Table of Contents

- Introduction

- Editor’s Choice

- Contact Center as a Service Market Statistics

- Contact Center as a Activities and Services Statistics

- Contact Channels Supported by Customer Service Teams Worldwide

- Primary Industries of Contact Centers Worldwide

- Jobs Created in the Global Call Center Industry

- Call Centers Opened or Expanded – By Region

- Reasons for Using/Contacting Contact Centers

- Investment Trends

- Level of Quality Assurance Process

- Consumer Preferences and Trends

- AI Usage Trends

- Positive Aspects of Bot Contact

- Global Contact Center Satisfaction Trends

- Challenges and Concerns

- Innovations in Contact Center as a Service Statistics

- Regulations for Contact Center as a Service Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Contact Center as a Service Statistics (CCaaS) shows a cloud-based solution offering businesses a scalable, flexible, and cost-effective approach to managing customer interactions.

By leveraging cloud infrastructure, CCaaS provides seamless access to a range of features. Including omnichannel support (voice, email, chat, social media, SMS). Advanced tools like AI-driven analytics and chatbots, and integration with other business systems.

This model enhances operational efficiency, reduces capital expenditures, and ensures robust disaster recovery and security measures. All while delivering a user-friendly experience that supports agents and managers.

Editor’s Choice

- The revenue of the global Contact Center as a Service (CCaaS) market is projected to reach USD 23.6 billion by 2032.

- The distribution of market share within the Global Contact Center as a Service (CCaaS) market varies significantly across different end-use industries. The Banking, Financial Services, and Insurance (BFSI) sector holds the largest share, accounting for 25% of the market.

- In 2021, the distribution of contact centers across various industries worldwide showcased a varied landscape. Financial services led the sectors, comprising 17% of the total, underscoring its reliance on robust customer interaction frameworks.

- In 2023, the primary reasons for contacting customer service globally varied, reflecting the diverse needs and issues experienced by consumers. Both reporting an issue with a product or service and requiring product or service information accounted for the highest share of reasons, each at 13%.

- In 2019, the primary drivers of investment in contact centers worldwide. They were largely focused on enhancing customer-related aspects and expanding business capabilities. A significant 85% of respondents identified customer experience and expectations as the key driver. Emphasizing the central role of customer satisfaction in strategic investments.

- In 2022, customer expectations from Contact Center as a Service (CCaaS) vendors reveal distinct preferences and demands. A significant 66% of customers expect companies to understand their needs and expectations thoroughly.

- In the evolving landscape of Contact Center as a Service (CCaaS), recent innovations have been particularly transformative. Driven by leading companies like Genesys, NICE, Amazon Web Services (AWS), and Five9, each recognized as leaders in Gartner’s 2023 Magic Quadrant.

