Table of Contents

- Introduction

- Editor’s Choice

- Global Contactless Payments Market Size

- Contactless Payments Market- by Components

- Regional Breakdown of Contactless Payments Usage

- Demographic Insights on Contactless Payments

- Consumer Behavior and Contactless Payments

- Contactless Payments and E-commerce

- Security Concerns and Contactless Payments

- Future Trends in Contactless Payments

Introduction

According to Contactless Payments Statistics, Contactless payments have revolutionized modern transactions, allowing secure and convenient payments without physical contact between a device and a point-of-sale terminal. Users tap or wave their payment device near the terminal, enabling quick, hygienic, and secure transactions.

The significance of contactless payments lies in their convenience, heightened hygiene considerations, advanced security features, widespread acceptance, and alignment with evolving consumer preferences.

The proliferation of mobile wallets and government initiatives, alongside global expansion, has fuelled their rapid growth, making payments an integral part of our digital economy, transcending geographic boundaries, and reshaping how we make payments.

Editor’s Choice

- Over the past decade, the contactless payment industry has experienced remarkable growth at a CAGR of 15.4%.

- The contactless payment market was valued at 22.4 billion in 2022 and is expected to account for a revenue of $90.6 billion in 2032.

- The outlook for contactless payments is robust, with a forecast of surpassing $10 trillion by 2027 and a substantial projected growth of 221% in payments between 2022 and 2026.

- Regarding user demographics, younger generations are notably more inclined to embrace payments, with 73% of millennials and 66% of Gen Z consistently utilizing this payment method.

- Furthermore, there’s a discernible trend in the increasing adoption of payments for e-commerce transactions. In 2020, there was a significant uptick, with a 30% surge in payments for online purchases.

- As per Statista, the Asia Pacific region became the largest market for contactless payments in 2020, boasting transaction values exceeding $1.5 trillion.

- A 2022 survey by the National Retail Federation unveiled that 67% of retailers now offer contactless payment options, a significant increase from the 40% recorded in 2019.

Global Contactless Payments Market Size

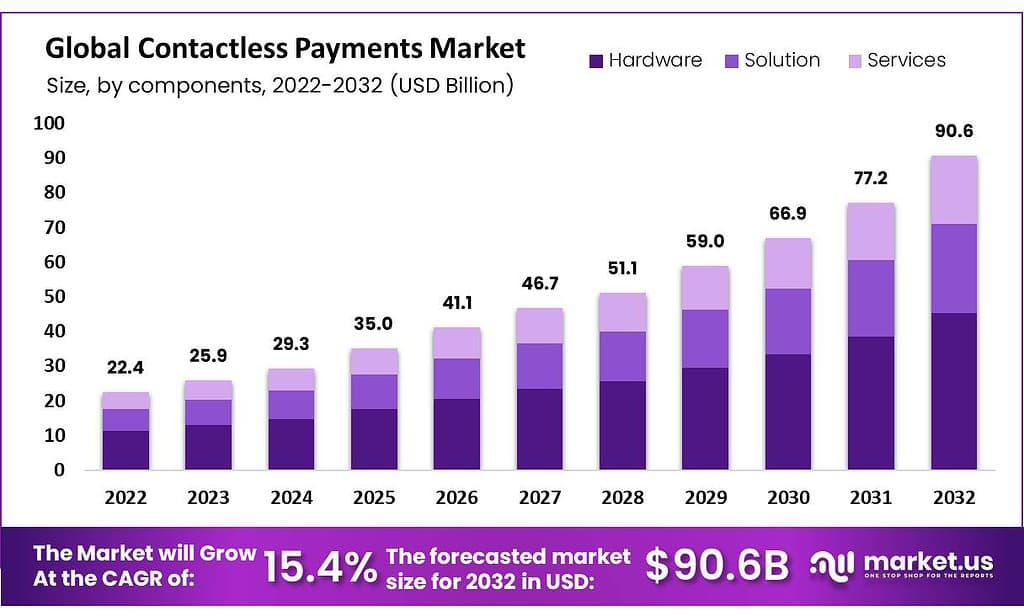

- Over the past decade, the contactless payment industry has experienced remarkable growth at a CAGR of 15.4%.

- In 2022, contactless payment revenue amounted to $22.40 billion, marking the beginning of an upward trajectory.

- The growth trajectory is likely to remain strong, with revenue projected to reach $59.0 billion in 2029, $66.9 billion in 2030, $77.2 billion in 2031, and an impressive $90.6 billion in 2032.

Contactless Payments Market- by Components

- The global contactless payments market has grown remarkably from 2022 to 2032, with revenues escalating substantially across its key components.

- In 2022, the market’s total revenue stood at $22.40 billion, with hardware generating $11.2 billion, solutions contributing $6.4 billion, and services accounting for $4.8 billion.

- The momentum persisted through 2030, 2031, and 2032, culminating in a total market revenue of $90.6 billion, driven by hardware revenue of $45.3 billion, solutions at $25.7 billion, and services generating $19.6 billion.

Regional Breakdown of Contactless Payments Usage

- Contactless payments are gaining widespread popularity globally.

- As per Statista, the Asia Pacific region became the largest market for payments in 2020, boasting transaction values exceeding $1.5 trillion.

