Table of Contents

Introduction

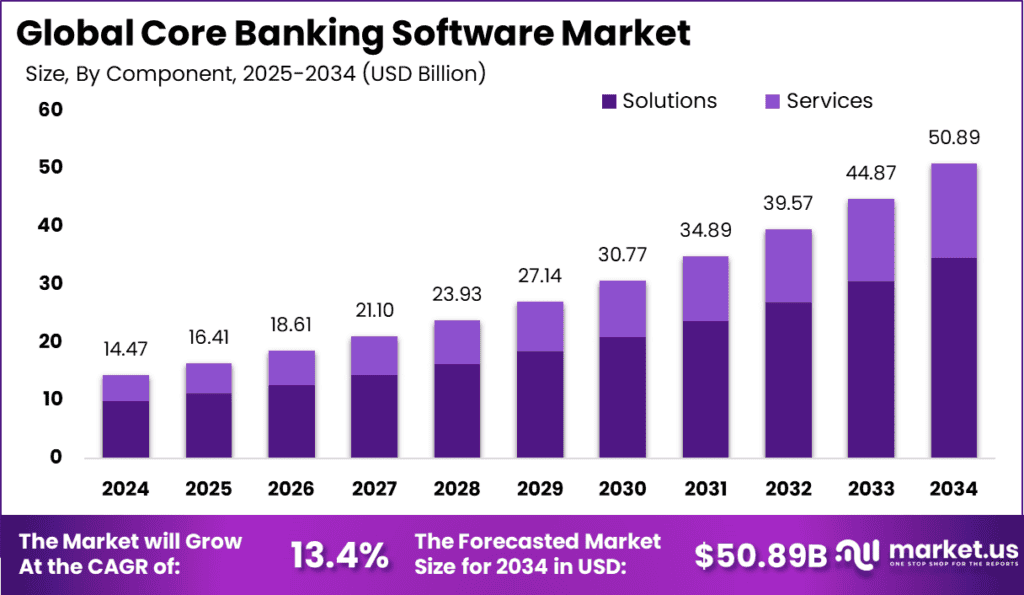

The Global Core Banking Software Market is forecasted to reach USD 50.89 billion by 2034, up from USD 14.47 billion in 2024, reflecting a CAGR of 13.4% between 2025 and 2034. In 2024, North America dominated with over 31% market share and revenue of USD 4.48 billion. The surge in digital banking adoption, demand for cloud-based solutions, and the need for operational efficiency are key growth drivers. Banks worldwide are investing heavily in upgrading legacy systems with advanced core banking software to enhance customer experience and meet regulatory requirements.

How Growth is Impacting the Economy

The rapid expansion of core banking software is reshaping economic frameworks by accelerating digital transformation in financial institutions. Enhanced banking operations reduce transaction costs and increase the speed of financial services, contributing to improved capital flow. This fosters financial inclusion, allowing underserved populations easier access to banking.

The software sector itself stimulates job creation in IT development, cybersecurity, and consulting services, driving economic diversification. Additionally, governments promoting fintech innovation and digital payments are enhancing economic stability and resilience. Overall, the core banking software market’s growth supports broader economic productivity and financial ecosystem modernization.

➤ Get valuable market insights here @ https://market.us/report/global-core-banking-software-market/free-sample/

Impact on Global Businesses

Core banking software advancements are revolutionizing global banking operations by automating processes and enabling personalized services. However, increasing implementation costs and complex regulatory compliance pose challenges, particularly for smaller banks. Supply chain shifts favor cloud providers and software vendors, requiring robust partnerships.

Different sectors experience unique impacts; retail banking focuses on improving customer engagement, while corporate banking benefits from process automation. Regulatory changes necessitate ongoing software updates, impacting vendor-client dynamics and IT budgets. Businesses must adapt to these shifts to maintain operational efficiency and competitive advantage.