Contact Center as a Service Market Statistics

Global Contact Center as a Service Market Size Statistics

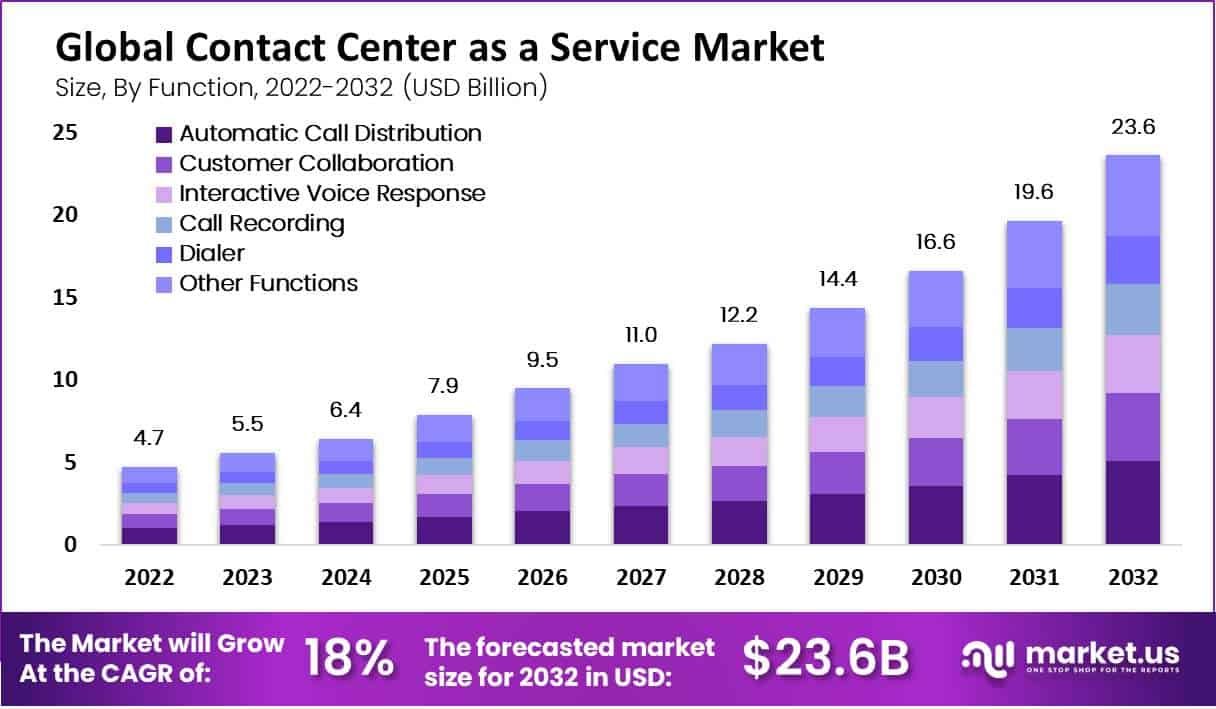

- The revenue of the global Contact Center as a Service (CCaaS) market is projected to experience consistent growth over the coming decade at a CAGR of 18%.

- In 2022, the market was valued at USD 4.7 billion.

- The following year, 2023, saw an increase to USD 5.5 billion.

- This upward trajectory is expected to continue, with revenues reaching USD 6.4 billion in 2024 and USD 7.9 billion in 2025.

- The growth rate remains robust into the latter half of the decade, with market size estimated at USD 9.5 billion in 2026, further increasing to USD 11.0 billion in 2027.

- By 2028, the market revenue is anticipated to grow to USD 12.2 billion, and by 2029, it is forecasted to reach USD 14.4 billion.

- The momentum is maintained into the early 2030s, with projections of USD 16.6 billion in 2030, USD 19.6 billion in 2031, and ultimately reaching USD 23.6 billion by 2032.

- This data underscores a substantial and sustained expansion in the CCaaS sector. Reflecting increased adoption and integration of cloud-based contact center solutions across various industries.

(Source: market.us)

Contact Center as a Service Market Size – By Function Statistics

- The Contact Center as a Service (CCaaS) market has exhibited significant growth across various functionalities over the forecast period from 2022 to 2032.

- In 2022, the total market revenue stood at USD 4.7 billion, distributed among various functionalities such as Automatic Call Distribution (USD 1.02 billion), and Customer Collaboration (USD 0.82 billion). Interactive Voice Response (USD 0.70 billion), Call Recording (USD 0.62 billion), Dialer (USD 0.58 billion), and Other Functions (USD 0.97 billion).

- By 2023, the market expanded to USD 5.5 billion, reflecting growth across all segments.

- This upward trend continued, reaching USD 6.4 billion in 2024, and is projected to grow significantly to USD 23.6 billion by 2032.

- Notably, Automatic Call Distribution is expected to grow from USD 1.02 billion in 2022 to USD 5.10 billion by 2032.

- Similarly, substantial growth is forecasted in Customer Collaboration. Increasing from USD 0.82 billion in 2022 to USD 4.11 billion by 2032. Other functionalities, including Interactive Voice Response, Call Recording, and Dialer, are also projected to see robust increases.

- By 2032, revenues for Other Functions are anticipated to more than quadruple to USD 4.86 billion from USD 0.97 billion in 2022. Demonstrating the expansive scope and increasing reliance on CCaaS solutions across various sectors.

(Source: market.us)

Contact Center as a Service Market Share – By End-use Industry Statistics

- The distribution of market share within the Global Contact Center as a Service (CCaaS) market varies significantly across different end-use industries.

- The Banking, Financial Services, and Insurance (BFSI) sector holds the largest share, accounting for 25% of the market.

- This is followed by the Consumer Goods & Retail sector, which comprises 21% of the market.

- The IT & Telecom industry also holds a substantial portion, representing 17%.

- Government-related usage accounts for 14% of the market share, indicating significant adoption within public sector communications.

- The Healthcare sector comprises 12%, reflecting its reliance on robust customer service solutions.

- Lastly, other end-use industries collectively hold 11% of the market. Demonstrating the widespread applicability and utilization of CCaaS solutions across various fields.

- This distribution highlights the pervasive and versatile nature of CCaaS. Catering to a broad range of sectors with diverse communication needs.

(Source: market.us)

Contact Center as a Activities and Services Statistics

Services Provided by Contact Centers Worldwide

- As of March 2013, contact centers worldwide offered a range of services to meet various customer needs. With a significant focus on both business-to-business (B2B) and business-to-consumer (B2C) customer care.

- B2B customer care was the most provided service, utilized by 39% of respondents, closely followed by B2C customer care at 37%.

- Inbound sales were also a major service, representing 30% of the offerings.

