Table of Contents

Introduction

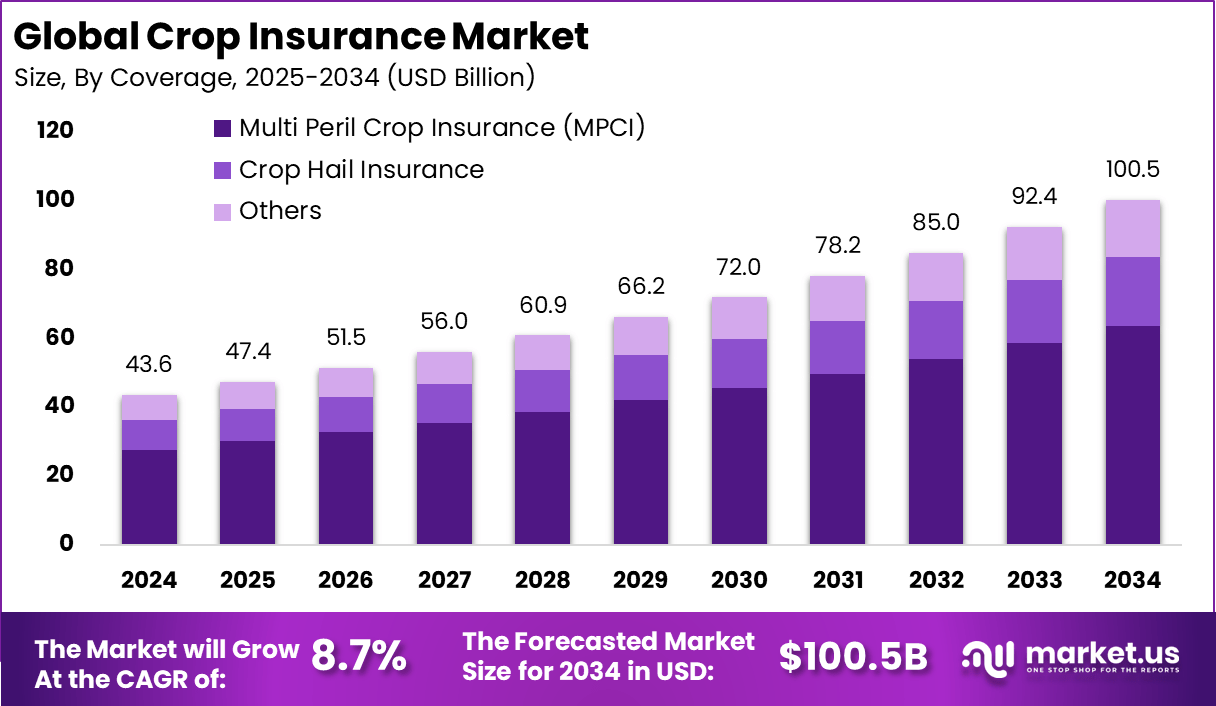

The Global Crop Insurance Market is projected to grow significantly, with an expected market size of USD 100.5 billion by 2034, up from USD 43.6 billion in 2024. This growth represents a compound annual growth rate (CAGR) of 8.7% during the forecast period from 2025 to 2034. North America currently holds the dominant market position, accounting for over 35.2% of the market share and generating USD 15.35 billion in revenue in 2024. The increasing frequency of extreme weather events, rising global food demand, and the growing adoption of crop insurance by farmers are key drivers of market expansion.

How Growth is Impacting the Economy

The expansion of the crop insurance market is having a substantial economic impact on both the agricultural sector and the broader economy. As climate change continues to result in more unpredictable weather patterns, the need for crop insurance to safeguard against losses is becoming more critical. The market’s growth contributes to agricultural stability, helping farmers manage risks related to crop failure due to drought, floods, pests, or disease.

This, in turn, promotes the economic stability of agricultural regions, supporting global food production systems. Increased demand for crop insurance also fosters innovation in agricultural risk management products, creating job opportunities in both the financial and agricultural sectors. Furthermore, this market growth encourages investment in agricultural technology and infrastructure, boosting economic development, particularly in emerging markets.

➤ Unlock growth! Get your sample now! – https://market.us/report/global-crop-insurance-market/free-sample/

Impact on Global Businesses

Rising costs of weather-related events and increased claims due to more frequent natural disasters are driving up the cost of crop insurance premiums. As insurers face higher payouts, they are adapting by investing in technology to better assess risks and improve data collection for accurate pricing. Supply chain disruptions in the agricultural sector, including issues with raw materials and logistics, have also made it more challenging for insurers to set accurate premiums.

However, the crop insurance market has become more sophisticated, with insurers leveraging satellite imagery, weather data, and machine learning algorithms to assess risks more effectively. These technologies are helping reduce costs over time by improving the accuracy of claims and risk management. As demand for insurance grows, the sector will need to adapt to changing weather patterns and regional crop cycles to remain sustainable and profitable.

