Table of Contents

Market Overview

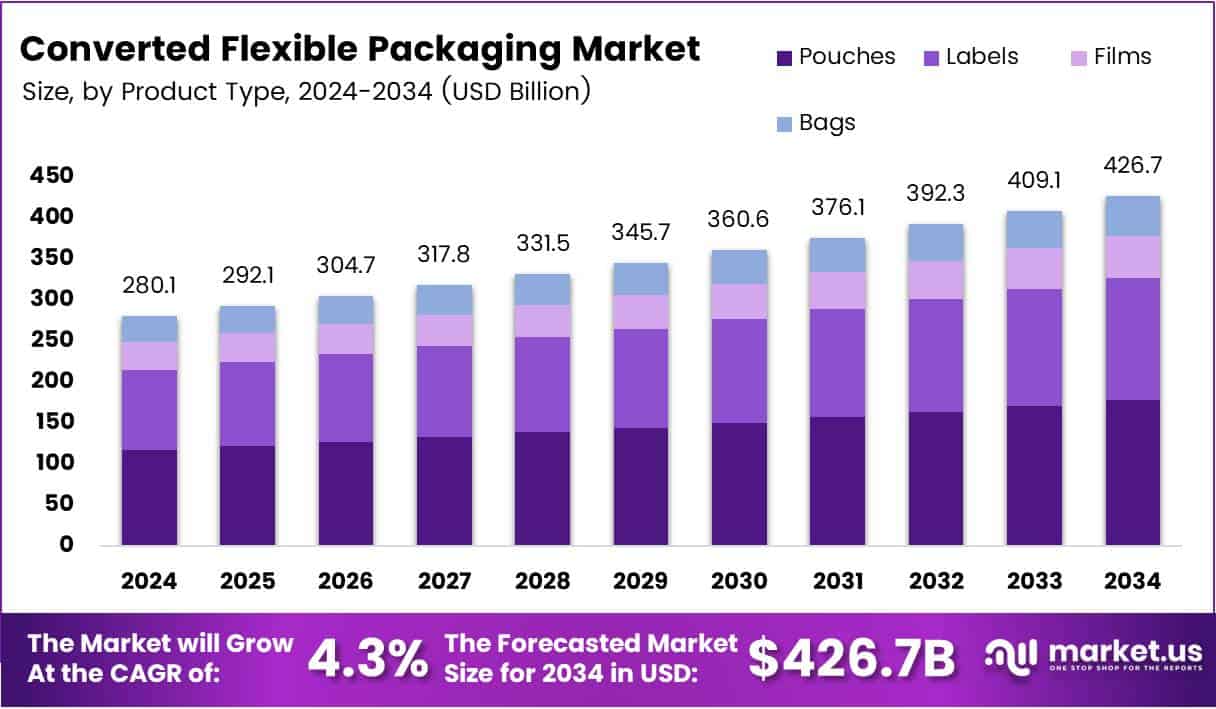

The Global Converted Flexible Packaging Market is projected to grow from USD 280.1 Billion in 2024 to USD 426.1 Billion by 2034, expanding at a CAGR of 4.3% during the forecast period. This growth is driven by rising demand for sustainable, lightweight, and cost-effective packaging solutions.

The market is rapidly shifting toward sustainability. Plastic currently accounts for 72% of the market, but innovations in recyclable and biodegradable materials are gaining traction. Advanced processes like pyrolysis and bio-renewable polymers derived from sources like used cooking oil are enabling production with up to 60% renewable content in some packaging formats.

Growing government efforts to manage solid waste are boosting investment in recycling infrastructure. For instance, the goal to process 3 million tonnes of municipal solid waste annually, with 35% converted into fuel and 14% recycled materials, is creating strong tailwinds. These changes are supported by evolving regulations that promote biodegradable and recycled-content packaging. As a result, the industry is not only addressing environmental concerns but also unlocking new growth avenues.

Converted flexible packaging now plays a key role in achieving global sustainability goals. It supports compliance with regulations while helping companies gain a competitive edge through innovation and eco-responsibility.

Key Takeaways

- Market value projected at USD 426.1 Billion by 2034, with a CAGR of 4.3%.