- Help desk services, including IT support, were provided by 29% of respondents.

- Technical support was another key service provided by 26% of the contact centers.

- Additionally, 25% of the centers handled internal and back-office tasks, and an equal percentage offered outbound sales.

- Field service was slightly less common, with 24% of contact centers offering it.

- These services underscore the diverse functionality of contact centers. Highlighting their role in supporting various aspects of business operations and customer engagement.

(Source: Statista)

Industry Revenue of Activities of Call Centres

- The industry revenue for “activities of call centers” in the United Kingdom has exhibited fluctuations over the period from 2012 to 2025.

- Starting in 2012, the revenue was USD 2,632.91 million and saw a growth trajectory, reaching USD 3,199.85 million by 2014.

- However, a decline followed, with revenue dropping to USD 2,259.67 million in 2016.

- The revenue saw a slight recovery in the following years, peaking at USD 2,686.71 million in 2018.

- Afterward, a downward trend resumed, with 2020 witnessing a revenue of USD 2,214.22 million amid global economic challenges.

- A modest recovery ensued post-2020, with projections showing a slight increase to USD 2,297.87 million in 2023 and then a stabilization around USD 2,297.17 million in 2024.

- The revenue is expected to decrease slightly to USD 2,288.42 million by 2025.

- This data outlines the resilience and the challenges within the UK call center industry over the examined period.

(Source: Statista)

Contact Channels Supported by Customer Service Teams Worldwide

- In 2023, customer service teams worldwide support a diverse array of contact channels to engage with consumers.

- Email leads are the most prevalent channel, utilized by 91% of respondents. Closely followed by traditional phone calls at 89%.

- Contact forms are also widely adopted, used by 56% of service teams, while 52% support chat functions.

- Social media platforms serve as a significant point of contact for 43% of teams.

- Services tailored for logged-in website users are provided by 37% of teams. Whereas customer portals are utilized by 35%.

- For users not logged into websites, 31% of teams offer support. A share that is matched by mobile applications, SMS, and proactive emails.

- Video calls are used by 20% of customer service teams, reflecting a growing but more niche adoption.

- The least common, yet still notable, are proactive SMS campaigns, used by 15% of respondents, indicating a strategic approach to customer engagement.

- This wide range of channels underscores the evolving landscape of customer service. Where digital and traditional methods converge to enhance user experience and accessibility.

(Source: Statista)

Primary Industries of Contact Centers Worldwide

- In 2021, the distribution of contact centers across various industries worldwide showcased a varied landscape.

- Financial services led the sectors, comprising 17% of the total, underscoring its reliance on robust customer interaction frameworks.

- The technology, media, and telecommunications sectors followed closely. Representing 15% of the industry share, indicative of the sector’s significant customer engagement needs.

- Retail held a 13% share, reflecting its customer-centric operations.

- Manufacturing accounted for 10%, highlighting the industry’s growing focus on customer service as a differentiator.

- Tourism and transportation, sectors greatly dependent on customer service for operations and client satisfaction, made up 8% of the market.

- Energy, resources, and industrials were represented with a 7% share, illustrating the expanding role of customer service in traditionally product-focused industries.

- This breakdown reflects the critical role of contact centers in facilitating customer relations and operational efficiency across diverse sectors.

(Source: Statista)

Jobs Created in the Global Call Center Industry

- From 2020 to 2023, the global call center industry saw significant fluctuations in job creation across various sectors.

- The Business Process Outsourcing (BPO) sector experienced dramatic growth. With job numbers rising from 110,255 in 2020 to 152,895 in 2023, following a dip in 2021.

- In the financial services sector, job creation remained relatively steady, peaking at 14,862 in 2021 and maintaining a stable rise to 14,450 in 2023.

- Healthcare showed a more volatile pattern, with jobs dropping to 2,323 in 2021 from 7,082 in 2020, then partially recovering to 5,300 by 2023.

- Telecommunications witnessed a decline over the four years, starting at 8,468 jobs in 2020 and dropping to 2,561 by 2023.

- Utilities, on the other hand, saw a gradual increase from 140 jobs in 2020 to 1,375 by 2023.

- Government-related jobs decreased sharply after 2020, starting from 5,010 and dramatically reducing to just 200 by 2023.

- The software industry also saw a decrease, from 1,805 jobs in 2020 to 200 by 2023.

- Retail and travel sectors exhibited minor scales in job creation, with travel peaking at 915 jobs in 2022 before falling to 80 in 2023.

- The ‘Others’ category, includes various smaller industries. Showed some recovery in 2023 with 2,615 jobs, despite a drop in previous years.

- These trends reflect a dynamic landscape in employment within the call center industry. Influenced by economic shifts, technological advancements, and sector-specific demands.

