.30% of companies, and 7.90% utilized it specifically for logistics management, such as sensors for tracking in warehouse operations.

- Energy consumption management through smart meters, thermostats, and lights was another notable IoT application, with 7.00% of firms using it.

- Condition-based maintenance, leveraging sensors to monitor maintenance needs, accounted for 6.00% of IoT use.

- Additionally, 3.00% of respondents reported using IoT for production processes, such as sensors or RFID tags, to monitor or automate production activities.

- Finally, 2.60% of companies employed IoT in customer service, utilizing smart cameras or sensors to offer personalized experiences.

- These figures indicate a growing but varied adoption of IoT technology within the E.U.’s construction industry.

(Source: Statista)

Top Tasks Accomplished Using Software in the Construction Industry

- Construction companies have increasingly adopted software solutions to enhance efficiency in various operational areas.

- Accounting is the most common task managed with software, with 85.40% of respondents reporting its use.

- Estimating tasks follow, with 60.40% of companies relying on software for this purpose.

- Project management tools are utilized by 56.50% of firms, while 49.20% of respondents use software for project scheduling.

- CAD/BIM (Computer-Aided Design/Building Information Modeling) and take-off software solutions are each employed by 45.20% and 45.00% of companies, respectively.

- Other key areas include bid management, where 33.60% of companies use technology, and client relationship management, with 25.10% adoption.

- Prequalification tasks are handled with software by 12.30% of firms, reflecting the growing role of technology across diverse functions within the construction industry.

- These figures underscore the critical role of digital tools in streamlining various tasks and processes within the sector.

(Source: Knowledge Annual Construction Technology Report 2017)

Top Requested Construction Software Functionalities by Contractors Statistics

- Contractors in the construction industry have specific software functionalities they prioritize to improve efficiency and project management.

- The most requested feature, cited by 60% of respondents, is the ability to calculate costs quickly.

- Following this, 40% of contractors look for software that provides take-off capabilities.

- Accounting and job management functionalities are important for 37% of respondents, while 34% emphasize the need for project tracking.

- Document management is a priority for 25% of contractors, and 24% value project scheduling features.

- Additional functionalities include generating materials, which are sought by 18% of contractors, and preparing bid proposals, requested by 17%.

- Integration with other systems is a requirement for 7% of respondents, while mobile access ranks lower, with 6% of contractors considering it a key feature.

- This data highlights the diverse range of functionalities that contractors seek to streamline operations and manage project complexities efficiently.

(Source: Knowledge Annual Construction Technology Report 2017)

Key Investment Statistics

- Global investment in the architecture, engineering, and construction (AEC) industry has seen significant growth between the periods of 2017-2019 and 2020-2022.

- From 2017 to 2019, total funding reached USD 27 billion across 944 deals, representing an 85% increase over previous years.

- In the following period, from 2020 to 2022, funding grew to USD 50 billion, with the number of deals rising to 1,229.

- However, the rate of increase during this period slowed to 30%.

- This trend reflects a substantial rise in investment activity in the AEC sector, although the pace of growth moderated between the two periods.

(Source: McKinsey)

Importance of Technology to Construction Business Strategy

- In 2022, construction businesses in Australia had varying opinions on the importance of technology to their business strategy.

- For 26% of respondents, technology was considered extremely important.

- Meanwhile, 34% of businesses deemed it important but not critical.

- Interestingly, 40% of respondents indicated that technology was not important to their business strategy, reflecting a significant portion of the industry that may not yet fully embrace or prioritize digital transformation efforts.

- This distribution highlights the diverse perspectives within the construction sector regarding the role of technology in driving business success.

(Source: Statista)

Challenges and Concerns

- As of June 2023, the construction industry in India faced a variety of market challenges.

- A majority, 51% of respondents, described the challenges as difficult but manageable. Indicating that while obstacles exist, they can be navigated with the right strategies.

- Another 39% believed these challenges were part of a normal business cycle or related to global issues, suggesting they were not out of the ordinary.

- However, 8% of respondents felt the challenges were unlike anything they had seen before. Pointing to unprecedented conditions.

- Meanwhile, 2% were unsure of how to classify the current market environment, reflecting some uncertainty within the industry.

(Source: Statista)

Technological Innovations in Construction Software Statistics

- Technological innovations in construction software are transforming the industry by improving efficiency, safety, and sustainability.

- Key developments include Building Information Modeling (BIM), which enables real-time collaboration and 3D modeling, enhancing project planning and execution.

- Integration with Geographic Information Systems (GIS) allows for advanced data analysis and improved decision-making during construction.

- Digital twins, virtual replicas of physical assets, are becoming popular for real-time monitoring and predictive maintenance.

- Robotics and automation, including drones and AI-driven machines, streamline repetitive tasks and enhance safety on job sites.

- Furthermore, 3D printing is being utilized to construct entire buildings, significantly reducing time and labor costs.