- In 2024, pouches led by product type.

- Plastic held a 42.8% market share in material type.

- Printed packaging was the top technology segment.

- Food & beverages remained the largest end-use sector.

- Asia Pacific led the market with 36.1% share, worth USD 101.1 Billion.

Key Market Drivers

- Lightweight Packaging Adoption

Flexible packaging is replacing rigid containers to reduce material costs and emissions. It offers better logistics, making it both economical and sustainable. - Growth in Food & Beverage Industry

This sector relies heavily on flexible packaging for barrier protection, resealability, and visual appeal especially for ready meals, snacks, and dairy. - Rising Demand for Portability

Urban lifestyles fuel demand for resealable pouches and single-serve formats. These are easy to use, carry, and dispose of. - Sustainability Push

Companies are adopting recyclable and compostable materials. Innovations like mono-material films and compostable laminates are becoming popular with brands and regulators.

Market Challenges

- Recycling Barriers: Multi-layered packaging is difficult to process due to mixed materials like plastic and aluminum.

- Raw Material Volatility: Fluctuating prices of polymers and resins can affect profit margins.

- Strict Regulations: Sectors like food and pharma face tight standards, increasing complexity and compliance costs.

Segmentation Analysis

- Product Type: Pouches lead due to their versatility. Labels, films, and bags follow with specific uses.

- Material Type: Plastic remains dominant at 42.8%, with aluminum, paper, and biodegradable options serving niche needs.

- Packaging Technology: Printed formats are preferred for branding, while smart packaging is emerging with promising growth.

- End-Use Industries: Food & beverage leads, followed by pharmaceuticals, personal care, and home care products.

Regional Insights

- Asia Pacific holds 36.1% of the global market, led by strong manufacturing, urban growth, and demand in food and e-commerce.

- North America shows steady growth with sustainability and pharma needs driving adoption.

- Europe is advancing eco-friendly packaging, supported by stringent environmental policies.

- Middle East & Africa is expanding with urbanization and rising demand for packaged goods.

- Latin America especially Brazil and Mexico is seeing growth from food processing and cost-effective flexible formats.

Competitive Landscape

The market is moderately fragmented. Global leaders and regional players compete through innovation, cost efficiency, and sustainability. Mergers and acquisitions are common strategies to boost market presence.

R&D is increasing for high-barrier materials and smart packaging. New features like traceability, freshness indicators, and anti-counterfeit systems are enhancing packaging functionality and brand trust.

Trends and Innovations

- Smart Packaging: Features like RFID and freshness indicators are gaining popularity.

- Digital Printing: Ideal for short runs, promotions, and seasonal campaigns.

- Mono-Material Films: Easier to recycle without losing performance.

- Refillable Formats: Growing in personal care and home care for circular economy alignment.

Future Outlook

The future of the converted flexible packaging market looks promising. Rising demand for sustainable, lightweight, and user-friendly formats will fuel continued innovation. Regulatory changes and consumer expectations will push the industry toward circular solutions.

Packaging is evolving beyond protection. It now delivers convenience, sustainability, and brand differentiation. As a result, converted flexible packaging will remain a key enabler in modern supply chains.

Recent Developments

- Aug 2024: Pakka Limited raised INR 244.7 crore to expand its eco-friendly paper-based packaging.

- Mar 2024: Watttron secured €12 million ($10.27 million) to scale digital temperature control for energy-efficient packaging.

- Mar 2025: Constantia Flexibles acquired a majority stake in Aluflexpack to grow in aluminum packaging.

- Apr 2025: Toppan Holdings acquired Sonoco’s thermoformed and flexible packaging business to strengthen its global position.

- Apr 2025: Coral Products purchased Arrow Film Converters for £502,899, expanding its UK market presence.

Conclusion

The converted flexible packaging market is on a strong growth path. Demand is being driven by the need for convenience, sustainability, and smarter packaging formats. As innovation shapes materials and technologies, companies are better positioned to meet consumer and regulatory expectations. The shift toward mono-materials, digital printing, and refillable formats will define the next wave of growth. In this evolving landscape, packaging is no longer just a container it is a core component of brand value and environmental responsibility.