(Source: Statista)

Call Centers Opened or Expanded – By Region

- From 2016 to 2023, the global landscape for call center operations underwent significant shifts. With various regions showing diverse trends in the opening or expansion of facilities.

- Latin and Central America experienced a fluctuating trend, peaking at 55 call centers in 2022 before reducing to 37 in 2023. The Philippines also saw a variable trend, culminating in a high of 45 in 2016, followed by a sharp decline and a recovery to 34 in 2023.

- The United States, historically a leader in call center operations, saw a dramatic reduction from a high of 223 in 2016 to just 26 in 2023. Indicating a major shift possibly driven by outsourcing or advancements in technology reducing the need for traditional call centers. India showed a gradual increase over the years, rising from 8 in 2016 to 15 in 2023.

- Africa has seen a gradual growth in call center operations, from only 1 in 2016 to 14 in 2023, reflecting an expanding service industry in the region. Western Europe’s numbers have been somewhat steady. With a notable decrease from the highs of the early period (44 in 2017 and 42 in 2016) to 13 in 2023.

- The Asia-Pacific region showed moderate fluctuations but maintained lower numbers overall, reaching a peak of 18 in 2017 and decreasing to 9 in 2023.

- Eastern Europe and Canada have both seen a general decline over the period, with Eastern Europe dropping to 5 and Canada to just 2 in 2023. The Middle East saw the least activity in 2023, with no new expansions, down from a peak of 5 in 2016.

- These trends provide insights into the global distribution and strategic choices in the call center industry. With significant variations by region influenced by economic, technological, and geopolitical factors.

(Source: Statista)

Reasons for Using/Contacting Contact Centers

Reasons for Contacting Customer Service Worldwide

- In 2023, the primary reasons for contacting customer service globally varied, reflecting the diverse needs and issues experienced by consumers.

- Both reporting an issue with a product or service and requiring product or service information accounted for the highest share of reasons, each at 13%.

- This was closely followed by inquiries related to payment or invoice information and order or delivery issues, both at 12%.

- Complaints about a product, service, or the company itself constituted 10% of the contacts. The same percentage as reporting a technical problem and intentions to buy a product or service.

- Checking the status of a case represented 9% of the reasons.

- There were also customer interactions for updating contract information, making up 8%.

- Less frequent reasons included returning a product, which accounted for 2%, and wanting compensation, which was at 1%.

- This distribution underscores the varied and complex nature of customer service interactions in addressing consumer concerns and facilitating transactions.

(Source: Statista)

Leading Reasons Why Consumers Call Customer Service

- In Japan, as of August 2023, the reasons why consumers predominantly contact customer service highlight specific challenges and preferences in problem resolution.

- A substantial 60.6% of respondents indicated they reached out to customer service because they were unable to solve their problem via the website. Reflecting possible limitations in online self-service tools.

- Another 32.5% preferred to quickly solve their issue through direct conversation, valuing the immediacy and direct interaction of voice communication.

- For 24% of the consumers, phone support was the only available option. Which might indicate a gap in multi-channel support from businesses.

- Additionally, 18.3% had specific questions they wanted to discuss directly with a service representative, underscoring the need for personalized customer support.

- A small fraction, 1.5%, cited other reasons for contacting customer service, which could include less common or more complex issues.

- This data illustrates the significant reliance on traditional customer service channels in Japan. Particularly in scenarios where digital platforms do not meet consumer needs.

(Source: Statista)

Investment Trends

Drivers of Investment in Contact Centers

- In 2019, the primary drivers of investment in contact centers worldwide were largely focused on enhancing customer-related aspects and expanding business capabilities.

- A significant 85% of respondents identified customer experience and expectations as the key driver. Emphasizing the central role of customer satisfaction in strategic investments.

- Service improvement followed closely, with 78% of the share, underscoring the ongoing efforts to enhance the quality of customer interactions.

- Business growth was another major factor, cited by 56% of respondents. Reflecting the aim to scale operations in response to increasing demand.

- Competitive pressure and increased strategic importance were also notable drivers, reported by 34% and 33% of respondents, respectively. These factors highlight the need for contact centers to adapt and innovate in a competitive market landscape.

- Expansion in the scope of services or products was pointed out by 31% of the respondents. Indicating investments aimed at diversifying offerings to meet a broader range of customer needs.

- Lastly, the expansion of operational footprints was a driver for 13% of the respondents. Illustrating the strategic geographic and market expansion goals of some organizations.

- This distribution of drivers illustrates a clear focus on improving customer service capabilities. Enhancing competitive stance, and broadening operational reach within the global contact center industry.