Strategies for Businesses

To succeed, businesses should adopt scalable, cloud-based core banking solutions supporting real-time data analytics and omnichannel services. Partnering with reliable cloud providers can reduce infrastructure costs and enhance security. Emphasizing compliance through integrated regulatory modules is essential. Continuous staff training will help maximize technology benefits and improve customer experience. Agile development methodologies enable quick adaptation to market changes and faster rollout of features. Investing in robust cybersecurity measures ensures data protection, building customer trust and regulatory adherence.

Key Takeaways

- Market projected to grow at 13.4% CAGR, reaching USD 50.89 billion by 2034

- North America leads with 31%+ market share in 2024

- Digital transformation and cloud adoption are primary growth drivers

- Rising costs and regulatory demands challenge some market players

- Scalable, agile solutions with strong compliance focus are vital strategies

➤ Buy Full PDF report here @ https://market.us/purchase-report/?report_id=149480

Analyst Viewpoint

Currently, core banking software is rapidly modernizing legacy systems, driven by growing demand for digital banking and operational efficiency. Cloud-based solutions and AI-powered analytics are becoming mainstream, enhancing service delivery. Looking ahead, integration of blockchain and advanced cybersecurity will further boost the market. The outlook remains positive as financial institutions prioritize technology-driven transformation to stay competitive, compliant, and customer-centric in a rapidly evolving financial landscape.

Regional Analysis

North America dominates the core banking software market with over 31% share in 2024, supported by advanced fintech ecosystems and regulatory frameworks. Europe follows, driven by modernization and digital banking investments. Asia-Pacific is an emerging market, fueled by expanding financial infrastructure and smartphone penetration. Latin America and the Middle East & Africa are gradually adopting core banking solutions, propelled by financial inclusion initiatives and digital payment growth. Regional regulatory environments and technology adoption levels significantly influence growth trajectories.

➤ Discover More Trending Research

- Smart Budgeting Apps Market

- Smart Navigation Apps Market

- Privacy-Enhancing Computation Market

- Embedded FPGA Market

Business Opportunities

Opportunities abound in AI-enabled and blockchain-integrated core banking platforms. Providers can offer cloud migration and cybersecurity enhancement services to meet evolving needs. Emerging markets present growth potential by digitizing unbanked populations. Customized solutions for niche banking segments like microfinance and digital-only banks open new revenue streams. Collaborations between software developers and financial institutions to co-create innovative products enhance market penetration and drive sustainable growth.

Key Segmentation

The core banking software market is segmented by deployment, component, and end-user:

- Deployment: On-premises, Cloud-based

- Component: Software, Services (Implementation, Maintenance, Consulting)

- End-User: Retail Banking, Corporate Banking, Cooperative Banking, Others

These segments reflect diverse customer preferences and technological maturity across banking sectors globally.

Key Player Analysis

Market leaders focus on cloud computing, AI integration, and enhanced cybersecurity to stay competitive. Investments in user-friendly interfaces and API-based omnichannel banking support client engagement. Strategic fintech partnerships accelerate innovation and digital transformation. Continuous compliance module updates ensure regulatory alignment. Scalability and customization capabilities enable catering to diverse banking needs worldwide, establishing key players as pivotal contributors to the evolution of global financial services.

Top Key Players Covered

- Temenos AG

- Infosys Ltd.

- FIS (Fidelity National Information Services)

- Finastra

- Oracle Corporation

- SAP SE

- Tata Consultancy Services (TCS)

- Jack Henry & Associates, Inc.

- nCino

- Mambu

- Backbase

- Thought Machine

- Others

Recent Developments

- Launch of cloud-native core banking platforms with enhanced scalability

- Introduction of AI-driven fraud detection and analytics modules

- Expansion of fintech partnerships to broaden API offerings

- Deployment of blockchain solutions for secure transaction processing

- Development of modular architectures enabling faster feature upgrades

Conclusion

The core banking software market is set for sustained growth driven by digital transformation and regulatory pressures. Financial institutions embracing innovative, scalable solutions will secure a competitive advantage and meet evolving customer expectations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)