Table of Contents

Introduction

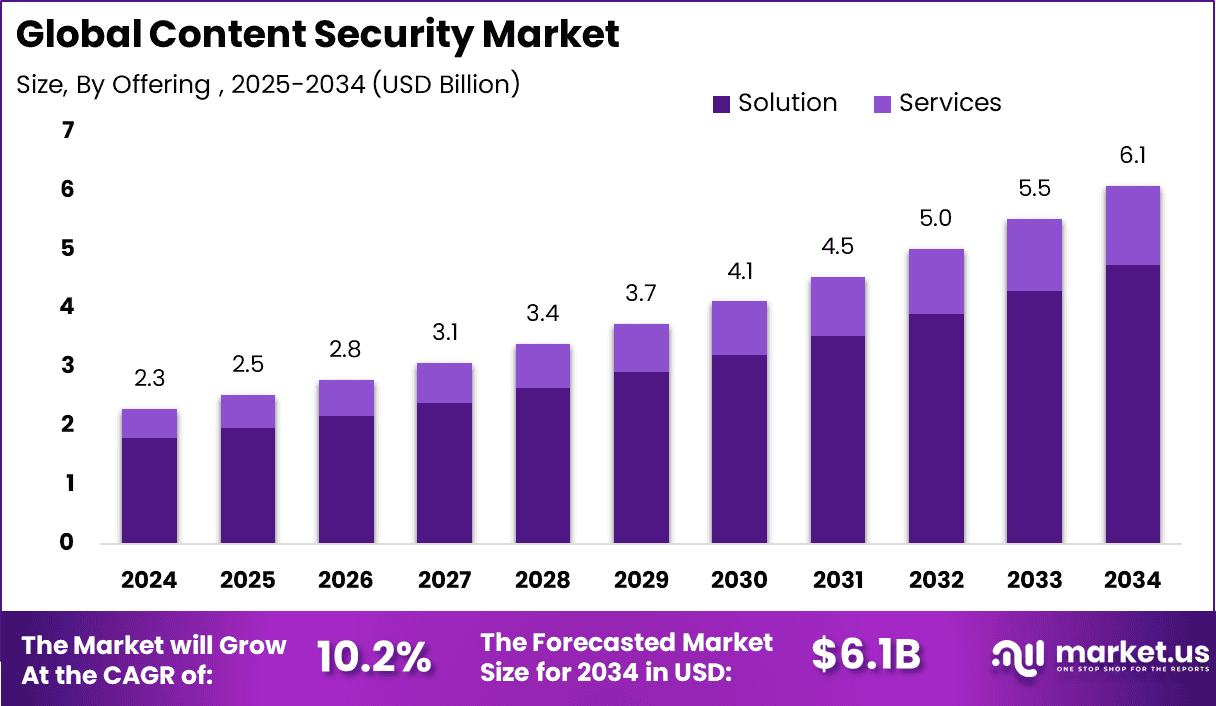

The Global Content Security Market was valued at USD 2.3 billion in 2024 and is expected to grow to USD 2.5 billion in 2025, reaching approximately USD 6.1 billion by 2034. This expansion reflects a compound annual growth rate (CAGR) of 10.2% over the forecast period. North America led the market in 2024, contributing USD 0.8 billion in revenue and accounting for over 38.0% of the global share. The rise in cyber threats, regulatory pressure for data protection, and growing demand for secure content sharing across digital platforms are key factors driving this growth.

How Growth is Impacting the Economy

The rise of the content security market is contributing significantly to the global cybersecurity economy. As organizations increasingly digitize operations and adopt cloud platforms, investment in content security is not just optional but essential. Government sectors, financial institutions, and healthcare providers are expanding budgets to protect sensitive information from breaches.

This results in a robust market for content filtering, email encryption, DRM, and threat detection tools. Additionally, the market’s growth stimulates employment in cybersecurity services, boosts R&D in AI-based threat detection, and strengthens digital trust in online business environments. The increased focus on secure communications, especially in remote work settings, is driving the development of resilient digital infrastructures that enhance economic productivity.

➤ Unlock growth! Get your sample now! – https://market.us/report/content-security-market/free-sample/

Impact on Global Businesses

Content security has become a critical business imperative as cyberattacks grow in complexity and frequency. For global enterprises, the shift to hybrid work environments and cloud storage increases exposure to data leakage, phishing, and malware infiltration. These risks elevate operational costs due to potential legal liabilities, reputational damage, and remediation efforts.

Sector-specific impacts are also profound: financial services require encrypted transaction content; healthcare must protect patient data under HIPAA; and media companies are tackling content piracy. Meanwhile, supply chain partners demand secure collaboration, driving enterprises to invest in integrated content protection across endpoints, email, and file-sharing services.

Strategies for Businesses

Businesses are investing in multilayered content security strategies that include data loss prevention (DLP), secure access controls, and cloud-based threat intelligence. Many are adopting AI-driven security tools that identify anomalies in user behavior and document access patterns. Integrations with email gateways, cloud access security brokers (CASB), and secure web gateways (SWG) are becoming standard.