(Source: Statista)

Drivers of Investment in Call Centers

- Between 2015 and 2019, the drivers of investment in call centers underwent notable changes. In 2015, the dominant driver was the growth of business, cited by 78% of respondents. Followed closely by customer experience and expectations at 71%.

- Service improvement was also significant, influencing 57% of investment decisions. However, by 2017, customer experience had become the primary driver, increasing dramatically to 88%. Reflecting a heightened focus on customer satisfaction across the industry.

- Service improvement also saw an increase to 73%, aligning with the emphasis on enhancing customer interactions. By 2019, while customer experience remained a major driver at 85%, service improvement rose further to 78%, indicating ongoing prioritization of service quality.

- Growth of business, which was the top driver in 2015, experienced a decline by 2019, falling to 56%, suggesting a shift in focus towards refining existing operations rather than expansion. Competitive pressure saw a gradual increase from 24% in 2015 to 34% in 2019, highlighting growing market competition.

- The importance of strategic expansion also shifted, with the expansion in the scope of services or products dropping from 59% in 2015 to 31% in 2019 and the expansion of operational footprints decreasing from 33% to 13% over the same period. This trend indicates consolidation and deepening of core service offerings over geographical or service scope expansion.

- Increased strategic importance as a driver also diminished, decreasing from 49% in 2015 to 33% in 2019, reflecting a potential realignment of strategic priorities within the call center industry.

- These shifts underscore a maturing market where enhancing customer experience and improving service quality have become paramount.

(Source: Hodu Soft)

Spending on Cloud and Data Centers

- From 2009 to 2023, enterprise spending on cloud infrastructure services and data center hardware and software showed significant trends and shifts.

- In 2009, spending on data center hardware and software was at $60.7 billion, vastly overshadowing the mere $1 billion spent on cloud infrastructure services. However, as the years progressed, a clear shift in spending priorities became evident.

- By 2010, data center spending increased to $71.4 billion, with a slight rise in cloud infrastructure services to $1.5 billion.

- This trend continued, with data center spending peaking at $93.3 billion in 2019, while cloud infrastructure services spending began a rapid ascent. Reaching $96 billion in the same year, nearly equaling data center investments.

- By 2020, cloud infrastructure spending had surpassed data center investments, reaching $129.5 billion compared to $89 billion for data centers.

- The disparity grew even more pronounced in the following years, with cloud infrastructure spending escalating to $178 billion in 2021 and projected to reach $270 billion by 2023.

- Meanwhile, data center spending also showed recovery and growth post-2020, reaching $98.05 billion in 2021, but no further data was provided for subsequent years up to 2023.

- Moreover, This shift highlights the growing emphasis on cloud services as central to enterprise IT strategies, reflecting broader industry trends toward digital transformation and cloud reliance.

(Source: Statista)

Level of Quality Assurance Process

- In 2018, the level of quality assurance processes at call centers worldwide varied. Reflecting differing stages of development and emphasis on quality controls.

- Only 11% of respondents reported having basic quality assurance processes in place, indicating minimal implementation.

- Slightly more advanced but still limited processes, described as somewhat basic, were in place at 16% of call centers.

- A larger portion of call centers, 34%, described their quality assurance processes as somewhat optimized, suggesting a more structured approach but not fully developed.

- The majority, at 39%, indicated that their processes were optimized, demonstrating a comprehensive and effective quality assurance framework.

- This distribution highlights a significant inclination towards higher optimization levels in quality assurance within the call center industry, aiming to enhance service delivery and customer satisfaction.

(Source: Statista)

Consumer Preferences and Trends

Customer Expectations from CCaaS Vendors

- In 2022, customer expectations from Contact Center as a Service (CCaaS) vendors reveal distinct preferences and demands.

- A significant 66% of customers expect companies to understand their needs and expectations thoroughly. Additionally, 45% of consumers show a preference for services that are ‘quick and convenient’ over those that are ‘detailed and customized’.

- Real-time responses and interactions are expected by 64% of consumers, emphasizing the importance of immediacy in customer service. About 38% of customers want agents to immediately recognize who they are and understand the context of their queries. Indicating a demand for personalization and efficiency.

- A robust 74% of consumers desire that providers customize their experience based on previously known information about them. In comparison, another 66% would prefer to design their optimal solutions to problems. Highlighting a trend towards consumer control and customization in service solutions.

- In the US, 34% of consumers cite quick resolution of issues as the most important aspect of a satisfying customer service experience. Furthermore, nearly 80% of American consumers identify speed, convenience, knowledgeable help, and friendly service as the most crucial elements of a positive customer experience.

- Finally, 65% of consumers would prefer to receive fewer, more tailored communications through their preferred channels. Underlining a demand for relevance and efficiency in communication.

- These insights underscore the critical aspects that CCaaS vendors must address to meet the evolving expectations of modern consumers.