- Following closely behind was Europe, with its transaction values surpassing $1 trillion during the same year.

Asia Pacific

- Indeed, beyond being the central hub for contactless payments, the Asia Pacific region is at the forefront of a swift expansion.

- Experts project that by 2025, over half of all transactions in this part of the world will rely on contactless methods.

- Notably, China is leading the global charge, with over 40% of all transactions across the globe occurring within its borders.

Europe

- In recent years, contactless payments have been steadily gaining ground in Europe.

- According to Statista’s forecasts, the number of contactless payment users in Europe is expected to reach an impressive 300 million by the year 2022.

- Among the European nations, the United Kingdom stands out as a leader in this trend, with over 60% of all transactions now opting for contactless methods.

North America

- Contactless payments are still emerging in North America but are gaining momentum rapidly.

- According to Finical, the projection is that payments in the United States will experience a remarkable surge, reaching a substantial $1.5 trillion by 2024.

- Canada is also embracing this trend, with a noteworthy increase in the use of contactless payment methods. Currently, more than 50% of all transactions in Canada are carried out using this convenient payment method.

- This shift underlines the growing attraction of payments in North America, driven by their convenience and efficiency in everyday financial transactions.

Latin America

- Certainly, contactless payments are becoming increasingly popular in Latin America, with Brazil and Mexico taking the lead in embracing this payment method.

- According to Pomelo Pay, payments in Brazil are anticipated to reach $10 billion by 2021.

- Meanwhile, Mexico has witnessed a remarkable surge in payments, with usage surging by more than 50% over the past year.

- This trend highlights the growing preference for the convenience and efficiency of contactless payments in these vibrant Latin American economies.

Middle East and Africa

- Indeed, payments are still in the early stages of adoption across the Middle East and Africa. Still, a clear and promising upward trend indicates rapid growth soon.

- Statista’s projections show a substantial anticipated increase in the transaction value of contactless payments in the Middle East and Africa, with an expected reach of $47 billion by 2024.

- Nations such as the United Arab Emirates, Saudi Arabia, and South Africa are leading the charge in this adoption.

Demographic Insights on Contactless Payments

By Age

- Certainly, contactless payments have become increasingly favored by consumers spanning various age groups.

- In 2022, data from Finical illustrates that 45% of individuals aged 18-24 used payments at least once a week, closely trailed by 44% of those in the 25-34 age bracket.

- In contrast, among consumers aged 65 and older, the utilization of payments weekly was notably lower, with only 23% embracing this method.

By Gender

- Regarding gender, men exhibit a slightly higher inclination for contactless payments than women, although this gender difference is not particularly pronounced.

- Additionally, it’s pertinent to observe that urban areas witness higher adoption rates than rural regions, as indicated in the report’s findings.

According to Income

- Regarding income disparities, Statista’s research indicates that individuals with higher earnings are more disposed to use contactless payments.

- By 2025, it is predicted that consumers with annual incomes exceeding $75,000 will constitute a substantial 46.5% of all contactless payment users in the United States.

According to Education

- In educational attainment, Pomelo Pay’s report underscores that individuals with more advanced educational backgrounds are more inclined to embrace payments.

- Specifically, those holding a bachelor’s degree or higher are 1.5 times more likely to opt for contactless payments than those with a high school diploma or lower educational level.

Consumer Behavior and Contactless Payments

- Certainly, contactless payments have been on an upward trajectory in terms of popularity among consumers in recent years. As per a Juniper Research report, the total value of contactless payment transactions is anticipated to exceed $10 trillion by 2027, with an impressive 221% surge in payments expected between 2022 and 2026.

- The COVID-19 pandemic was pivotal in expediting the embrace of contactless payments, driven by heightened concerns about touching surfaces and handling physical cash.

- Notably, a 2022 survey by the National Retail Federation unveiled that 67% of retailers now offer contactless payment options, a significant increase from the 40% recorded in 2019.

- Furthermore, Federal Reserve research revealed that the utilization of payments rose from 24% in 2019 to 31% in 2020.

- Consumers have articulated several reasons for their preference for payments. Foremost among these is the convenience factor, as payments are recognized for their speed and efficiency compared to traditional payment methods.

Contactless Payments and E-commerce

- Contactless payments have experienced a notable surge in usage, particularly in the context of the COVID-19 pandemic.

- As online shopping gained prominence, the adoption of payments has seen a significant uptick, especially within the e-commerce sector.

- As reported by Fit Small Business, there’s an expectation that payments will witness substantial growth, surpassing the $10 trillion mark by 2027.

Security Concerns and Contactless Payments

- Skimming and cloning are the most common security risks associated with payments.

- Nearly a third of consumers familiar with contactless technology remain uninterested, citing security concerns.

Future Trends in Contactless Payments

- As per insights from Forbes, the momentum behind mobile payments is poised to persist and gain further traction.

- This enduring trend is propelled by the rising ownership of smartphones among individuals and the convenience they offer for conducting payments.

- In tandem, adopting QR codes to facilitate contactless payments is on a sharp upward trajectory.

- Fit Small Business predicts a substantial 44% growth in the utilization of QR codes for payments between 2021 and 2025.