- These innovations are driving a shift towards smarter, greener construction practices, making the industry more adaptive to modern challenges.

(Sources: Houzz, Trimble Constructible, Intellectsoft, XB Software)

Regulations for Construction Software

- Regulations for construction software vary globally, often aligned with safety, sustainability, and digital standards.

- In many countries, the adoption of Building Information Modeling (BIM) is increasingly mandated.

- For instance, the U.K. and parts of Europe require BIM usage in public projects to enhance project collaboration and efficiency.

- In the U.S., regulations focus on safety standards outlined by OSHA, emphasizing tools for compliance with safety protocols on job sites. Such as fall protection and hazard communication.

- In Japan, regulations aim to integrate software solutions that streamline disaster-resilient constructions.

- Additionally, countries like France and Spain have implemented stringent energy efficiency regulations. Requiring construction software to track and manage energy performance.

- These varied regulations across regions encourage the development and use of software that helps construction companies comply with local laws, improve productivity, and reduce risks.

(Sources: BIMobject for manufacturers, BIMobject, Sensera Systems)

Recent Developments

Acquisitions and Mergers:

- Autodesk acquires ProEst: In 2023, Autodesk, a leading provider of design and construction software, acquired ProEst. A cloud-based estimating software company, for $200 million. This acquisition aims to enhance Autodesk’s capabilities in cost estimation and project management, further solidifying its position in the construction software market.

- Trimble acquires e-Builder: In mid-2023, Trimble, known for its advanced technology solutions for the construction industry, acquired e-Builder. A construction management software company, for $500 million. This acquisition is intended to expand Trimble’s project management offerings and improve collaboration tools for construction teams.

New Product Launches:

- Procore introduces Procore BIM: In 2024, Procore launched Procore BIM, a new tool that integrates Building Information Modeling (BIM) capabilities directly into its construction management platform. This tool allows construction teams to visualize and coordinate complex projects in real time, improving efficiency and reducing errors.

- Bentley Systems launches SYNCHRO 4D: In late 2023, Bentley Systems released SYNCHRO 4D. An advanced construction scheduling and project management tool that integrates 4D modeling with real-time data analytics. This launch is aimed at improving project planning and execution by offering enhanced visualization and predictive insights.

Funding:

- Buildertrend raises $100 million for platform expansion: In 2023, Buildertrend, a cloud-based construction management software provider, secured $100 million in funding to expand its platform’s features and scale its operations globally. The funding will also support the development of new tools for small to mid-sized construction companies.

- PlanGrid secures $80 million in Series D funding: In early 2024, PlanGrid, a construction productivity software company, raised $80 million in Series D funding to enhance its mobile-first construction management platform. This funding will help PlanGrid develop more robust project collaboration and field management features.

Technological Advancements:

- AI and Machine Learning in Construction Software: AI and machine learning are being increasingly integrated into construction software to improve project forecasting, risk management, and resource allocation. By 2025, over 30% of construction software platforms are expected to incorporate AI-driven tools, enhancing decision-making and project outcomes.

- Cloud-Based Construction Management: The shift to cloud-based construction management platforms continues to grow. Offering better collaboration and real-time access to project data. By 2025, it is projected that 60% of construction firms will use cloud-based software for managing their projects, driven by the need for flexibility and scalability.

Market Dynamics:

- Growth in the Construction Software Market: This growth is fueled by the increasing adoption of digital tools in construction. The demand for better project management solutions and the rise of smart city initiatives.

- Rising Demand for Mobile and Field Management Tools: As construction sites become more complex. There is an increasing demand for mobile and field management tools that allow for real-time communication and data access. By 2025, mobile construction software solutions are expected to account for 40% of the market. Reflecting the industry’s move towards digital and mobile-first strategies.

Conclusion

Construction Software Statistics – The construction software market is rapidly growing as the industry embraces digital transformation to enhance efficiency, project management, and cost control.

With the increasing adoption of cloud-based solutions and data analytics, companies are streamlining workflows and addressing project complexities.

While larger firms lead in adoption, smaller firms are gradually following suit. Despite challenges such as integration and initial costs.

The long-term benefits of construction software, improved productivity, safety, and profitability, are making it essential for the industry’s future.

FAQs

Construction software is a digital tool designed to help construction companies manage various aspects of their projects. Including project management, cost estimation, scheduling, and document control.

Key benefits include improved project efficiency, better cost control, streamlined communication, enhanced safety management, and data-driven decision-making.

There are several types, including project management software, Building Information Modeling (BIM) tools, accounting software, scheduling and estimating tools, and field management applications.

Cloud-based solutions allow users to access software from any device with an internet connection, enabling real-time collaboration and data sharing across teams.

It centralizes project information, automates workflows, and improves communication, allowing for better scheduling, budgeting, resource management, and risk mitigation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)