(Sources: Salesforce, NTT Data, Freshworks, Broadridge, Qualtrics, PwC)

Impact of Poor Customer Service on Consumer Behavior

- The negative repercussions of subpar customer experiences provided by CCaaS vendors reveal significant impacts on consumer behavior and brand perception in 2022.

- A considerable 65% of consumers believe that the majority of companies they interact with need to enhance their customer experience—a noticeable increase from 59% the previous year and significantly up from 35% in 2019.

- Despite these expectations, only 49% of US consumers feel that companies currently offer a good customer experience. Wait times also pose a major irritant, with 44% of people feeling annoyed, irritated, or angry after waiting between 5 to 15 minutes.

- Furthermore, 67% of US and UK shoppers indicate they would cease doing business with a brand following just two or three poor customer service interactions. A single bad experience is enough for 30% of customers to abandon a brand permanently.

- Moreover, 78% of consumers report that their perception of a brand was permanently altered—either positively or negatively—by a single interaction with a contact center.

- This sentiment is echoed by 58% of consumers who would end their relationship with a business due to poor customer service, and 32% of US consumers would stop doing business with a brand they loved after one bad experience.

- Additionally, 32% of consumers have a low tolerance for delays, stating they would only wait up to 5 minutes for a response from customer service.

- These statistics highlight the critical importance of excellent customer service in retaining consumer loyalty and maintaining a positive brand image.

(Sources: Broadridge, PwC, Replicant, IDC, Qualtrics)

Preferences for Human Connection vs. Automation

- In the United States in 2023, preferences for customer service interaction varied significantly across different generations when it came to choosing between human connection and automation.

- Among Generation Z, 71% preferred automated services for simple issues, while 57% expected a human to respond immediately upon contacting a company.

- Millennials showed a higher preference for both automation and human interaction. With 72% favoring automation for simple issues and a notable 71% expecting an immediate human response.

- Generation X members were more moderate, with 60% preferring automated services and 54% expecting human interaction.

- Baby boomers, on the other hand, demonstrated the least preference for automation at 55%, and only 48% expected a human response immediately.

- Across all generations, the averages stood at 62%, preferring automation for straightforward issues and 57% expecting an immediate human response, highlighting a general trend towards favoring efficiency in resolving simpler queries through automated services while retaining a significant expectation for human engagement in customer service interactions.

(Source: Statista)

AI Usage Trends

- In 2023, the adoption of artificial intelligence (AI) in customer service teams varied notably across different industries worldwide.

- The energy, resources, and industrial sectors led the way, with 60% of respondents indicating the use of AI.

- Retail and fast-moving consumer goods (FMCG) industries, along with the public sector, education, and healthcare sectors, each reported a 50% adoption rate.

- Transportation and logistics industries followed closely at 47%.

- The financial services industry showed a moderate adoption rate of 43%, while the telecommunications and media sectors had 39% of respondents utilizing AI.

- Professional services and technology sectors reported a lower AI usage rate of 32%.

- The automotive industry’s adoption was even lower at 30%, and manufacturing had the least, with only 19% of respondents indicating AI usage in customer service.

- This data reflects a varied landscape in AI integration into customer service functions, highlighting more significant adoption in industries. Where complexity and scale possibly offer more substantial benefits from AI technologies.

(Source: Statista)

Positive Aspects of Bot Contact

- In 2023, the positive aspects of using bots in customer service in Poland were highlighted through a survey where respondents shared varied experiences.

- The most valued feature, as reported by 35.4% of respondents, was the bots’ availability 24 hours a day, emphasizing the convenience of round-the-clock service.

- Additionally, 27.8% appreciated that while bots did not resolve their cases. They efficiently connected them to the right consultant, enhancing the efficiency of issue escalation.

- Quick answers to questions were noted by 21.8% of respondents, reflecting the bots’ ability to provide timely responses.

- The friendly demeanor of bots was highlighted by 17% of participants, and 15.1% found that there were no understanding problems when interacting with the bots.

- Moreover, 14.2% valued the quick and independent problem-solving capabilities of the bots.

- Enjoyment from using the technology was expressed by 8.8% of the respondents. Indicating a positive reception towards interaction innovation.

- However, 27.9% of respondents noted no positive aspects, signaling areas for potential improvement in bot-based customer service experiences.

- This feedback illustrates a mixed but generally favorable perception of bot interactions in the customer service landscape within Poland.

(Source: Statista)

Global Contact Center Satisfaction Trends

- From 2010 to 2022, the global contact center satisfaction index has shown varied trends in customer satisfaction levels between the private sector and government entities.

- In 2010, the satisfaction index stood at 75 for the private sector and 64 for government services. Over the years, both sectors saw fluctuations.