Strategies for Businesses

- Leverage advanced technologies such as AI, machine learning, and satellite imagery to assess crop risks more accurately and improve pricing models.

- Expand into emerging markets where agriculture is a key economic driver, offering tailored crop insurance products to local farmers.

- Foster partnerships with government agencies and non-governmental organizations to develop affordable and accessible crop insurance solutions for smallholder farmers.

- Provide value-added services such as agricultural advisory, climate risk analysis, and crop yield forecasting to differentiate from competitors.

- Focus on sustainability and climate-resilient agricultural insurance products, especially for regions vulnerable to climate change impacts.

Key Takeaways

- The global crop insurance market is projected to grow at a CAGR of 8.7%, reaching USD 100.5 billion by 2034.

- North America leads the market with a 35.2% share and USD 15.35 billion in revenue in 2024.

- Increasing climate variability and demand for food are driving the need for crop insurance.

- Technological advancements are improving risk assessment and premium pricing.

- Businesses need to focus on sustainability, market expansion, and technology to succeed.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=155109

Analyst Viewpoint

The crop insurance market is poised for steady growth, driven by the increasing need to protect agricultural investments against weather-related risks. With the rising frequency of extreme weather events, the market will likely see higher adoption rates, particularly in regions vulnerable to climate risks. The integration of technology into risk management processes, such as the use of satellite imagery and AI, will continue to shape the future of the industry. Over the coming years, businesses that prioritize innovation and sustainability in their offerings are expected to thrive, as consumers and farmers increasingly seek more comprehensive, climate-resilient solutions.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Climate risk management for farmers | Increasing frequency of extreme weather events and crop losses |

| Satellite-based crop assessment | Improved accuracy in risk assessment and claims processing |

| Crop yield prediction and insurance | Growing demand for reliable food production and climate adaptation |

| Agricultural investment protection | Rising investment in agriculture and need for financial stability |

Regional Analysis

North America dominates the crop insurance market, holding 35.2% of the market share in 2024, driven by widespread adoption of crop insurance by farmers and the availability of advanced technologies. However, the market is growing in regions such as Europe and Asia Pacific, where the adoption of crop insurance is increasing due to the rising frequency of natural disasters and the growing need for risk management solutions. In emerging markets, there is significant growth potential as farmers seek protection against the impact of climate change and volatile commodity prices.

Business Opportunities

The growing demand for crop insurance presents numerous business opportunities, particularly in emerging markets where agriculture plays a crucial role in economic development. Companies can expand by offering affordable and customizable crop insurance products for smallholder farmers in regions such as Asia, Africa, and Latin America. Additionally, the use of technology to assess and manage risk presents an opportunity to reduce operational costs, improve the accuracy of claims, and offer more competitive premiums. Partnerships with local governments, NGOs, and agribusinesses will further boost market penetration and help reach a broader customer base.

Key Segmentation

- By Type: Multi-peril crop insurance is the most widely adopted, followed by crop-hail insurance and revenue insurance.

- By End-User: Large-scale commercial farmers and smallholder farmers are the main end-users, with smallholders increasingly adopting insurance products.

- By Distribution Channel: The market is segmented into direct sales, brokers, and digital platforms, with digital platforms expected to grow rapidly due to increasing smartphone penetration.

Key Player Analysis

Key players in the crop insurance market are focusing on expanding their product offerings and improving risk assessment tools using data analytics, satellite imagery, and AI. These companies are also enhancing partnerships with governments and agricultural organizations to offer affordable insurance solutions. The competition is intensifying as more players enter the market, but those that invest in innovation and regional partnerships are well-positioned to capture significant market share.

- PICC

- Chubb Ltd.

- QBE Insurance Group

- Tokio Marine HCC

- Zurich Insurance Group

- Agriculture Insurance Co. of India (AIC)

- Fairfax Financial (Brit, Allied World)

- American Financial Group (Great American)

- ICICI Lombard

- Sompo Holdings

- Swiss Re Corporate Solutions

- AXA XL

- Munich Re

- Mapfre

- Farmers Mutual Hail Insurance Company

- GlobalAg Risk Solutions

- Agriculture Insurance Company of Kenya

- Agriculture Reinsurance Ltd.

- Grupo BrasilSeg

- Others

Recent Developments

- Integration of satellite-based crop risk assessment technology to improve underwriting accuracy.

- Expansion of crop insurance products to smallholder farmers in developing regions.

- Introduction of digital platforms for policy purchase and claims processing.

- Government-backed initiatives to promote crop insurance adoption among rural farmers.

- Development of climate-resilient crop insurance products for regions facing frequent natural disasters.

Conclusion

The crop insurance market is set to experience strong growth, driven by the increasing need to mitigate agricultural risks related to climate change and weather variability. As the market expands, businesses that leverage technology, offer tailored products, and forge strategic partnerships will be best positioned to capitalize on this growth. With a promising outlook, the crop insurance market is poised to play a key role in the future of sustainable agriculture and food security.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)