Companies are also focusing on employee awareness training and zero-trust frameworks to minimize insider threats. For compliance, organizations are implementing automated audit trails and document classification systems to align with GDPR, CCPA, and other data protection mandates.

Key Takeaways

- Global content security market to reach USD 6.1 billion by 2034

- CAGR of 10.2% during 2025–2034

- North America led in 2024 with USD 0.8 billion (38.0% market share)

- Cloud adoption, remote work, and regulatory mandates are driving demand

- AI-based DLP, CASB, and threat detection tools are key focus areas

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=160084

Analyst Viewpoint

The content security market is evolving from a reactive compliance function to a proactive strategic pillar. Current market momentum is driven by a heightened threat environment, accelerated digitalization, and rising stakeholder expectations for secure content delivery. In the near term, demand will be strongest among heavily regulated industries and multinational corporations with distributed workforces. Over the next decade, SMEs are expected to contribute significantly to market expansion as SaaS-based content security tools become more affordable and user-friendly. The outlook remains strongly positive as organizations align cybersecurity with digital transformation.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Secure Email Systems | Phishing prevention, encryption, regulatory compliance |

| Cloud Content Protection | Cloud-native workloads, BYOD policies, hybrid work |

| Digital Rights Management | Content piracy mitigation, media streaming, IP protection |

| Endpoint Security | Zero-trust access, remote workforce enablement |

| Data Loss Prevention | Insider threats, compliance audits, file monitoring |

Regional Analysis

North America held a 38.0% market share in 2024, generating USD 0.8 billion in revenue. Its dominance stems from mature cybersecurity infrastructure, early adoption of cloud services, and strict compliance mandates like HIPAA and CCPA. The U.S. remains a key innovator in AI-based content protection and leads enterprise spending on SaaS-based security.

Europe follows with strong demand driven by GDPR enforcement and privacy-first digital policies. Asia Pacific is witnessing the fastest growth, especially in China, India, and Japan, where data localization and government-backed cybersecurity investments are accelerating adoption. Latin America and the Middle East are gradually increasing budgets for digital protection in financial and government sectors.

Business Opportunities

The market presents rich opportunities for both niche security vendors and established enterprise software firms. Startups focusing on AI-powered DLP, content fingerprinting, and secure collaboration platforms can rapidly gain traction. Enterprises are actively seeking integrated platforms that offer content scanning, email filtering, and secure sharing from a single interface.

There is also demand for vertical-specific solutions, such as content redaction for legal and DRM for media firms. As regulatory complexity rises, compliance-as-a-service platforms offering automated documentation and threat reports are becoming increasingly attractive for mid-sized businesses.

Key Segmentation

The market is segmented by solution type, deployment mode, organization size, application, and end-user industry. Solution types include email protection, data loss prevention, digital rights management, encryption, and web filtering. Deployment modes cover cloud-based and on-premise models, with cloud dominating in terms of scalability and cost efficiency.

By organization size, large enterprises lead adoption, but SMBs are growing rapidly due to affordable SaaS options. Applications include secure file sharing, email communication, endpoint protection, and internal data collaboration. Key end-users span BFSI, IT & telecom, healthcare, education, media & entertainment, and government.

Key Player Analysis

Leading players are differentiating through AI-driven threat detection, user-friendly dashboards, and seamless integration across cloud and hybrid IT environments. Several companies are expanding into unified threat management platforms to combine DLP, encryption, and secure gateways. Vendors are also partnering with cloud service providers to offer embedded content security in IaaS and SaaS environments. With increasing regulatory scrutiny, firms are focusing on auditability, role-based access control, and real-time policy enforcement. The competition is intensifying as newer entrants bring agile, zero-trust-native solutions, pushing incumbents to innovate rapidly.

- Proofpoint

- McAfee, LLC

- NortonLifeLock, Inc.

- Trend Micro Incorporated

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Sophos Group plc

- Forcepoint LLC

- Proofpoint, Inc.

- Zscaler, Inc.

- Barracuda Networks Inc.

- F5 Networks, Inc.

- Mimecast Limited

- Digital Guardian

- Clearswift (HelpSystems, LLC)

- WatchGuard Technologies, Inc.

- Cyren Ltd.

- Webroot Inc. (an OpenText company)

- Kaspersky Lab

- Others

Recent Developments

- In March 2025, a top vendor launched a browser-based DLP tool for remote workers

- In April 2025, a major cloud provider integrated content filtering into its collaboration suite

- In February 2025, a European firm released an AI-driven email threat sandboxing feature

- In January 2025, a startup introduced decentralized content access control using blockchain

- In June 2025, a government partnership was announced to secure public sector file exchanges

Conclusion

The content security market is evolving as a foundational component of modern cybersecurity architecture. With rising threats, stricter regulations, and growing reliance on digital collaboration, demand for advanced and integrated content protection tools is set to grow consistently, offering long-term growth opportunities for technology vendors and enterprises alike.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)