- The private sector peaked at 77 in 2013 and experienced its lowest point at 68 in both 2018 and 2019, while the government sector reached its highest satisfaction rate of 72 in 2013 and its lowest at 63 in 2014.

- Notably, in recent years, while the private sector’s satisfaction level decreased to 69 in 2022, the government sector saw a slight improvement, reaching 70 in the same year, indicating a convergence in satisfaction levels between the two sectors.

- This data suggests that both sectors have experienced ups and downs. Recent trends show government satisfaction indices catching up to or even surpassing those of the private sector, reflecting potential improvements in government customer service practices.

(Source: Statista)

Challenges and Concerns

- In the United States in 2021, various challenges were identified as significant obstacles in optimizing the customer journey for enhancing customer experience (CX).

- The most prevalent challenge, experienced by 39.9% of respondents, was silo management. Highlighting the issue of lack of inter-departmental collaboration.

- Close behind, 38.9% pointed to agent capability, including gaps in knowledge and empowerment, as a key hurdle.

- Organizational policies and the lack of a clear escalation path were also major concerns for 37.4% of respondents.

- Another 35.5% cited a lack of automation, such as insufficient tracking systems, that hindered effective management of customer interactions.

- Data-related challenges were noted by 33.5% of respondents, who reported an inability to gain insightful data from trusted sources.

- Approximately 31% struggled with identifying key decision points within the customer journey.

- Digital design issues, where solutions did not function as intended, were problematic for 30% of respondents.

- Integration of systems across multiple channels was a challenge for 29.6% of respondents. Similarly, 29.6% found that customer journey strategies were unclear.

- Process blockage points were difficult to identify for 27.1% of respondents.

- Notably, a small percentage, 5.9%, did not identify with any of the listed challenges.

- These insights underscore the complex array of hurdles that organizations face when attempting to refine customer experiences effectively.

(Source: Statista)

Innovations in Contact Center as a Service Statistics

- In the evolving landscape of Contact Center as a Service (CCaaS), recent innovations have been particularly transformative, driven by leading companies like Genesys, NICE, Amazon Web Services (AWS), and Five9, each recognized as leaders in Gartner’s 2023 Magic Quadrant.

- These companies have harnessed artificial intelligence (AI) and cloud-based solutions to enhance customer and agent experiences.

- Genesys has streamlined its offerings into a singular, robust platform, Cloud CX. It supports large-scale enterprise environments with its advanced AI and digital capabilities, aiming to provide empathetic customer experiences across all interaction points.

- NICE’s CXone platform integrates AI to offer sophisticated tools for conversation guidance and digital journey orchestration, enhancing the overall customer experience.

- AWS has made significant strides with Amazon Connect, introducing features like agent guidance and advanced analytics. These have played a crucial role in its recognition as a leader in the CCaaS space for its innovative pricing models and robust partner network.x

- Meanwhile, Five9 has been acknowledged for its AI capabilities and enterprise-level CCaaS solutions that cater to large service operations, enhancing both customer experience and operational efficiency.

- These developments reflect a broader trend towards more agile, responsive, and customer-focused CCaaS solutions, underscoring the sector’s rapid evolution and the increasing importance of technology in shaping customer service landscapes.

(Source: CX Today, Business Wire, Amazon Web Services, Call Centre Helper)

Regulations for Contact Center as a Service Statistics

- In the dynamic landscape of Contact Center as a Service (CCaaS), regulations and policies play a crucial role in shaping the market, especially as the deployment of cloud-based solutions continues to expand globally.

- The regulatory framework for CCaaS varies significantly by country and is influenced by data protection laws, privacy regulations, and industry-specific compliance requirements.

- In regions like North America and the European Union, strict regulations such as GDPR and CCPA mandate rigorous data security and privacy practices, which directly affect how CCaaS providers operate and interact with customer data.

- In contrast, countries in Asia-Pacific are witnessing a rapid adoption of CCaaS solutions, driven by a more flexible regulatory environment that still ensures data protection but with varying degrees of rigor compared to Western standards.

- Providers must navigate these complex regulatory landscapes to offer compliant and secure services that meet the needs of global enterprises. For example, in the US, adherence to standards like HIPAA for healthcare-related communications is essential, while in Europe, GDPR compliance is critical for protecting customer information across all sectors.

- Moreover, as the market grows, the integration of advanced technologies like AI and machine learning in CCaaS platforms introduces new regulatory challenges that must be addressed to ensure the ethical and lawful use of technology.

- Therefore, CCaaS providers must continuously update their services and policies to stay compliant with the evolving regulations. While ensuring seamless and secure customer interactions across various industries and regions.

(Sources: CX Today, DMG Consulting)

Recent Developments

Acquisitions and Mergers:

- Zoom acquires Solvvy: In 2023, Zoom acquired Solvvy, an AI-powered conversational platform, for $300 million. This acquisition enhances Zoom’s CCaaS capabilities by integrating AI-based self-service tools, helping contact centers improve customer engagement and automate repetitive tasks.

- Genesys acquires Bold360: In 2023, Genesys, a leading CCaaS provider, acquired Bold360, an AI and chatbot company, to expand its customer engagement solutions. The deal, valued at $400 million, strengthens Genesys’ ability to deliver enhanced AI-driven services and improve customer experience through personalized communication.

New Product Launches:

- Amazon Connect introduces AI-powered forecasting: In 2024, Amazon Web Services (AWS) launched a new feature for Amazon Connect, its CCaaS platform, that leverages AI-powered forecasting to predict call volume and customer needs more accurately. This feature helps contact centers optimize staffing and improve service levels.

- Five9 launches IVA (Intelligent Virtual Agent) Studio: In late 2023, Five9 introduced IVA Studio, a tool that allows businesses to easily create AI-powered virtual agents for their contact centers. The solution helps companies deploy bots that can handle customer inquiries autonomously, improving response times and reducing costs.

Funding:

- Talkdesk secures $230 million in funding: In 2023, Talkdesk, a cloud-based CCaaS provider, raised $230 million in Series D funding to accelerate its global expansion and invest in AI-powered features for customer experience management. This funding positions Talkdesk to compete more effectively in the growing CCaaS market.

- Aircall raises $120 million to expand CCaaS offerings: In early 2024, Aircall, a cloud-based phone system for contact centers, raised $120 million to develop new tools aimed at enhancing customer support services, particularly focusing on AI-driven features and integrations with popular CRM platforms.

Technological Advancements:

- AI and machine learning in CCaaS: AI and machine learning are becoming integral to CCaaS platforms, helping automate customer interactions, provide predictive analytics, and personalize experiences. By 2025, over 50% of CCaaS providers are expected to incorporate AI-driven tools for intelligent routing, sentiment analysis, and self-service capabilities.

- Omnichannel communication integration: CCaaS platforms are increasingly integrating omnichannel capabilities, allowing customers to interact through various channels like voice, chat, email, and social media. By 2026, omnichannel solutions are projected to account for 45% of the CCaaS market, driven by customer preferences for seamless, multi-channel communication.

Market Dynamics:

- Growth in the CCaaS market: The growth is fueled by increasing demand for cloud-based solutions, the need for scalability in customer service operations, and the rise of AI-enhanced automation tools.

- Rising adoption of cloud-based contact centers: As businesses continue to migrate to the cloud, 60% of contact centers are expected to adopt cloud-based CCaaS solutions by 2025, enabling greater flexibility, remote work capabilities, and real-time analytics.

Conclusion

Contact Center as a Service Statistics – The Contact Center as a Service (CCaaS) industry, is essential for modern customer service. Provides businesses with flexible, scalable, and cost-effective solutions to manage customer interactions.

Further, key benefits include enhanced customer experiences through advanced analytics, cost efficiency by reducing hardware investments, and easy scalability to adjust to changing demand.

Additionally, CCaaS supports the integration of cutting-edge technologies such as AI and machine learning, continuously updating with the latest features and security enhancements.

Despite challenges like data security and dependency on internet connectivity. The CCaaS market is set to grow as businesses increasingly value cloud-based solutions for superior customer service outcomes.

However, this ongoing shift is integral to digital transformation across industries, ensuring that CCaaS remains crucial for competitive customer service strategies.

FAQs

CCaaS is a cloud-based solution that allows businesses to manage their customer interactions without the need to invest in or maintain on-premise contact center infrastructure. It provides software-based customer interaction management, analytics, and communication tools over the Internet.

Unlike traditional contact centers that require a substantial upfront investment in hardware and software. CCaaS operates on a subscription model with the infrastructure hosted in the cloud by service providers. This setup reduces capital expenditure and offloads maintenance and upgrades to the service provider, offering greater scalability and flexibility.

Any business that interacts with customers can benefit from CCaaS, especially those with fluctuating call volumes or those looking to expand customer service operations without significant capital investments. It is particularly beneficial for small to medium-sized enterprises (SMEs) and companies with limited IT resources.

The primary risks include data security concerns, as data is hosted off-premise, and potential service disruptions due to internet dependency. However, reputable CCaaS providers typically offer robust security measures and high service availability to mitigate these risks.

Transitioning to CCaaS involves selecting a suitable provider, planning the migration of data and services, training staff to use the new system, and potentially integrating the CCaaS with existing CRM and ERP systems. It’s crucial to choose a provider that offers good technical support and service level agreements (SLAs).

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)